Unlocking the magic of 55,000 theme park visitor feedback!

While many observers believe Disney theme parks are suffering from a slowdown in attendance, we see price cuts reviving interest in visiting and recent attendees feeling better about wait times.

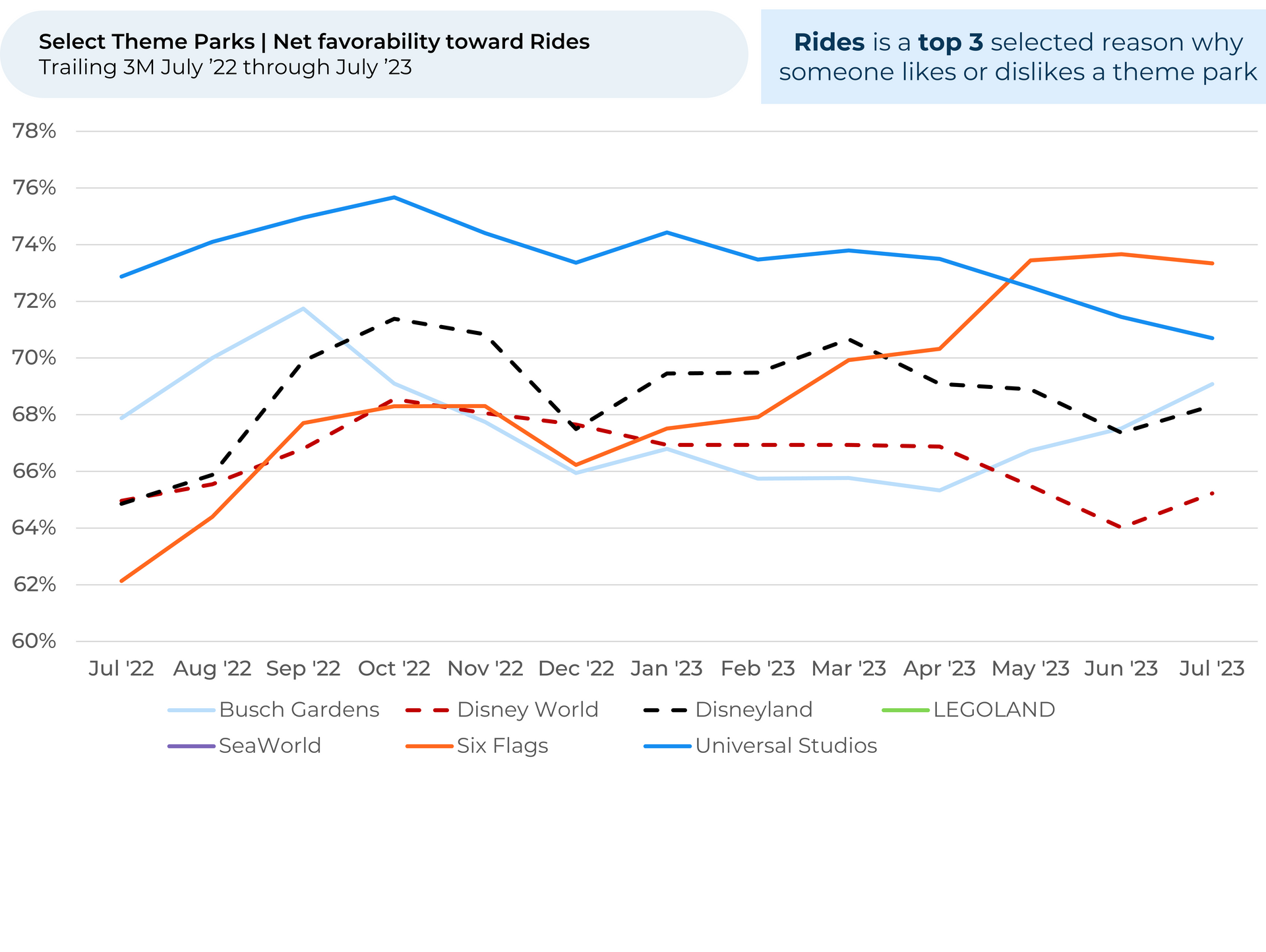

Analyzing 55,000 pieces of feedback from “The Crowd” of theme park visitors, including more than 20,000 from across Disney’s parks, from July 2022 through July 2023, we find:

Key Takeaways

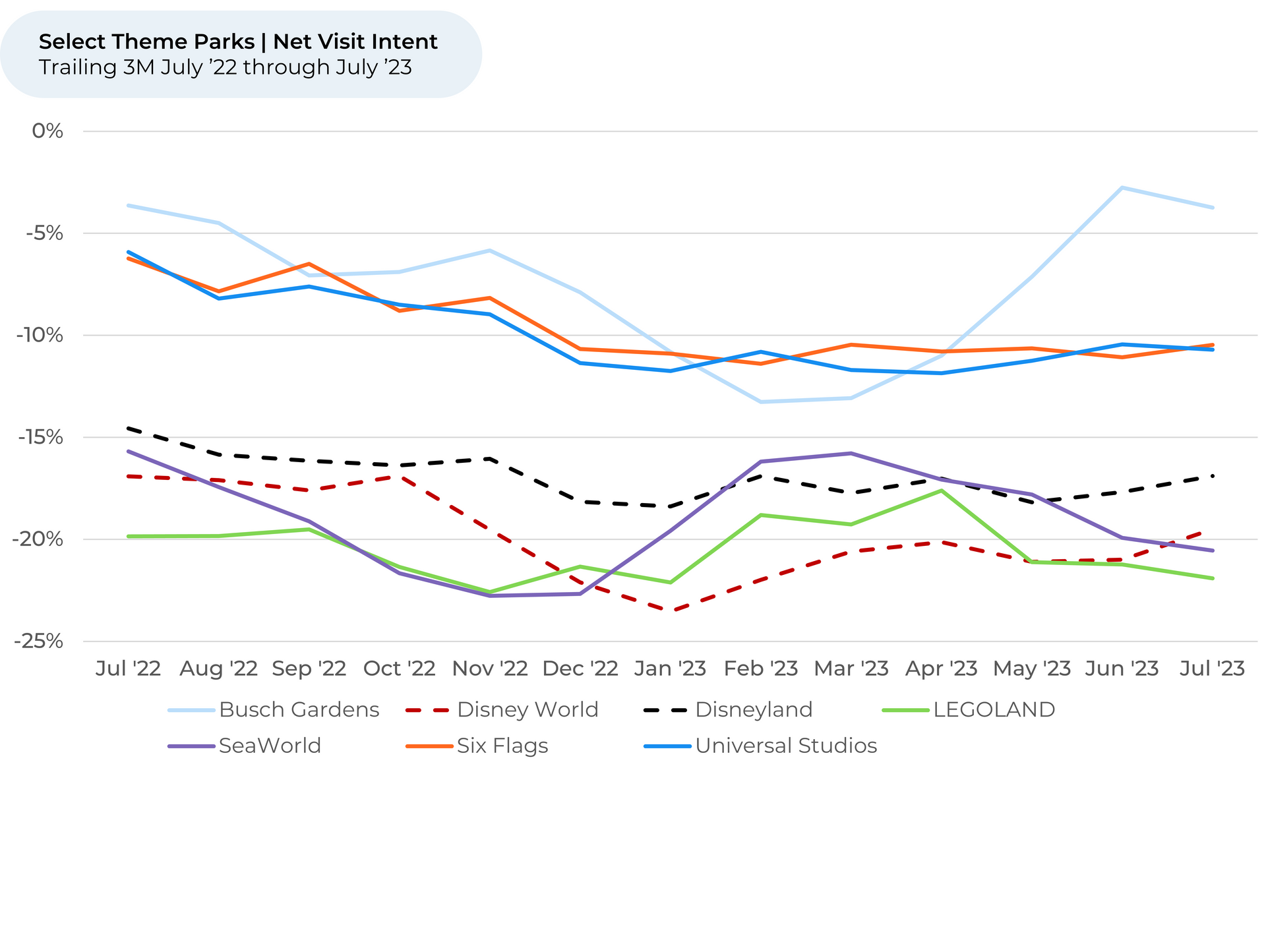

- July Visit Intent1,2 for Disney parks is down 2% compared to last July, but up 1% vs. a month and three months ago. Given debate about how much Disney attendance will suffer from January price hikes, Disney’s recent Visit Intent trends being better than the rest of the industry is a positive sign for its relative growth outlook. Visit intent for other theme parks we follow was flat vs. three months ago and down 4% from a year ago.

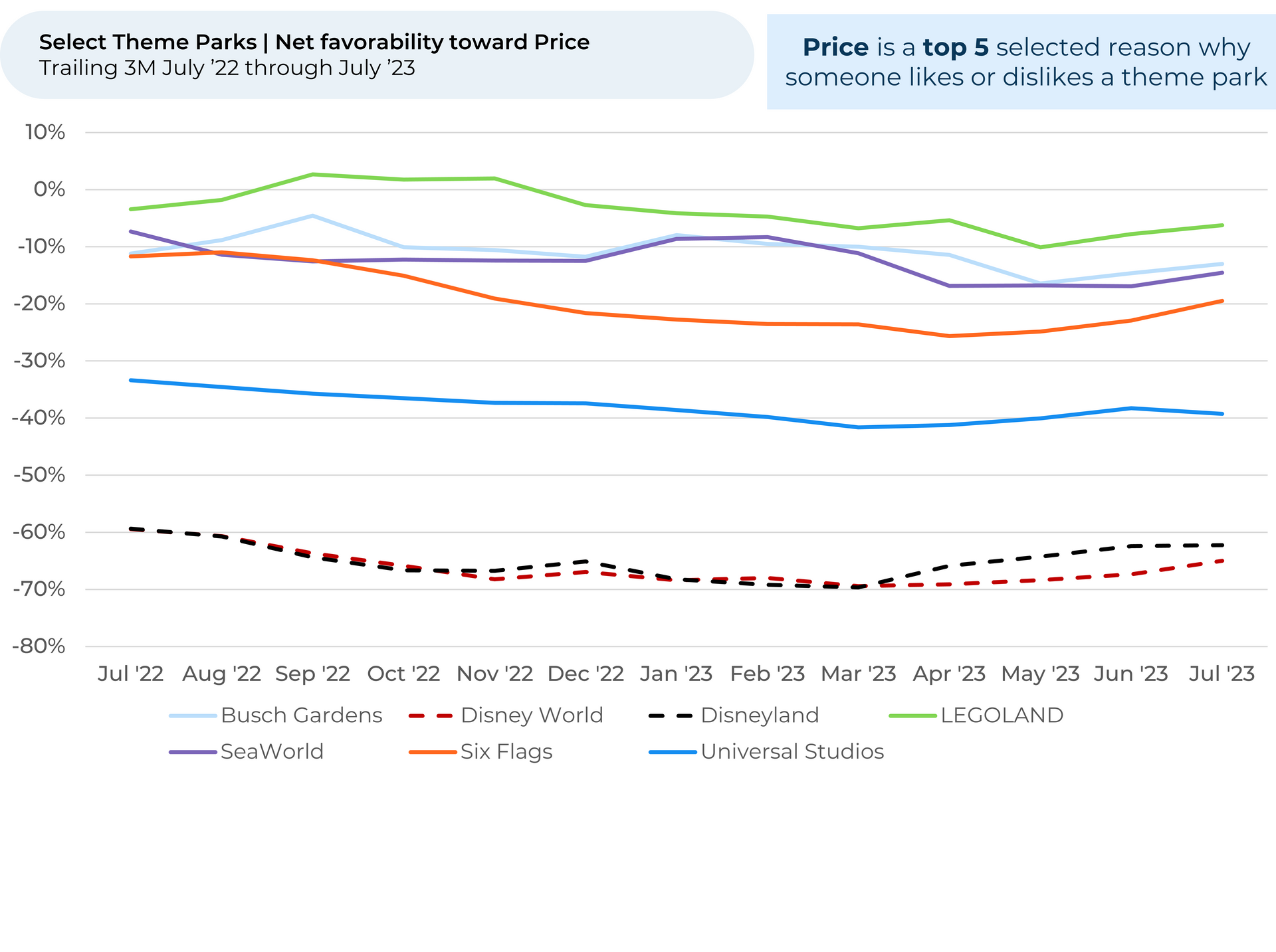

- Disney’s new holiday price cuts seem to be helping future attendance. Disney parks have cut Christmas ticket prices, which seems to be pleasing customers. In addition to an increase in Visit Intent, net favorability toward Disney parks’ Prices improved 2% in July vs. June.

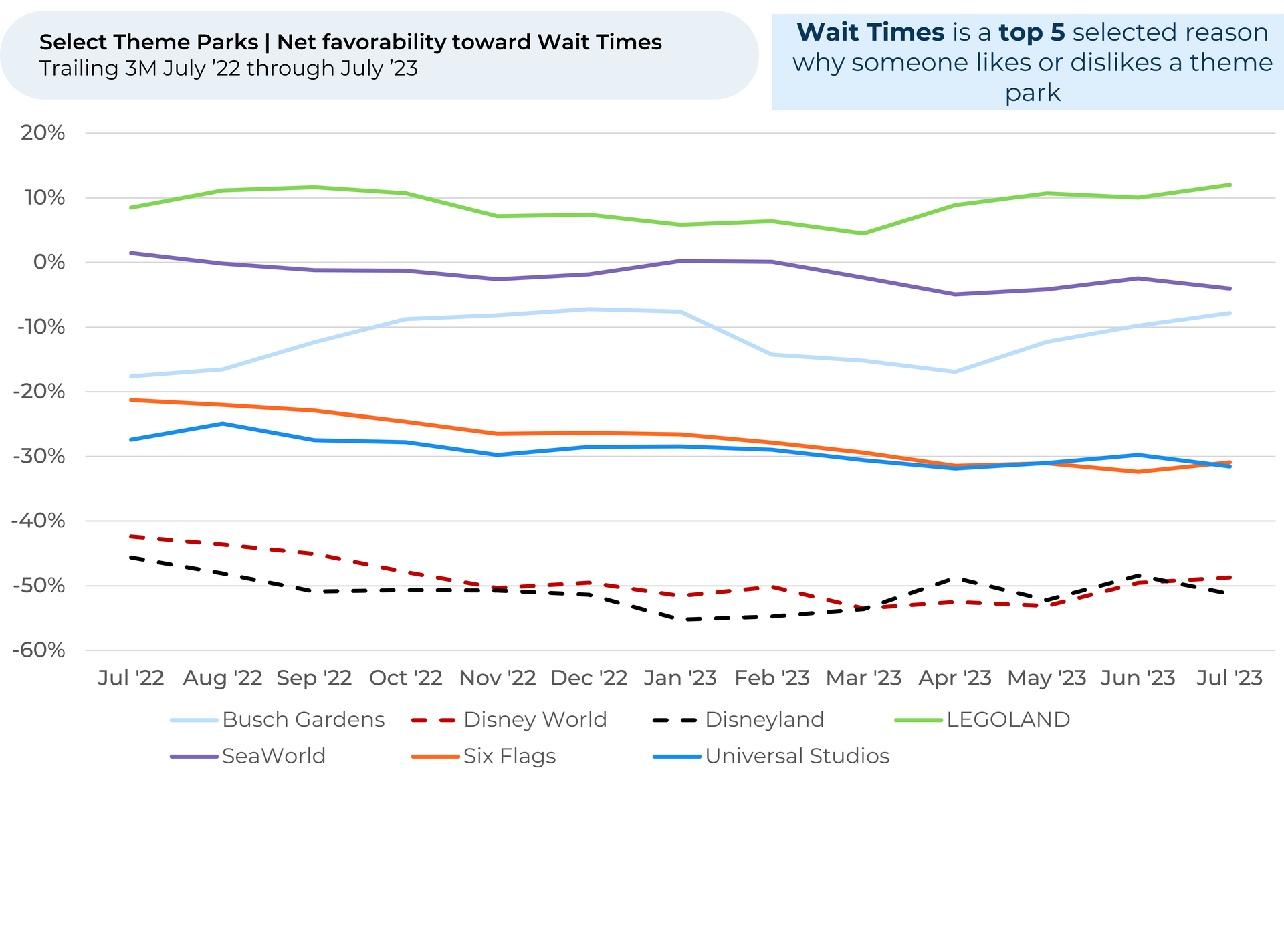

- Customers have been feeling happier about ride wait times, indicating that wait times have likely come down. The Wall Street Journal recently reported that shorter wait times and greater discounts are indicating lower attendance. Net favorability3 towards wait times for Disney World rose 4% the last three months, but at -50% it is still way behind the -18% average for other parks ex. Disney.

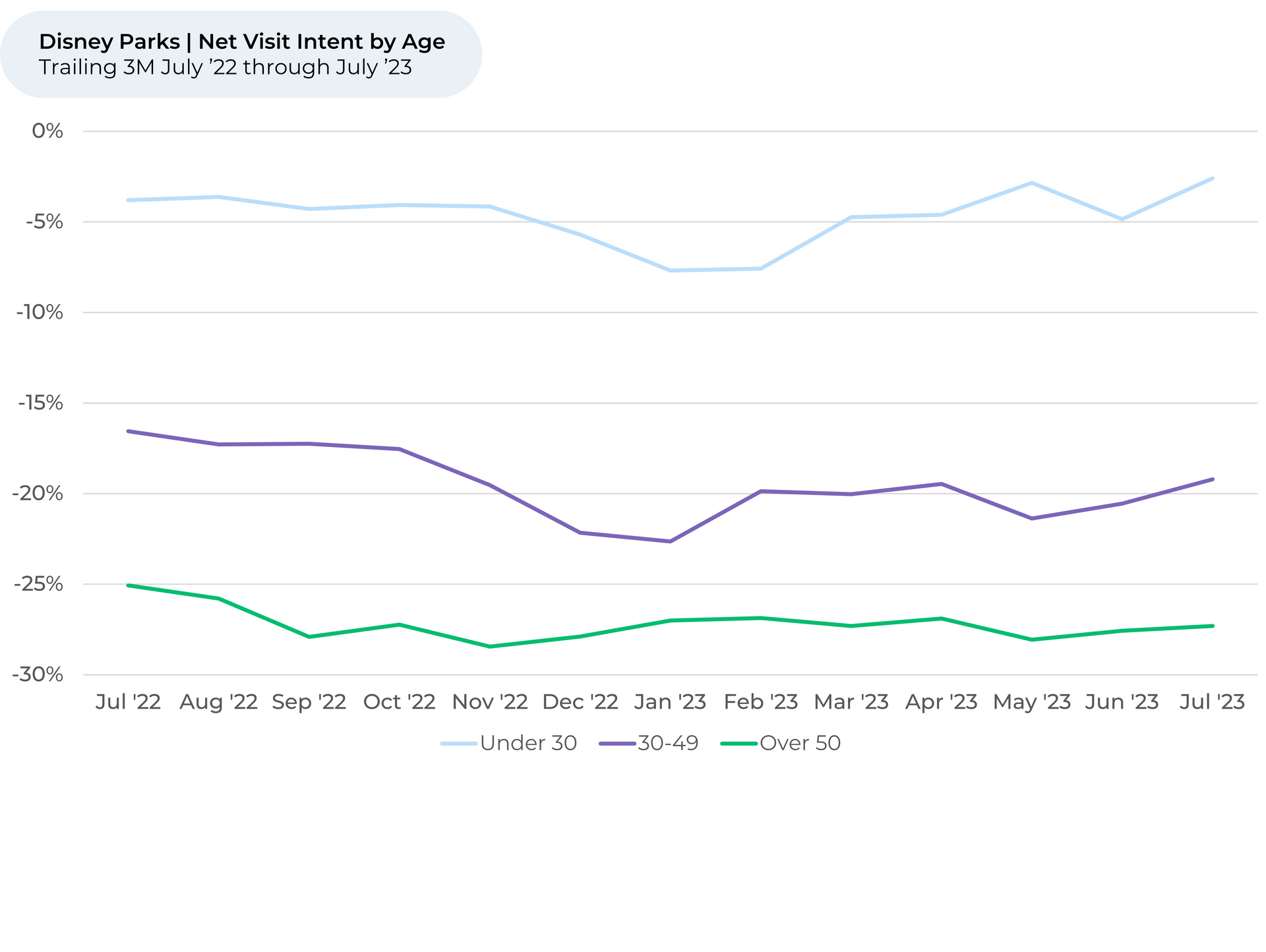

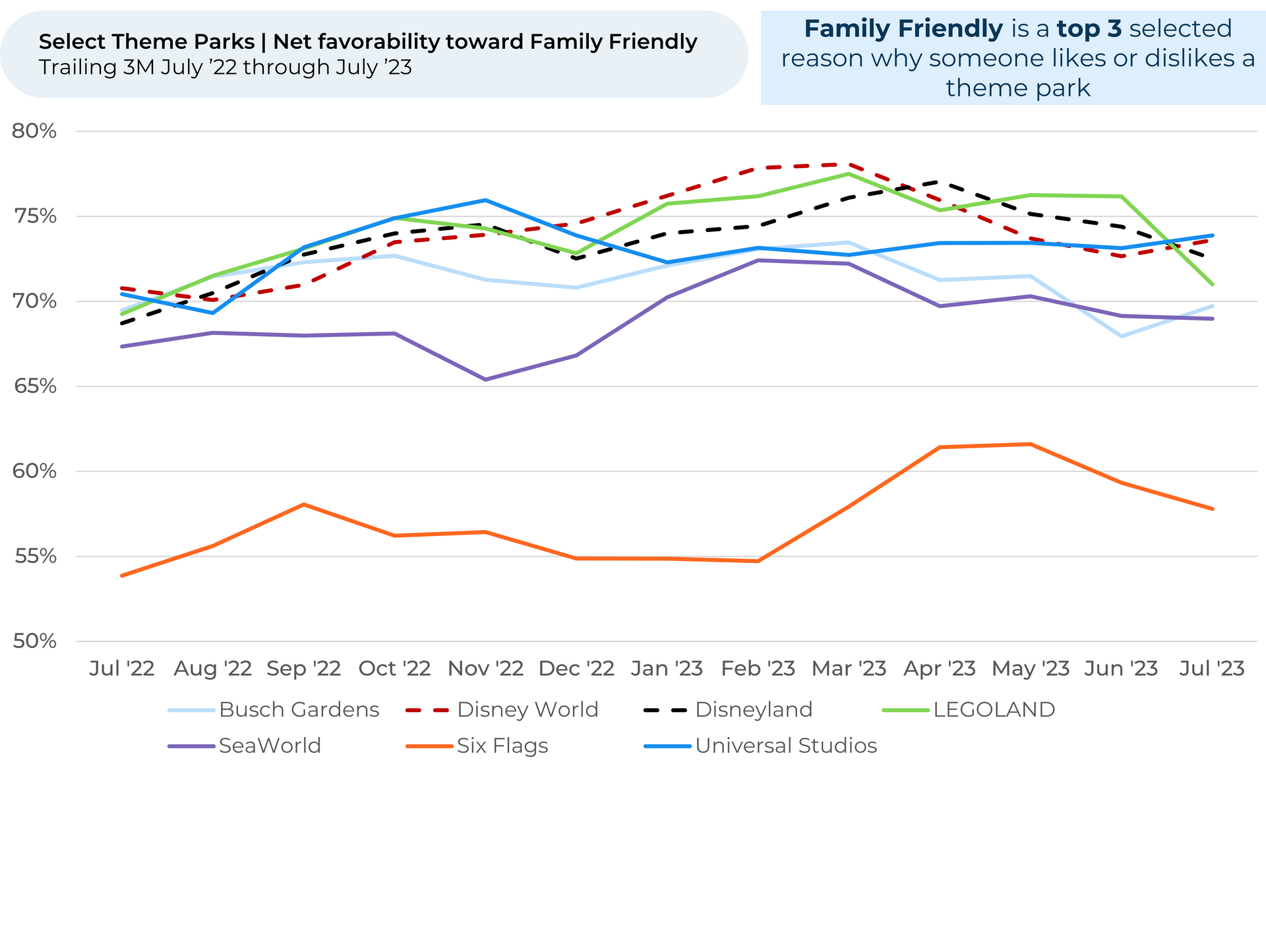

- Disney’s feud with Florida political leadership seems to be hurting how many families with young children feel about the parks. Visit Intent dropped the most over the last year with visitors in their 30s and 40s, corresponding with a drop in net favorability3 toward “Family Friendly”. Both declines align with escalations in Disney’s feud that started in March 2022. Visit Intent is actually up with customers under 30 since last year.

Discover HundredX insights into Theme Park Trends:

Please contact our team for a deeper look at HundredX's theme park data, which includes 130,000 pieces of customer feedback across over 14 theme park brands (including over 50,000 on Disney parks).

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Net Favorability are presented on a trailing three-month basis unless otherwise noted.

- Visit Intent reflects the percentage of customers who plan to visit a specific brand more during the next 12 months, minus the percentage who plan to visit less. We find businesses that see customer Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.