If HBO’s The Last of Us proves anything, it’s that video games with strong storylines can successfully cross the line into film and TV to drive greater commercial success for both.

First released as a PlayStation 3 game in 2013, Naughty Dog’s The Last of Us has seen several iterations over the years, including a remaster, a remake, and a sequel. The long-planned show received critical acclaim from gamers and non-gamers alike, drawing in some of the biggest ratings HBO has seen in recent years.

HundredX looked to The Crowd, real people who leave feedback on streaming services and video games, to better understand what the show means for HBO Max. By analyzing 100,000 pieces of feedback on video streaming services and more than 45,000 pieces of feedback on 51 video game brands, we find:

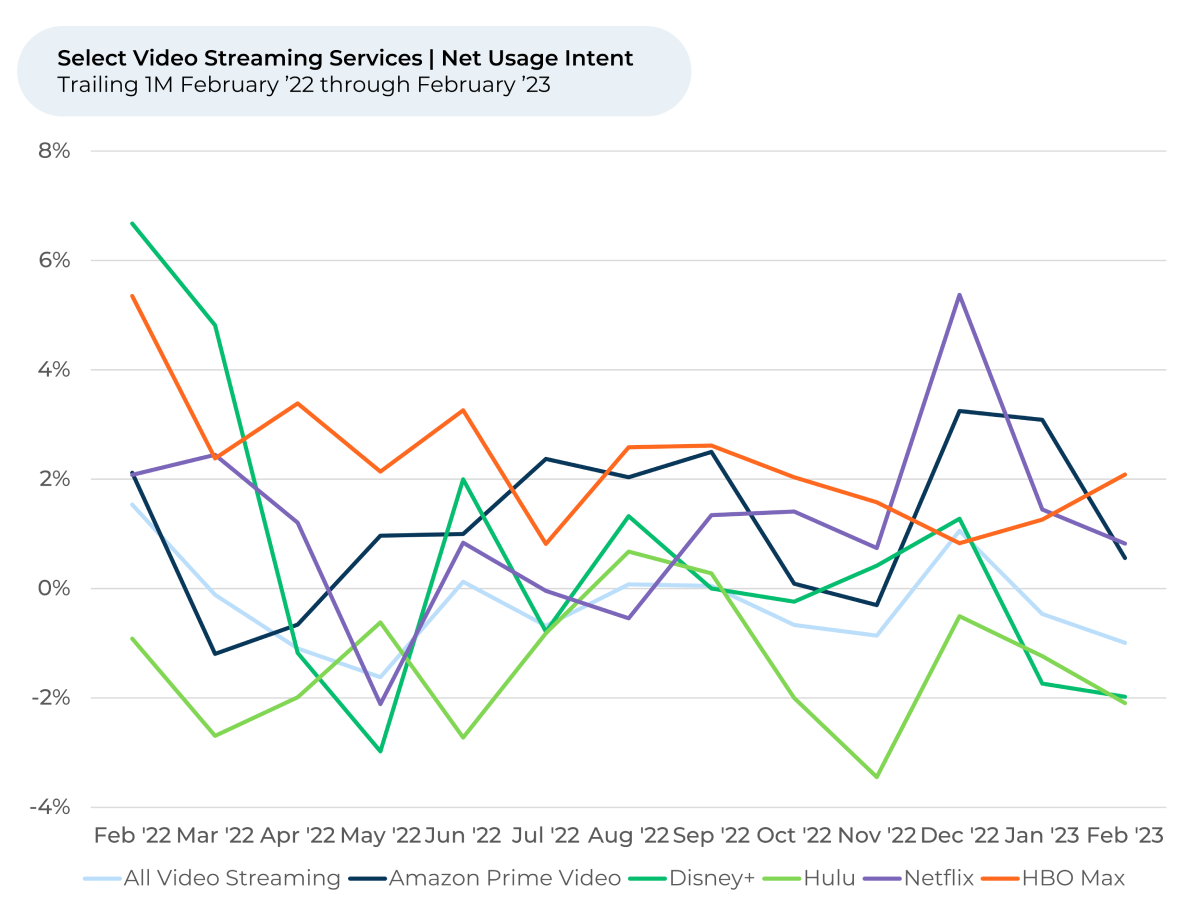

- Since The Last of Us premiered on HBO on January 15, 2023, we have seen an uptick in people indicating they plan to watch HBO Max more. It was the only major streaming service with higher Usage Intent the last few months.

- The increase in HBO Max Usage Intent was driven by a surge in satisfaction with the streaming platform’s original content and new releases.

- The release of the show coincided with more people indicating they plan to play The Last of Us game more.

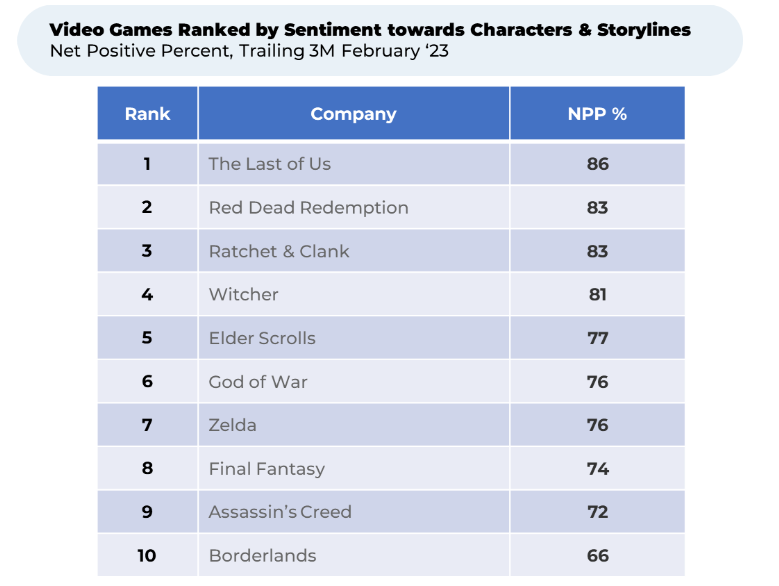

- Respondents like the characters and storylines of

The Last of Us more than any of the other 51 game brands we cover. We share a list of top games for storylines, which would seem to make great candidates for future shows and movies.

Fans react positively to the debut of The Last of Us

Compared to some of its biggest competitors, HBO Max stands out as the only one to see a gain in Usage Intent₂,₄ over the past few months.

While Usage Intent fell in January and February for streaming services as a group, it rose for HBO Max, leading it to now be the highest-ranking streaming service.

It’s probably not a coincidence that the Usage Intent increase happened just as

The Last of Us debuted in January. According to HBO, 4.7 million people watched

The Last of Us on its premiere night across all its platforms, making it HBO’s second-largest debut since 2010 after last summer’s

House of the Dragon. The show has consistently brought in high ratings – Episode 8 reached more than 8 million viewers when it came out on March 5.

New content boost

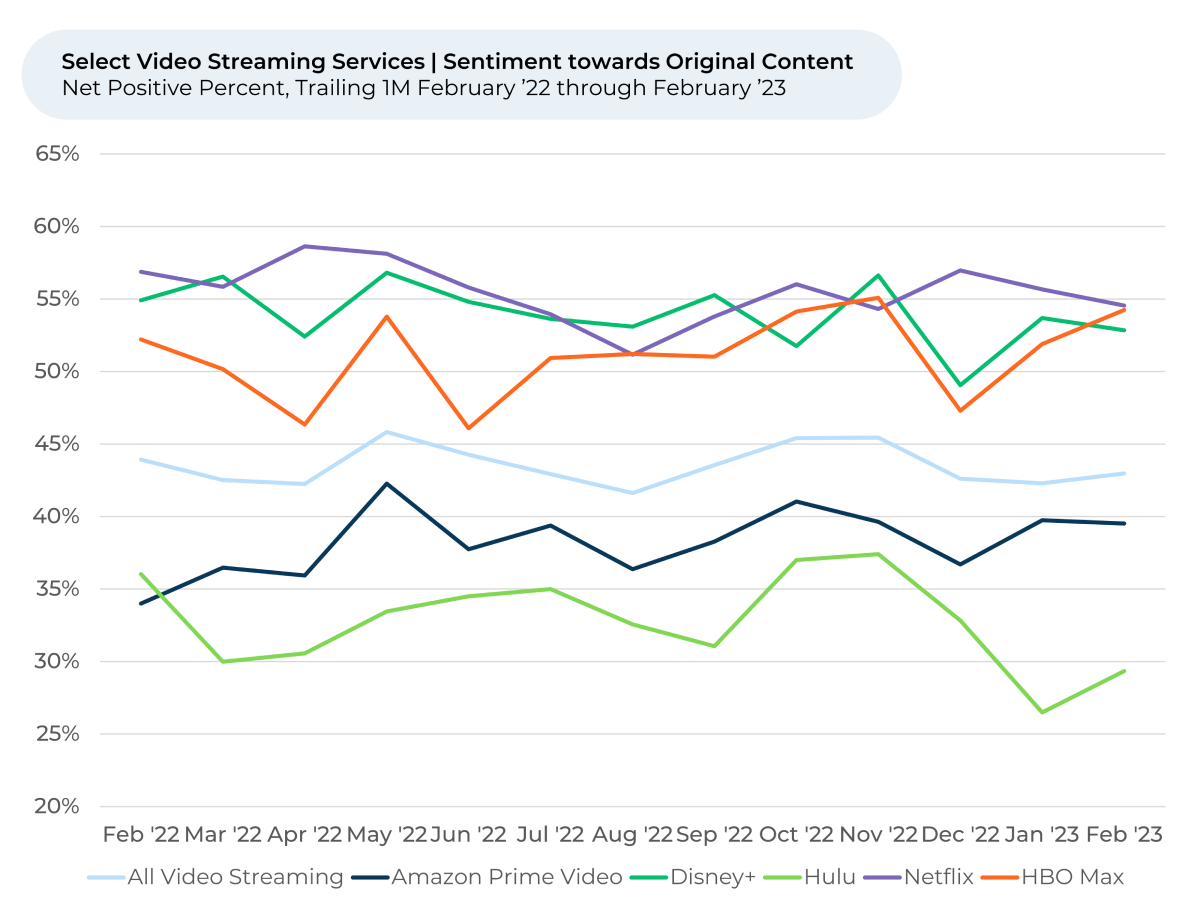

The Usage Intent increase for HBO Max appears to be driven by viewers’ improved sentiment₃ towards the network’s new releases and original content, two of the top drivers of customer satisfaction with streaming platforms.

Since January, HBO Max viewers feel significantly more positively about the network’s original content. While sentiment towards original content remained relatively flat for all streaming services, it surged 7% for HBO Max from December through February.

“Love some of the original content coming from HBO. Game of Thrones, House of Dragon, True Detective, and The Last of Us are all good shows,” one HBO Max user told HundredX.

Viewers also feel more positively about HBO Max’s new releases. Sentiment towards new releases increased 3% from December through February for HBO Max while it dipped 1% for all streaming services.

Another pleased HBO Max viewer told HundredX that while it can be hard to wait a week for new episodes, “I am a HUGE fan of their original series, especially White Lotus and Last of Us.”

The game also benefits

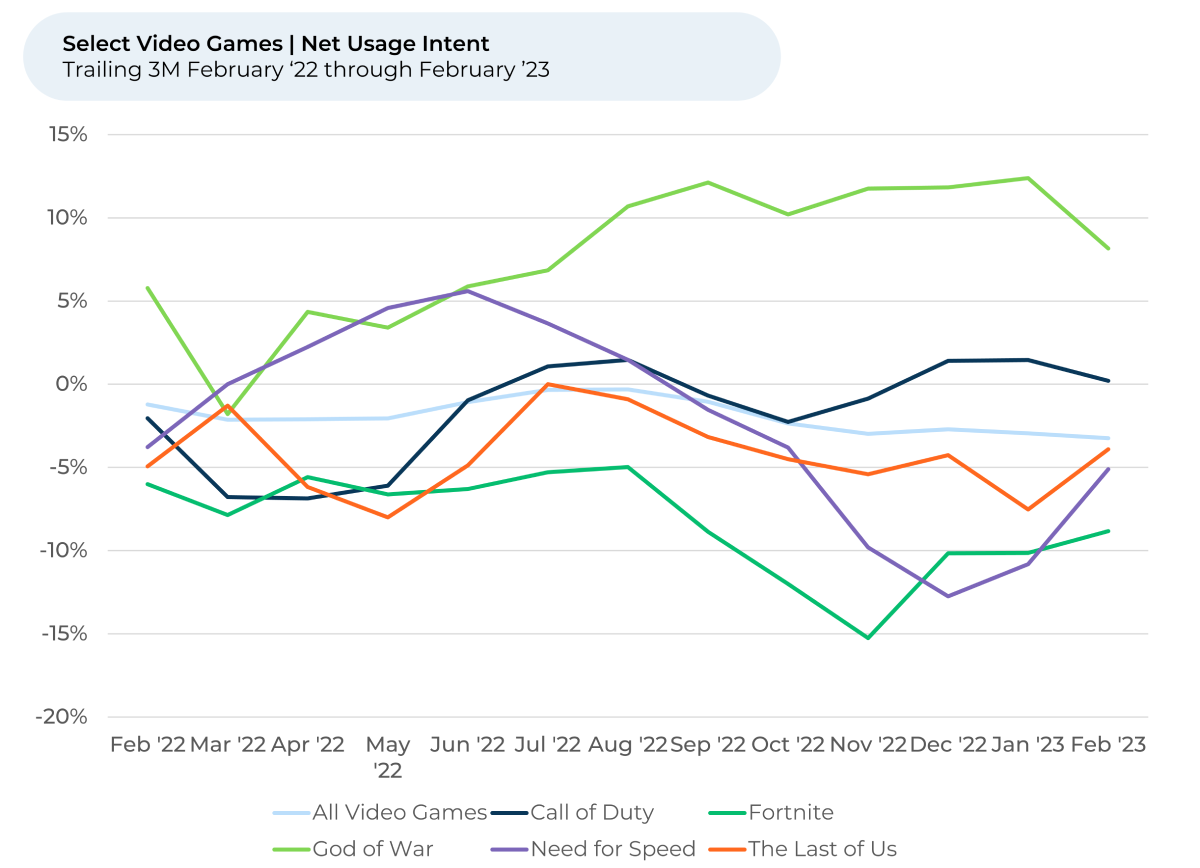

Usage Intent for the game brand increased notably since January, gaining on some of the biggest games on the market and the video games as a group.

The Last of Us games, available on PlayStation consoles and due out on PC at the end of March, also seemingly has seen a boost from the release of the show.

“Love that it's a tv show now,” one happy gamer told HundredX.

Our data indicates gamers like the characters and storyline, a top driver of gamer satisfaction, for

The Last of Us games better than any of the 51 game brands HundredX tracks. Sentiment jumped by 16% from December to February, seemingly benefiting from the release of the show.

“Great storyline throughout both games,” one person told HundredX. Another commented, “This was one of the best story driven games I’ve ever played.”

Anyone looking to make a show or movie out of a video game should take note of how The Crowd ranks a game’s characters and storylines – the above list can help. Several of the games on the list have already been made into successful movies or shows, and at least one more (Borderlands) is due out as video content soon.

Please reach out to get more information on video games or the video streaming industry.

PS – someone please look at how high

Red Dead Redemption is ranked.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Usage intent reflects the percentage of customers who plan to use a specific brand during the next 12 months minus the percentage that plan to use less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- While HundredX typically prefers to analyze data on a trailing three-month (T3M) basis, we analyzed video streaming services on a T1M basis in this instance to best capture movement related to the January premiere of The Last of Us.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing. Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.