E-Commerce drives retail; top brands to watch

As we monitor the start of the busiest time of year for Retail sales, we look to The Crowd to get an indication of what the next few months may bring. Leveraging HundredX’s proprietary listening methodology, we evaluate more than 100,000 pieces of feedback from real customer experiences across the country. Focusing on the E-commerce sector, we develop insights into future Net Purchase Intent (NPI), the sentiment drivers behind changes in intent, and Customer Satisfaction (CSAT).

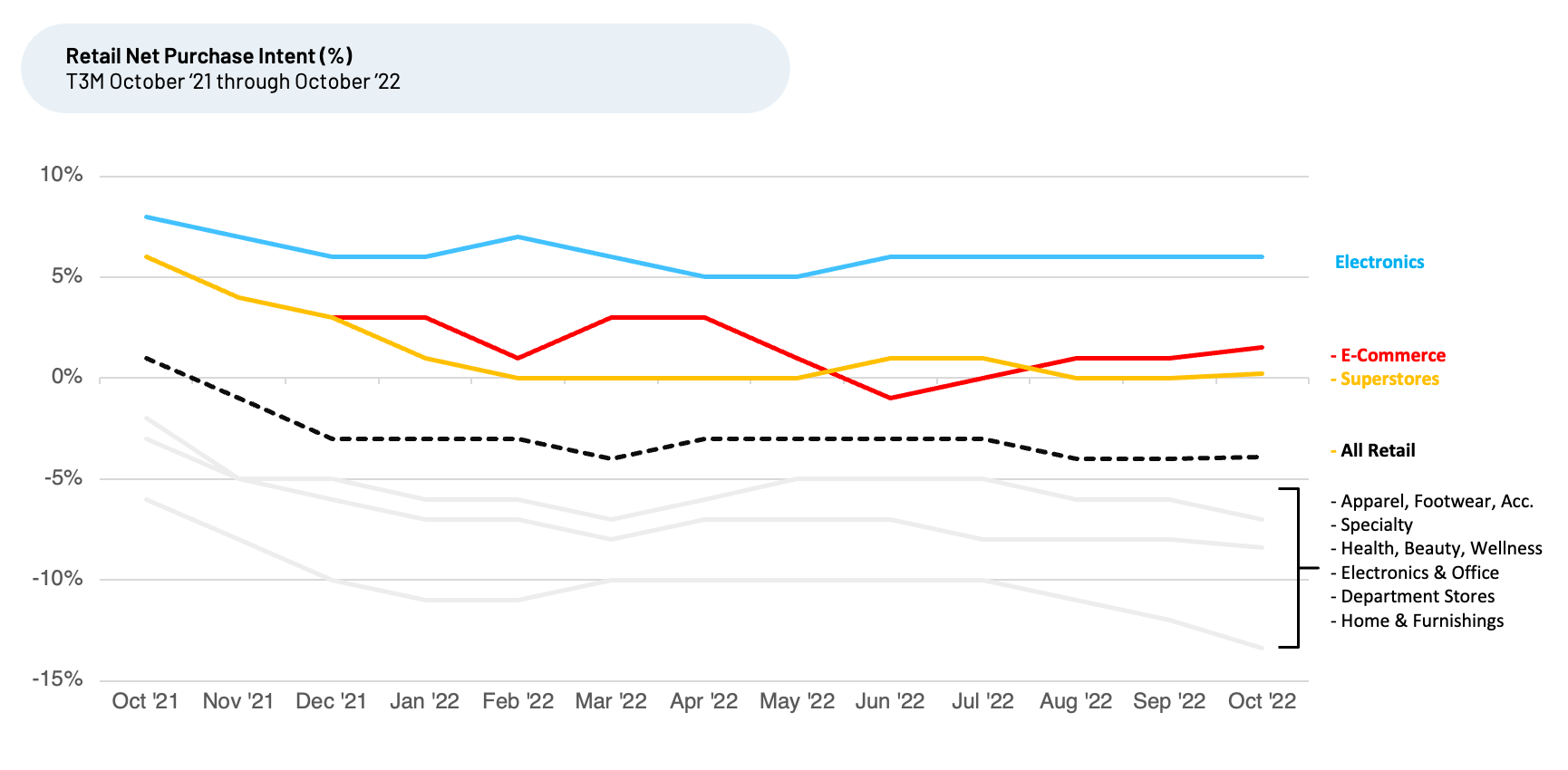

We observed a broad pullback in overall consumer Retail Purchase Intent during the past year, falling from 1% NPI trailing three months ended (T3M) October 2021 to -4% for T3M October 2022. During the last six months, this trend became more pronounced across almost every Retail sector, except E-Commerce, which continues improving, posting a positive 1% NPI in T3M October 2022.

Key Takeaways

- NPI continues to drop for the Retail Industry overall. We believe the falling NPI reflects concerns about inflation and general economic uncertainty.

- E-Commerce is one of the few categories in Retail that has seen both improved and positive NPI. We believe this indicates strong double digit growth rates for electronic shopping retail sales should continue and may even improve during the coming months.

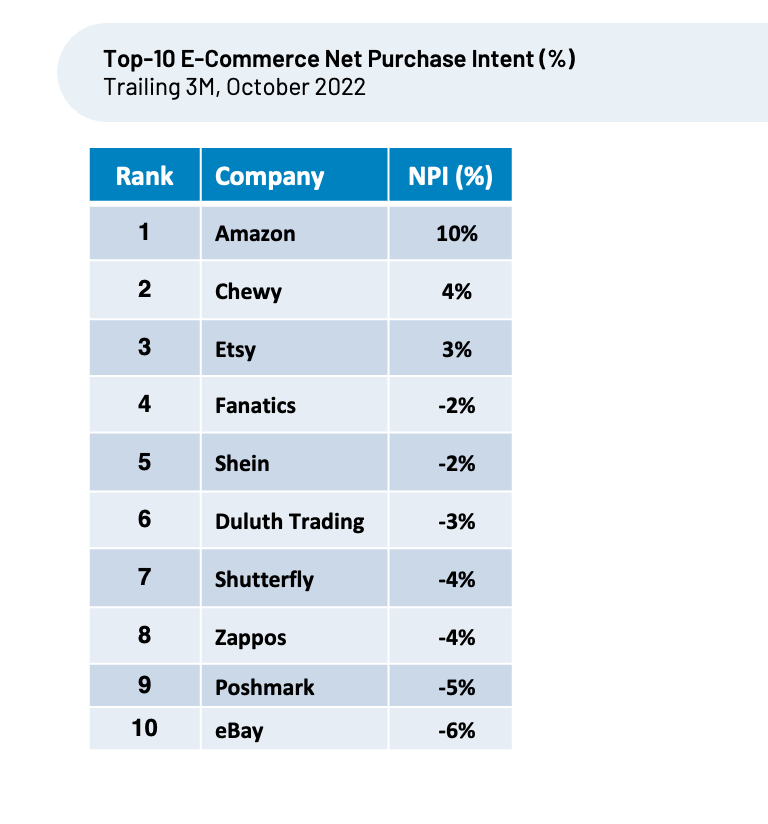

- Amazon remains the brand with the strongest growth outlook within our E-Commerce coverage, followed by Chewy and Etsy.

- Customer Satisfaction (CSAT) for E-Commerce (4.4 on a 5-point scale) has remained steady over the course of the last year. It is one of the top measures for any sector in our coverage.

- Top E-Commerce retailers do a great job of satisfying customers on Selection, Delivery Speed, and Price, the most important drivers for the overall industry.

E-Commerce growth likely to continue improving, in contrast

to most of Retail

We observed a broad pullback in overall consumer Retail Net Purchase Intent during the past year, falling from 1% T3M October 2021 to -4% T3M October 2022. During the last six months, this trend became more pronounced across almost every Retail sector.

NPI for E-commerce is one Retail group that has actually seen improvement during recent months and is positive overall, at 1% for T3M October 2022, up from -1% in June 2022. We believe modestly positive NPI, along with its gains over other sub-sectors that remain flat to down, indicates consumers will most likely continue to spend more money on E-Commerce relative to other Retail areas. Year-over-year growth in Retail sales for Electronics shopping improved every month, moving from 8% in May 2022 to 14% in September 2022. These strong rates should remain sustainable and may even improve further during the coming months.

As a reminder, NPI reflects the percentage of customers who plan to purchase more of a brand during the next 12 months minus the percentage that plan to purchase less. The monthly retail sales data reported by the U.S. Census Bureau for 10 sub-sectors HundredX covers has an average correlation of about 70% with the NPI data for those industries. We find changes in the direction of NPI tend to occur two to six months before the same trend occurs for reported retail sales figures.

Winners in E-Commerce

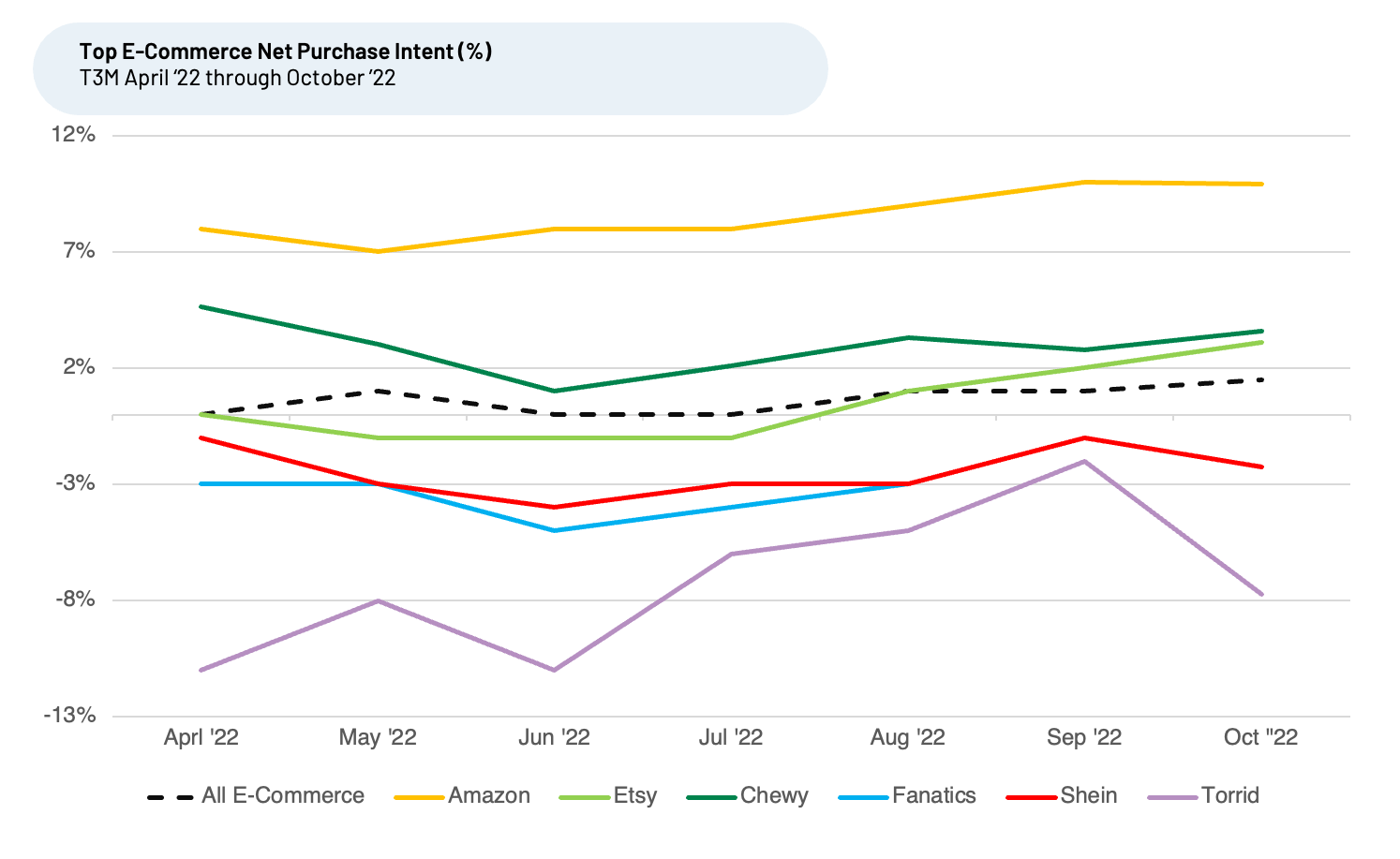

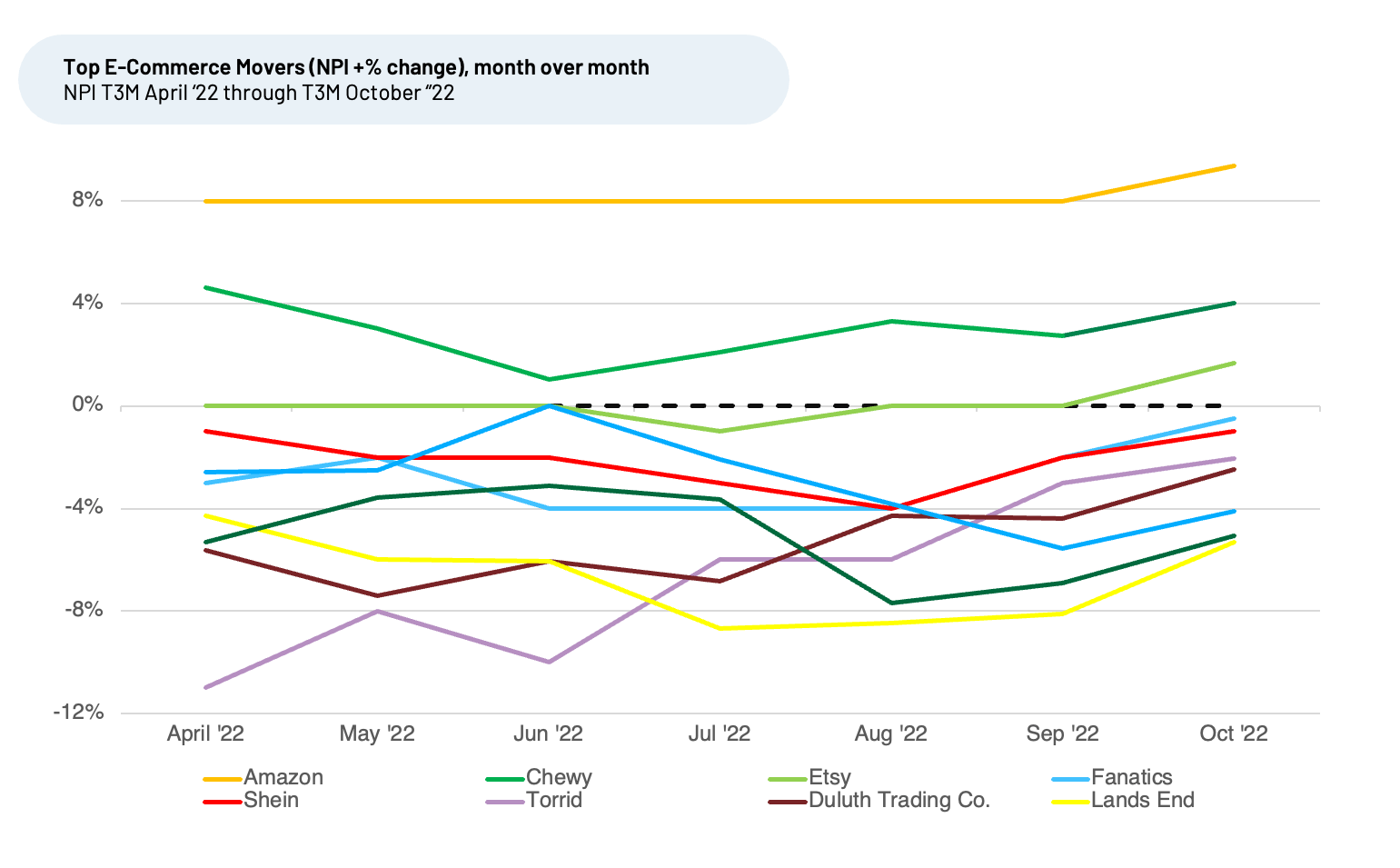

HundredX data tells us that in October 2022, more consumers want to increase their spending at Amazon, Etsy, Chewy, Fanatics, Shein, and Torrid than in any month since June 2022. Amazon maintains the highest overall NPI in E-Commerce and the broader Retail sector.

Analyzing the E-Commerce group, The Crowd has the best spending outlook for the following brands.

E-Commerce NPI Highlights

Amazon continues to post stable NPI at 10% month over month. Amazon maintains the highest overall NPI in Retail and E-Commerce. Its customers continue to say they plan to shop more there in the future, perhaps intent on saving with the Prime Member sale and through the holiday season. Amazon remains far ahead of the overall E-Commerce sector in important customer satisfaction drivers, including Selection, Ease of Use, Checkout, Delivery Speed, and Price. Amazon, Etsy, and Chewy lead the category with these drivers. HundredX’s Net Positive Percentage (NPP) measures sentiment on specific drivers of a company/brand customer satisfaction. All of these resonate with customers. One recent customer commented, “I love Amazon Prime. I'm starting to just go on there and see everything that they offer. Get ideas and make shopping lists for when we move.”

Chewy’s NPI rose from -1% June 2022 to 3% October 2022. Resilient demand categories such as dog food and healthcare, and the recurring nature of their autoship and subscription business (73% of sales) help in extending market share in the recession-resistant pet category. A recent customer commented, “It is nice having our dog food on auto ship. And giving back to the shelters when u need to return food is wonderful."

Etsy’s NPI increased from 1% June 2022 to 4% October 2022. Online DIY/Crafts marketplace experienced strong sales growth during the pandemic. The company continues to thrive, and it plans to invest $600 million in marketing during the coming year. Their unique products set them apart. Customers recently commented: “Etsy has so many cool things to offer. Their ability to offer “crafts” and other neat things like that makes it such a diverse website to shop at!” “Love the opportunity to buy from multiple small business owners in one spot.”

Shein’s NPI dropped from -1% in September to -2% in October 2022, after posting positive gains since June 2022’s -4% NPI. The Chinese brand, embraced by GenZ shoppers who love its inexpensive, throwaway fashion, has begun the feel pressure from competitors replicating its model, and pushback from consumer’s who pay attention to sustainability. Sales have declined since the Pandemic, but new warehouses and shipping times focused on US customers could propel renewed growth. Top satisfaction drivers include Price (ranked first for the group), Ease of Use, and Styles. New efforts are focused on improving Delivery Speed and Customer Service. A recent customer commented, “The Shein site is very easy to shop on. The pricing is great, and my recent deliveries have arrived before the commit date.” Another shared, “We love how affordable the products are and the fast delivery. The quality was better than I expected for the price. We will continue to use the app and order from them.”

Fanatics’ NPI dropped from -1% in September to -2% in October 2022, after posting positive gains since June 2022’s -5% NPI. Fanatics recently decided to expand into the rapidly growing online sports betting industry, after building its business on major licensing arrangements with pro teams. Most of Fanatics’ growth has come through acquisitions and investments by major sports leagues. Primary satisfaction drivers for the company include Styles, Delivery Speed, and Quality. Despite apparel designed for all major sports leagues, customers admire the brand’s uniqueness, “You can find items here that you can’t find in other stores.”

