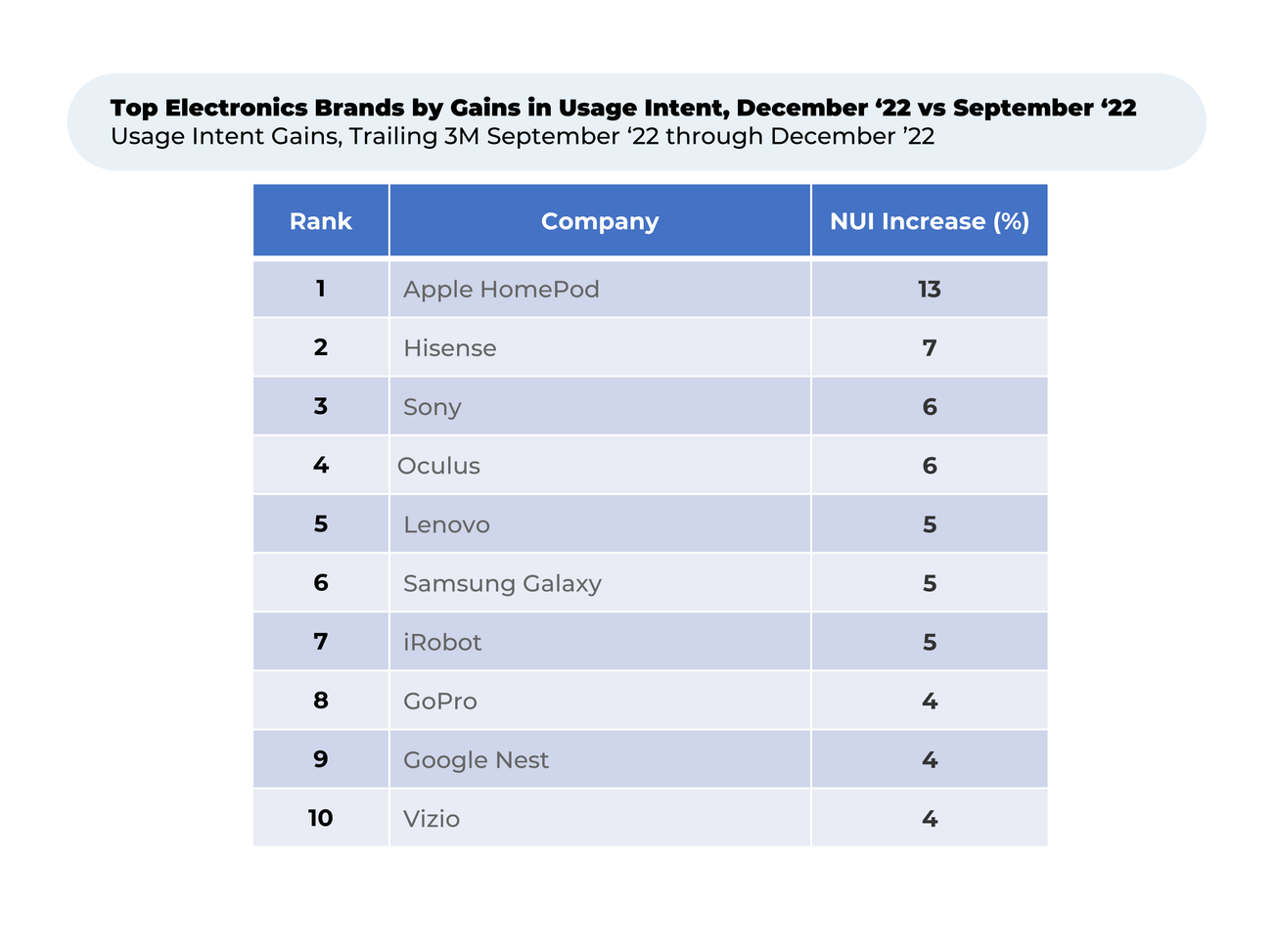

Usage Intent for the Consumer Electronics brands we cover was up very slightly in December to 6.5%, from the 6.2% for November discussed in our Electronics coverage in December. Usage Intent reflects the percentage of customers who plan to use a specific brand during the next 12 months minus the percentage that intends to use less. While the overall space was stable, we found some Electronics brands made significant gains in Usage Intent over the past three months, from September to December 2022.

