As the American economy demonstrates surprising resilience amid inflationary pressure and rising interest rates, consumers find themselves adapting to new realities. Ongoing economic uncertainty has resulted in noticeable shifts in spending habits, with consumers gravitating towards more cost-effective options.

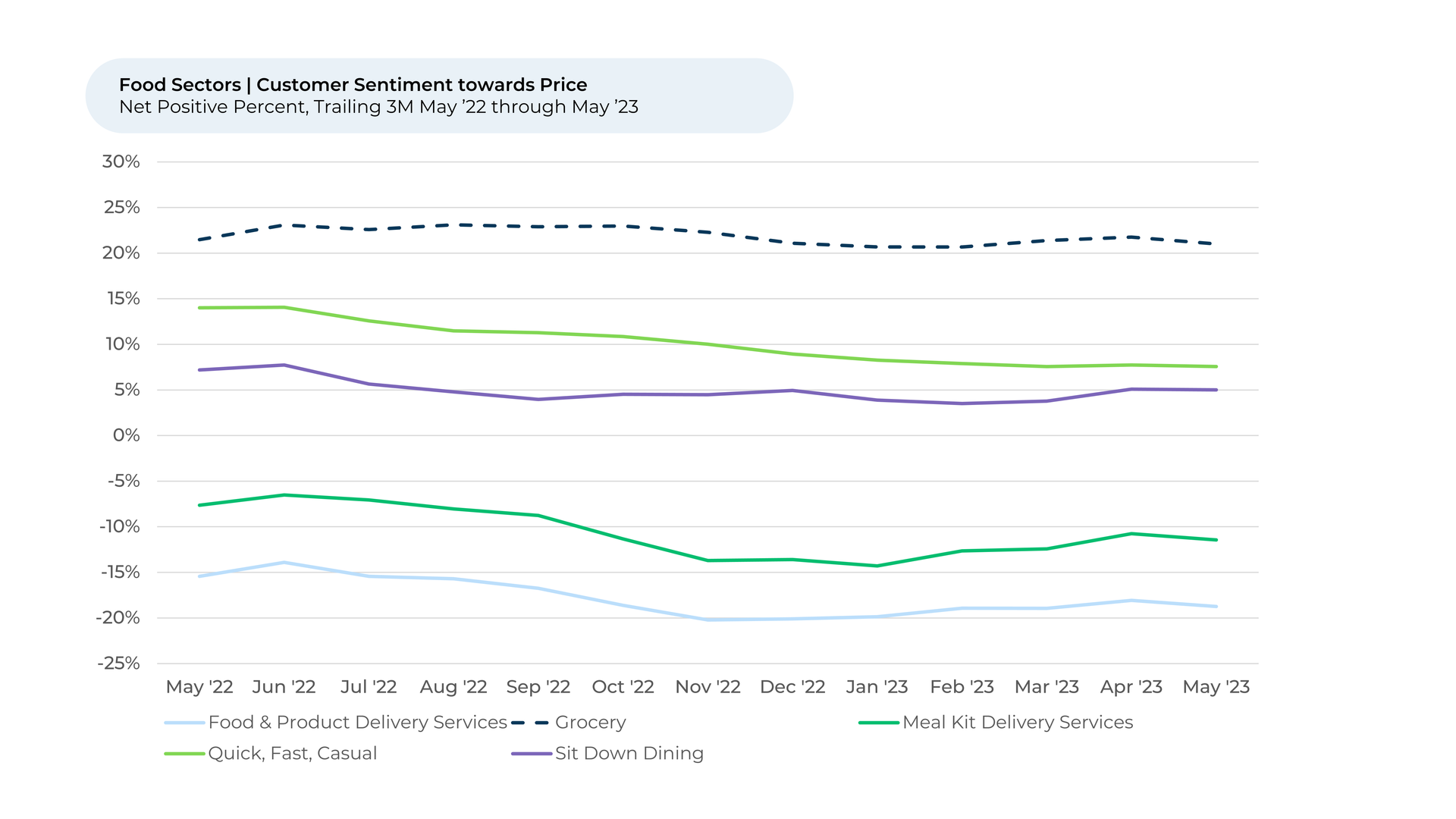

As a result, demand patterns and price sentiment have changed across various segments of the food industry — from restaurants and fast-food joints to meal kit delivery services, takeout services, and grocery stores.

After analyzing more than 900,000 pieces of feedback across the entire food sector, including 170,000 pieces of feedback across 61 grocery chains, we find:

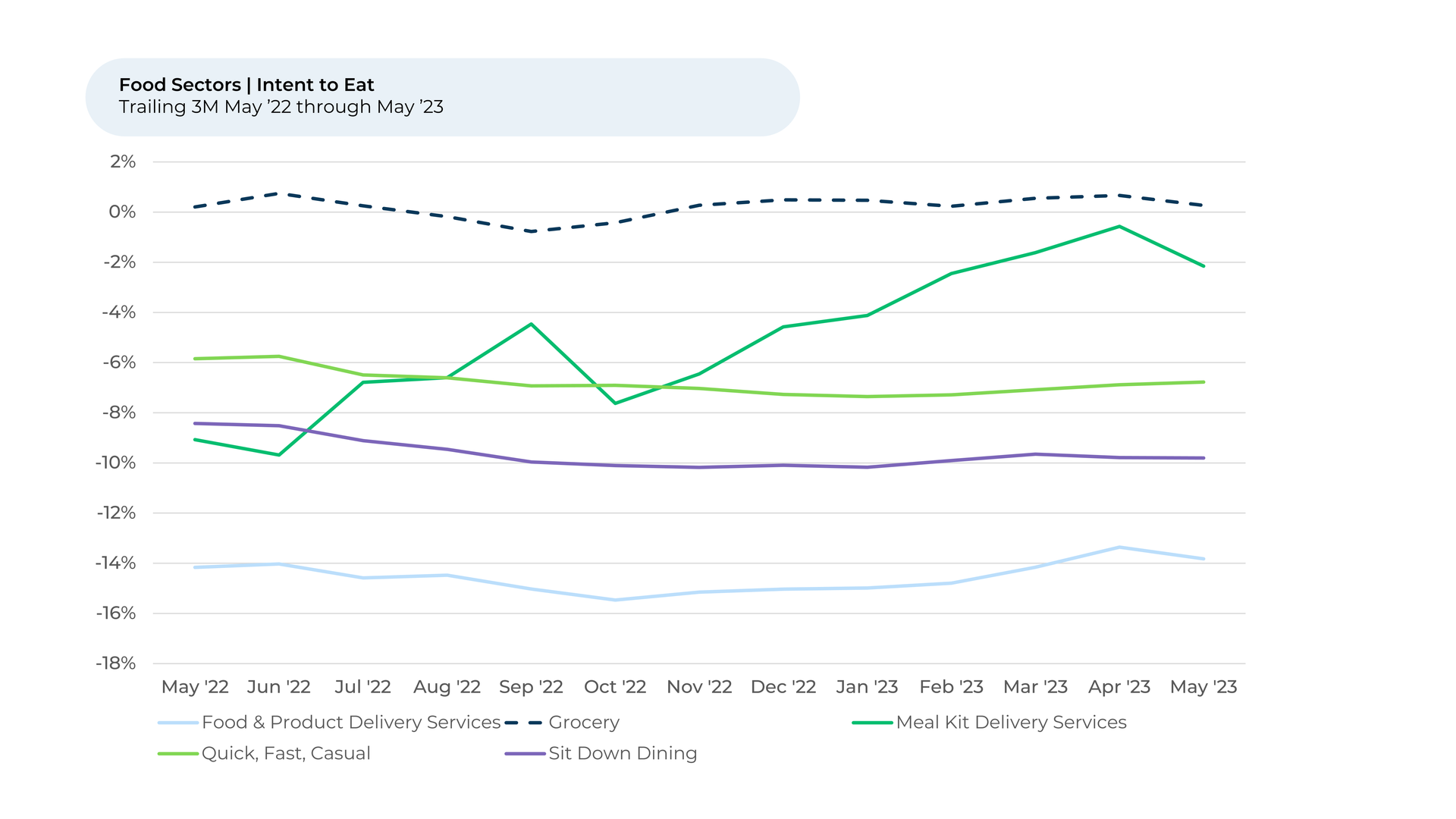

- Intent to Eat1,2 has remained within a pretty tight range for most of the major food industries over both the last three months and year. However, it rose 7% from October 2022 through April 2023 for meal kit delivery services, much more than any other food industry.

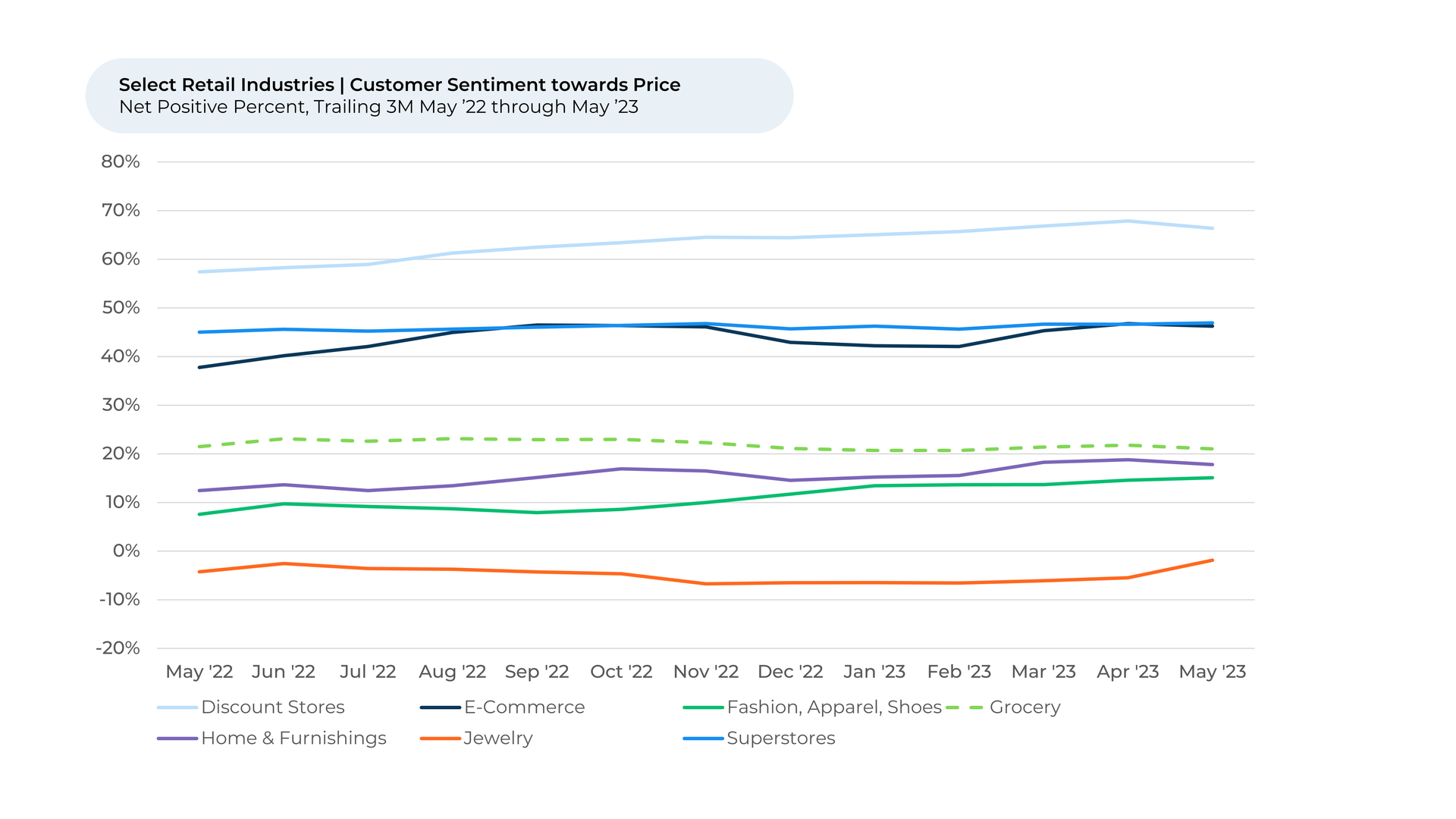

- Grocery Purchase Intent remained stable over the past year, corresponding with stable customer sentiment3 towards Price. Across the broader retail sector, customers are happier with grocery prices than those of many other retail industries. Discount stores, like Dollar Tree, e-commerce stores and superstores do a better job pleasing customers on price.

- Still, Purchase Intent increased notably for Harris Teeter and Market Basket over the past three months. Harris Teeter made several marketing upgrades, while Market Basket continues to please on price.

Meal kits gaining ground on rest of food while grocery more stable than most other retailers

We found in April that “The Crowd” of real food industry customers says that the

growth in people planning to keep eating meal kits

is outpacing intent to consume for other food industries. Meal kit Loyalty Intent rose steadily by 7% from October 2022 through April 2023 before dropping slightly in May. This increase significantly outpaces the relatively stable Intent to Eat for other food-related industries.

More affordable than eating at restaurants and more convenient than shopping at grocery stores, meal kit services retain customer interest even amidst rising inflation in food costs.

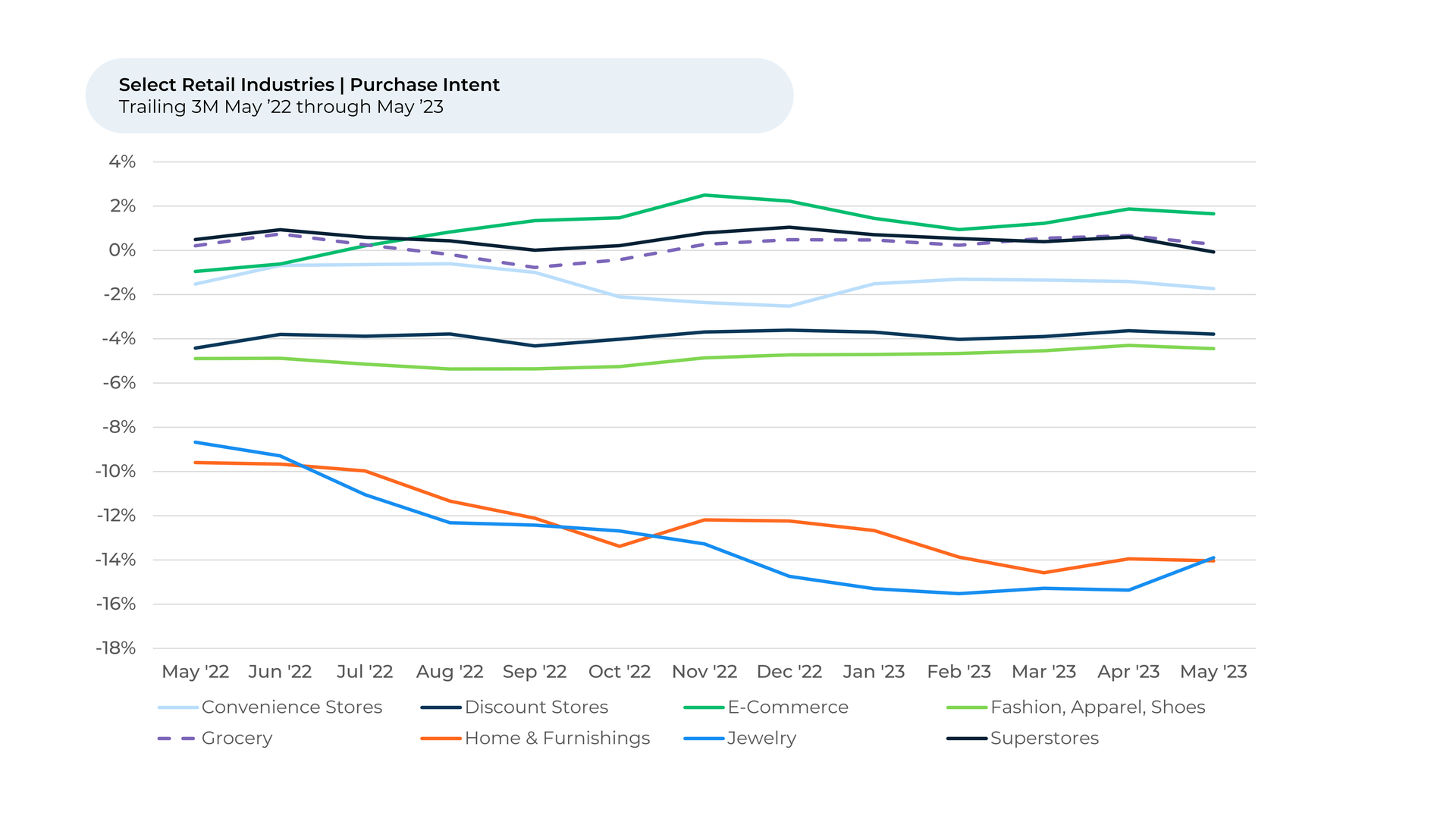

Meanwhile, Purchase Intent for the grocery industry has remained stable over three, six, and twelve-month periods. Grocery stores, along with superstores, have demonstrated resilience. They've maintained positive and stable Purchase Intent scores throughout the past year, suggesting that consumers still rely on these outlets for essential items.

This stability stands in contrast to changes seen in other, non-food related retail sectors, such as jewelry and home & furnishings, which saw Purchase Intent decrease by 5% and 4% respectively over the past year. On the other hand, e-commerce is the only retail industry we follow that has witnessed Purchase Intent growth, albeit small, over the same period.

Price appears to be a significant factor driving these trends

Customer sentiment towards grocery store prices remained steady at around 20% over the past year. However, sectors that emphasize lower prices as part of their business models saw an increase in customer sentiment. These include discount stores (+9%), e-commerce stores (+8%), and superstores (+2%).

At the same time, grocery stores, despite being outperformed by discount, e-commerce, and superstores, continue to please their customers more with their prices compared to other food industries. Quick, fast, casual restaurants, the second-highest rated food industry for Price sentiment, fell further behind grocery stores over the past year as its Price sentiment dipped by 6%.

Despite the inflationary pressures and the rise of meal kits, the resilience of Price sentiment for grocery stores and superstores underlines their essential role in consumers' everyday life. They are the primary source for purchasing food for most people, likely due to their relatively lower prices compared to restaurants, meal kits, and food delivery services.

Harris Teeter saw the biggest Purchase Intent increase over the past three months

While Purchase Intent has remained stable for the overall grocery industry, some individual brands saw some notable improvements. Over the past three months, North Carolina-based Harris Teeter (+7%) and Massachusetts-headquartered Market Basket (+5%) increased in Purchase Intent the most.

The Purchase Intent jump for Harris Teeter, which was acquired by Kroger in 2013, appears to be driven by its success increasingly pleasing its customers with its produce (+6% in sentiment), store services (+6%), and availability (+5%) since February 2023.

In March, the grocery chain revamped its marketing efforts, rolling out a new logo, tagline, and food icons while advertising the changes in new TV spots and social media posts. The efforts are meant to give Harris Teeter a more modern look while making its products look more enticing. Then, in April, the company began allowing shoppers to pay with Apple Pay. Recently, Harris Teeter has also introduced new display cases that better show off its fresh produce.

The modernization and marketing efforts seem to have paid off.

“Fresh produce and meats are where this store shines. They have the lowest prices for the best selection,” a Harris Teeter customer told HundredX in June.

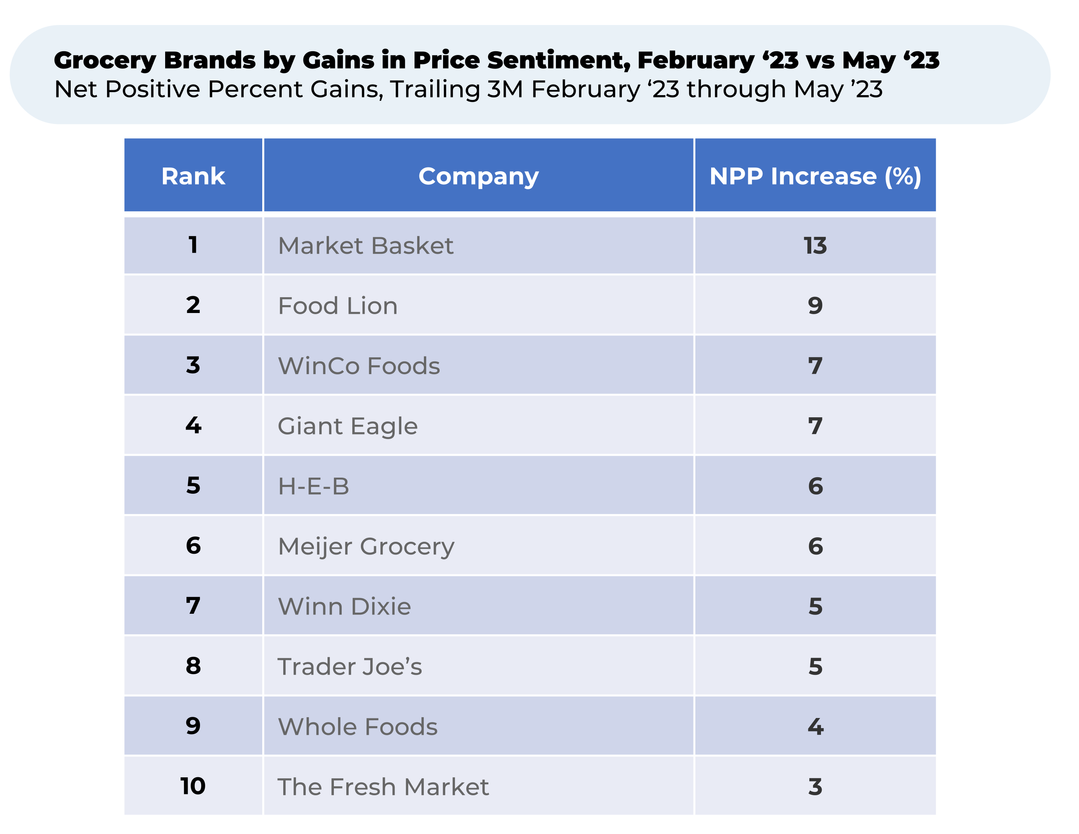

Meanwhile, Market Basket is pleasing its customers with its prices, enjoying the highest increase in price sentiment over the last three months of any grocer we follow. Customer sentiment towards price, already higher than most of Market Basket’s competitors, increased 13% since February.

Regularly

recognized for its relatively low prices, Market Basket appears focused on keeping groceries affordable for its customers. In turn, its customers are showing their appreciation.

“Thank you for providing groceries at an affordable price!!” one Market Basket customer recently told HundredX.

Another recently noted, “Market basket is a great store. It has everything needed at a good price with a good-sized inventory. Inflation has caused the prices of food to rise to the extreme. This store has gone up too but to a lesser degree.”

Despite the economic uncertainties and shifts in the market, consumers have found a way to adapt their food consumption behaviors to fit their needs. We will continue to stay close to the pulse of change in the industry, with future winners likely to be those that continue to deliver affordability and convenience to customers.

- Intent to Eat reflects a way to compare the future intentions of customers across various food-related industries. It captures:

- Loyalty Intent for Meal Kit Delivery Services, which is the percentage of customers who plan to keep using the service minus the percentage who intend to cancel. It also captures Visit Intent for Groceries, Usage Intent for Food Delivery, and Purchase Intent for the dining industries, which all represent the percentage of customers who expect to visit, use or spend more on a brand minus those who intend to visit, use or spend less.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.