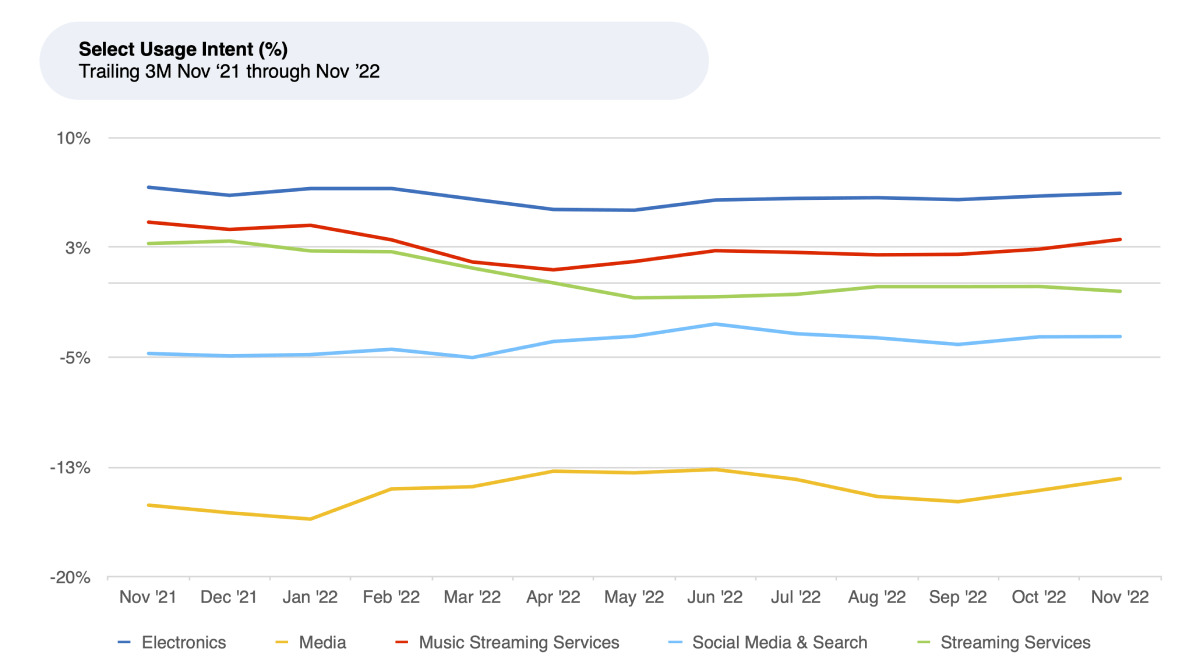

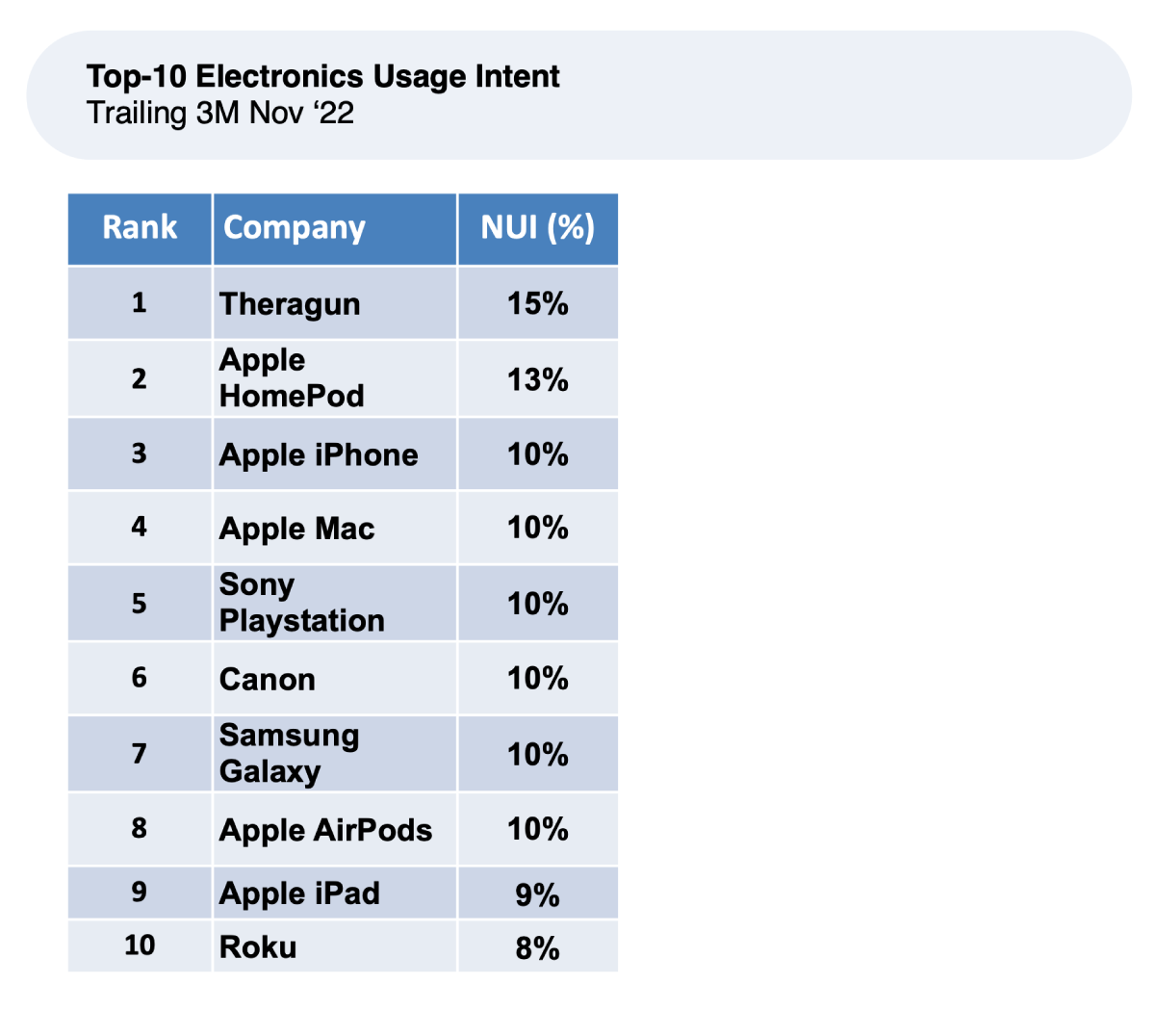

Though Usage Intent for the broader Electronics group has been stable in a 5%-6% range for the last year, we observe positive trends for leaders including Theragun, Apple and Canon.

The Crowd tells us that they intend to use the following products and brands more.

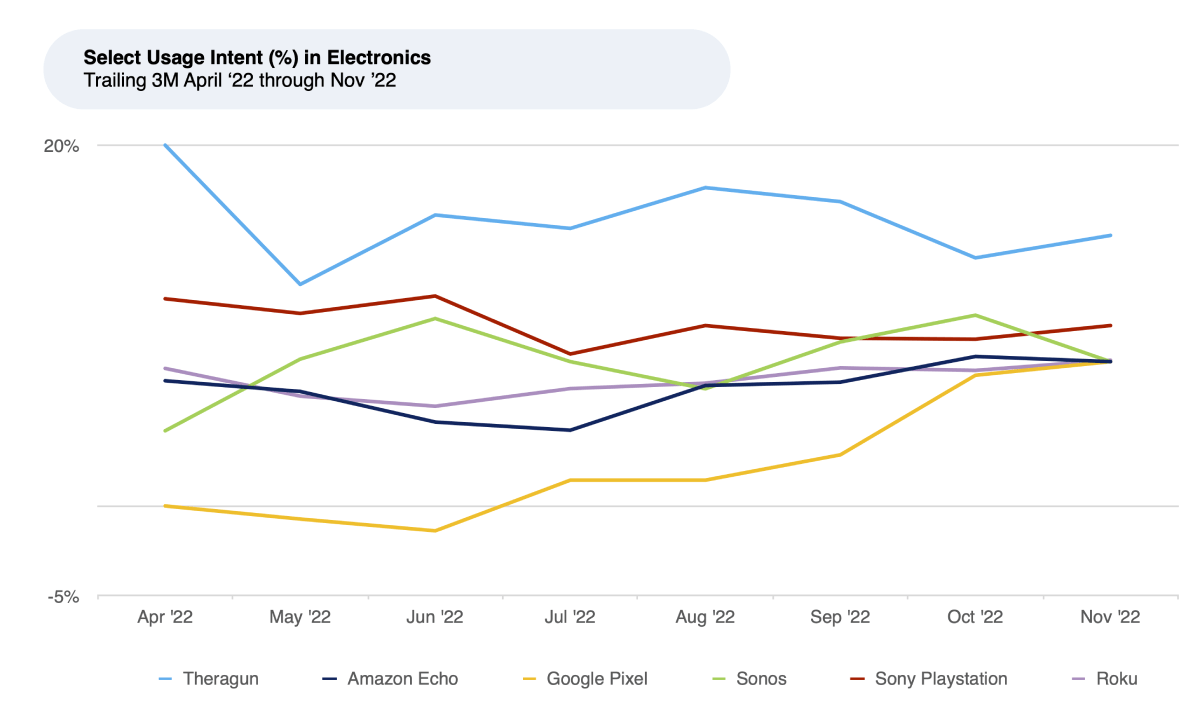

Theragun, the Usage intent leader in Electronics, increased from 12% in May 2022 to 17% September 2022 before dropping to 15% in November 2022. Boosted by discount pricing and Amazon Prime sales, Theragun remains the category leader with the most consumers who want to use it more. Over the last six months, Theragun saw its user satisfaction increase vs. the Electronics sector most significantly for Usability, Reliability, Instructions, and Install / Setup. HundredX measures customer satisfaction with specific factors as the percentage of customers that select it as a reason he or she likes the brand minus the percentage that choose it as a reason he or she does not. Theragun improved by 10% to 25% vs. peers on all four factors over the last six months. One happy customer recently told HundredX, “I had no idea how amazing this would be! It is a game changer!!!” Another added, “Purchased the mini on sale and was so happy with the usability of it. I purchased another one for my mother who also uses it daily.”