It’s a brand-new year, and plenty of new content is already available on Netflix. There is the unique chaos of Kaleidoscope, the financial horror story of MADOFF: The Monster of Wall Street, and the Gothic crimes of The Pale Blue Eye – and it’s only the beginning of January. That’s not to mention the new ways to watch content on the platform. Netflix released its cheaper, ad-supported tier in November, following the lead of other major services like HBO Max and Disney+.

With so much content and so little time, HundredX looks to The Crowd, 22,000 real Netflix subscribers who leave feedback with HundredX, to understand what people think of Netflix and why. Going into 2023, we find:

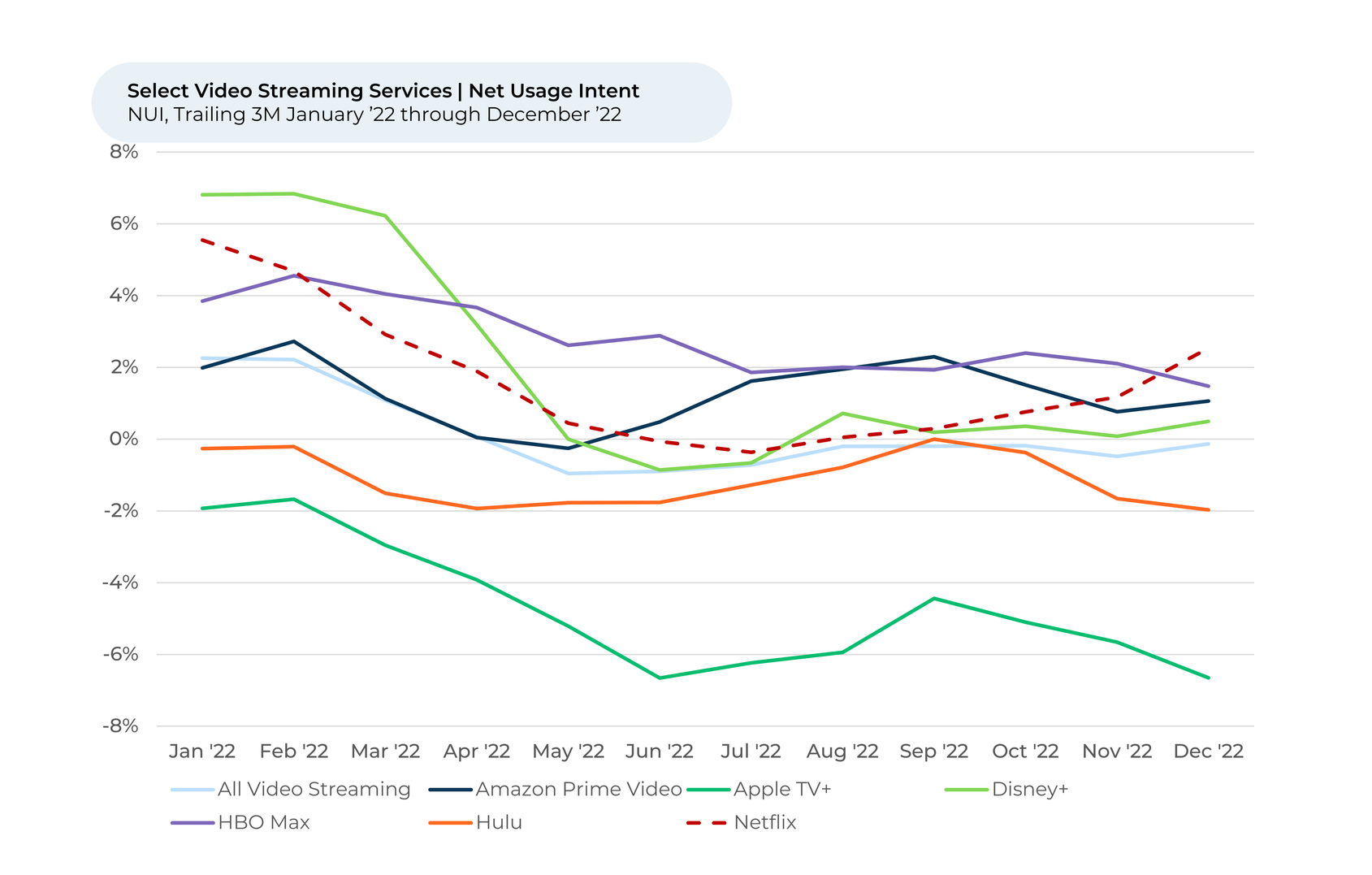

- After declining throughout the first half of 2022, Usage Intent is now growing quicker for Netflix than it is for the Video Streaming industry overall. It is the only service we track to post gains in the last two months.

- It’s still early days since Netflix released its ad-supported plan in November, but customers of its ad-supported plans show higher Usage Intent1 than its ad-free plans (opposite of industry trend).

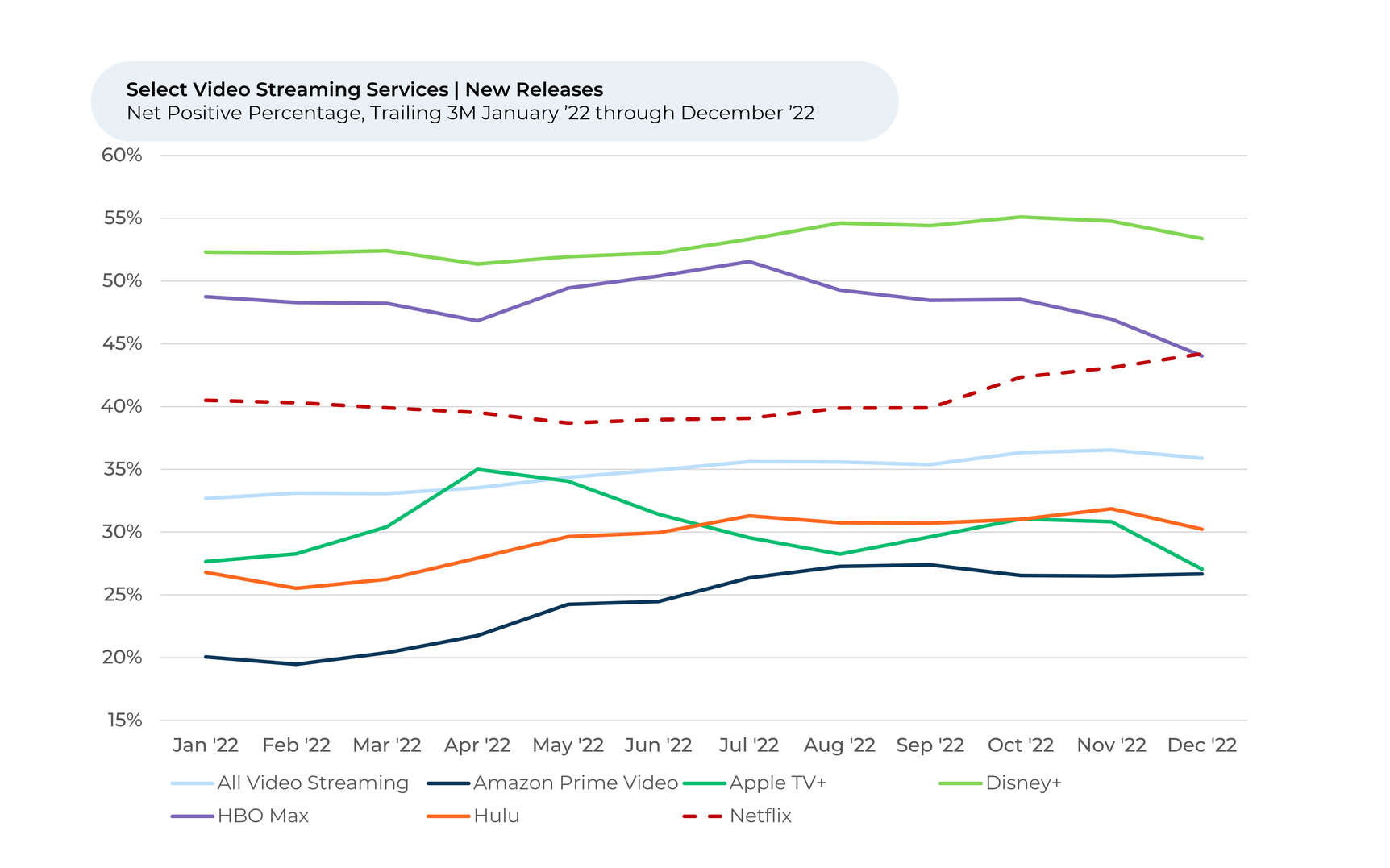

- Over the past few months, subscribers feel increasingly happy with Netflix’s Original Content, New Releases, and Amount of Programming, reflecting credit for a strong slate of 4Q releases.

As of December, more people plan to increase their use of Netflix than other major streaming services. Over the past several months, Usage Intent rose slowly but steadily for Netflix, from 0% in July to 3% in December. This outpaces the overall industry, which saw Usage Intent remain steady at 0% during that time, implying Netflix is likely back to gaining share from competitors. Usage intent reflects the percentage of customers who plan to use a specific brand during the next 12 months minus the percentage that plan to use less.

Interestingly, Usage Intent for subscribers of Netflix’s new ad-supported plan is notably higher (5%) than those with an ad-free plan (1%) in December. This is the opposite of what we see for the other major video streaming services, which have higher usage intent for their ad-free tiers than ad-supported tiers. This potentially indicates that Netflix has successfully brought in new users who were waiting for lower-priced plans with ads and are hungry to watch more content soon.

While some reports indicate Netflix’s ad-supported plan is seeing

slower-than-expected adoption rates, our data shows users are perhaps warming to the new plan. One user told HundredX in December, “I will be moving to the subscription with ads to save money.” Another added, “The variety of programming keeps me returning after I finish a show.”

Considering the Options

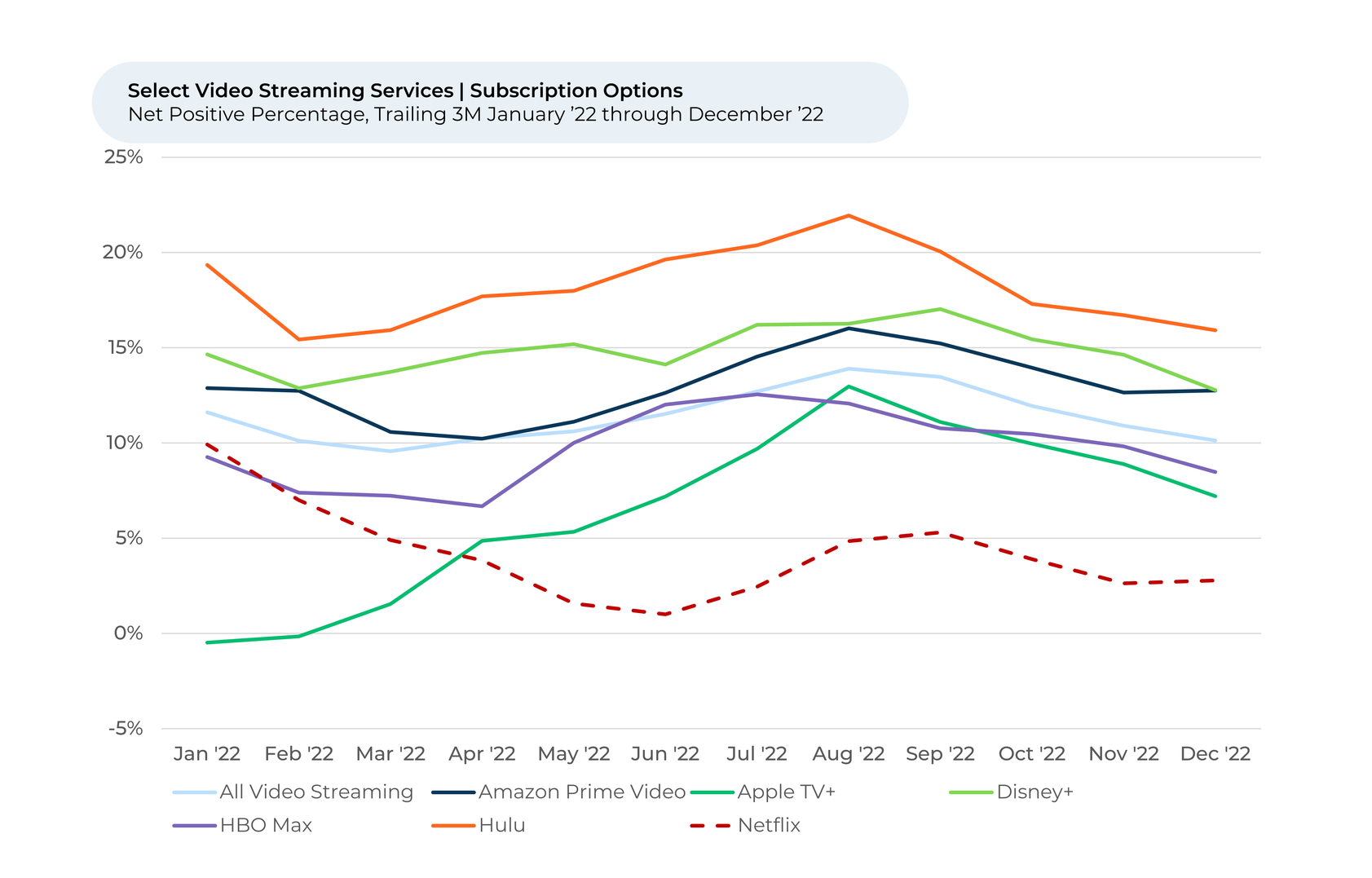

Sentiment towards Subscription Options and Price remained pretty steady for Netflix in November and December, while they fell for the overall Streaming industry. Netflix continues to lag the industry in sentiment for both, but the spread narrowing is potentially notable. Whether it will remain at the bottom of the pack over the next few months is something we will watch closely, but it appears some customers are pleased Netflix is offering a new plan.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Over the past few months, Netflix subscribers increasingly liked the streaming company’s Original Content, New Releases, and Amount of Programming. Crowd sentiment towards Netflix’s New Releases has jumped to 44% in December from 40% in September, while the industry overall has been around 36%. Netflix released several major hits near the end of 2022, including

Dahmer – Monster: The Jeffrey Dahmer Story in September,

The Watcher in October,

Wednesday in November, and

Glass Onion: A Knives Out Mystery in December.

Netflix, at least in The Crowd’s view, is on the right track in terms of original and new content. How its significant investments will fair in 2023 remains to be seen. HundredX will continue monitoring Netflix and other streaming services throughout 2023.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a

mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact.