Resilient spending on staples contrasts with a dip in discretionary items, capturing the attention of business leaders and investors. As Home Depot's Q2 report highlights slowdowns in spending on big-ticket and discretionary items, we drill into the data to understand any implications for Lowe’s (reports August 22) and broader home-related industries.

Examining 1.2 million pieces of customer feedback from “The Crowd” of retail shoppers, including 80,000 across 17 home improvement brands, we find:

Key Takeaways

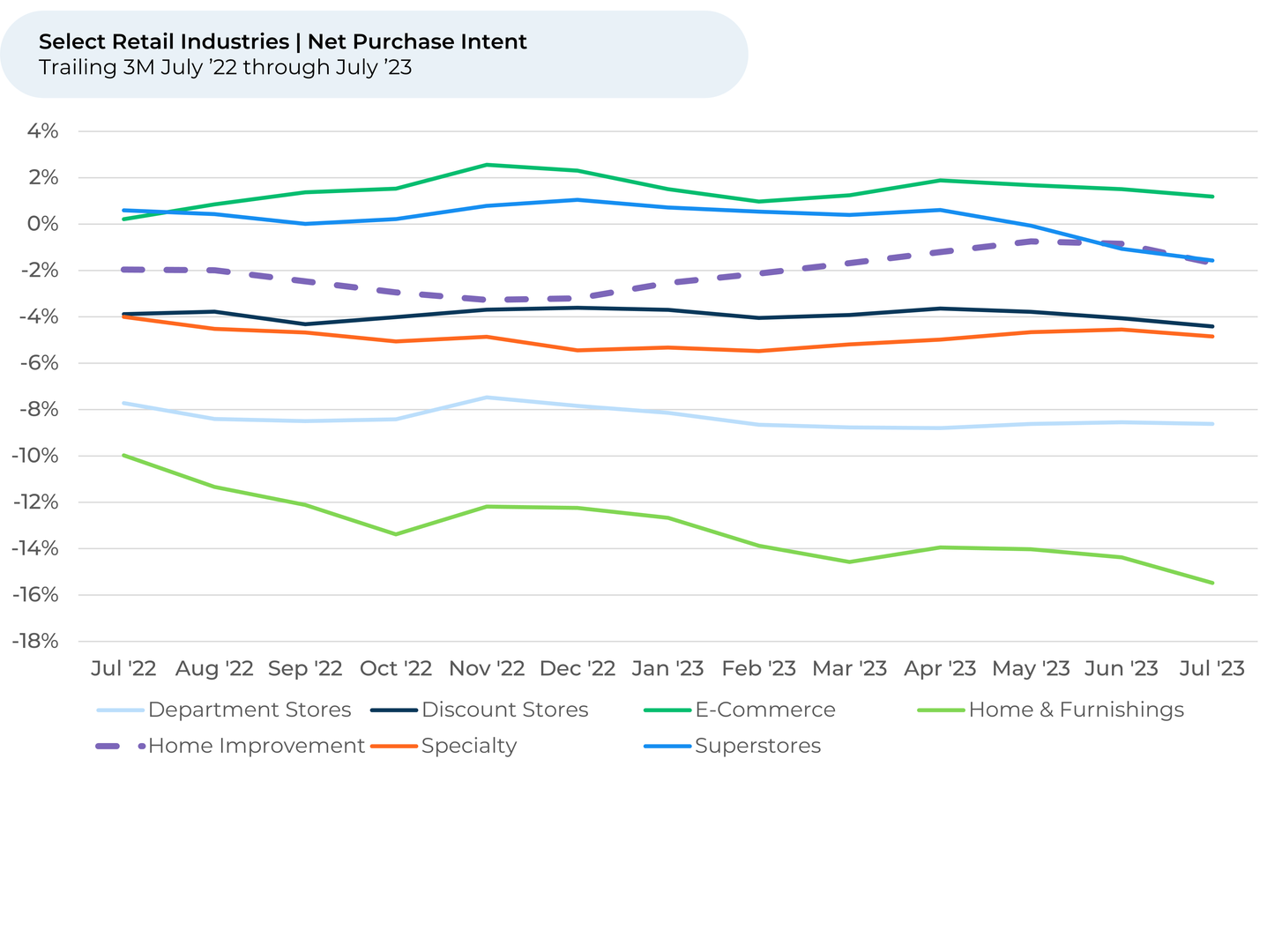

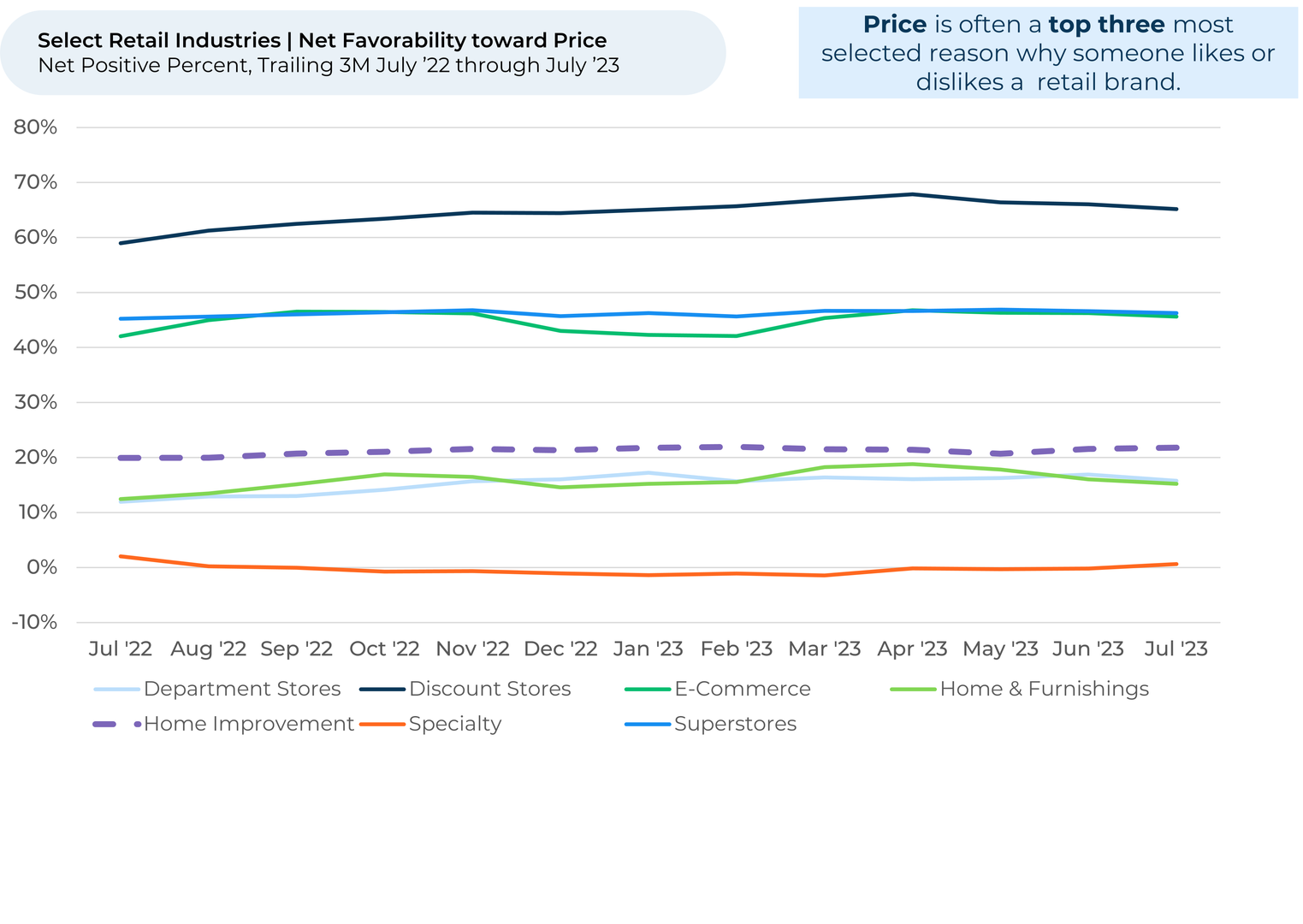

- Net Purchase Intent¹,² for the home improvement industry fell 1% from three months ago but remained in the same range as the last year. However, the more discretionary home & furnishings industry is down the most of any retail industry we follow, down 2% in the last three months and 5% over the last year.

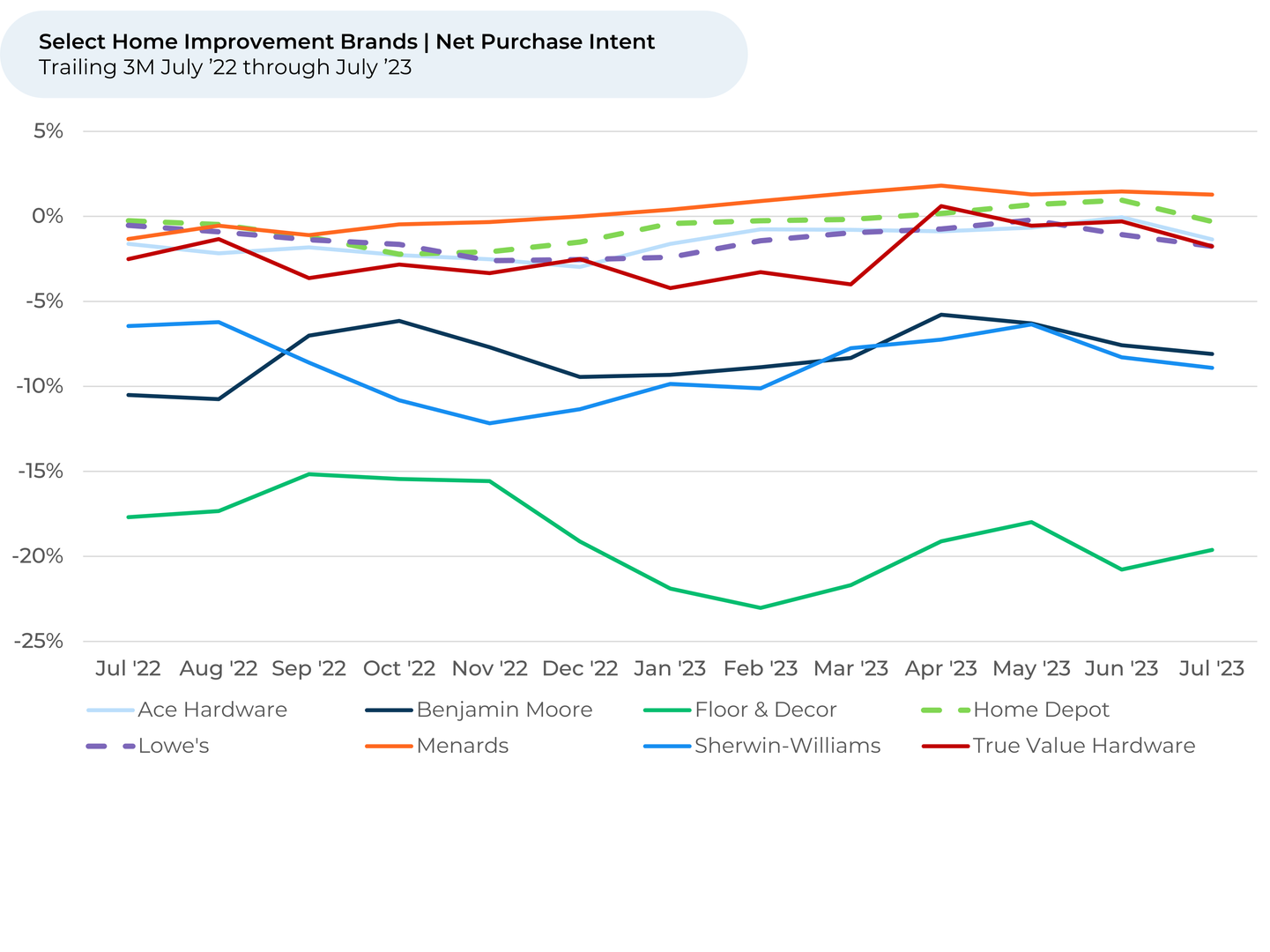

- Within home improvement, Purchase Intent was down the most for the paint companies over the last three months (-2%), in line with the broader trend of discretionary spending being softer than staples.

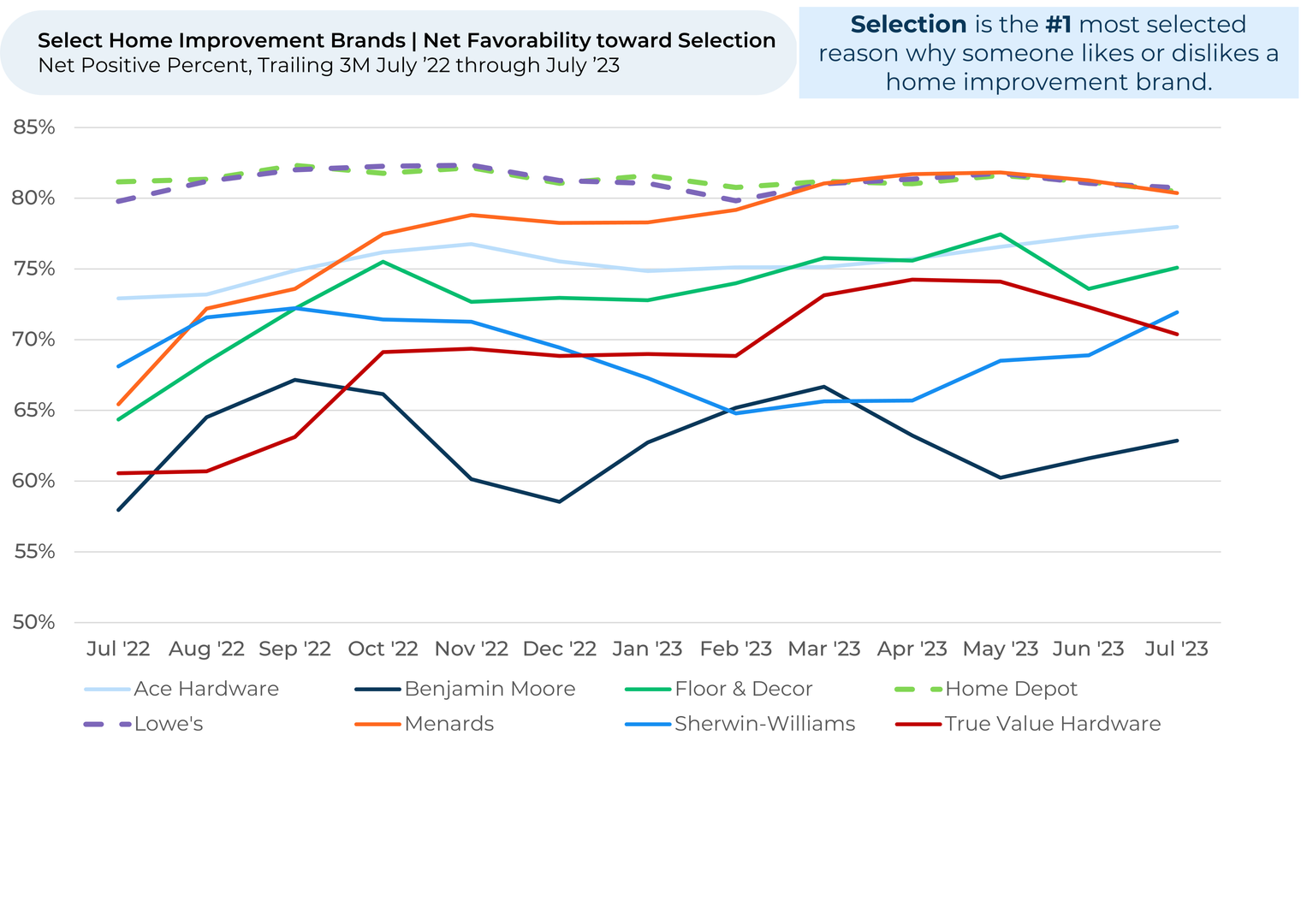

- Lowe’s 1% decline in Purchase Intent over the last three months was greater than Home Depot being flat, indicating its sequential growth trend is likely to be a little weaker. Home Depot reported 2Q US comp sales growth of -2% vs. the prior year, better than -5% reported in 1Q.

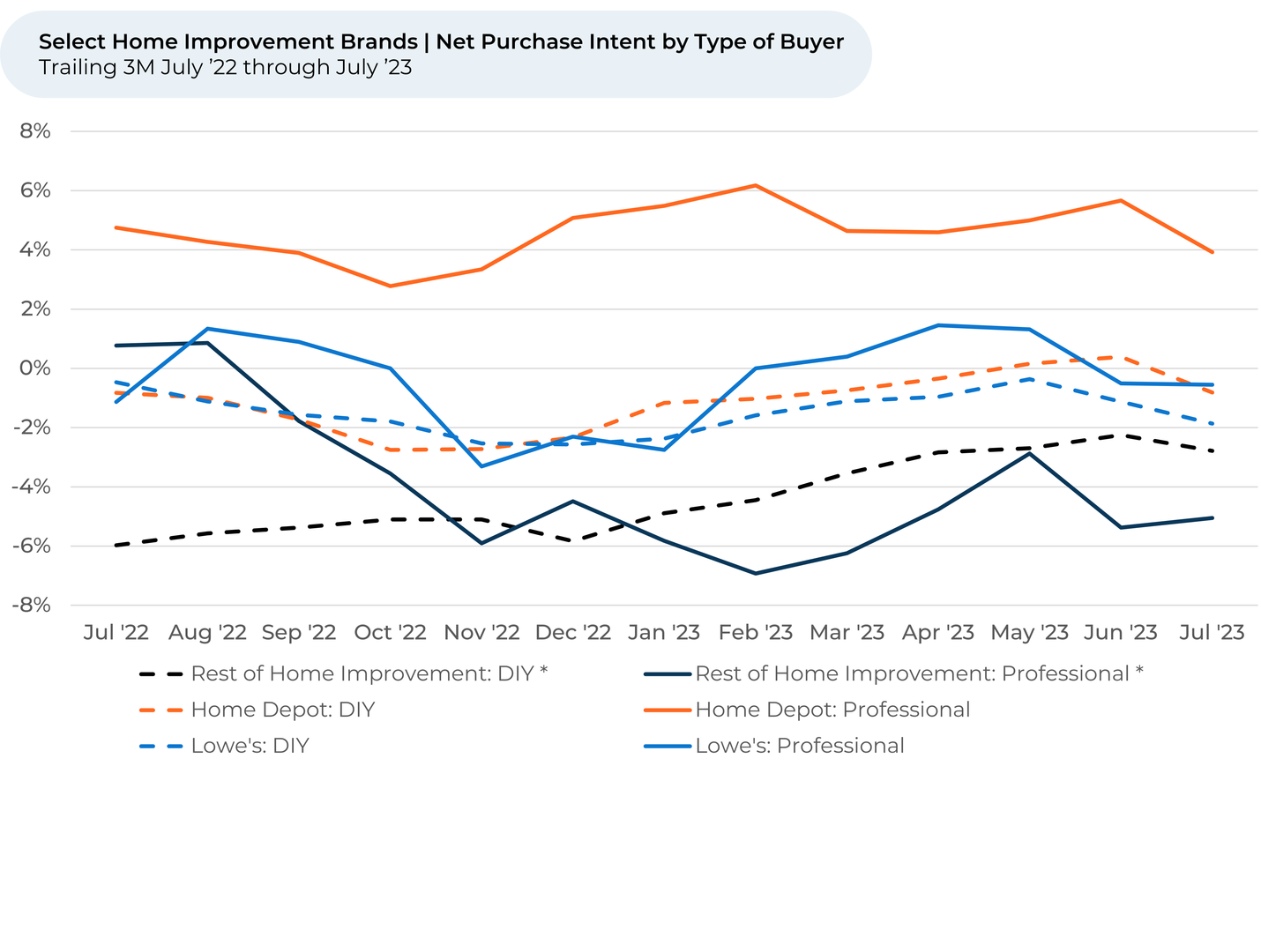

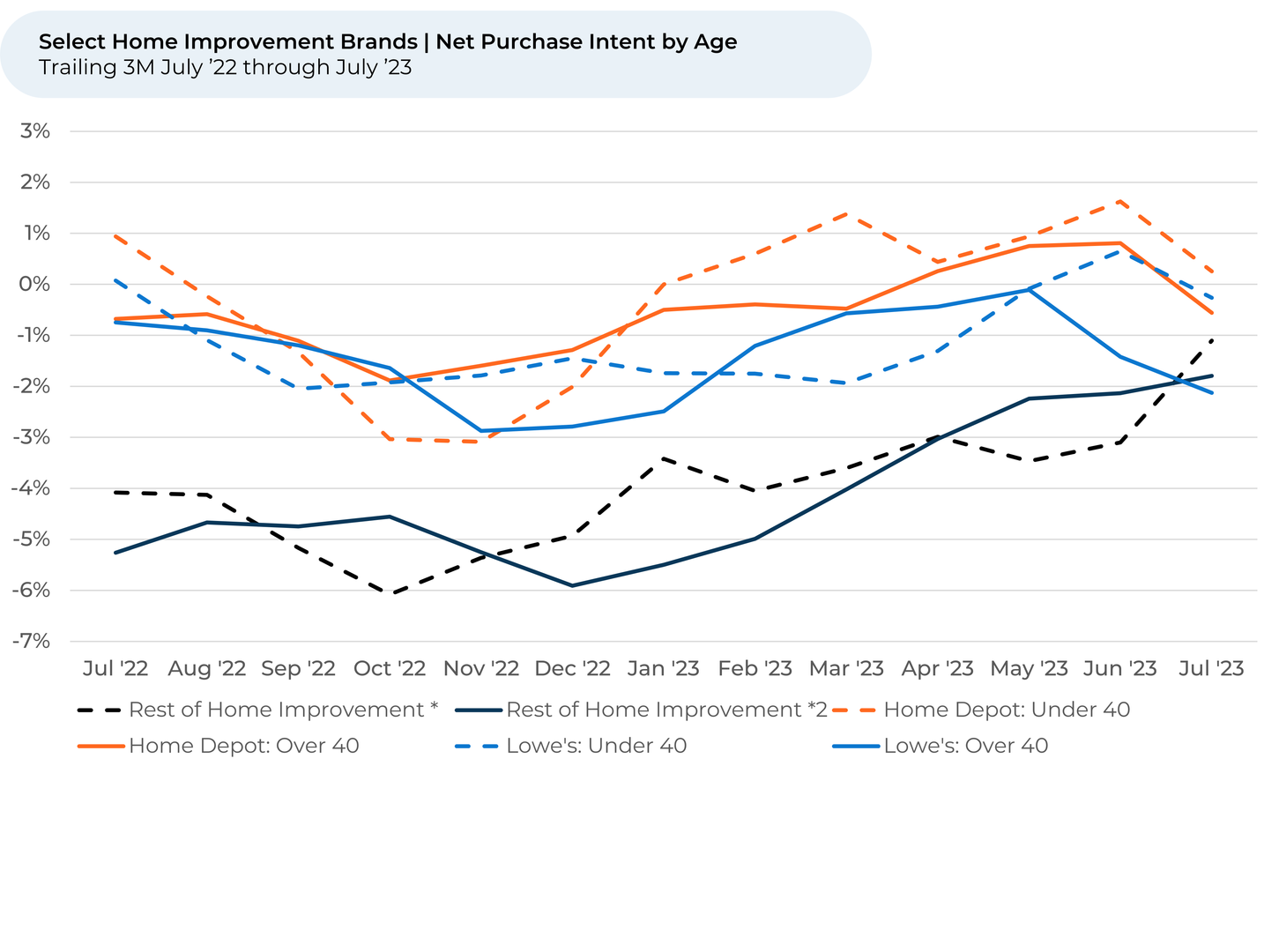

- Purchase Intent for the Home Improvement industry overall dropped more among professional contractors than DIY-ers and customers over 40 (those most likely to own a home, according to U.S. Census Bureau) than those under 40 over the past three months. This aligns with Home Depot’s Q2 earnings report, which noted slowing demand for professional projects and appliances. Lowe’s Purchase Intent dropped more than Home Depot’s for customers who are professionals, DIYers and over 40.

Please contact our team for a deeper look at HundredX's home improvement data, which includes more than 160,000 pieces of customer feedback across over 17 home improvement brands (including over 60,000 on Home Depot).

- All metrics presented, including Net Purchase (Purchase Intent) and Net Positive Percent / Favorability, are presented on a trailing one-month basis unless otherwise noted.

- Purchase Intent represents the percentage of customers who expect to spend more with that chain over the next 12 months, minus those that intend to spend less. We find businesses that see Purchase Intent trends gain versus the industry or peers have often seen revenue growth rates, margins and/or market share also improve versus peers.

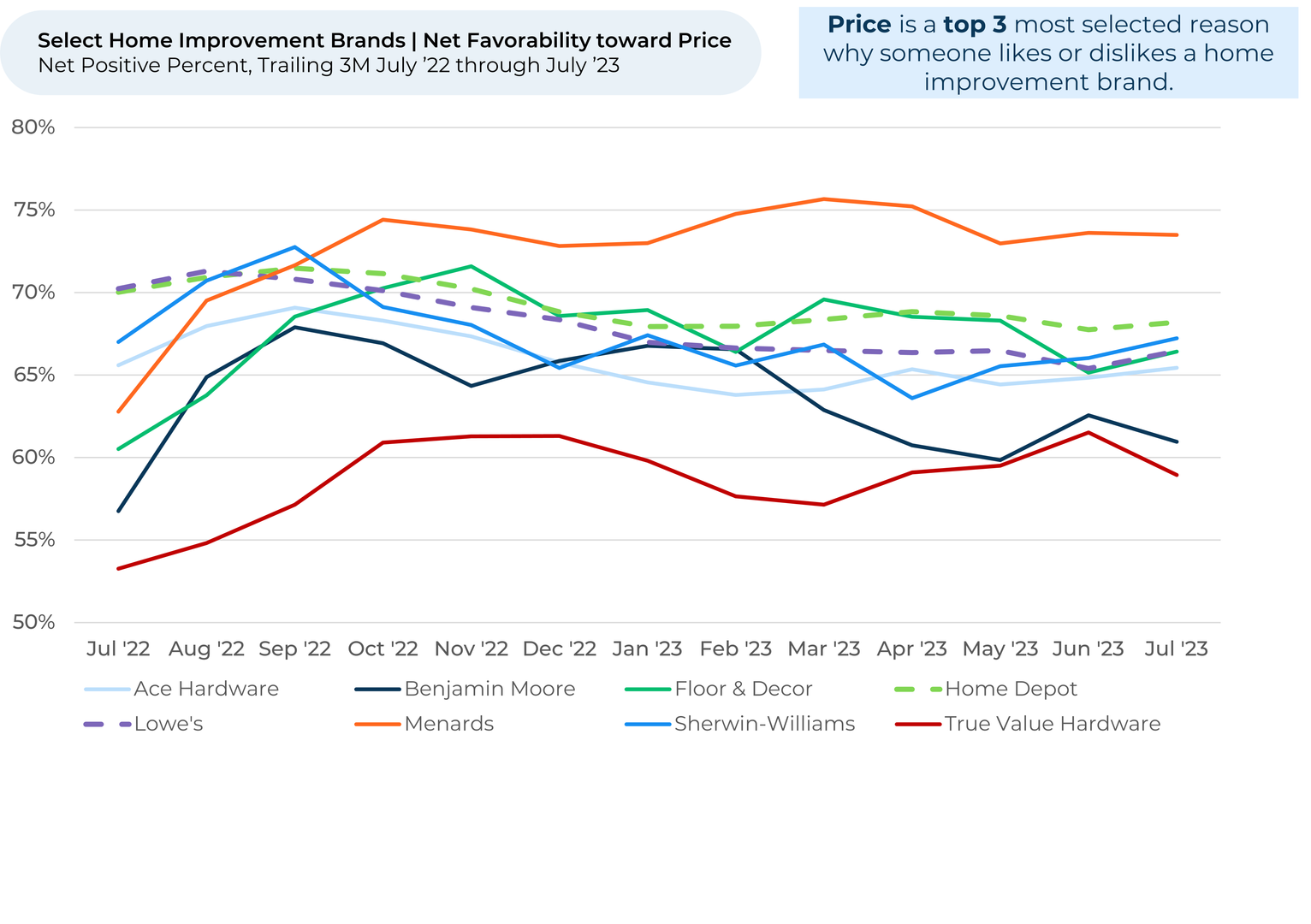

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.