In a move to improve sales, Nike is expanding its partnerships with Foot Locker, Macy’s, DSW, and other retailers.

Looking at more than 250,000 pieces of feedback from “The Crowd” of apparel and footwear shoppers, including 15,000 pieces from just Nike customers, we’ve found these partnerships could be a smart way for Nike to address their customer’s unhappiness about the availability and selection of its products.

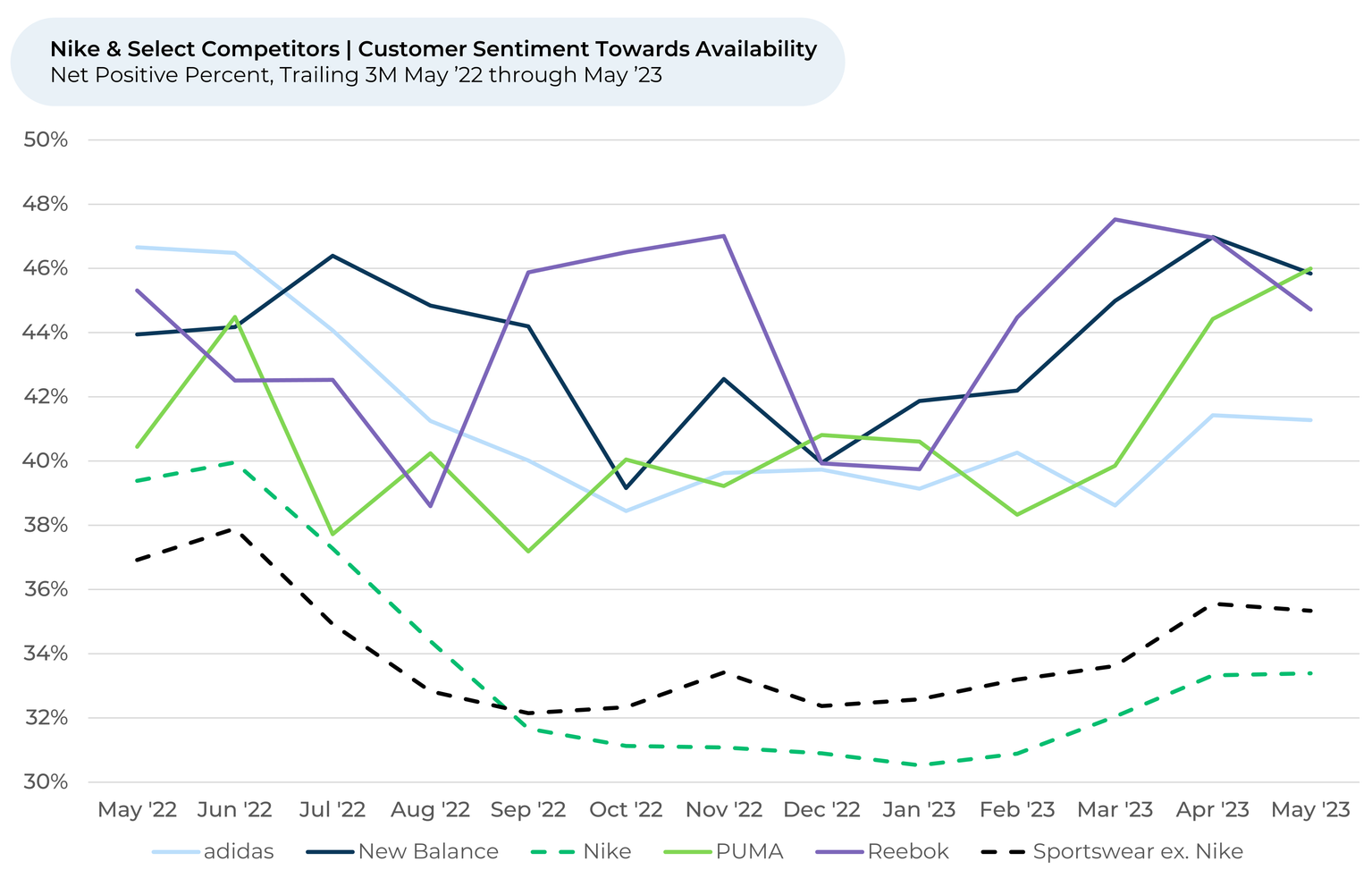

Sentiment1,2 of Nike customers towards the availability and selection of its products are down 6% and 9%, respectively, over the past year. This far outpaces the 2% and 5% decline for other sportswear companies. Selection is the only area besides price where Nike significantly lags its peers.

The drop in shopper sentiment towards Nike’s selection and availability speaks to an accessibility issue resulting from supply chain challenges in 2021-2022 and decisions to shift away from certain retail distribution partners. Customer sentiment towards availability has bounced by 3% in the last three months as Nike works through its elevated inventories by pushing more product into the market (much of it discounted), while sentiment towards selection is down 2% over the same period.

By comparison, customers like the availability of PUMA’s products more than that of its competitors. PUMA reported it grew its wholesale business

in Q1 2023, with a focus on being “the best partner to retailers.” More insights into PUMA can be seen in

our recent report on sportswear.

Customers want Nike products back in third-party retailers

During the height of the COVID-19 pandemic, Nike and other apparel retailers doubled down on their direct-to-consumer (DTC) business, figuring that since retailers like Macy’s and DSW were closed during lockdowns, they would need to shift their sales online. After announcing in 2020 that it would revamp its Consumer Direct Acceleration strategy, Nike turned away from its long-time retail partners and instead pushed to sell more products on its own websites and its DTC stores. The strategy has apparently worked – Nike DTC made up 44% of revenue as of May 2023, up from 16% in 2011.

Now, though, Nike is trying to mend its retail partnerships as it plans to bring products back to partner stores this fall. Dick’s Sporting Goods president, director, and CEO Lauren R. Hobart reaffirmed Dick’s commitment to Nike in its May earnings call, and earlier this year, Foot Locker CEO Mary Dillon said her company is again working closely with Nike.

Many customers have recently shared their desires to see more Nike product in other stores with HundredX. In June, one woman shared, “normally buy Nike at Dicks. They have a very limited selection vs what is shown online. Please improve.”

Another Nike customer added that while she thinks Dick’s does have a good selection of Nike products, “I wish Nike was in DSW shoe stores…that seems to have gone away.”

We’ll closely monitor the data to see how Nike’s partnership expansion pays off.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.