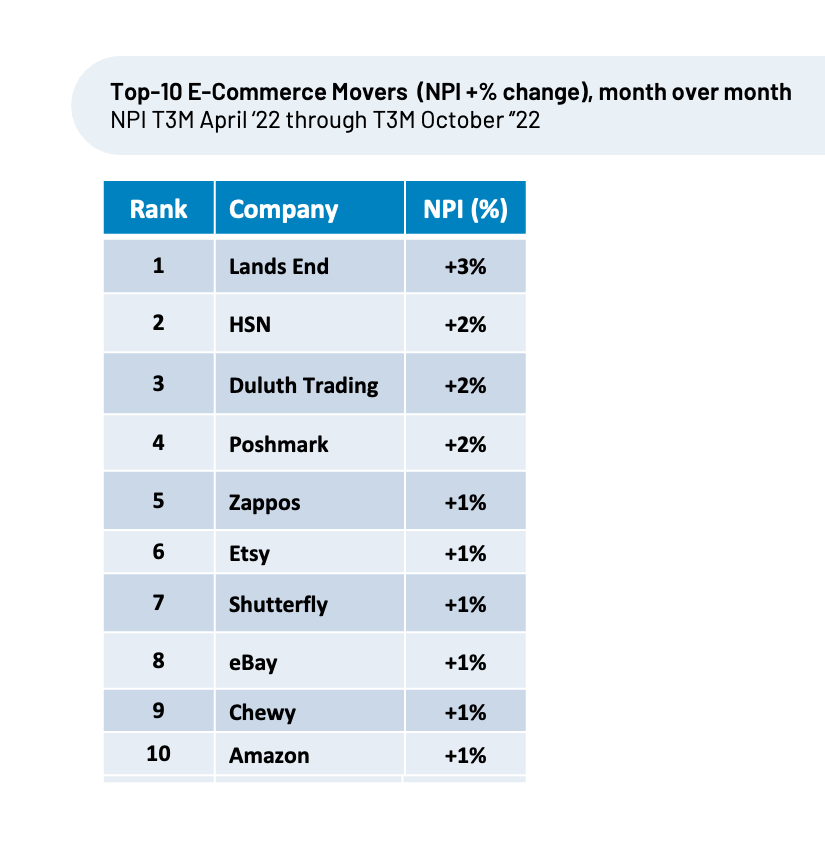

E-Commerce's largest NPI improvers for trailing three-month period October 2022

When we compare trends in a brand’s NPI relative to the Industry NPI, we find the top performers who gain in NPI relative to bottom performers tend to gain market share within a sector. A number of brands within the E-Commerce sector appear positioned to gain market share. Many of these brands still have a negative NPI, but improved versus the sector’s average month over month.

Top E-Commerce NPI Mover Highlights

Chewy, Amazon, and Etsy remain the top brands in terms of overall NPI for October. Their +1% NPI increase month over month, while not the highest of the group, indicates these brands should gain more market share, as consumers continue to favor them. These sites have become staples, and as the peak retail season progresses, we will watch for any further month over month gains.

Lands’ End posted the largest month over month NPI gain, moving up from -8% in September 2022 to -5% in October. The company expanded its partnership with Kohl’s in June, expanding the number of smaller Lands’ End stores operating within department store chain locations by the fall. Its products are also available for purchase on Kohl’s website. As Lands’ End’s store partnership expands, so does its online revenues. Over the last few months, we saw the brand significantly improve on sentiment vs. peers on Quality, Selection, Return Processes and Customer Service. The partnership is likely helping to improve perception on these satisfaction drivers. Customers recently told us, “I love that I can make returns at Kohl’s and don’t have to mail them back.” and, “Will purchase items from LE via Kohls…”

Duluth Trading Co.’s NPI rose from -7% in May 2022 to -2% in October 2022. Known for its creative marketing and high-quality customer service, the workwear and lifestyle brand operates primarily online, but has 65 retail locations. Over the last few months, we saw the brand significantly improve on sentiment vs. peers for Quality and Styles. The brand’s combo approach to retail pays off, as a customer recently told HundredX, “I like to browse and see what they have online, then go try it on and purchase it in their store.”

Torrid’s NPI rose from -11% in April 2022 to -2% in September 2022. NPI, however, has dropped to -8% during the last month. Torrid focuses on direct-to-consumer apparel, intimates, and accessories brand in North America for women sizes 10 to 30. Over the last few months, we saw the brand significantly improve on sentiment vs. peers on Styles, Selection, Quality, Customer Service and Checkout. Torrid leads the overall group for Customer Service.

E-Commerce Customer Satisfaction

We also find Customer Satisfaction (CSAT) for E-Commerce (4.4) has remained steady over the course of the last year, one of the top measures for any sector in our coverage. HundredX measures CSAT on a 5-point scale. Sentiment towards a driver of CSAT is measured by Net Positive Percent (NPP), which is the percentage of customers who say a driver (such as Quality or Price) is a reason they like a brand/product minus the percentage who say it is a reason they do not like it. The top factors driving E-Commerce customer satisfaction, and the reason they prefer a specific brand include Selection (chosen as top driver 86% of the time), Delivery Speed (85%), Price (80%), Ease of Use (77%), and Return Process (74%). Amazon, Chewy, and Esty lead by wide margins in all these categories.

While The Crowd tells us that the overall outlook for Retail purchase intent will most likely continue its mixed trend, with Retail continuing to show negative or little NPI growth, E-Commerce overall and select brands will gain market share relative to the broader sector. We continue to monitor trends within Retail, E-Commerce, and other areas to see if any changes emerge as the shopping season progresses as well as into 2023.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.