Following Target's Q2 earnings, we update our analysis on superstores to best understand the extent to which Walmart and other superstores are benefiting from Target's challenges.

Target's Q2 earnings on August 16 featured same-store sales down 5% versus last year, a sharp deceleration from flat in Q1 and the first decline in six years. The brand suffered from a decline in spending on discretionary items and backlash for its Pride Month collection. Our real-time data through mid-August indicates Target's business is likely to continue weakening.

Ahead of Walmart reporting earnings on August 17, HundredX looks to the wisdom of the crowd of real customers to see how the retailer is trending against its competitors in the superstore and grocery industries. Examining 146,000 pieces of feedback on superstores (50K for Walmart and 40K for Target) over the last year and 173K of feedback on the grocers (20K for Walmart Grocery and 11K for Target Grocery), we find:

Walmart is gaining relative to all the superstores, not just Target.

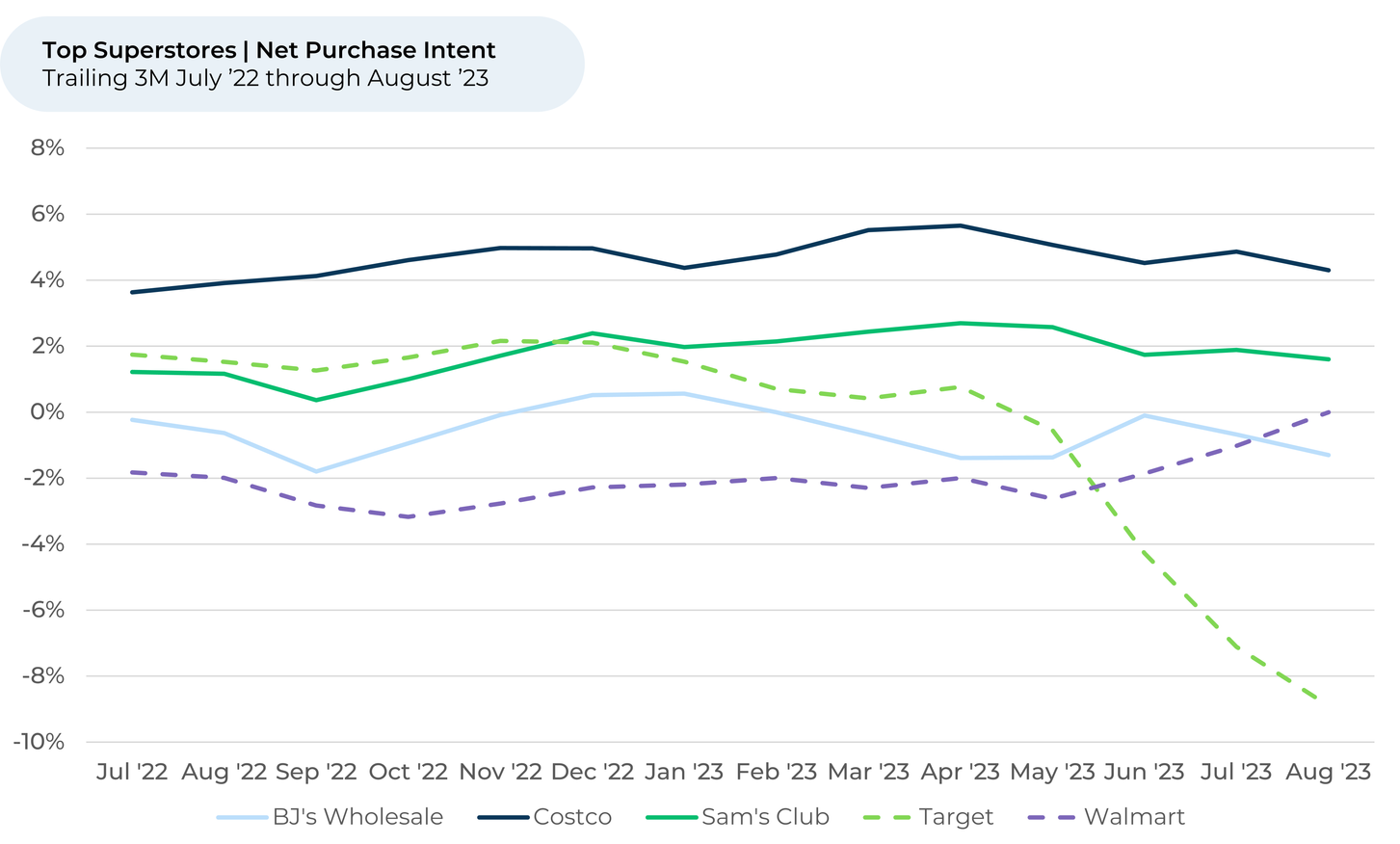

Future Purchase Intent1,2 for Walmart is up 1% for the three months through July vs. Target down 8%, Costco and Sam’s Club down 1%, and BJ’s actually up almost 1% as well. In the first two weeks of August Walmart gained another 1%, while Target is down another 2% and the others are flat to down another 1%.

When we see intent trends for a business gain versus its industry, it often results in revenue growth rates, margins and/or market share also improving versus peers over the following 6-12 months.

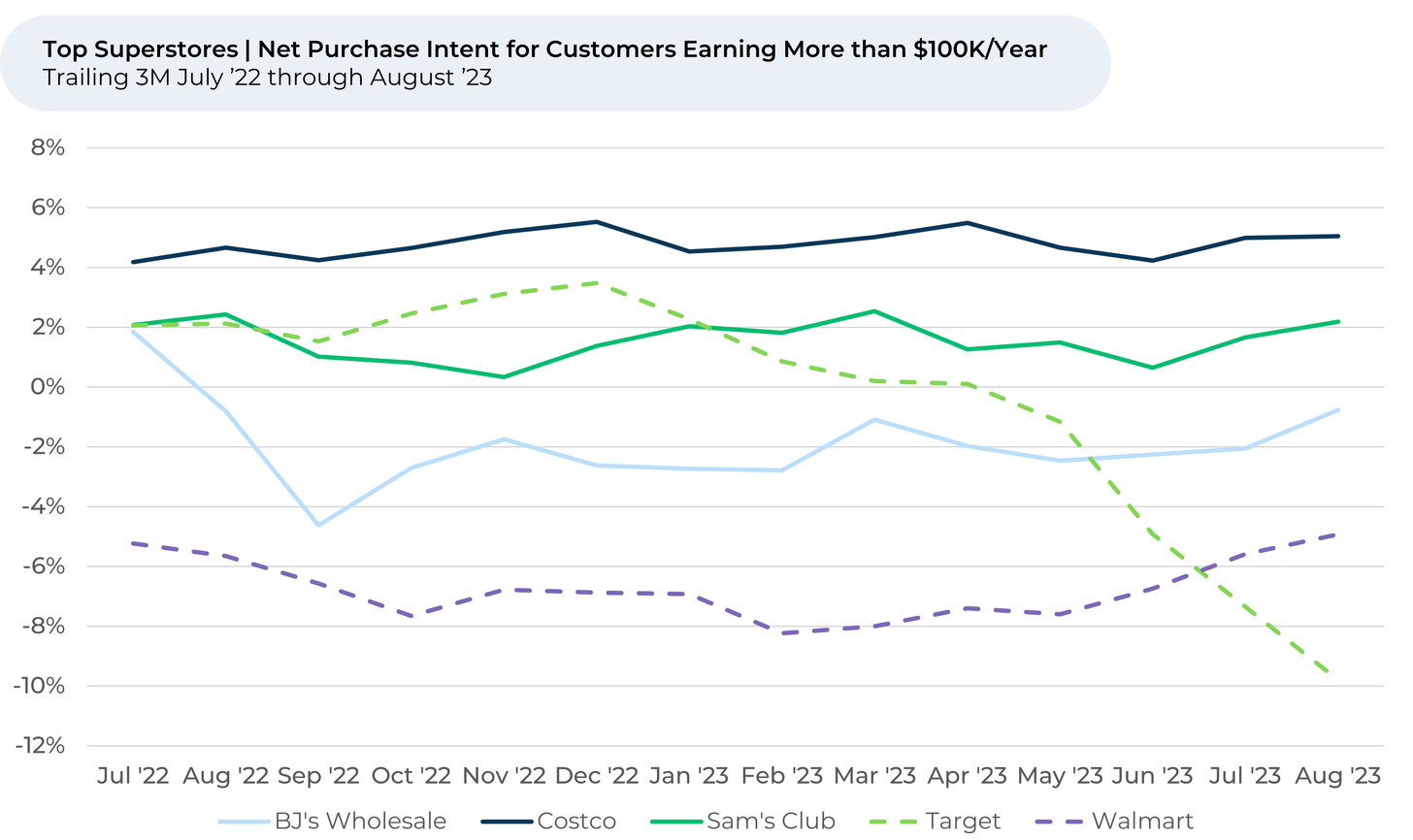

Among wealthier customers, Purchase Intent is up for all the superstores except for Target in July, indicating Target is losing its valued wealthier customer to all the others. The same trend has continued in August. However, on a three-month basis through July, Walmart is the only one that is up (2%), while Target is down (7%) and the others are flattish.

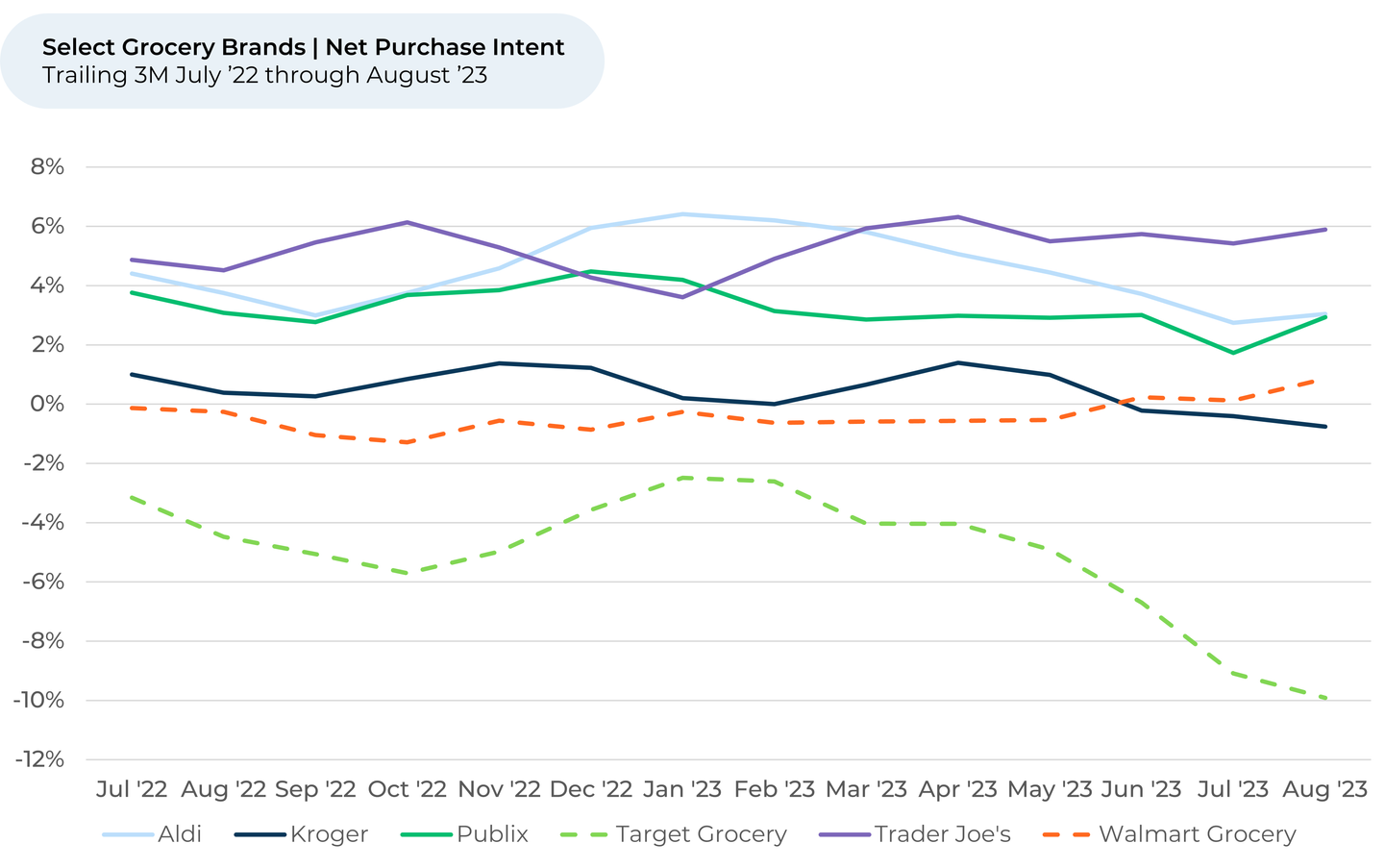

Walmart is gaining in the grocery channel as well. There has been a lot of focus on the ability for stores to bring in customers to shop for groceries regularly and then grow share of total wallet by getting them to purchase other items. Purchase Intent is up 1% for Walmart Grocery the last three months through July relative to down 5% for Target and down 1%-2% for other national grocers. In August so far, Walmart Grocery and Publix are up another 1%, while Target is down another 1% and all others are flat. These trends indicates Walmart is gaining share via its grocery store as well.

Many comments shared with HundredX by Walmart customers indicate it is succeeding in getting people who come in to shop for groceries to buy a number of other items:

- “A Walmart superstore has just about everything I need. It is a department store and grocery that is well stocked and has a wide selection of groceries, cosmetics, clothing, etc.” – 5/3/23, Male, 60+

- “Do 50% of my grocery shopping there. Love that superstores offer one stop shopping. Good selection of health and beauty products.” -- 6/17/23, Female, 60+

- “Walmart has always been the best place to get the most things from there. They are also a lot more affordable and I don’t think you can go to a grocery outlet for that price.” -- 7/20/23, Male, 18-29

Please contact our team for a deeper look at HundredX's superstore data, which includes a more than 280,000 pieces of customer feedback across 8 superstore brands (including over 90,000 on Walmart and over 85,000 on Target).

- All metrics presented, including Net Purchase Intent (Usage Intent), and Net Positive Percent / Net Favorability are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent reflects the percentage of customers who plan to spend more at a specific brand during the next 12 months, minus the percentage who plan to spend less. We find businesses that see customer Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.