Social media trends change so quickly it’s almost impossible to keep up with them. Or, it might be if we weren’t regularly analyzing thousands of pieces of feedback from social media users and posting our findings on the HundredX insights page.

Last month, we noticed that Usage Intent had risen notably for Facebook and LinkedIn. Facebook users also felt better about privacy on the social media platform, likely reflecting credit for changes it made to its privacy policies in mid-2022.

Now, we hone in on Twitter, which, after months of falling Usage Intent₁,₂, has posted a sharp increase in February. By analyzing more than 95,000 pieces of feedback from The Crowd of real social media users across 23 brands, we find:

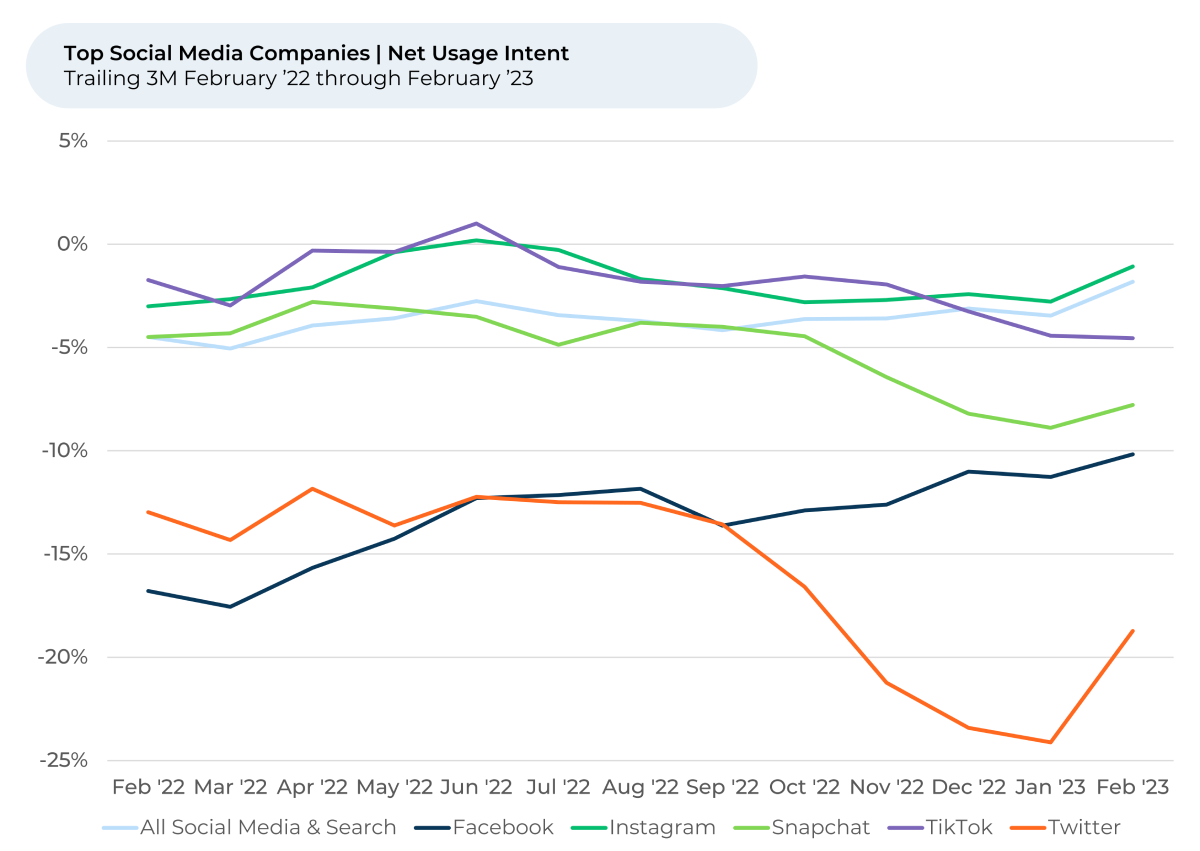

- Social media and search companies as a group gained in Usage Intent over the past month. Twitter gained significantly more than the overall group, although Usage Intent remains lower than its competitors.

- Twitter’s Usage Intent gain is primarily driven by middle-aged and wealthier users.

- Over the past month, Twitter users have felt notably happier about the platform’s ability to connect them to others, its value to them, and its customer support. The Super Bowl (February 12th) was likely a big driver, with Twitter resonating more with football fans than other platforms.

Social media and search companies as a group saw small gains in Usage Intent over the past three months, from November 2022 through February 2023. Most of that gain happened in February, with most major social media platforms seeing a small jump in Usage Intent.

Twitter, which had seen Usage Intent falling for months following Elon Musk’s divisive takeover of the platform in October, saw a sharp increase in February.

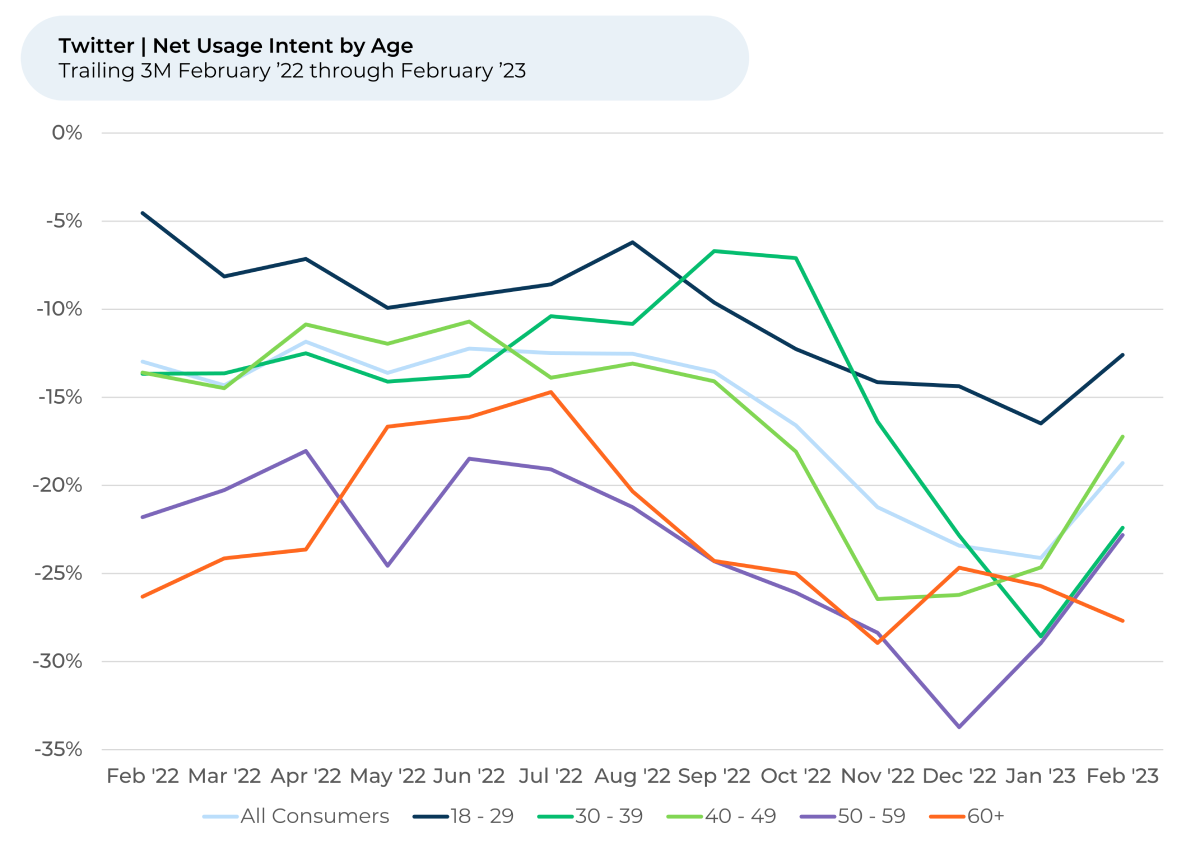

Age and money make a difference

Most of Twitter’s recent Usage Intent growth is powered by middle-aged and wealthier users. Usage Intent for users 40-49 years old increased dramatically, rising 9% over the past three months, with most of that gain driven by a 7% rise in February. 30-39-year-olds and 50-59-year-olds weren’t far behind – Usage Intent for both groups rose 6% in February.

While Usage Intent is negative across the board, it’s still highest with 18-29-year-old Twitter users. Usage Intent for this group saw a more modest gain of 4% last month.

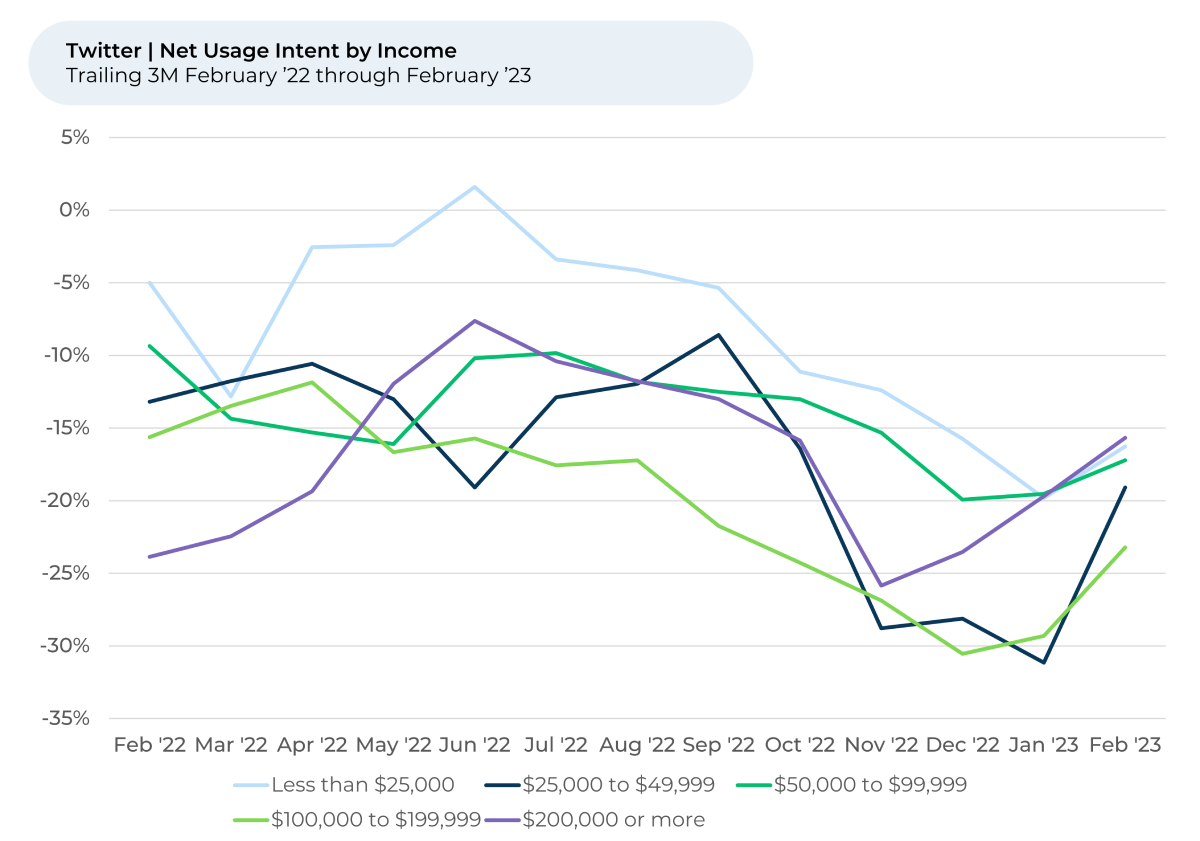

Among income brackets, Usage Intent for Twitter grew the most for households making more than $200K annually, increasing 10% from November to February, the highest among all income brackets. This is a departure from Usage Intent trends for the other large social media companies – where the distinct pattern has been that the lower the household income, the higher the purchase intent. Twitter, however, breaks that pattern.

But, why? Was it all about the Super Bowl?

In conjunction with the Super Bowl, we find Twitter users have felt notably happier₃ about the platform’s ability to connect them to others, its value to them, and its customer support over the past month.

It’s possible the Super Bowl, February 12th, played a part in driving up Usage Intent for social media companies, particularly Twitter. Super Bowl advertising giants Pepsi and Anheuser-Busch InBev spent millions advertising on Twitter around the time of the big game, seemingly expecting huge numbers of users to log on to talk football. This was apparently confirmed after Twitter became unavailable for some users around the start of Rihanna’s Super Bowl halftime show, likely due to an influx of people logging in as they watched it.

Twitter users seem to watch football more than other social media users – 22% of Twitter users who left feedback with HundredX also left feedback on the NFL on a trailing 12-month (T12M) basis. That overlap with the NFL is in the teens for every other social media platform.

Still, it will be interesting to see how Twitter users continue to react to changes to the platform, such as locking basic security features behind a paywall, something that Facebook was quick to emulate. HundredX will continue analyzing the social media space to keep you up to date on all that’s happening with The Crowd.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Usage intent reflects the percentage of customers who plan to use a specific brand during the next 12 months minus the percentage that plan to use less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.