Amidst rising food prices, grocery shoppers seek out great selection and a positive checkout experience.

Amid supply chain problems, labor shortages, and rising food prices, grocery stores are navigating a tricky landscape in 2022. These challenges impact both grocery chains and their shoppers.

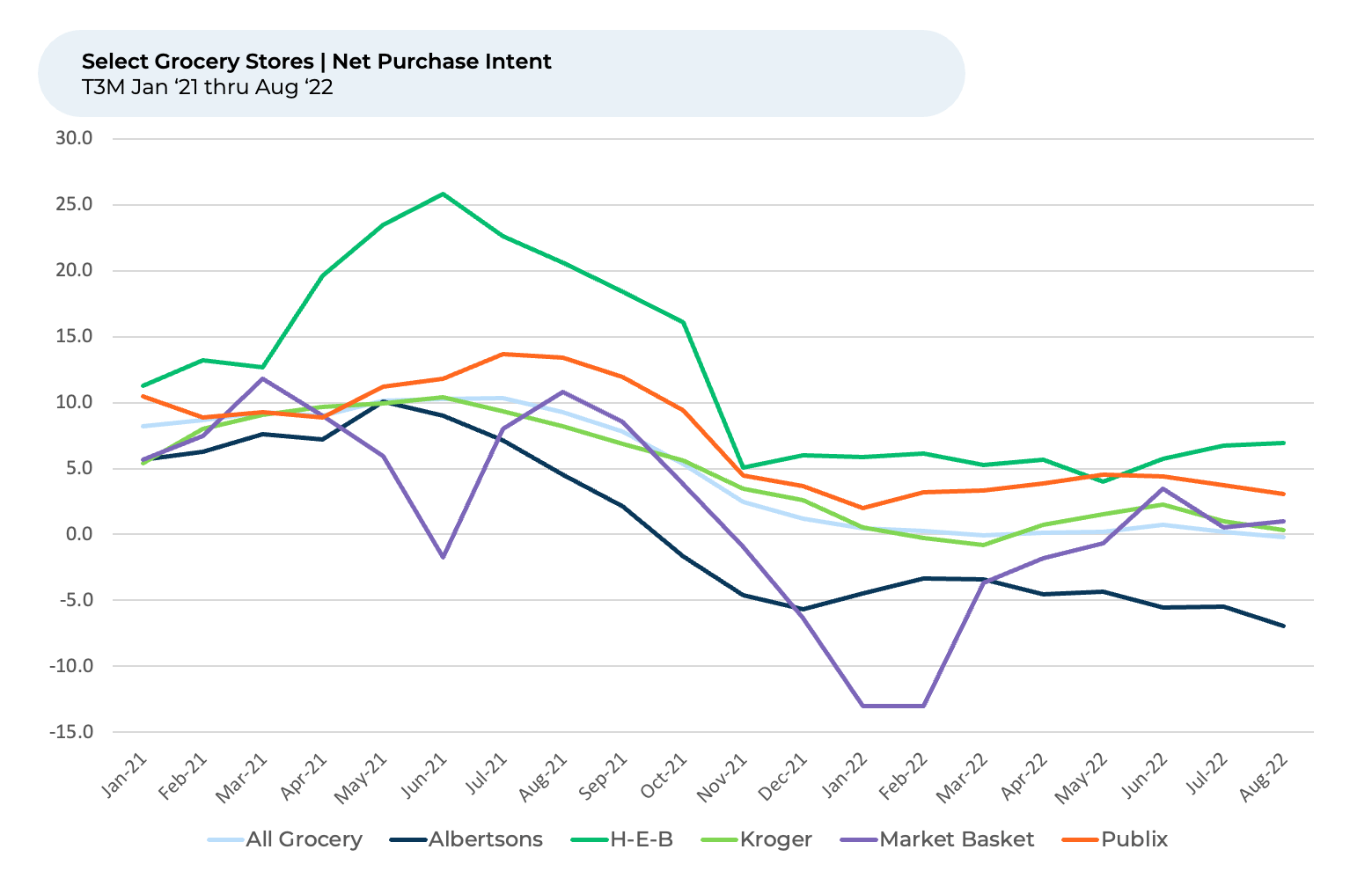

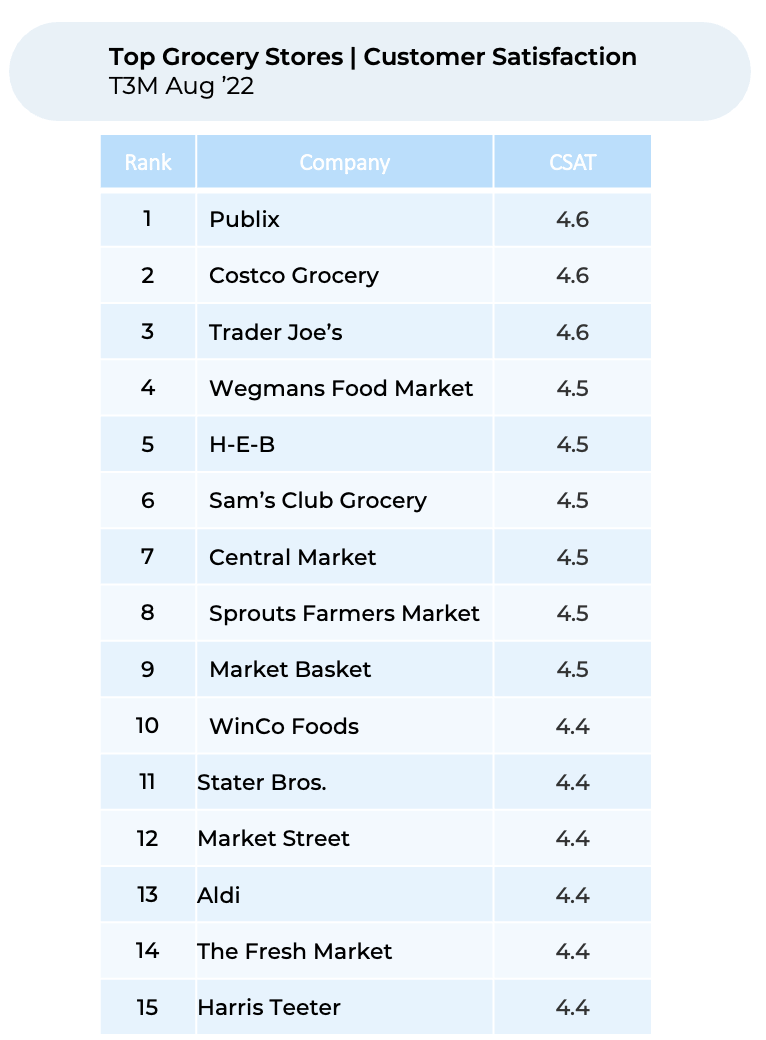

According to “The Crowd” — real grocery shoppers who share immediate feedback with HundredX — people are less keen to shop at grocery stores than they were a year ago. Demand growth, excluding the benefit of passing through higher food prices, appears to be down for the broader industry as it works through price and supply chain challenges. However, growth appears to be holding up best for large Texas chain H-E-B, while Publix is best positioned out of the large national chains. New England-chain Market Basket appears poised to grab market share as well, surging in customer satisfaction to rank in the top-10 of covered grocery stores in all the categories that matter most to consumers.

Leveraging HundredX’s proprietary listening methodology, we look at more than 190,000 pieces of customer feedback since January 2021 on 42 major grocery chains. We leverage that data for insights into consumers’ future net purchase intent (NPI), the drivers behind changes in intent, and customer satisfaction (CSAT). We then use these insights to understand the changing demands on grocery chains and which companies handle them best.

Recent Indicators from The Crowd

HundredX data from “The Crowd” indicates consumers plan to shop at grocery chains less than they did last year, but it appears they don’t have much choice if they want to make meals at home. Grocery industry volume or traffic growth appears on track to remain stable at modest levels in the near term. NPI dropped from 10% for the trailing three months ended (T3M) July 2021 to about 0% in T3M March 2022, but it has remained stable at that level ever since. As a reminder, NPI reflects the percentage of customers that plan to spend more at grocery stores over the next twelve months minus the percentage that plan to spend less.

Interestingly, while we have seen NPI remain soft but stable, comparable store sales growth for many of the publicly-traded grocery chains such as Albertson’s, Publix, Kroger, and Weis are up this year and have remained as of their latest results. We believe this positioning is likely due to the passthrough of higher food costs showing up in same store sales growth figures. When we back out the food-at-home inflation reported by the U.S. Bureau of Labor Statistics, we see the implied food volume / foot traffic comps have softened for all of these stores through 2022, consistent with the NPI pullback we observed for the industry throughout the earlier part of the year. We believe industry NPI stability should indicate stability for the volume growth. Comp store growth may end up more volatile if there is volatility in food inflation.

H-E-B, a Texas-based privately held grocery chain with more than 340 locations, stands out from the industry’s broadly flat NPI, with a move from 4% for T3M May 2022 to 7% in T3M August 2022, indicating some market share gains are on the horizon. Costco, the membership-only big-box retailer, also bucks the industry trend with NPI of 5% for T3M August 2022 up from 3% for T3M May 2022.

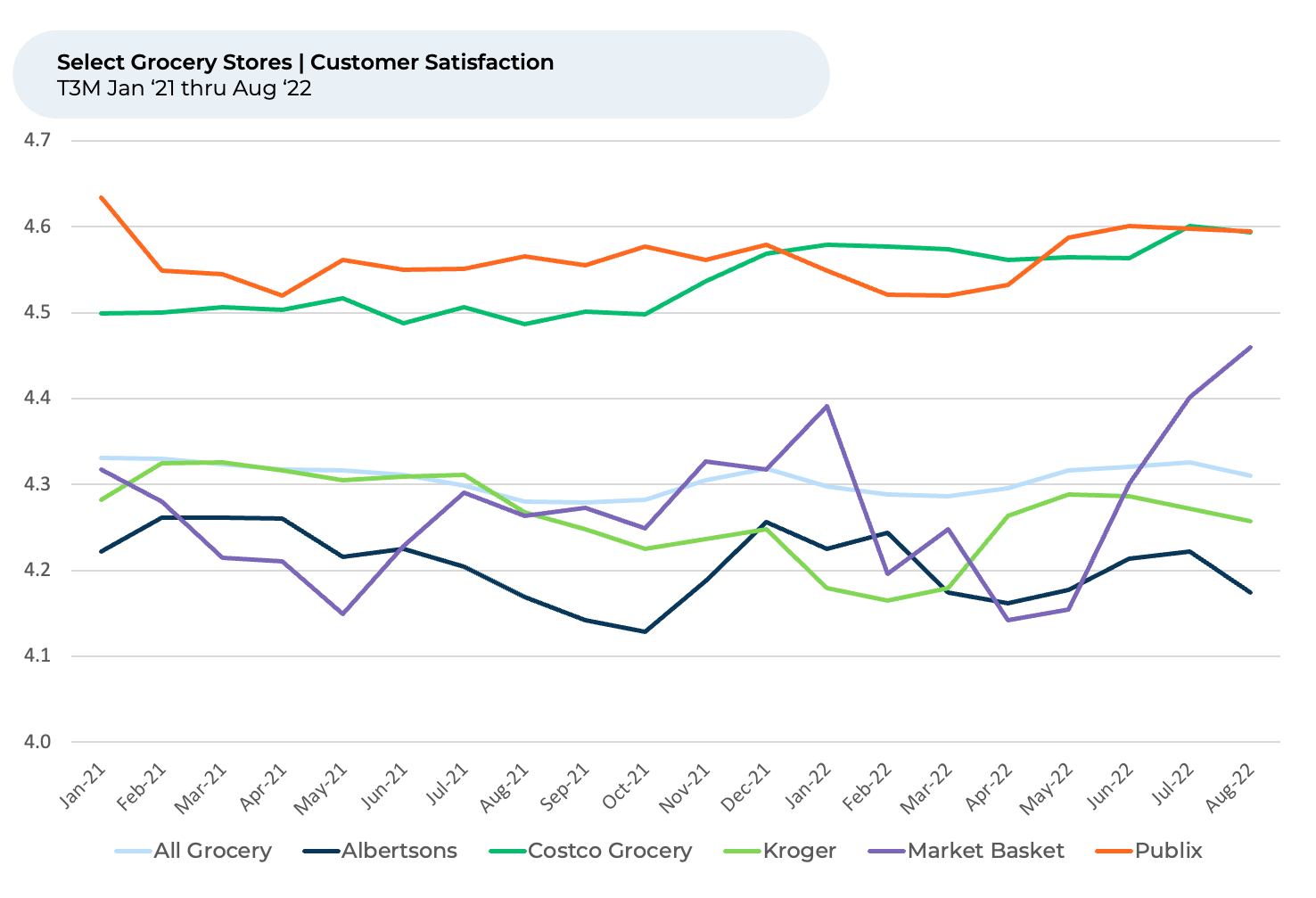

It is notable that Customer Satisfaction (CSAT), which HundredX measures on a 5-point scale, has remained relatively flat at 4.3 for the entire grocery industry since January 2021. It hasn’t followed the dip as NPI has, indicating grocery stores still delight their customers, even as demand growth has fallen due to many macro issues.

A Winning Formula for Grocers Amid Inflationary Pressures

To understand why some brands beat the competition with respect to CSAT and customer intent to spend more, we dig into specific purchase intent drivers to uncover “the why behind the buy." Our analysis indicates grocery chains with the best Customer Satisfaction (CSAT) tend to do a better job than the peer group at delighting customers on Price, Selection, and Speed / Checkout.

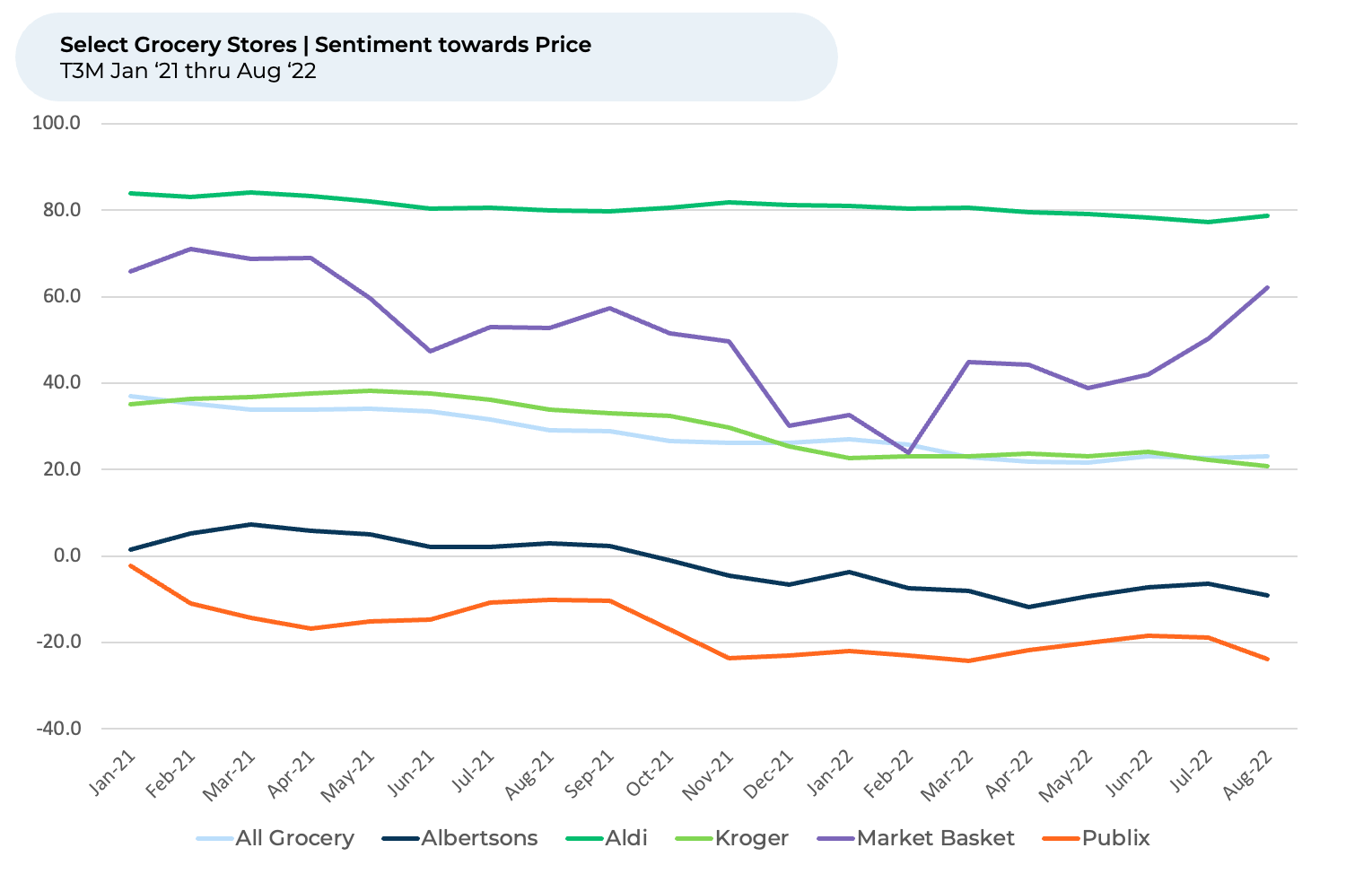

Price

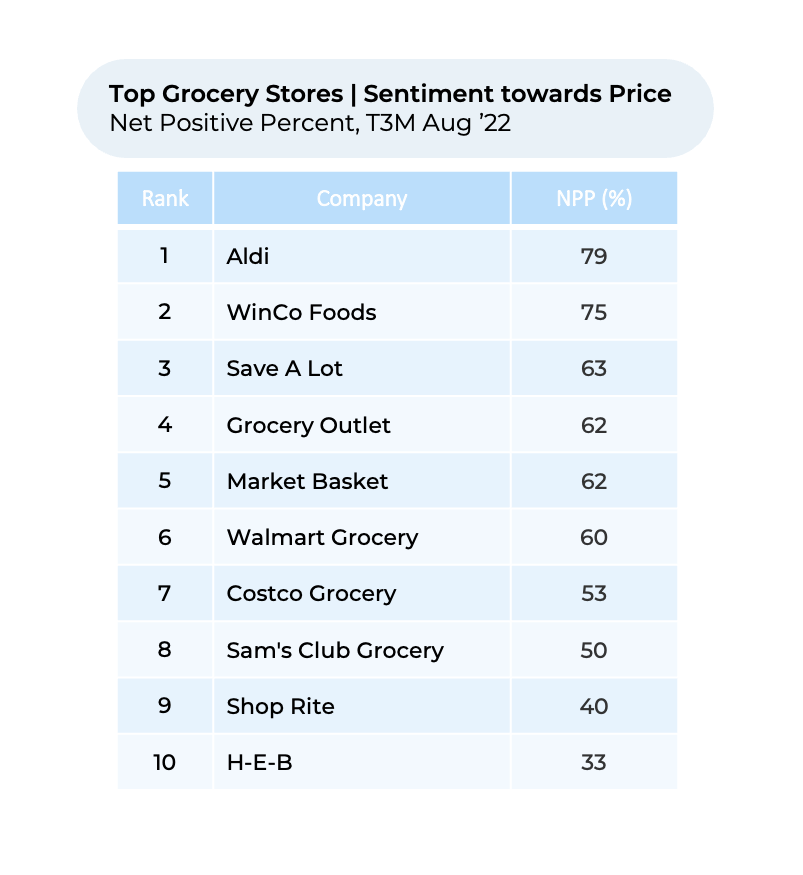

Price remains the most selected factor when shoppers consider why they like their favorite stores. It is no surprise we have seen focus on price begin to pick back up with inflation this year, with the percentage of grocery shoppers selecting price as a driver rising from May 2022 through August 2022 after dropping for most of 2021.

Aldi is the undisputed champion when it comes to “Price” Customer Satisfaction, having remained in the top position against competing grocery chains since at least January 2021. Its T3M August 2022 NPP of 79% is more than triple the industry average of 23% NPP.

Famous for its discount grocery prices, Aldi even sports the tagline “Quality Food. Everyday Low Prices.” To keep prices competitive, the company generally avoids selling brand name products, but does frequently sell overstock products.

Still, even long-time “Price” winner Aldi may need to watch its back in the Northeast. Market Basket, with 90 locations across New England, is gaining quickly on “Price” sentiment. The grocery chain saw its NPP jump from 24% for T3M February 2022 to 62% for T3M August 2022. One happy shopper recently shared with HundredX, “Market Basket is really popular in this area due to its great prices.” Another shared, “I shop here once monthly to stock up on freezer and pantry staples. I appreciate the prices, employee treatment, and the options available."

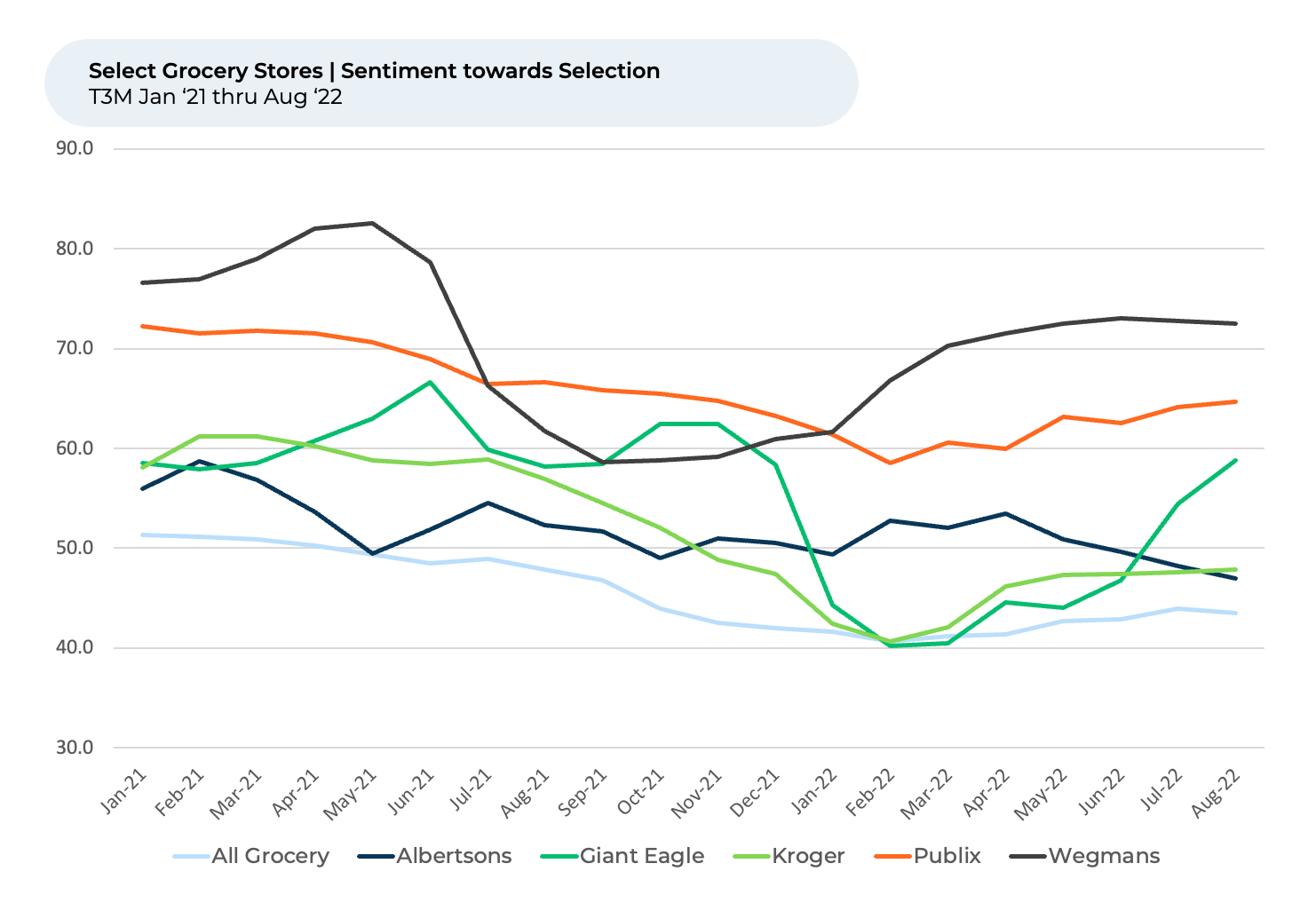

Selection

Consumers want more than just low prices. They also want their grocery stores to feature a great selection of items. However, supply chain problems have plagued grocery stores since the start of the COVID-19 pandemic. “Selection” NPP across all grocery stores has steadily declined from 51% for T3M January 2021 to 44% for T3M August 2022. Though supply chain problems are off their peak, grocery chains still find themselves with limited stock on some items. For months, a leading national chain has displayed the message, “We apologize, but due to shipping delays, some advertised [store brand] items may not be available to purchase” on its website.

Wegmans Food Market, the privately held chain with more than 100 stores across the U.S., leads in “Selection” customer satisfaction, with an NPP of 73% for T3M August 2022, far ahead of the industry average 44%. Wegmans boasts a relatively high selection of prepared meals and organic products. It partners with more than 400 family farms to stock its shelves with fresh produce. “Amazing selection and great prepared foods,” one Wegmans shopper said to HundredX.

Giant Eagle soared recently in sentiment towards “Selection,” up from a 41% NPP for T3M March 2022 to 59% NPP for T3M August 2022. The chain emphasizes its variety and huge assortment, and it appears “The Crowd” has taken notice. One customer noted, “Giant Eagle has a few items I purchase that are hard to find elsewhere, so I like knowing that I can stop in and find them there. I appreciate the selection of items, as well as the fact that the store is usually less crowded than other similar stores.”

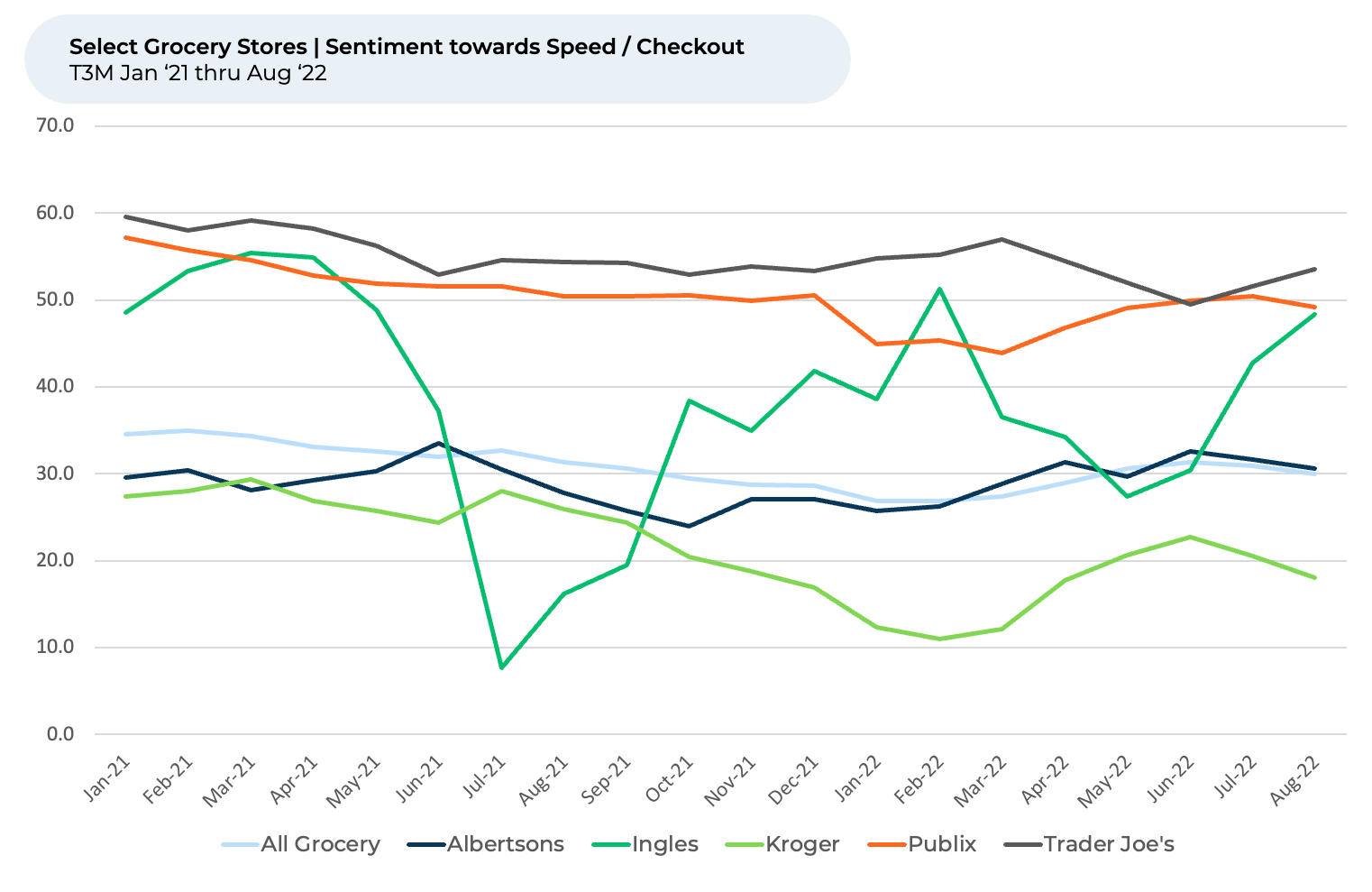

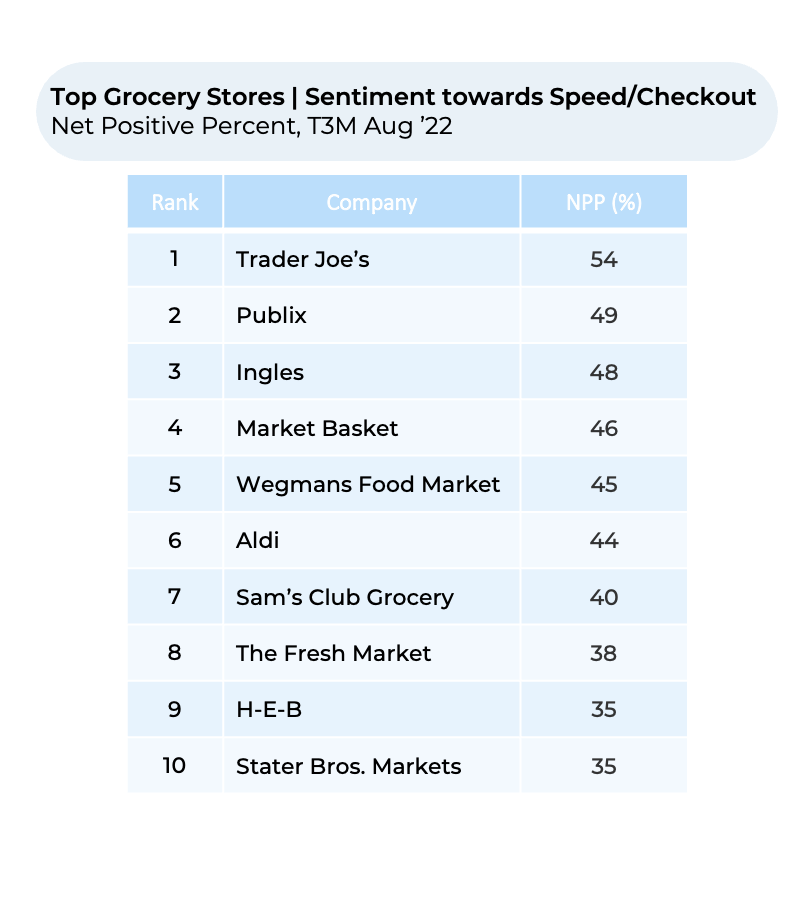

Speed / Checkout

Stores’ speed and checkout process also play an important role for consumers when it comes to customer satisfaction. Trader Joe’s has long held the highest slot in terms of “Speed / Checkout” Customer Satisfaction, with an NPP of 54% for T3M August 2022, way ahead of 30% for the industry. Based in California, Trader Joe’s has more than 530 locations across the U.S. Interestingly, Trader Joe’s locations don’t have online pickup or self-checkout. They do, however, have famously cheery and helpful employees.

We note an 80% correlation between satisfaction with speed and checkout (as measured by NPP) and associate “Attitude,” where Trader Joe’s also ranks first. The correlation indicates customers favor Trader Joe’s checkout experience because of the friendly attitude of checkout employees, as well as the speed. “Customer service is very good at Trader Joes. Quick check-out with pleasant cashiers,” one shopper told HundredX. “Love the products and variety. Employees are always speedy and focused on customer service,” someone else said of Trader Joe’s.

Ingles, the Southeastern chain with more than 200 locations, surged recently on the back of a recent investment to significantly expand its curbside pickup services. Ingles saw “Speed / Checkout” NPP jump from 27% for T3M May 2022 to 48% for T3M August 2022. The grocery chain aggressively hired during the height of the COVID-19 pandemic to keep shelves stocked and checkout lanes fast.

“Employees are always helpful and if the checkout lines get long, I have seen the manager come out and run a line,” one person to HundredX said of Ingles.

As grocery stores continue to navigate choppy waters with inflation, labor shortages, and supply chain problems, they should look to the experiences that make customers happy— Price, Selection, and Speed / Checkout. Investing in these areas may keep customers coming back.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on these Grocers and any of our 75+ industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact