C-Store Update: Drivers May Change Gears with Lower Gas Prices

In the second edition of our monthly look at Convenience Stores, we walk through why we see the potential for stores’ investment in food, beverage, and staff attitudes to pay off as gas prices normalize and these other factors rise in relative importance to consumers. Average gas prices have dropped a whopping 20% from their peak in June 2022 ($4.93) to August 2022 ($3.98). The average cost of a gallon of regular unleaded continues falling, down to $3.69, September 23, 2022.

Though gas prices are declining, extraordinary inflation this year led Americans to significantly change their driving habits, including fewer miles, combining errands, searching for “cheap” gas, and postponing summer road trips. Our data shows that convenience stores as a group saw growth stall as a result. However, “The Crowd” — real consumers of Convenience Stores who share immediate feedback with HundredX — indicates a handful of operators should gain market share from their peers, given their investments.

According to the National Association of Convenience Stores (NACS) Q3 Pulse Survey, 59% of convenience retailers say in-store customer traffic has decreased. While Convenience Stores (C-Stores) sell an estimated 80% of the fuel purchased in the United States, they rely primarily on in-store sales, not fuel sales, to drive profits.

Leveraging HundredX’s proprietary listening methodology, we evaluate more than 60,000 pieces of feedback from real customer experiences at 32 Convenience Store Retailers across the country to gain insight into the various differentiating factors that drive in-store activity and market share.

Recent Indicators from "The Crowd"

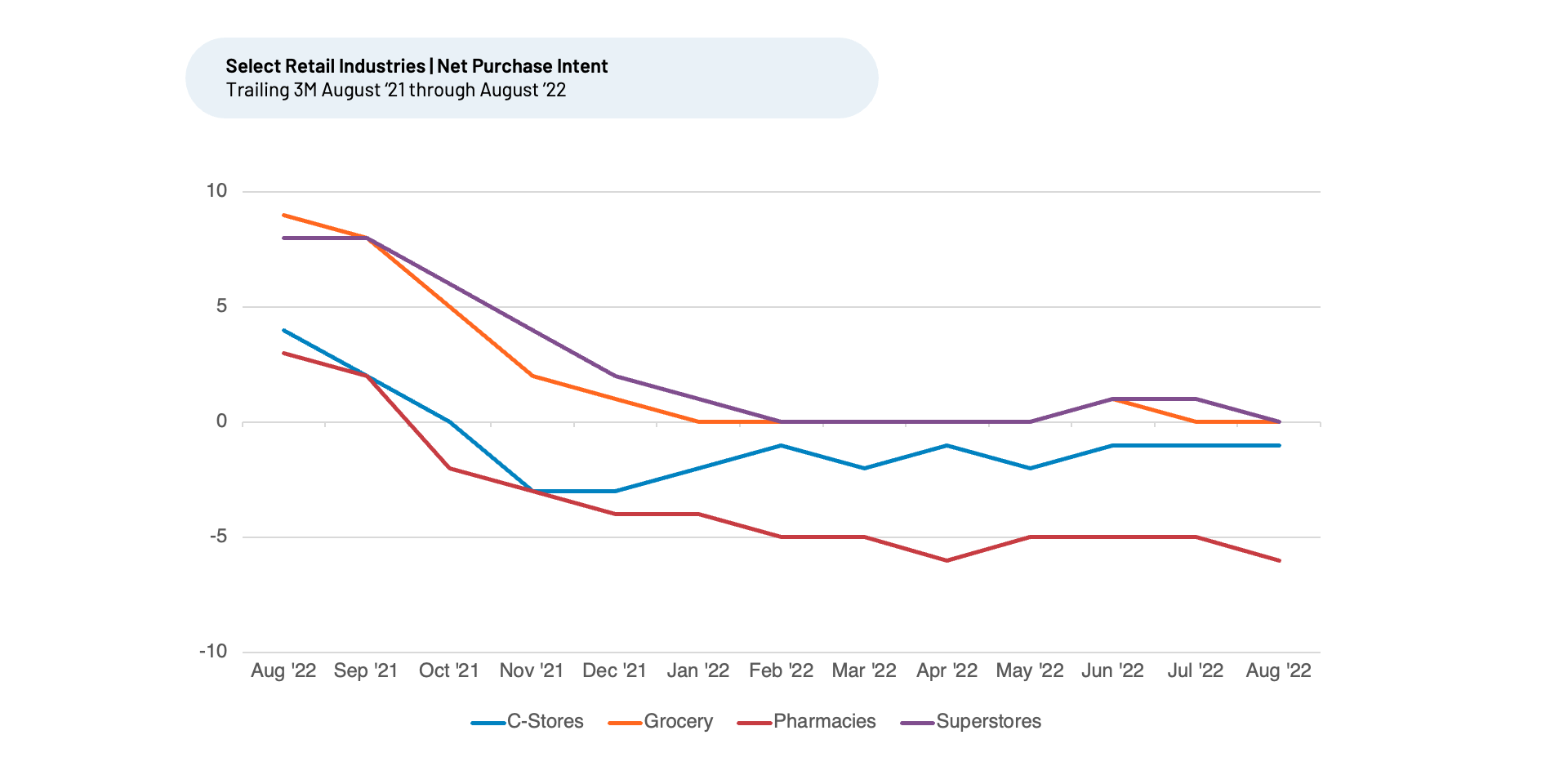

As early as August 2021, HundredX Net Purchase Intent (NPI) data shows The Crowd pointed to an impending drop in Convenience Store sales growth in 2022, as prices began to concern customers. That NPI downturn continued until leveling off in mid-2022. NPI reflects the percentage of customers who plan to purchase more at a Convenience Store over the next 12 months minus the percentage that plan to buy less.

Looking at the broader Retail industry, including other relative staples such as

Grocery, Superstores, and Pharmacies, C-Store NPI outpaced Pharmacies, but lagged the other spaces for most of

2022. During that same period, IRI transactional data for Grocery, Convenience, Drug Store, and Mass (Sam’s Club, Target, etc.) sales were directionally consistent with what The Crowd

shared. Over the last three months, C-Store NPI improved slightly as gas prices dropped. Customers seem to remain conservative with spending, and while our data would indicate growth should remain stable, we continue to watch closely to see how prices will affect the outlook.

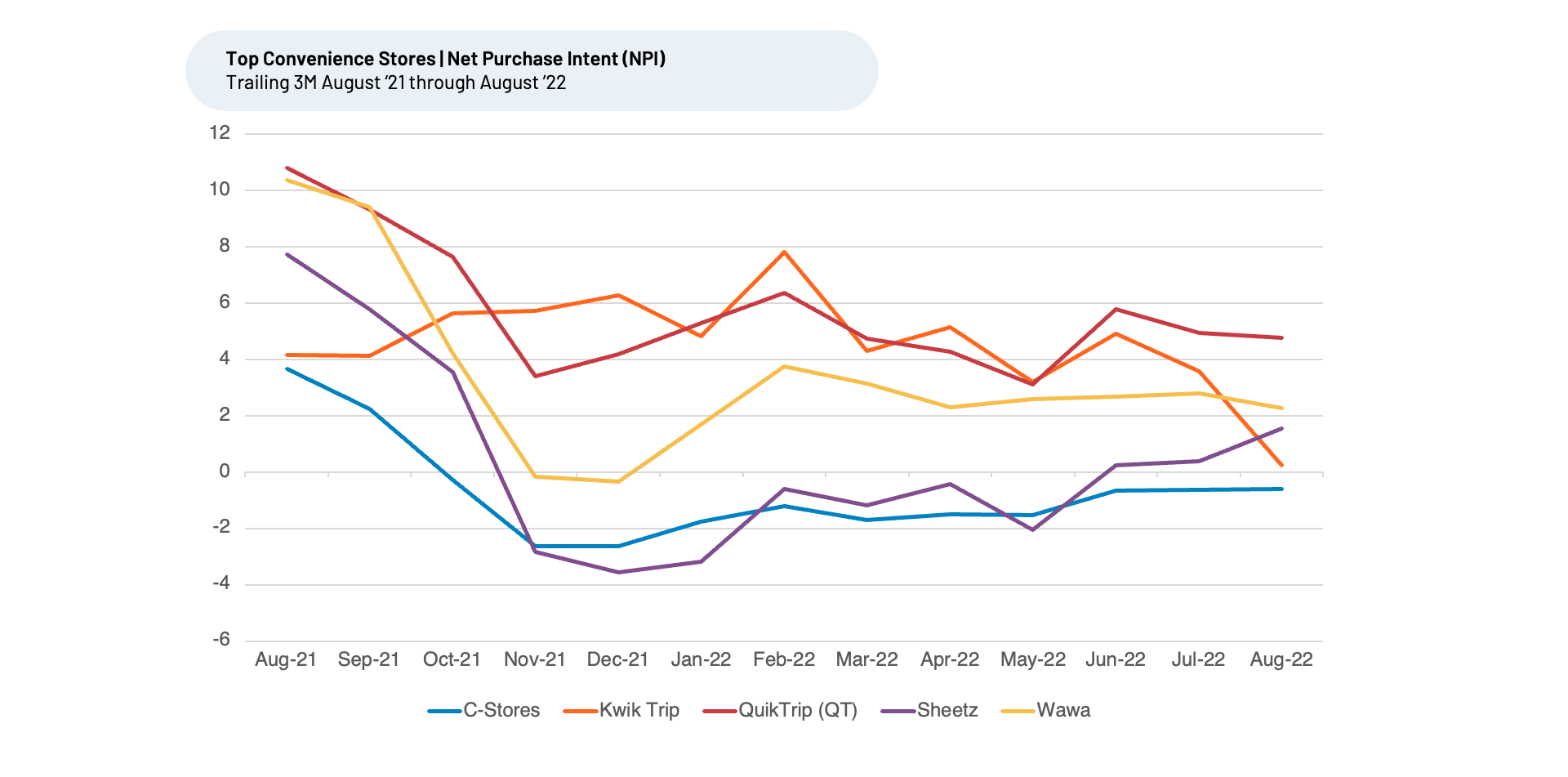

Looking at company NPI trends, QuikTrip, Wawa, and Sheetz posted the highest NPI of the large C-Stores we cover, for the trailing three months (T3M) August 2022, at 5%, 2%, and 2% respectively, well ahead of the sector average of -1% for 32 covered Convenience Stores. This indicates they are poised to gain market share as they focus on core strengths.

These top Convenience Stores for NPI for T3M August 2022 saw mixed sequential trends:

- Sheetz increased to 2% T3M August 2022, up from 0% T3M July 2022.

- QuickTrip (QT) remained stable at 5%.

- KwikTrip dropped from 4% to 0%.

- Wawa decreased to 2% from 3%.

A Winning Formula for Convenience Stores

We show why we believe these brands will likely gain share versus the competition, based on customer intent to visit more, digging into specific purchase intent drivers to uncover “the why behind the buy.” Our analysis indicates C-Stores with the best Customer Satisfaction (CSAT) over time tend to do a better job than the peer group at impressing customers with their Convenience, Gas Prices, and Cleanliness. While these factors will likely remain the top drivers of success near-term, we note increases in the rate at which C-Store customers have selected Beverages, Food, and staff Attitude as gas prices have fallen indicate these factors could be increasing in importance, and the leaders in these spaces are likely to gain more market share.

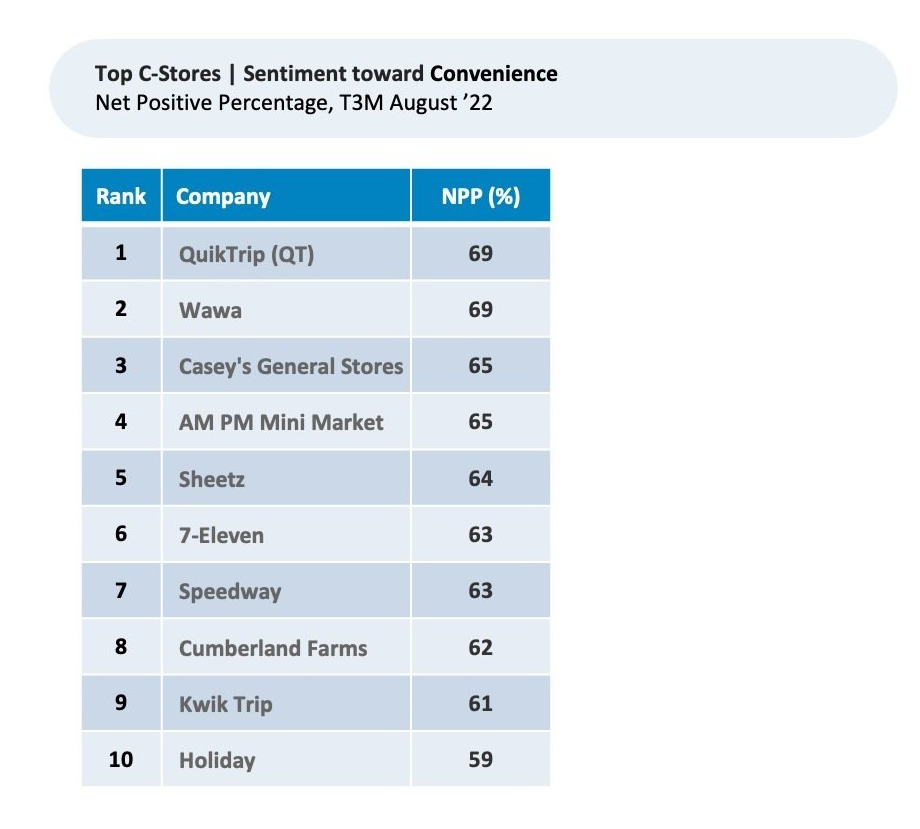

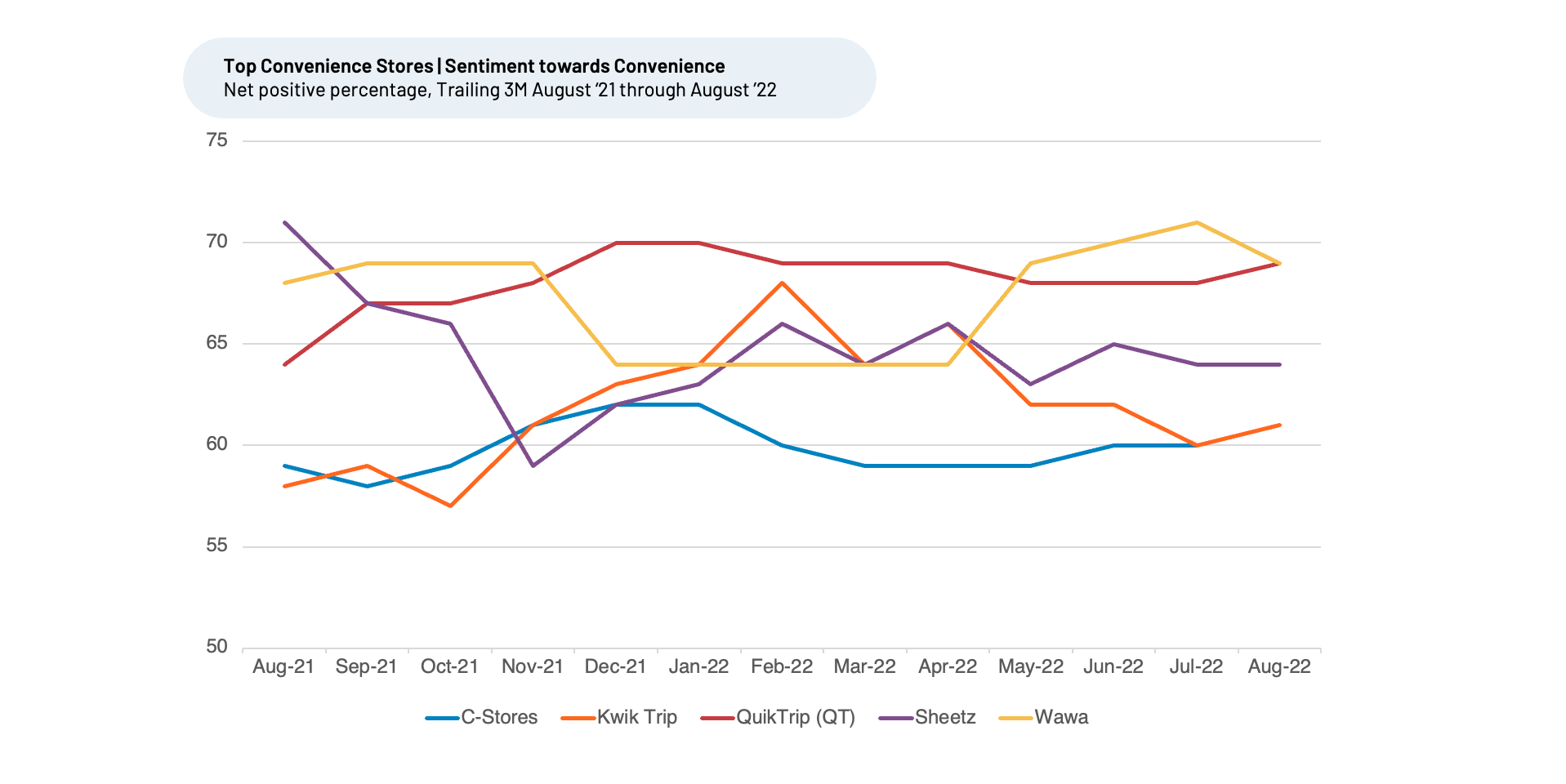

Convenience

It should come as no surprise that sentiment toward Convenience ranks as the top factor for Convenience Stores customer satisfaction. QuikTrip and Wawa lead the pack, with a Net Positive Percentage (NPP) of 69% for T3M August 2022, well ahead of the peer average of 61%. Sentiment or satisfaction toward a particular driver is measured using Net Positive Percentages (NPP), which represents the percentage of customers who view a factor as a positive (reason they liked the products, people, or experience) minus the percentage who see the same factor as a negative. One QuikTrip customer told HundredX, “QuikTrip is very clean and convenient. Gas prices are usually the best in the area and the service is always exceptional.”

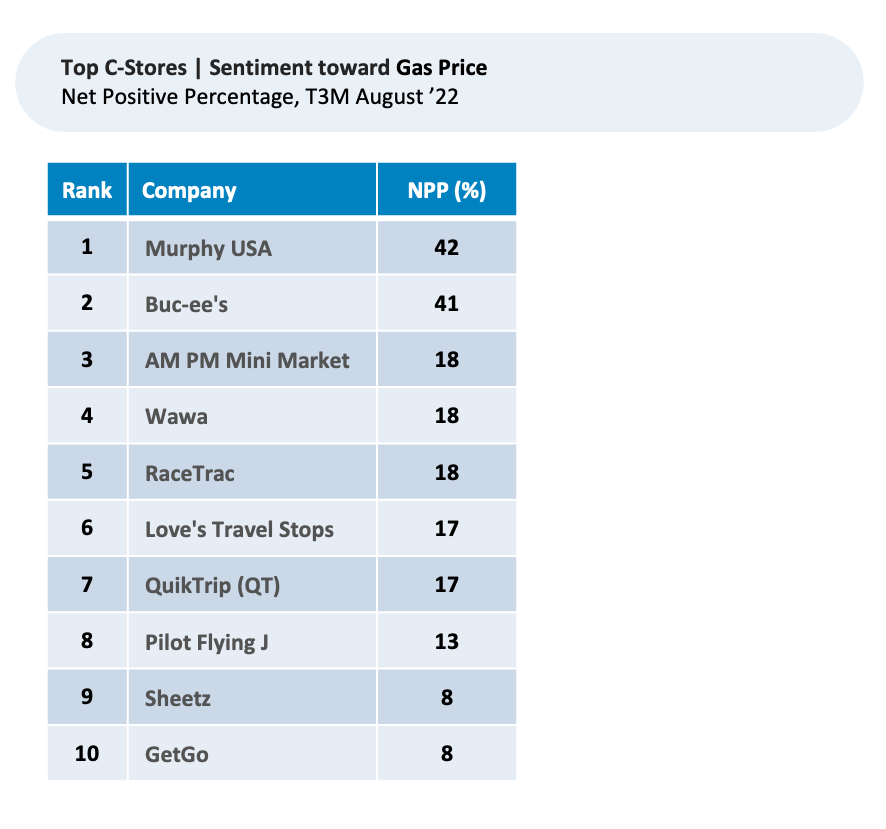

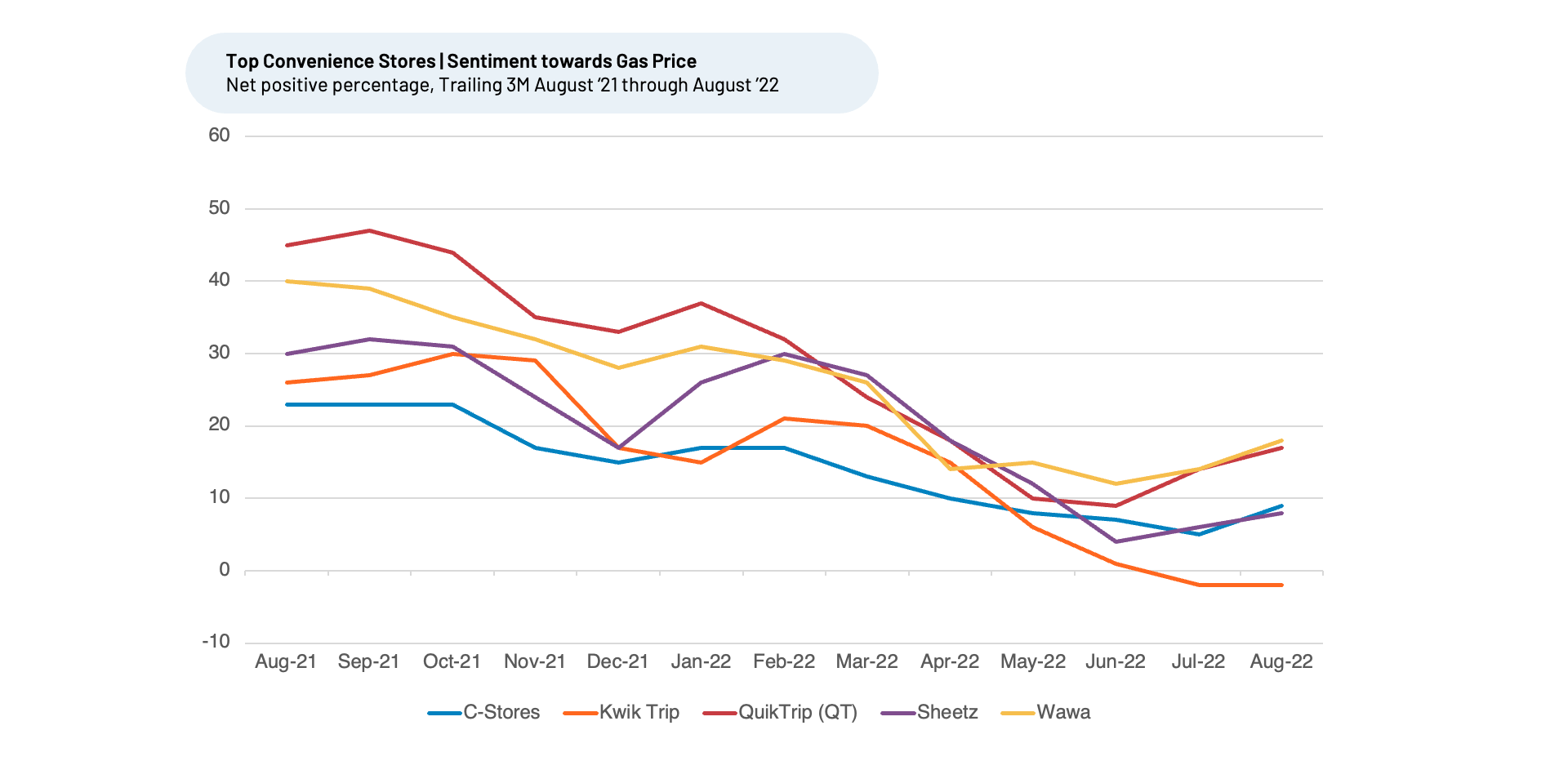

Gas Prices

Sentiment toward “Gas Prices,” which remains the second most selected driver of C-Store customer satisfaction and demand outlook, has improved for many of the largest chains — including QuikTrip, Kwik Trip, Wawa, and Sheetz — as prices fall at the pump. Wawa and QuikTrip are among the leaders of this group, with T3M August 2022 NPP of 18%, up significantly from 12% and 9%, respectively versus T3M June 2022, in line with the recent decline in prices.

Murphy USA, whose gas stations are located near Walmart stores across 27 states in the Southwest, Southeast, Midwest, and Northeast, is the overall leader in the group, with a T3M August 2022 NPP of 42%. Customers are fans of its focus on maintaining competitive prices, with one telling HundredX, “Since gas prices have risen, I will use Murphy more.” Another opined, “One of the best gas stations in my area. They seem to always be the cheapest place to get fuel.”

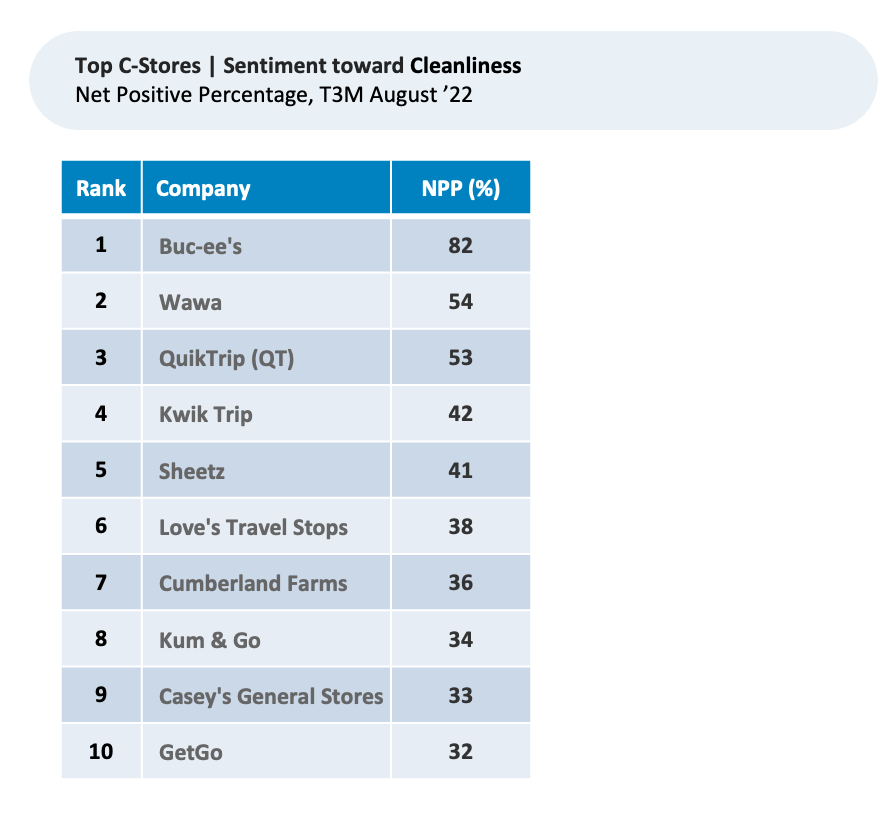

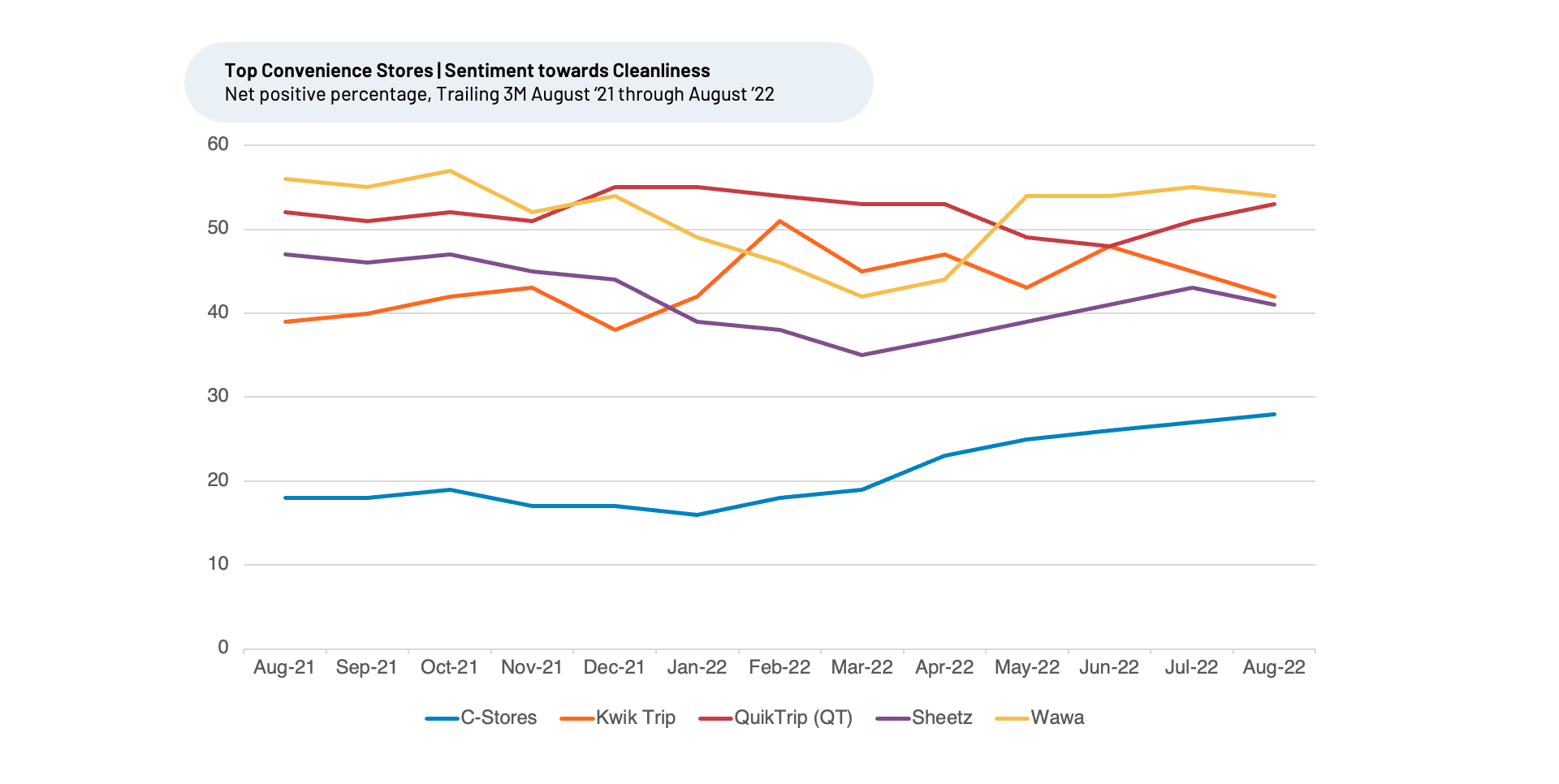

Cleanliness

Southern convenience store chain Buc-ee’s has made a name for itself by focusing on having clean restrooms. The Crowd noticed, with Buc-ee’s enjoying an 83% T3M August 2022 NPP for Cleanliness, well ahead of the next closest peer Wawa (54%) and the group average of 28%. One happy customer recently shared with HundredX, “Love this place!!! So much selection on food among other things!! Always clean bathrooms which are a super plus.” Another agreed by saying, “Love stopping here on road trips. Literally the cleanest and nicest restrooms EVER!”

QuikTrip is also a consistently strong performer and has narrowed the gap in the last few months to 53% NPP for T3M August 2022. One recent customer commented, “We go to QT almost daily. It is fast, friendly, clean, safe, and affordable. QuikTrip is a very clean and convenient.”

Driving Future Success Beyond the Pump

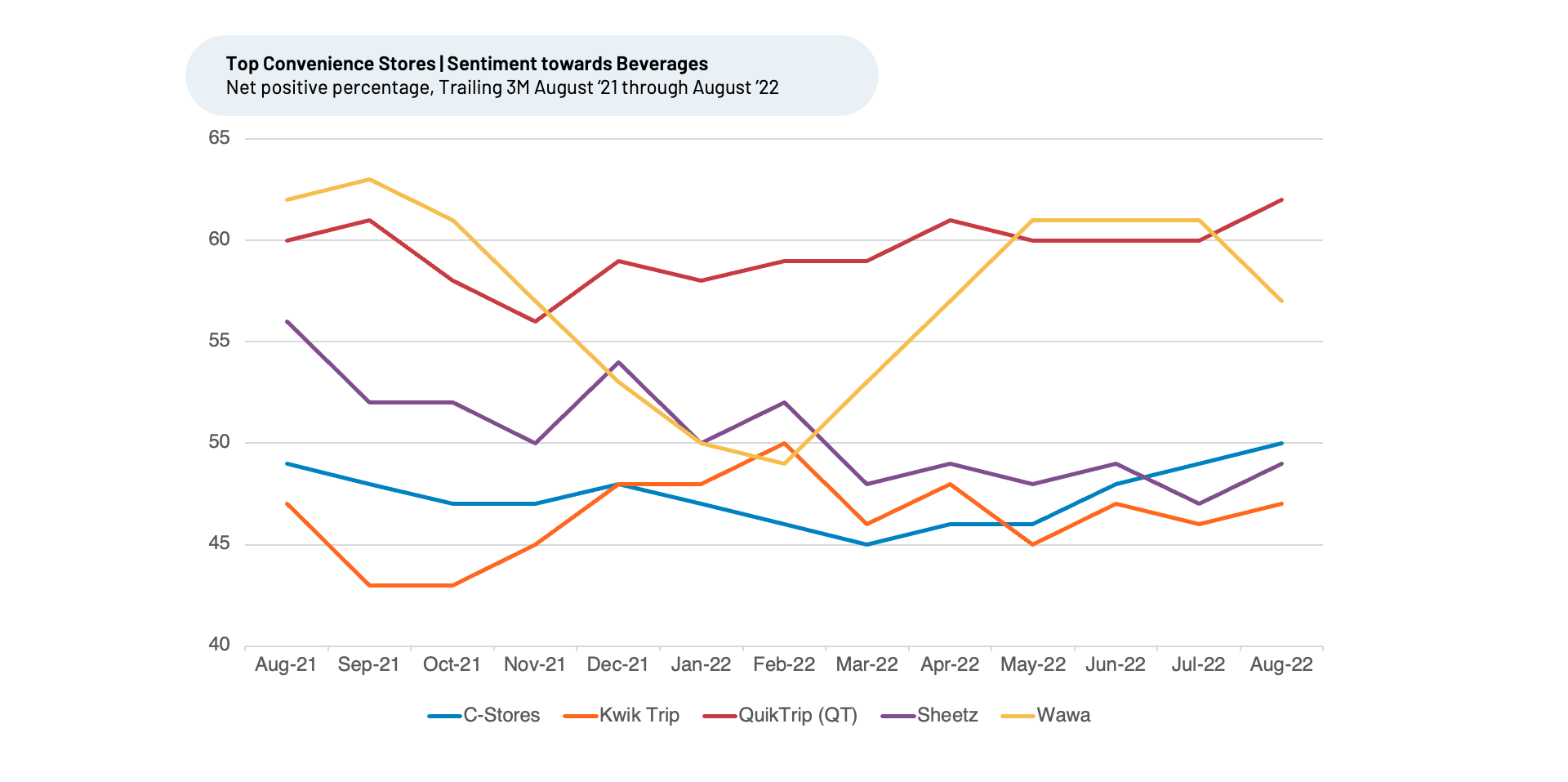

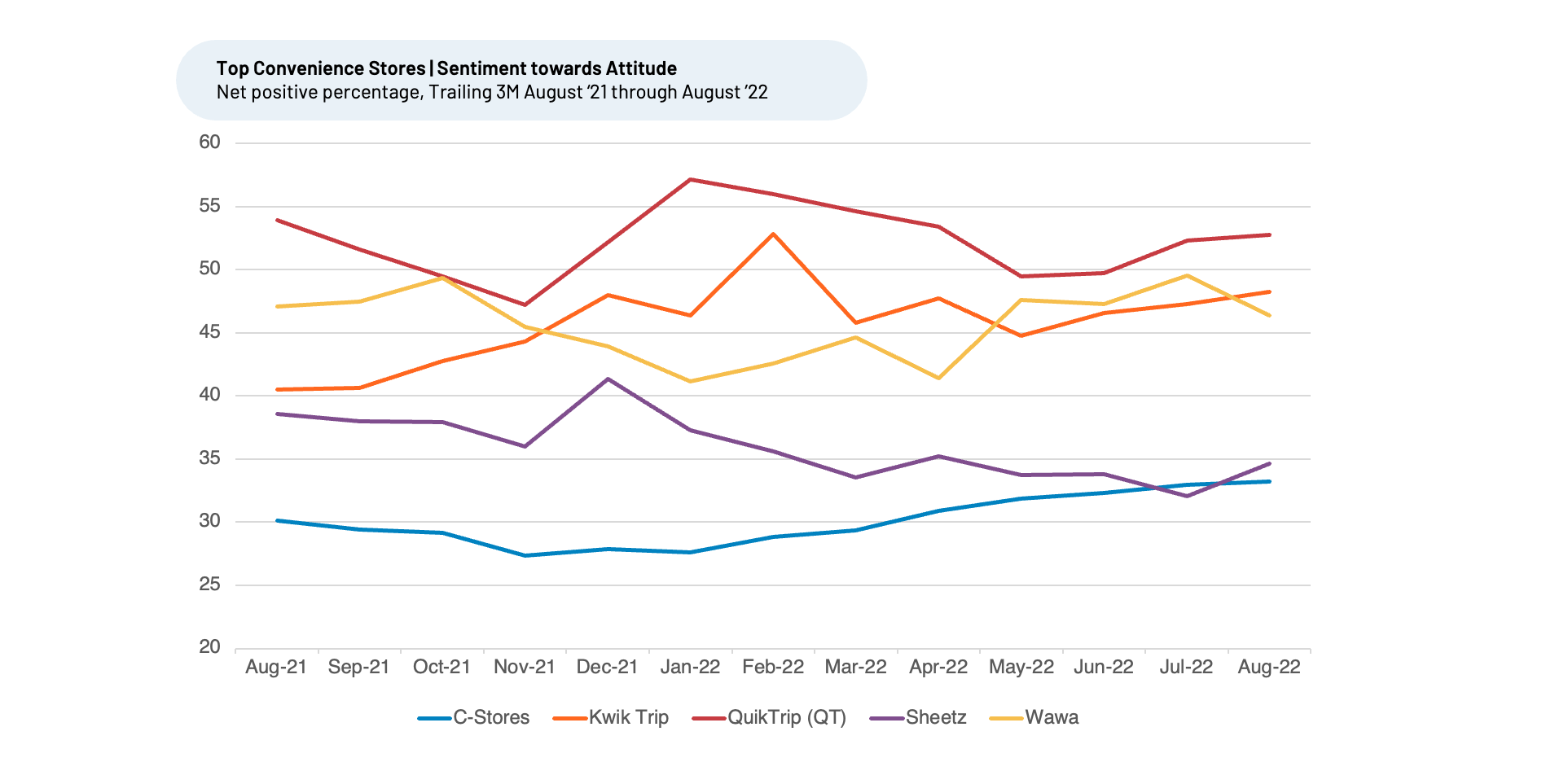

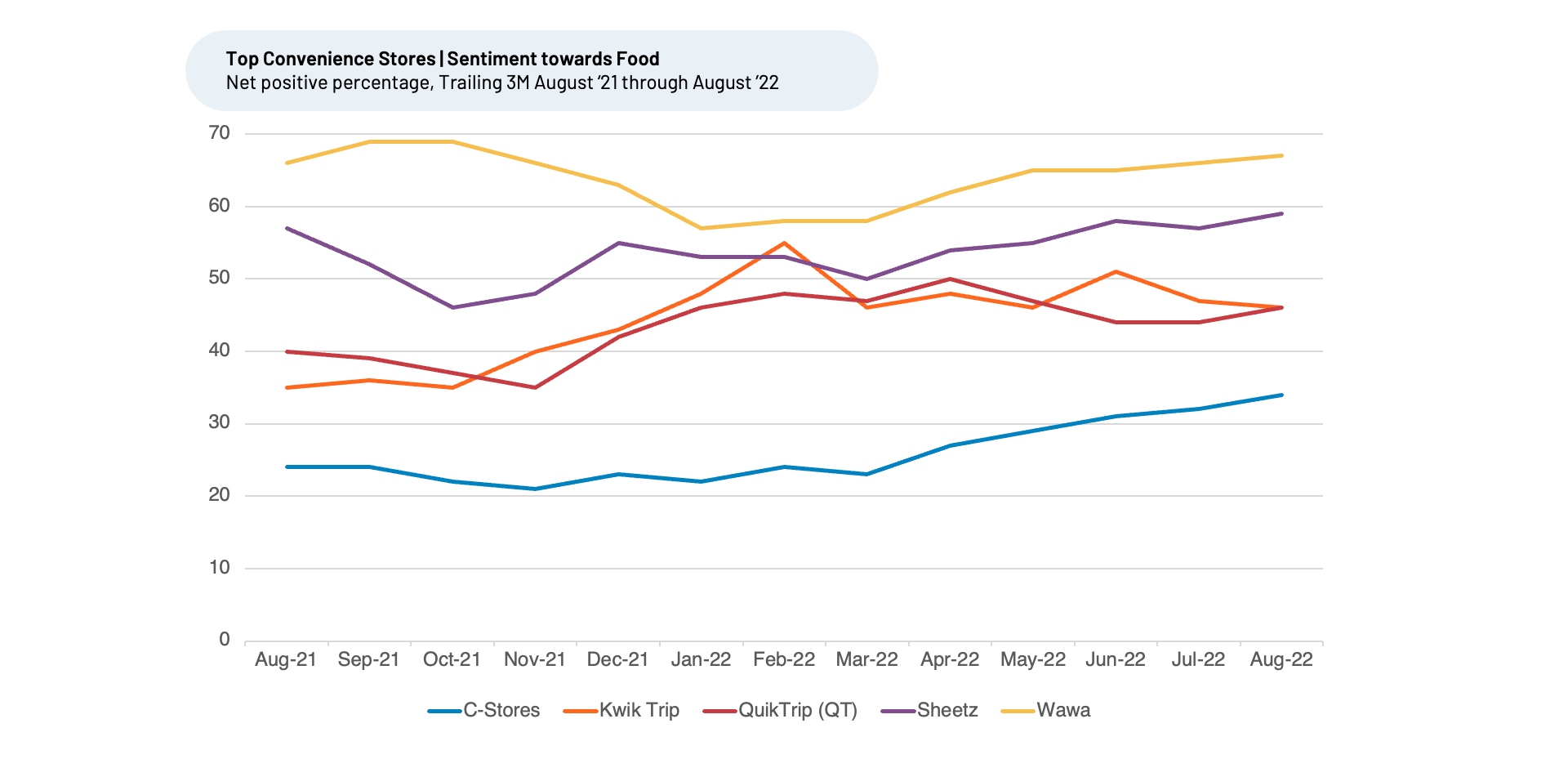

As gas prices decline, we believe other factors such as Beverages, staff Attitude, and Food are likely to become increasingly important differentiators of Convenience Store customer satisfaction and market share growth. Many top companies such as Wawa, QuikTrip, and Sheetz invested in these areas despite not being historically in the top three drivers of Customer Satisfaction for the sector. However, our analysis of selection frequency shows these factors have seen the largest increase over the last three months against a backdrop of falling gas prices.

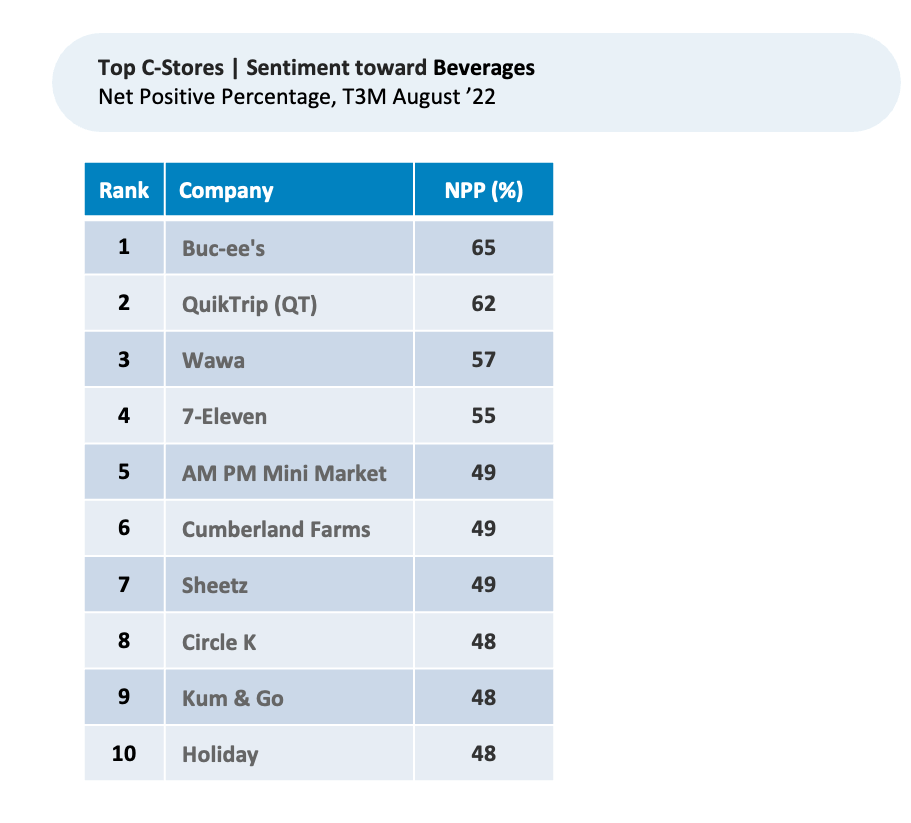

Beverages

QuikTrip stands out as a leader in “Beverage” Customer Satisfaction, on the back of many efforts to promote a diverse range of beverage options, such as its partnership with healthy hydration company Positive Beverage, as well as beverage promotions for mobile app users. QuikTrip’s NPP of 62% for T3M August 2022 is well ahead of the peer group average of 50%. One customer told HundredX, “Great selection in coffees, food, cold case drinks and food, teas, etc.” Another noted, “Great place to stop on road trips for gas and a break for drinks. Great variety and options.”

Wawa, another leader making customers happy with their beverages, also received The Crowd’s recognition for its efforts to provide high-quality coffee. One recent Wawa customer commented, “I primarily have had the breakfast sandwiches and coffee. The coffee is always fresh, and the sandwiches are freshly made as ordered and are delicious.” One went even further to say, “I don’t live near a Wawa, but when I travel, I seek them out. Coffee bar is the best of any convenience store nationwide.”

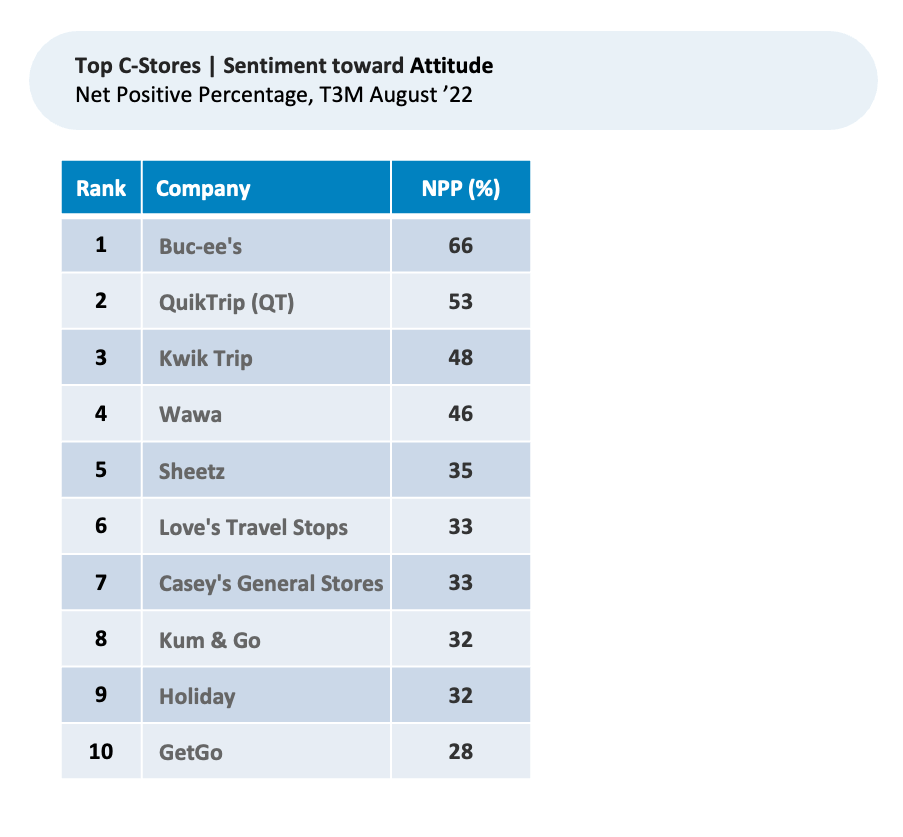

Attitude

In addition to their reputation for clean bathrooms, Buc-ee’s also leveraged its focus on friendly staff into the top “Attitude” Customer Satisfaction with a 66% T3M August 2022 NPP, followed by 53% for QuikTrip, which is up modestly from 49% for T3M May 2022. Both are well ahead of the group average of 33%. A QuikTrip customer commented, “I love QuikTrip. They have the friendliest staff. I always have a good experience when I go there.”

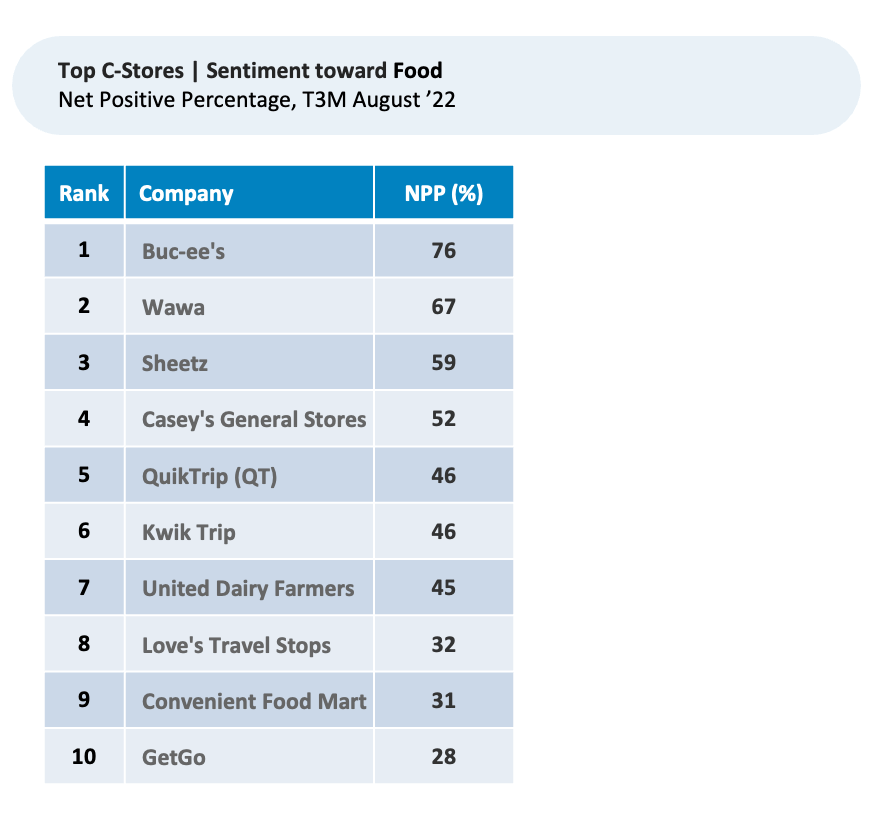

Food

Wawa’s investment in a fresh, built-to-order and ready-to-go food menu established it as the leader in “Food” Customer Satisfaction among the largest chains, followed by Sheetz. Wawa’s commitment to higher quality, in-store food and beverage offerings, award-winning sandwiches, a better-for-you “Balanced Choice” Menu, and technology to support easier ordering led to an NPP of 67% for T3M August 2022, almost double the industry average of 34%. One recent Wawa customer commented, “Always innovating and providing new food options,” while another shared, “…the food was amazingly good.”

Sheetz also gained ground with its food offerings and freshness. One customer told HundredX, “If given a choice of gas stations, I will choose Sheetz every time. Their gas prices are competitive, they provide gloves at the pump, have a great food and beverage selection, clean bathrooms and stores, and friendly employees.”

Driving Forward

Convenience stores continue to operate in a very dynamic environment, balancing

rapid changes in gas prices and early signs customers are putting a higher value on factors including Food, Beverage, and employee Attitude, which patrons have historically not seen as the biggest priorities. Those leveraging The Crowd’s insights to identify and invest in what matters most will enjoy the strongest growth and market share gains

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on any of the sectors mentioned here and any of our 75+ industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact