As runners, joggers, and walkers hit the streets and trails to burn calories and enjoy the warm weather, HundredX turns to "The Crowd" to get the latest on sneaker trends.

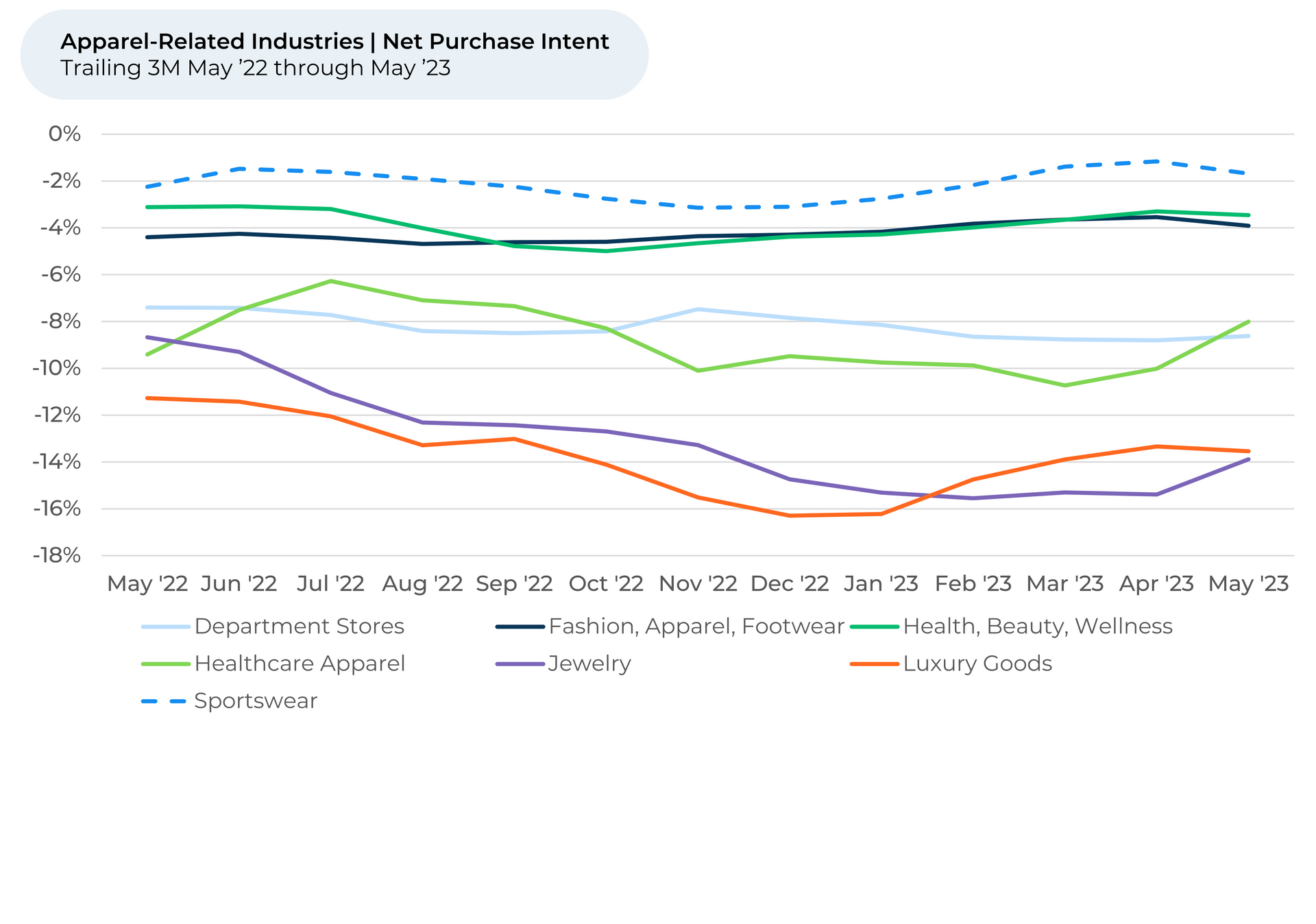

Among high inflation for everyday expenses, sneaker-wearers are keeping lower-cost brands in mind. Looking at 250,000 pieces of customer feedback across the fashion, apparel, and footwear sector, we find that Purchase Intent1,2 has been flat for the overall sportswear industry, but athletic footwear has seen some movement.

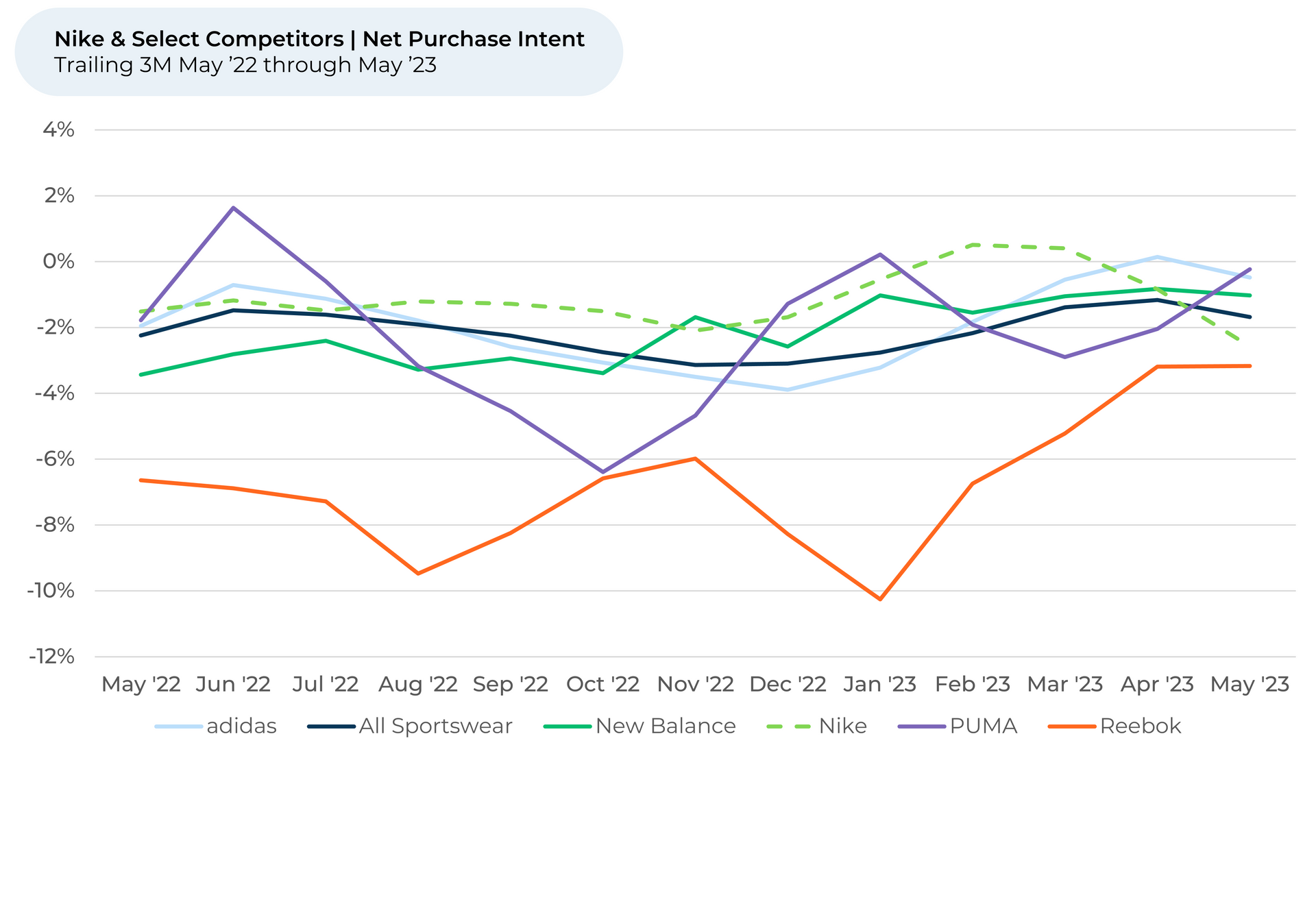

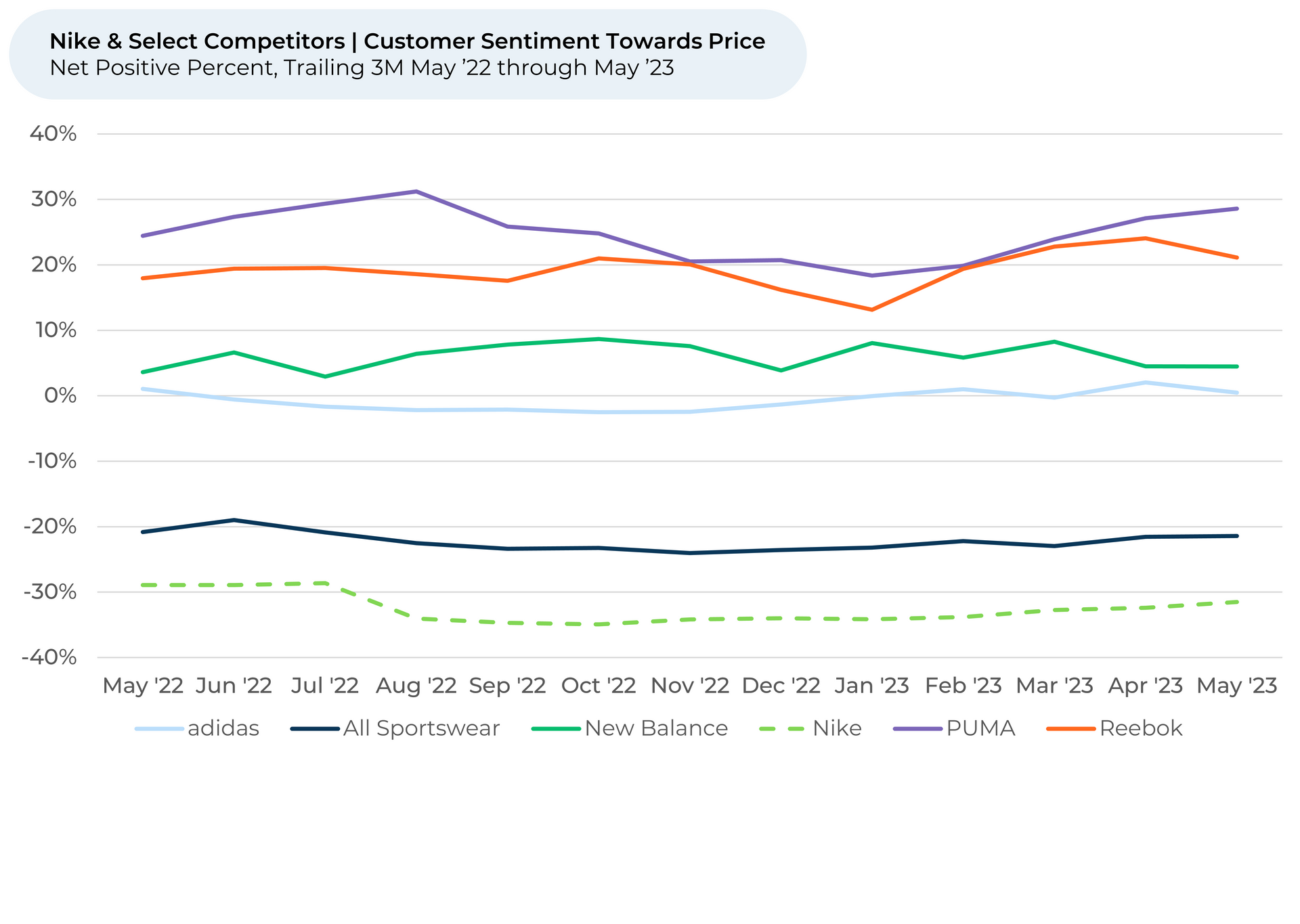

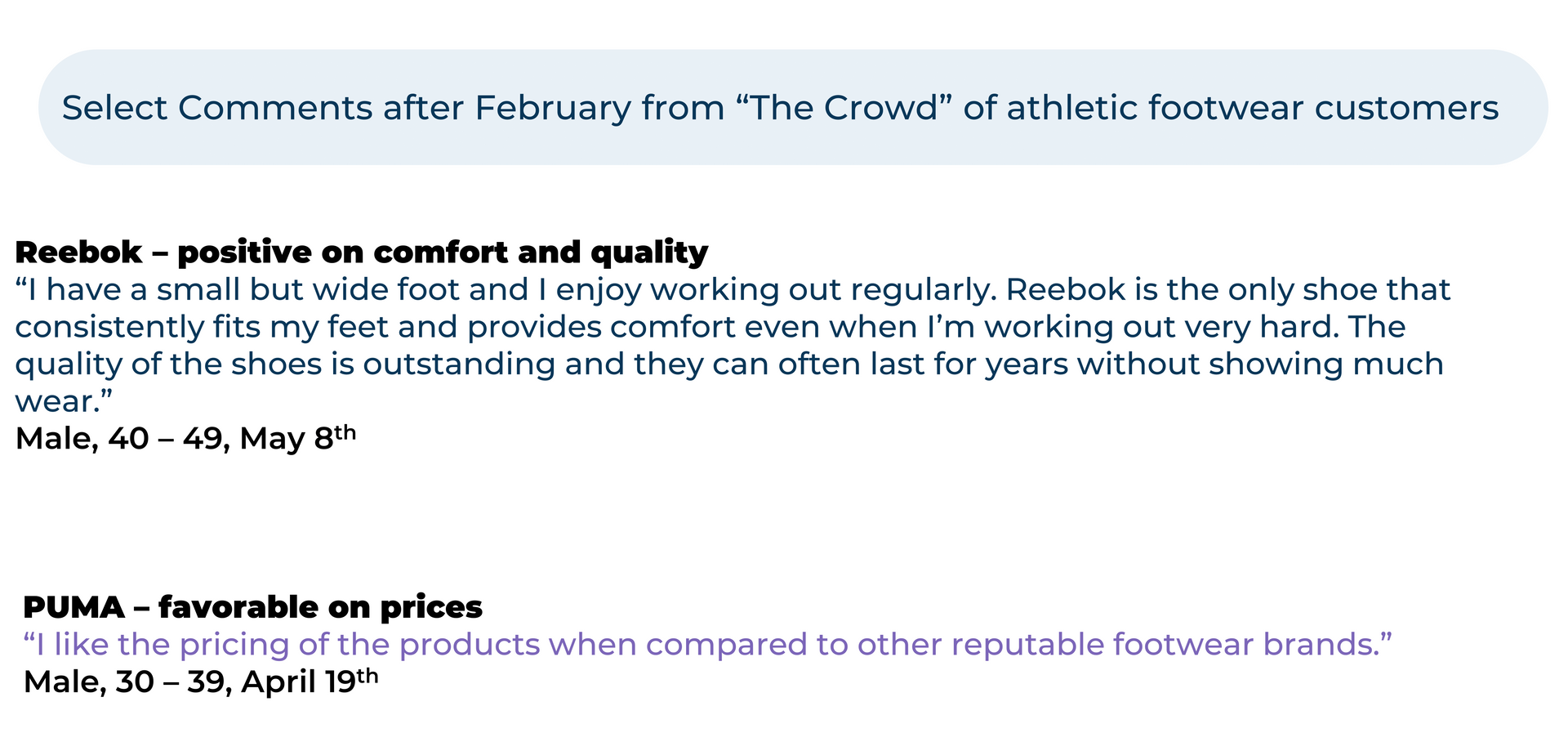

Reebok and Puma, two sneaker brands known for their relative affordability, jumped in Purchase Intent over the past three months as they continue to please customers with their prices. Meanwhile, Nike has slumped as customers feel unhappier with the brand's price, quality, comfort, and image.

A close analysis of our data reveals:

Key Takeaways:

- Over the past three months, sportswear demand outlook remained steady; it grew for luxury goods, healthcare apparel, and jewelry

- Nike Purchase Intent fell 4% over the past three months, even as it jumped for Reebok (+4%) and PUMA (+2%).

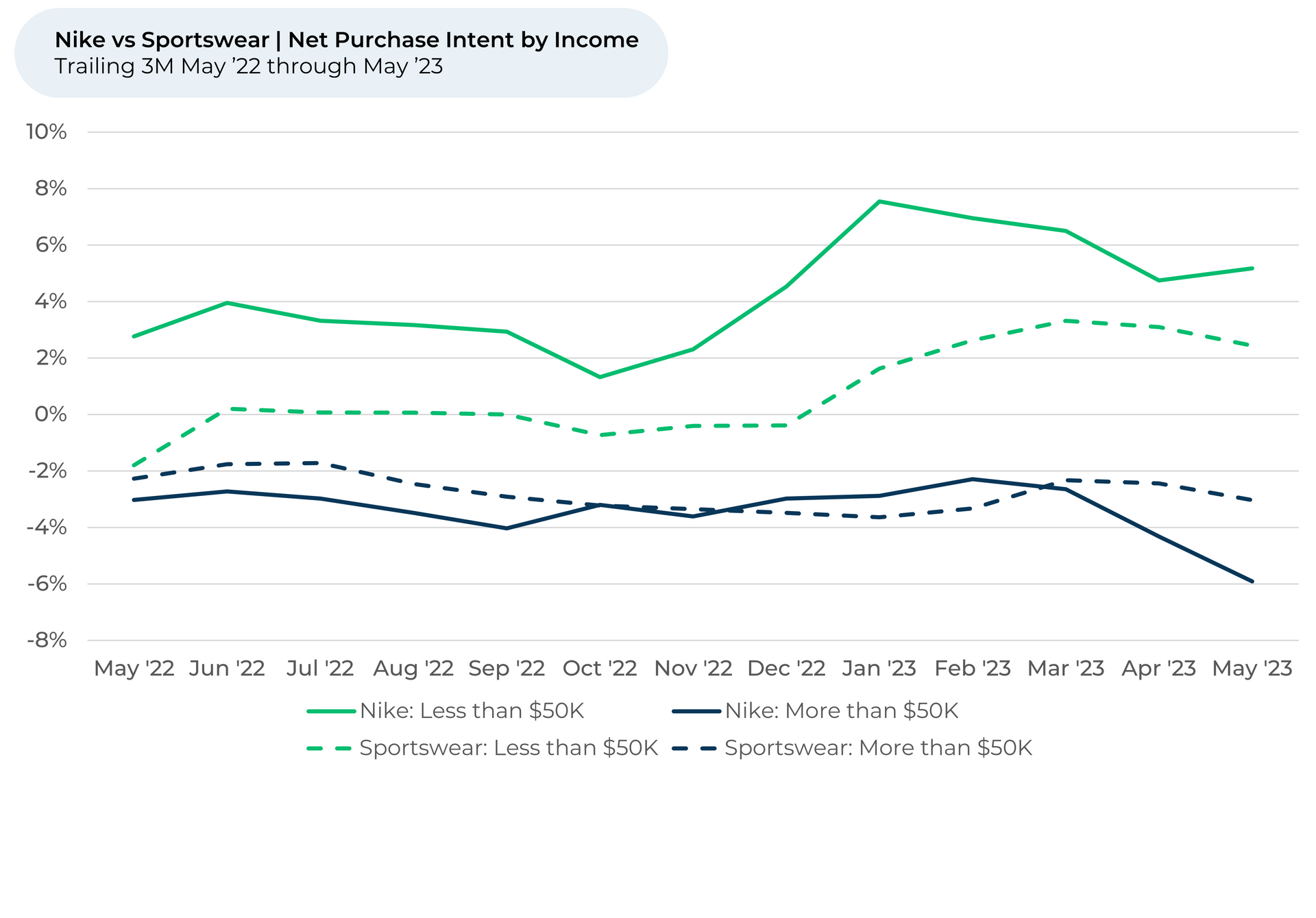

- Nike Purchase Intent fell the most people making more than $50,000 per year and middle-aged adults and was most resilient for young adults and people making less than $50,000 per year.

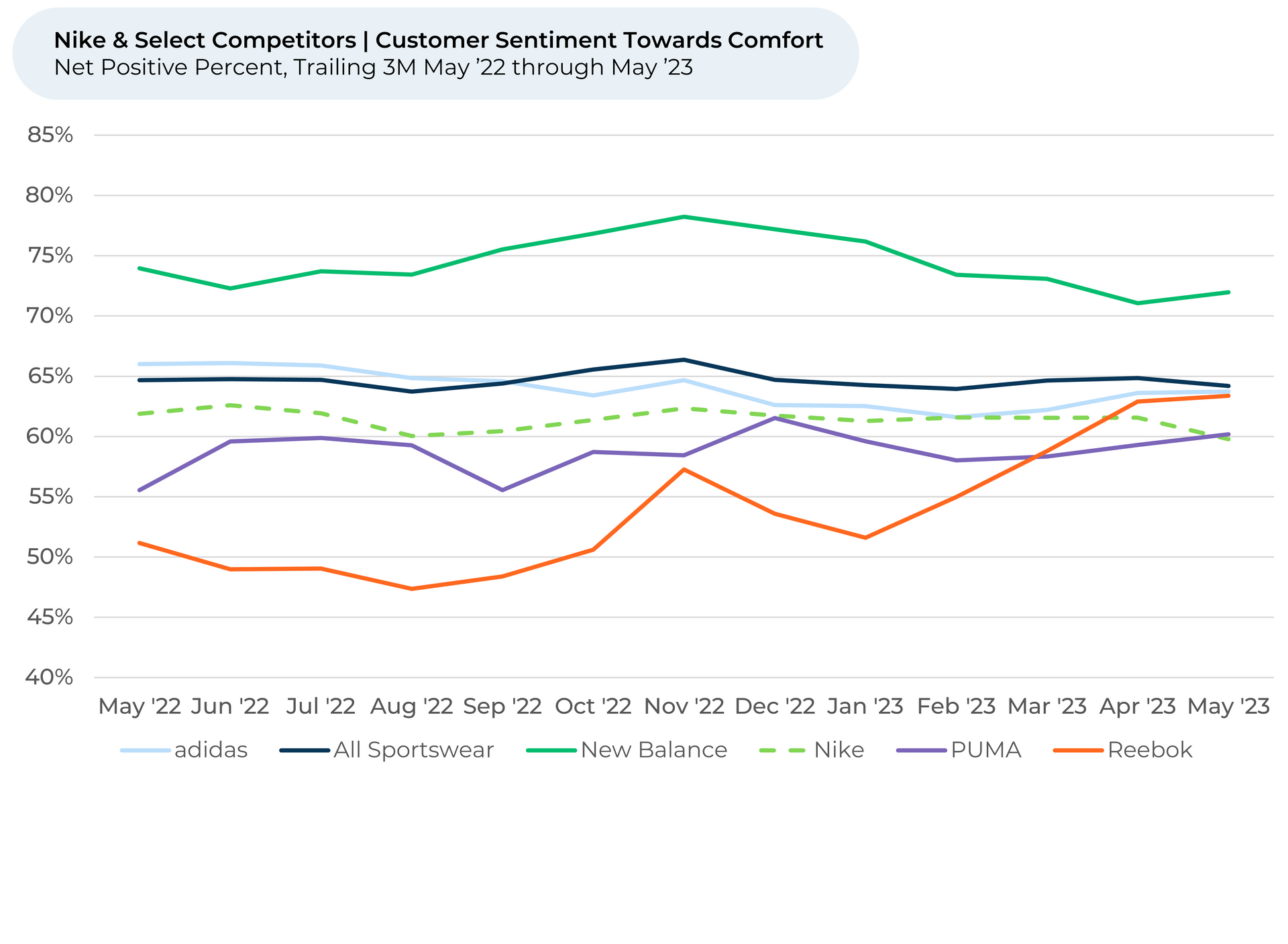

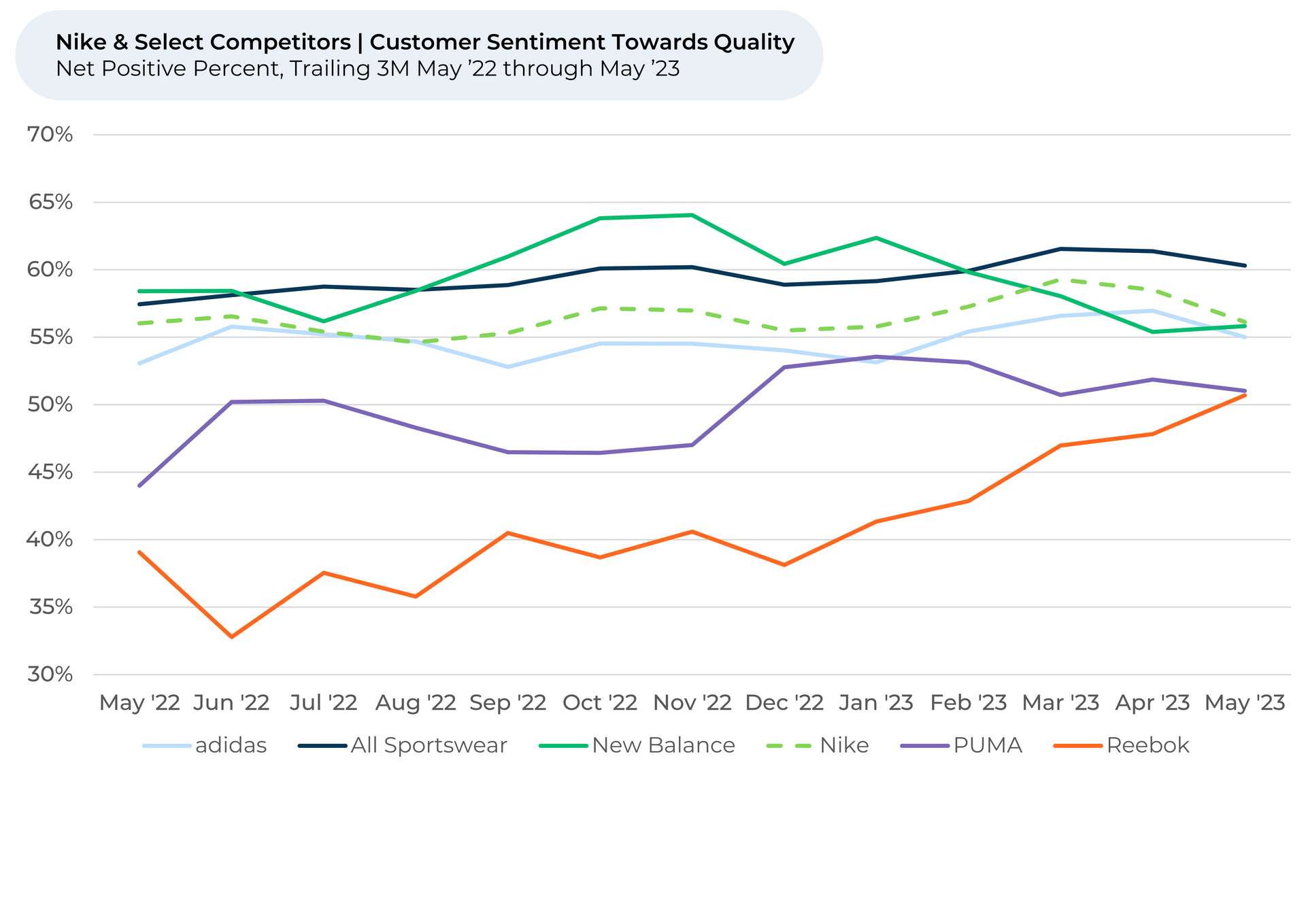

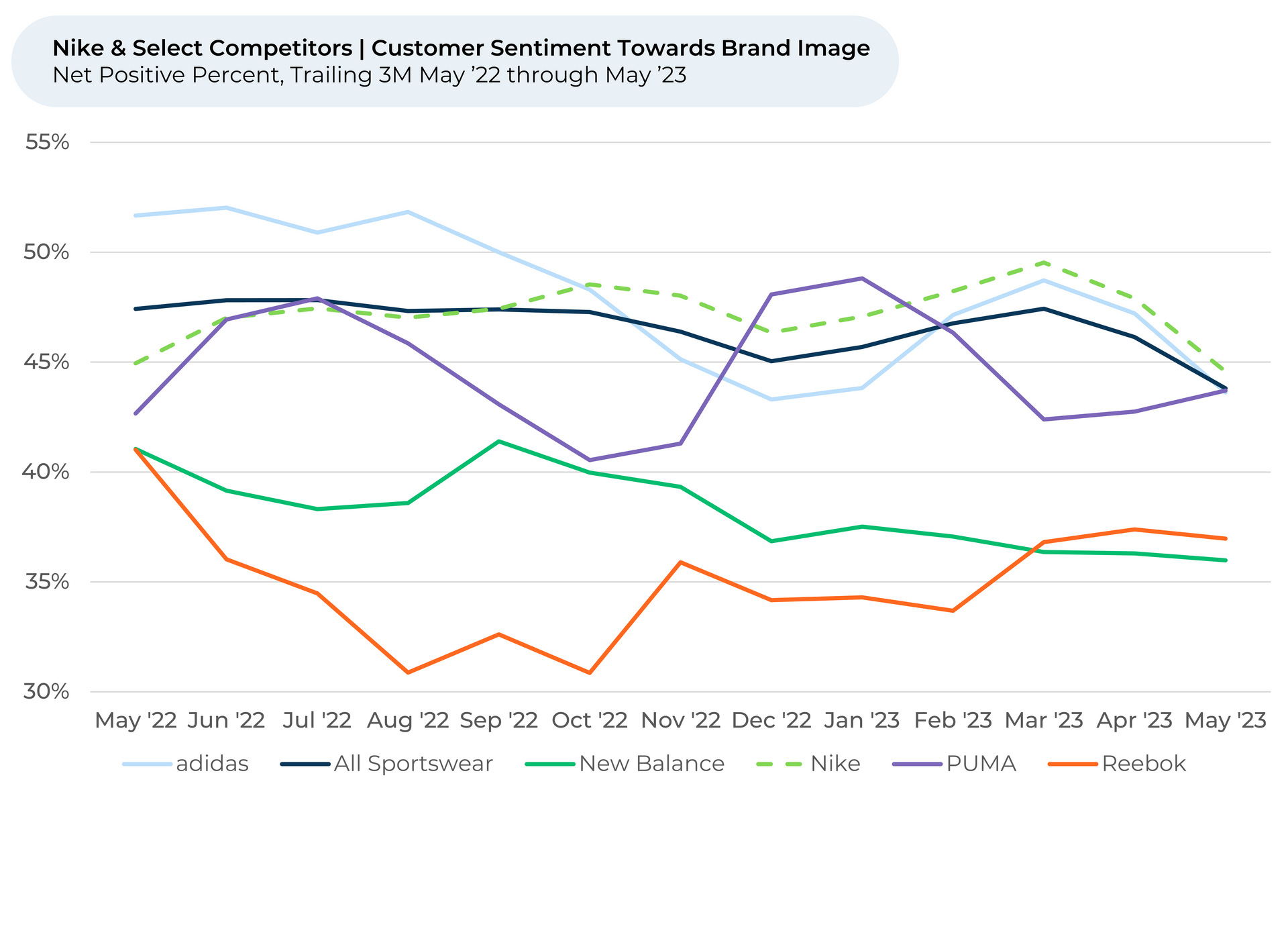

- In recent months, Nike customers have felt unhappier about the company’s prices, quality, comfort, and brand image.

- In contrast, customer sentiment3 toward the above factors surged for Reebok, which released a number of new shoes in early 2023. Price, Comfort, and Quality are the three most selected reasons why someone likes or dislikes a sportswear brand.

Discover HundredX insights into Sportswear and Athletic Footwear:

Please contact our team for a deeper look at HundredX's Fashion, Apparel, and Footwear data, which includes more than 600,000 pieces of customer feedback across 230 apparel brands.

- All metrics presented, including Net Consumption (Consumption Intent) and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent for fashion, apparel, and footwear represents the percentage of customers who expect to spend more of that brand over the next 12 months, minus those that intend to spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.