On the heels of the holiday shopping season and 2023 Consumer Electronics Show (CES 2023), HundredX looks to The Crowd for insights into some of the top electronics devices that surged in popularity to the end of 2022. By examining more than 80,000 pieces of feedback from real electronics customers across 2022, we can better understand who some of the market share gainers for 2023 are likely to be. We find Usage Intent¹ is correlated with share of time spent and retention, which can be a leading indicator of market share.

- Apple HomePod made the largest increase in Usage Intent, making it a likely share gainer in the hot smart speaker category, with improvements in customer sentiment towards its Technology, Design, and Quality.

- Oculus, the VR headset brand owned by Meta, appears to have gotten credit for its significant investments in technology and its ecosystem, with one of the largest leaps in Usage Intent.

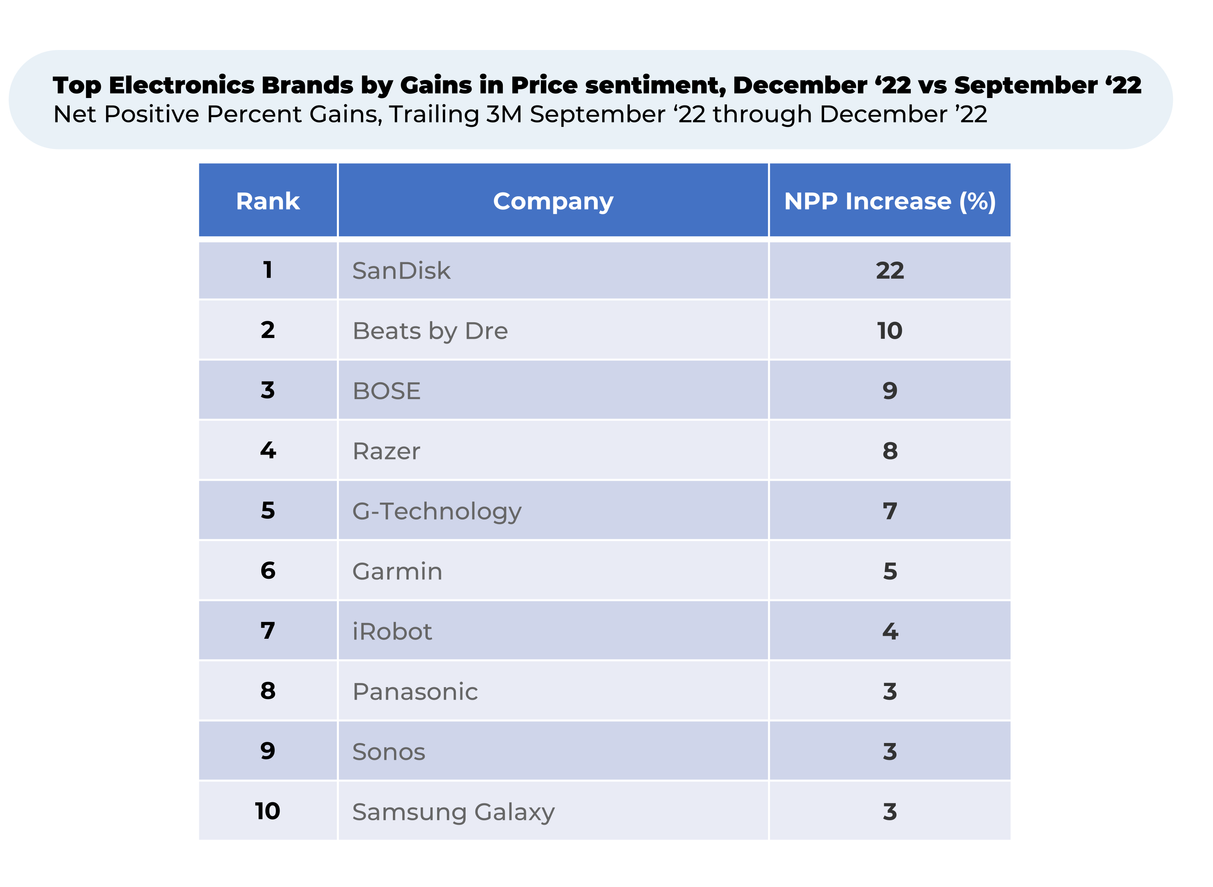

- Customers felt significantly more positive about the price for SanDisk and audio giants Bose and Beats by Dre after significant end-of-year sales.

Apple HomePod made the largest increase in Usage Intent since September, posting a rise of 13%. The competitive home smart speaker category remains hot. HomePod saw the greatest improvements in customer sentiment towards its Technology, Design, and Quality. Apple released several updates to HomePod in recent months, bringing a number of performance updates to the speakers. One customer that recently switched told us, “I love the small design, cheery orange color, and ease of switching back and forth with my iPhone. I've been with [a competitor product] for about 8 years, but when that device died, I got this as a gift and wish I'd have switched sooner.”

Meanwhile, major TV brands Hisense, Sony, and Vizio also made notable gains, between 4% - 7%. Nielsen, the longtime tracker of TV viewing, found an almost 8% increase in TV usage from October to November 2022. Hisense saw the most significant improvement in sentiment from the Crowd on its Value, while Sony saw the biggest boost in satisfaction with Quality.

One happy customer told HundredX in late December, “I love the Hisense brand television I purchased and I will continue purchasing from this brand in the near future because the products are well made and easy to use. The products are smart, cost less than its competitors and are of the same quality.”

Meta's Oculus VR headset significantly increased in Usage Intent as well, up 6% over the past three months. It appears Meta’s investment in new technology and the ecosystem is paying off, with the universe of apps growing. The Quest Store – the VR store for its Oculus headsets – had 33 apps making over $10 million as of October 2022, up from 22 apps in February 2022, according to VR news site Road to VR.

Meta also unveiled and released the Meta Quest Pro, a $1,500 VR headset made primarily for professionals and creatives, in October. Though they are expensive, sentiment towards their prices improved materially the last six months. With the holidays in December, it’s likely people splurged on headsets for their friends and family.

“My family loves this product. Grandparents gave them one for Christmas and my husband went out and bought another,” one person told HundredX in December.

“We love our Oculus. Everyone in our family uses it, from our five-year-old all the way up to the adults. My parents tried it only once and loved it so much they went out and bought their own! Well worth the money!” another person said.

The Price is Right

SanDisk, the maker of computer storage devices, made a huge jump of 22% in Price sentiment over the past three months. SanDisk offered massive sales for some of its products at the end of October (SanDisk Extreme microSD cards saw a 32% sale) and in November (some of SanDisk’s Extreme Portable SSDs saw more than 50% discounts).

Sentiment in Price also increased for audio giants Beats by Dre (+10%) and BOSE (+9%). Both companies are premium offerings with negative Price sentiment overall. But they offered significant Black Friday deals in November, with Beats offering 50% off some products and BOSE offering more than 40%. This resulted in hundreds of dollars in savings for customers.

“We have been using a Wave Radio and a BOSE stereo system for several years. The build quality, sound quality and performance is exceptional and these products have proven their cost in the value we get from them,” one BOSE customer recently told HundredX.

We will continue to watch how all the new products announced at CES 2023 and throughout the year are doing with customers.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a

mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact.