Following one of the busiest travel seasons of the year, the HundredX team analyzes trends across the Travel industry to identify relative winners and losers. This report breaks down the latest insights gleaned from thousands of real customers (“The Crowd”), who provide feedback to HundredX via our proprietary listening model. We look at more than 250,000 pieces of customer feedback on more than 125 companies across six sub-sectors of Travel in 2022.

This Month in Travel: January 2023 Update

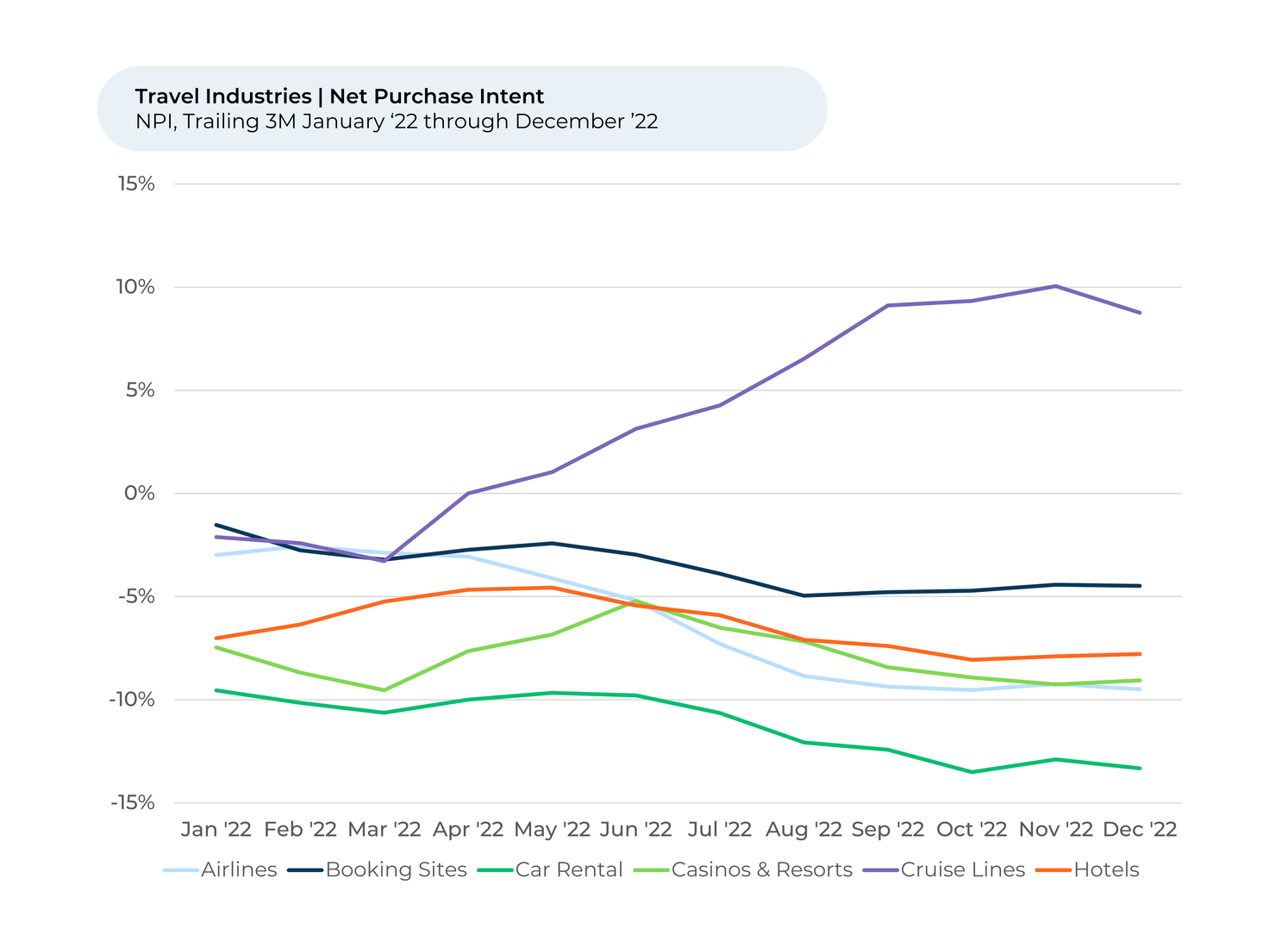

- Purchase Intent¹ across the Travel sector was generally stable and negative for December, with Cruise Lines (the only sector with positive purchase intent) seeing a slight dip in December.

- National Car Rental shows the biggest increase in Purchase Intent. Sentiment towards Price, Availability and other factors surged, potentially helped by its high-profile sponsorship of the PGA Jr. League Championship.

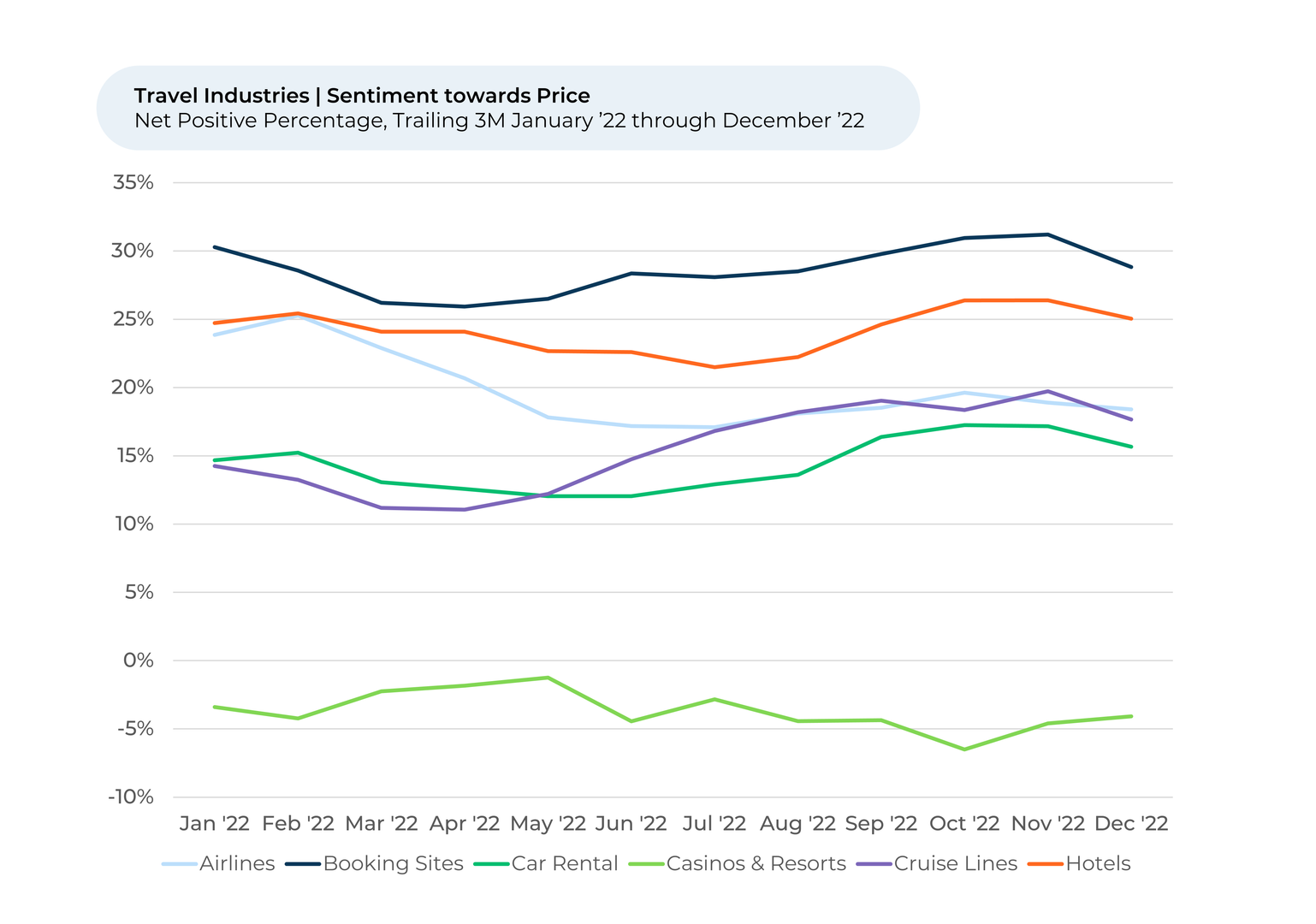

- Customer sentiment towards Price dropped for all travel sectors in December except for Casinos, which increased but still lags all other sectors.

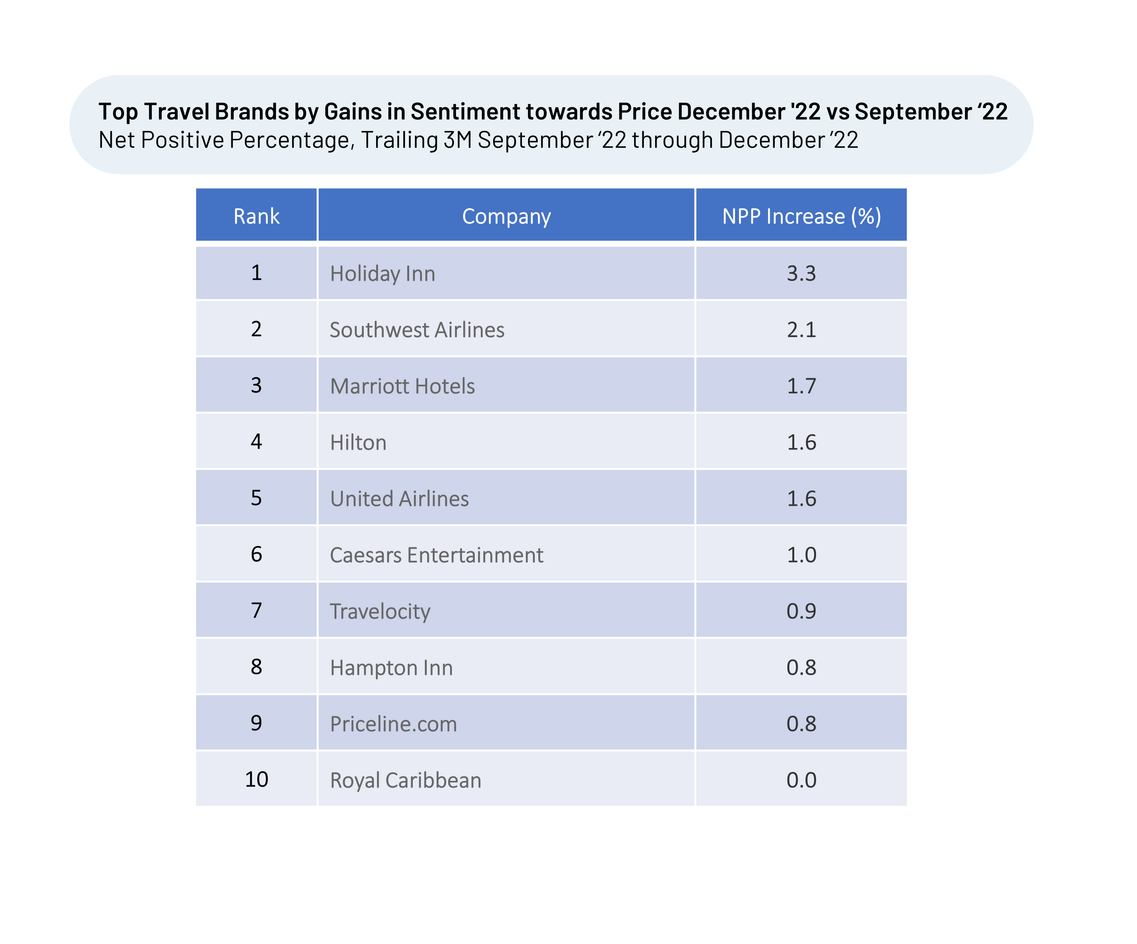

- Major hotel chains Holiday Inn, Marriott Hotels, and Hilton see some of the biggest gains in sentiment toward Price.

- Purchase intent and sentiment towards Southwest remained stable despite significant woes for its travelers in December. We will watch for a potential impact on its metrics in January.

Purchase Intent remained relatively stable across the Travel sector over the past three months. It remains mostly negative, with Cruise Lines the only industry where Purchase Intent is positive.

Most sub-sectors saw slight Purchase Intent increases in October and November, presumably as people planned to travel for the holidays. Those gains moderated in December, as people carried out their travel plans. It’s possible inclement weather also played a part, with travel, especially among airlines, heavily disrupted in mid and late December due to poor weather and subsequent scheduling issues.

Despite maintaining a positive Purchase Intent, Cruise Lines saw the biggest drop from November to December, falling about 2%. Sentiment towards most aspects of Cruise Lines also dropped from November to December, with Food & Beverage, Staff Availability, and Room falling the most.

Purchase Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. For cruises, it represents the percentage of customers who intend to take another trip with the brand in the next twelve months, minus those that do not.

Biggest Travel Purchase Intent Improvers

Despite the flat Purchase Intent for Travel overall since September 2022, some brands outperformed:

Pricing Sentiment

The Crowd often chooses Price as a top driver of satisfaction when leaving feedback for Travel brands. For most Travel sub-sectors, customers’ sentiment on Price remained positive and relatively stable over the past year, although it did drop for all but Casinos in December. Sentiment for booking sites and hotels remains the most positive and casinos the most negative. HundredX measures sentiment¹ as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like it.

We will continue monitoring the Travel space throughout 2023 by tracking which travel services people use and why. We are particularly interested in seeing whether Cruise will continue to gain market share from other sectors and whether flight availability problems will hurt impacted airlines.

- All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a

mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact.