As we continue through the holiday season, traditionally one of the biggest “snacking” times of the year, we look to The Crowd to indicate what types of salty snacks people want to eat. Leveraging HundredX’s proprietary listening methodology, we evaluate more than 145,000 pieces of feedback from real snack eaters across the country on over 100 brands from November 2021 to November 2022.

We leverage that data for insights into how customers view the top snack brands we cover, analyzing changes in Consumption intent1, the drivers behind those changes in intent, and Customer Satisfaction. (CSAT).

We have lined up some of the top snacks against each other and discover which ones do best at pleasing their customers and why.

Key Takeaways:

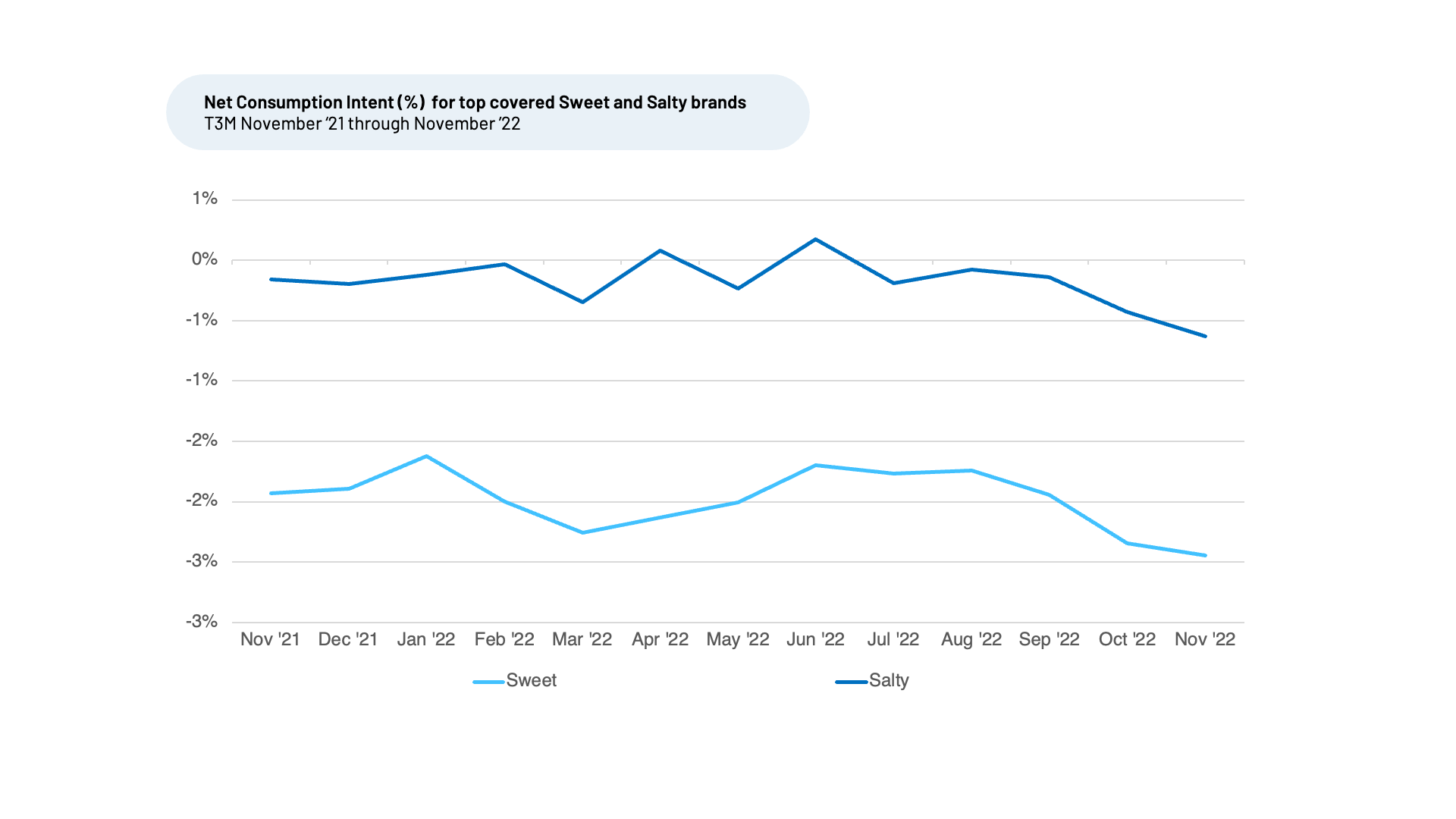

- Consumption intent for snacks has fallen slightly since August. Intent is higher for salty than sweet.

- Customers care most about Taste, Availability, and Flavor when it comes to salty snacks.

- People increasingly like popcorn snacks billed as “healthy,” like Boomchickapop and SkinnyPop.

- Snackers have noticed Doritos, the winner for “Flavors”, after launching many new ones this year

For these insights, we split our coverage of Snacks and Desserts into two categories – salty snacks and sweet snacks – and primarily dig into salty snacks for this report.

Slightly downward trend in Consumption intent

Consumption intent for both sweet and salty snacks have bounced around in a range over the last year, rising into the summer and falling slightly since August 2022. Intent for salty snacks is higher. As we move out of the summer months, people are less keen to eat snacks. That may change during the holiday season – last year Consumption intent was slightly up from November 2021 to January 2022.

Consumption intent reflects the percentage of customers who plan to consume more of a brand during the next 12 months minus the percentage that plan to purchase less.

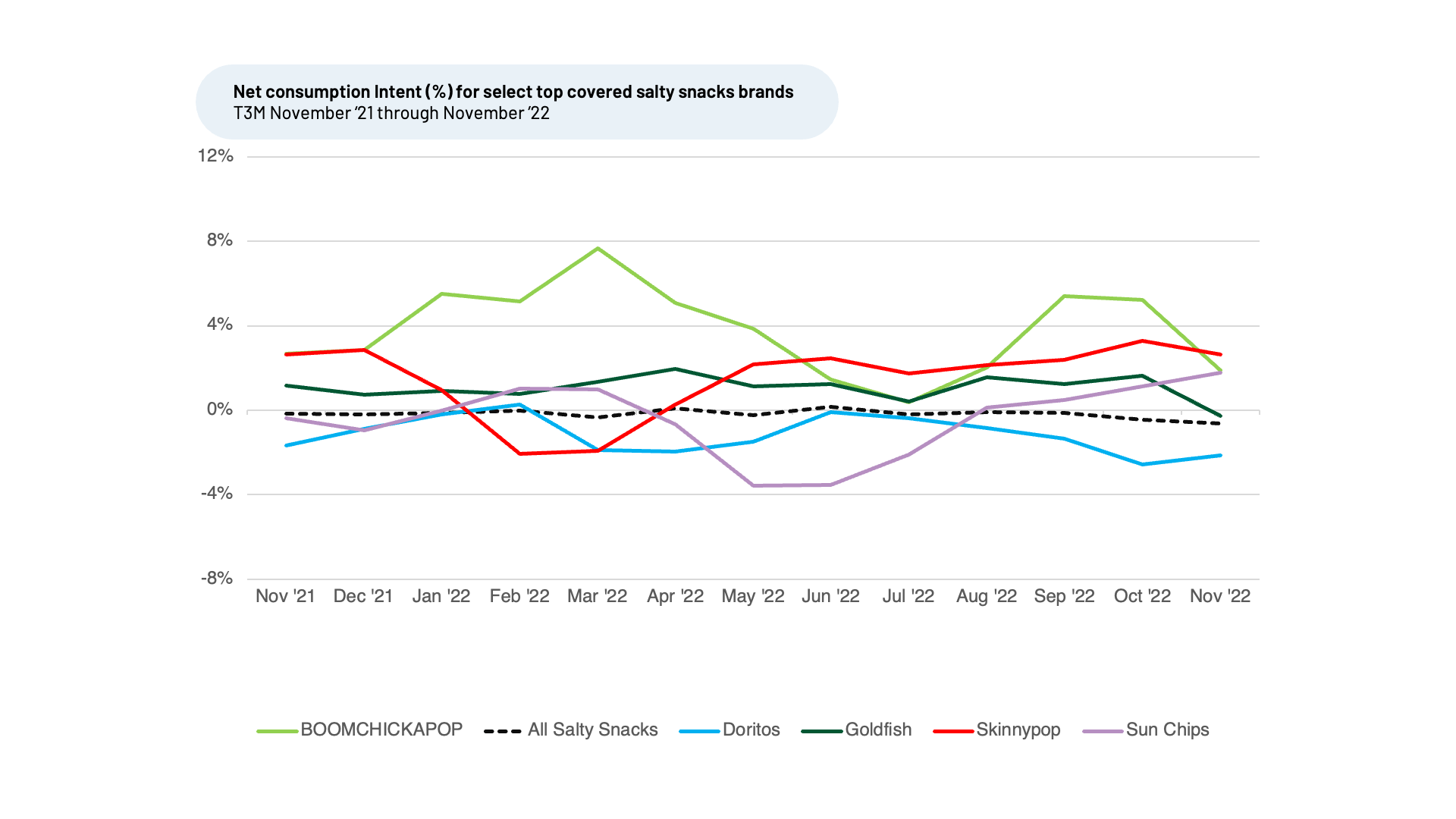

Digging into the salty snack brands we cover, we see SkinnyPop and Boomchickapop, popular pre-popped popcorn snacks, seemingly caught customers’ attention over the past few months. Both brands outpace the other snack brands we cover in Consumption Intent since April 2022. We find brands that see their spread in Consumption Intent improve vs. peers tend to see stronger growth rates and market share gain.

A crowd-pleaser: popcorn

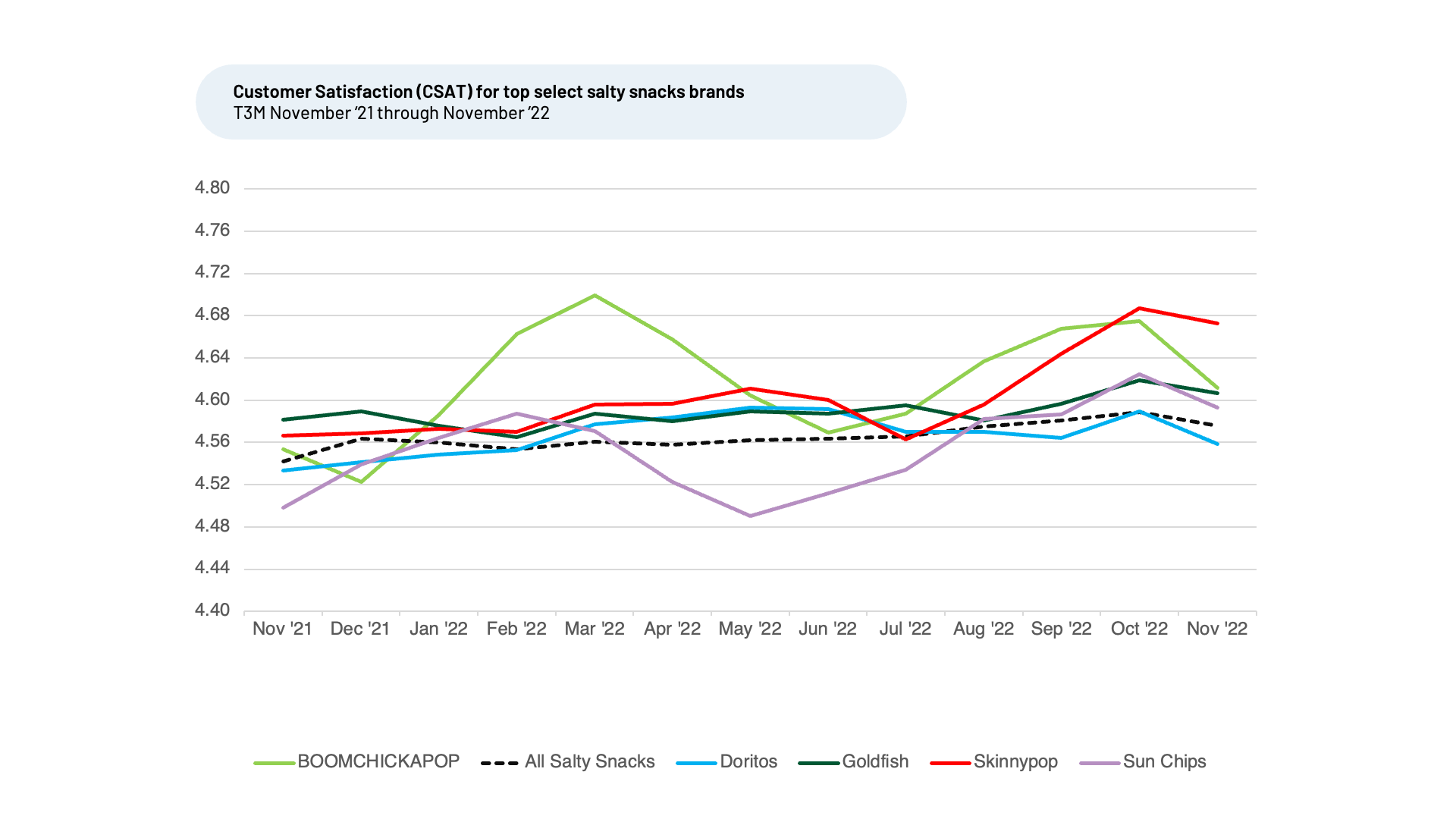

SkinnyPop and Boomchickapop have jumped in Customer Satisfaction (CSAT, measured on a five-point scale) since May 2022.

Perceived healthiness may be the reason. Both SkinnyPop and Boomchickapop bill themselves as healthy snacks, with less sodium, sugar, and fat than many other snacks and even popcorn brands. When considering SkinnyPop and Boomchickapop, “the Crowd” of HundredX feedback providers select “Healthy” as one of the top reasons they like the brands.

“SkinnyPop is a great snack. I try to limit the gluten I eat and Skinnypop, being gluten free and tasty, is a great snack I eat throughout the year,” one person said to HundredX.

Selection frequency for Healthy jumped from July to November for Boomchickapop, moving up 9% to 67%. Selection frequency is how often a customer selects a particular reason for why they do or do not like the snack. Snackers choose “Healthy” as a reason for liking SkinnyPop even more, with 73% selection as of November 2022.

On its website, SkinnyPop notes it was founded to provide people a snack that’s tasty and “good for them.” The website for Boomchickapop says the brand was founded to provide customers a snack they feel “good about” eating.

At the start of the summer months, customers’ sentiment for “Healthy” increased significantly for both brands. From June 2022 to November, Boomchickapop customers’ sentiment towards Healthy increased from 43% to 46%. Meanwhile, SkinnyPop customers’ sentiment towards Healthy increased from 64% in July 2022 to 70% in November, the highest score for Healthy of any of the large snacks brands we cover.

Sentiment is measured as a percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

During the past year, many well-known food and health blogs, media, and social media channels published content on healthy snacks to eat. Popcorn frequently made the lists, and, specifically, SkinnyPop and Boomchickapop.

Taste, availability, and flavors — oh my!

Even though Boomchickapop and SkinnyPop customers make their snack choices with health in mind, other snack eaters make their purchase decisions based on other factors. To understand why some snack brands beat the competition on satisfaction, we dig into specific drivers to uncover “the why behind the buy." Our analysis indicates salty snack brands with the highest customer satisfaction tend to do a better job than peers delighting customers on Taste, Availability, and Flavors.

Taste

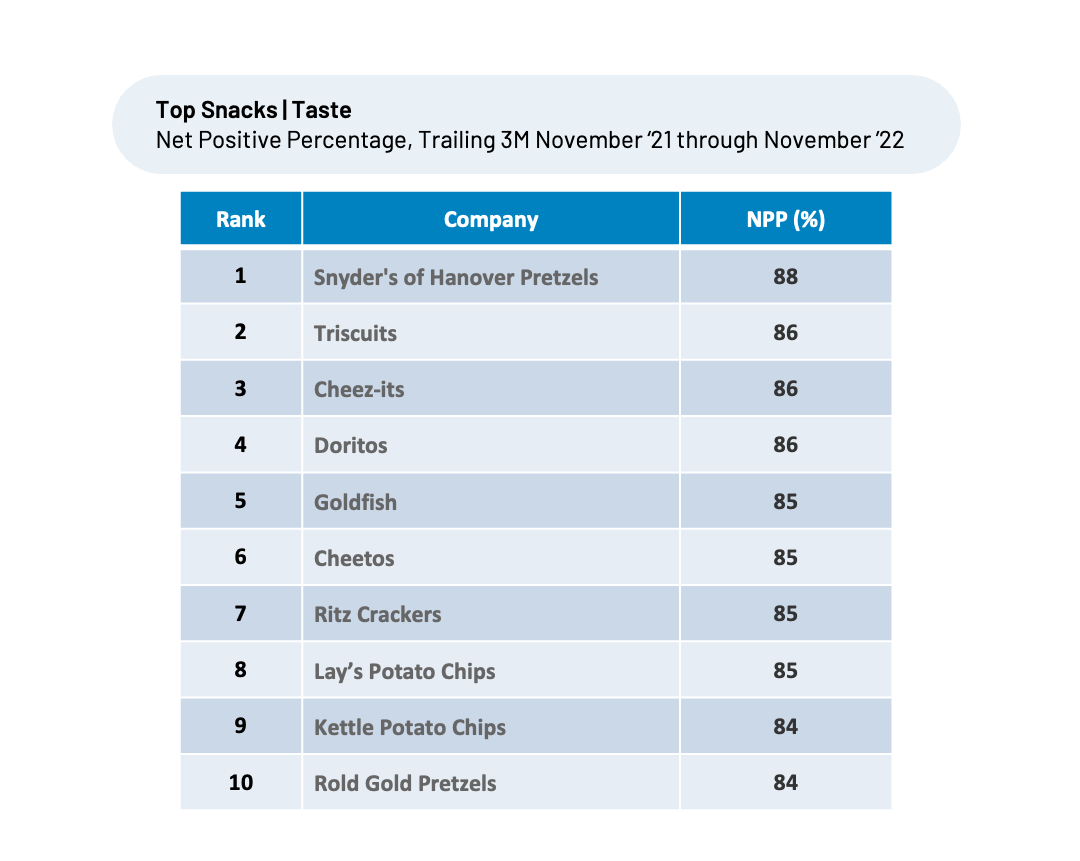

The Crowd most frequently selects Taste when considering why they like their favorite salty snacks. We find customers love the taste of Snyder’s of Hanover Pretzels over the competition we cover.

“Snyder’s is a good flavorful snack that will go perfect with a sandwich,” one person told HundredX.

While it didn’t make the list, Gardetto’s, the General Mills-owned maker of a mixed snack similar to Chex-Mix, made one of the biggest jumps in Taste sentiment over the past few months. Since August, sentiment towards Taste moved up 9% to 80% in November.

“I like to buy [Gardetto’s] in bulk from Sam’s Club. Once I start eating them, they are addictive. I can’t remember ever seeing commercials for them, so I don’t know what their advertising is. I just ate them once, liked them, and keep eating them as a salty crunchy snack. It’s great for road trips,” one person recently told HundredX.

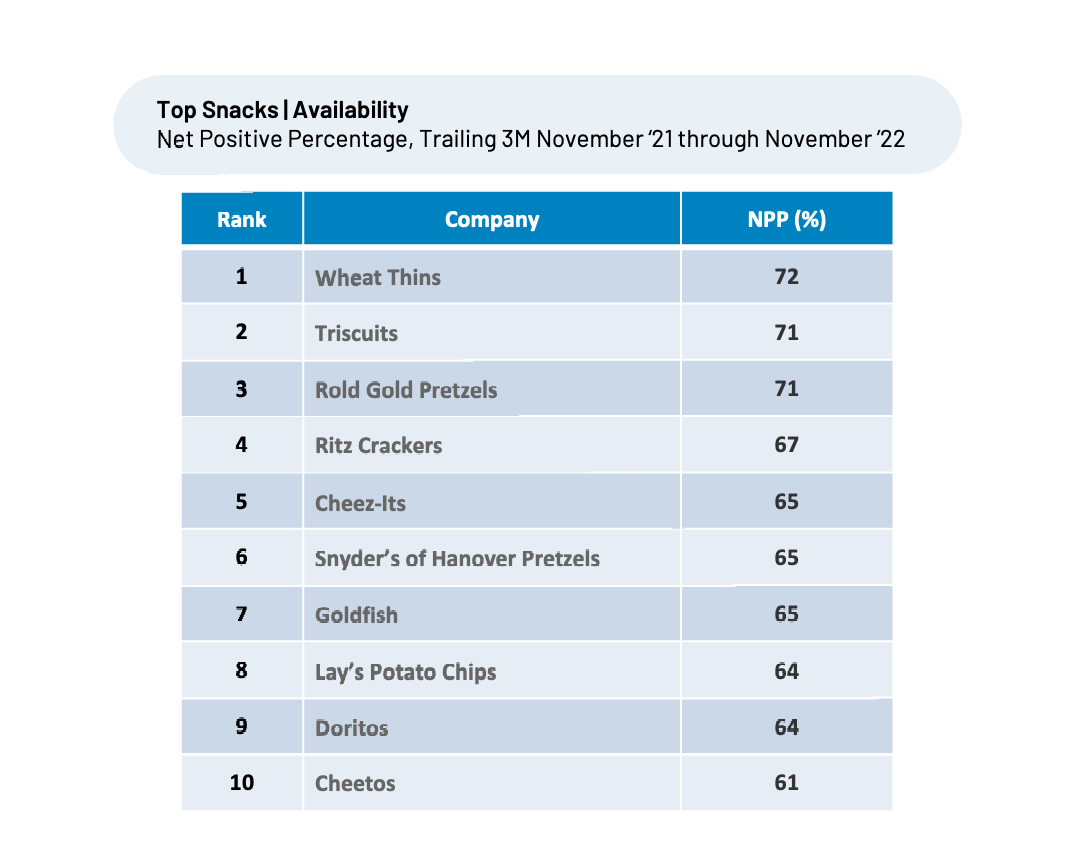

Availability

Good taste doesn’t mean much if customers can’t find their favorite snacks available to purchase. We find Availability is top of mind for many customers, right after Taste.

As of November 2022, Wheat Thins is the winner in Availability, boasting sentiment of 72%. Owned by Mondelez International, the major food manufacturer that makes dozens of popular brands, including Triscuits, Oreos, and Chips Ahoy!, Both Wheat Thins and Triscuits are staples in many grocery store snack aisles. In recent years, Triscuits has sold more than a dozen cracker flavors across its products.

“I like to buy [Wheat Thins] in bulk from Costco, one person told HundredX. Another person said, “We buy these crackers the most.”

Snyder’s of Hanover Pretzels, the classic pretzel brand owned by Campbells, is one of the biggest movers in Availability sentiment over the past year, having gone from 75% in November 2021 to 55% in April 2022, before moving back up to 65% in November 2022.

In its Q1 and Q2 2022 earnings calls, Campbells notes supply chain restrictions limited its ability to produce and sell certain snack brands, including Late July snacks, Snyder’s of Hanover pretzels and Lance sandwich crackers. The apparent supply chain woes coincide with the dip in customers’ sentiment towards Availability earlier this year before recovering recently.

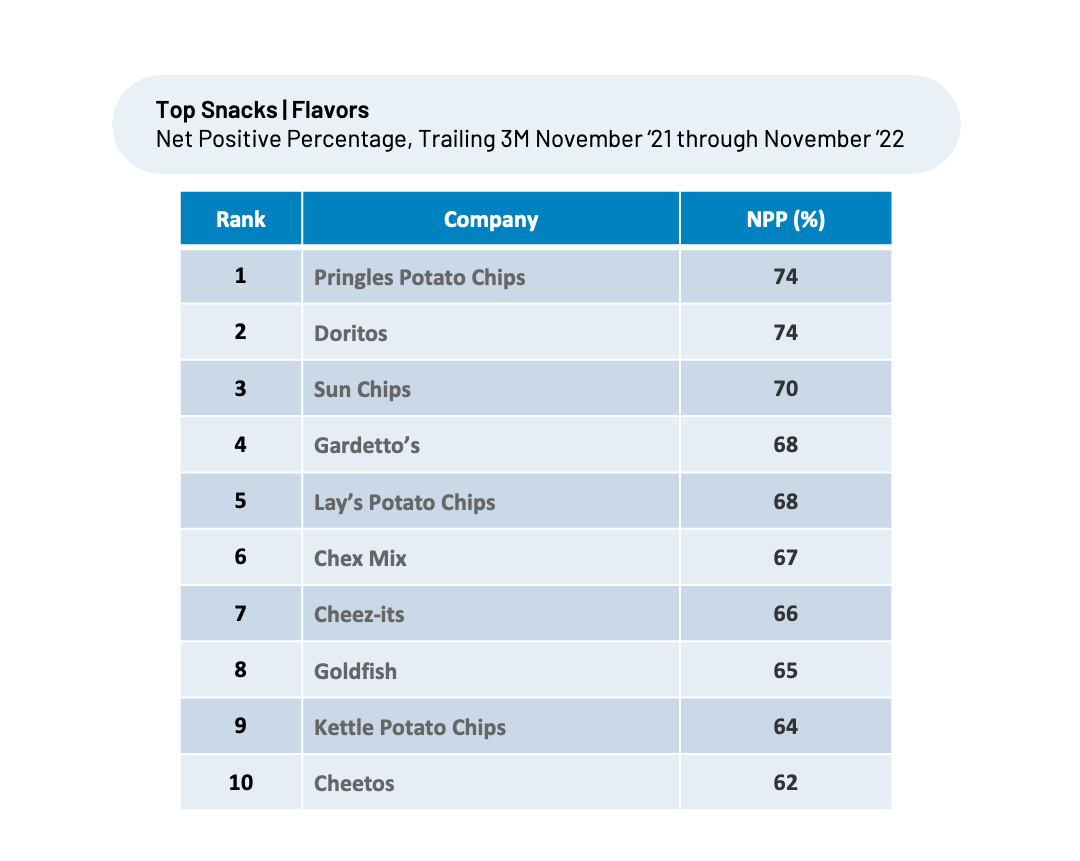

Flavors

Doritos, following a consistent upward trend since February, is one of the winners for Flavors, alongside Pringles. Doritos Flavors satisfaction rose from 69% in February to 74% in November 2022. The brand sells numerous flavors, and recently brought back its 3D branded chips. At the end of December 2021, Doritos introduced Flaming Hot Cool Ranch, a spicy take on its classic Cool Ranch flavor (the blue bag). The new Flaming Hot flavor was highly publicized in December 2021 and January 2022, and influencers took to YouTube, TikTok, and other social media platforms to “taste test” the flavor for their audiences. HundredX feedback takers noticed the new flavor, and it likely helped power the upward momentum in Flavor sentiment.

“The new flaming hot cool ranch are the best!” one Doritos eater said to HundredX in February 2022.

Another person noted, “Doritos have great and interesting flavors compared to other potato chip companies. Their originality is what makes them so good.”

Pringles, meanwhile, sells at least two dozen different flavors in the U.S. BBQ, cheesy, spicy, and even pickle flavors – Pringles sells it all.

We also see customers’ sentiment for Flavor for Cape Cod Potato Chips shoot back up in September 2022 after a dip in the summer. It appears some grocery stores began selling assorted packs, boxes of more than a dozen small chip bags of multiple flavors, in September. The move, coinciding with the start of the school year, could have helped Cape Cod Potato Chips’ Flavor sentiment move from 47% in August to 61% in November.

“If given the choice between Cape Cod chips and other brands, I will always lean towards the Cape Cod brand. The chips are always tasty, substantial, and consistent in quality,” one person told HundredX.

Based on our data, we find that salty snack brands looking to increase customer satisfaction should invest in improving the Taste, Availability, and Flavors of their products. These drivers keep customers coming back. We will keep an eye on trends in the Snacks industry as the holiday season continues and people hunker down for the winter with their favorite snacks in hand.

1 All metrics presented, including Net Consumption intent / Consumption intent, Customer Satisfaction, and

Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on our Snack insights and any of our other 2500+ brands or 75+ industries, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact