Chips, Dips, and Ad Frenzy - See How NFL Fans Respond

Eating wings, crunching chips, and drinking beer – that’s what the Big Game is about, right? … right? Well, maybe that’s just part of it; there’s also the commercials.

Jokes aside, HundredX analyzed 230,000 pieces of feedback from real people, January 2022 through January 2023, to discover the link between football fans, alcohol, and snacks. It turns out there are some drinks and snacks NFL fans seem to have more of than others.

We find:

- Ads work! Football fans generally leave more feedback¹ on brands that advertise during football games compared to others with lower ad spends.

- The top alcohol brands are Coors (4.1x more likely to leave feedback) and Bud Light (3.3x) , while the top snack brands are Doritos (2.7x) and Tostitos (2.6x).

- Crown Royal rose to be the only spirits brand in the top 5 for feedback by football fans, up sharply from 2022. It first started advertising to NFL fans in 2021 and makes its Big Game debut this year.

- Football fans are at least 1.5x more likely to leave feedback on the top alcohol brands overall compared to the average HundredX respondent.

- Football fans are at least 1.1x more likely to leave feedback on some of the top snacks we cover.

Drinks on the Couch

NFL fans generally leave feedback for the top alcohol brands at least 1.5x more than the average HundredX respondent. HundredX covers 66 alcohol brands in total.

For example, over the past three months, 2% of HundredX respondents shared thoughts on the liquor brand Tito’s, versus 7% for those that reviewed NFL. Note that people only leave feedback with HundredX for products or services they use.

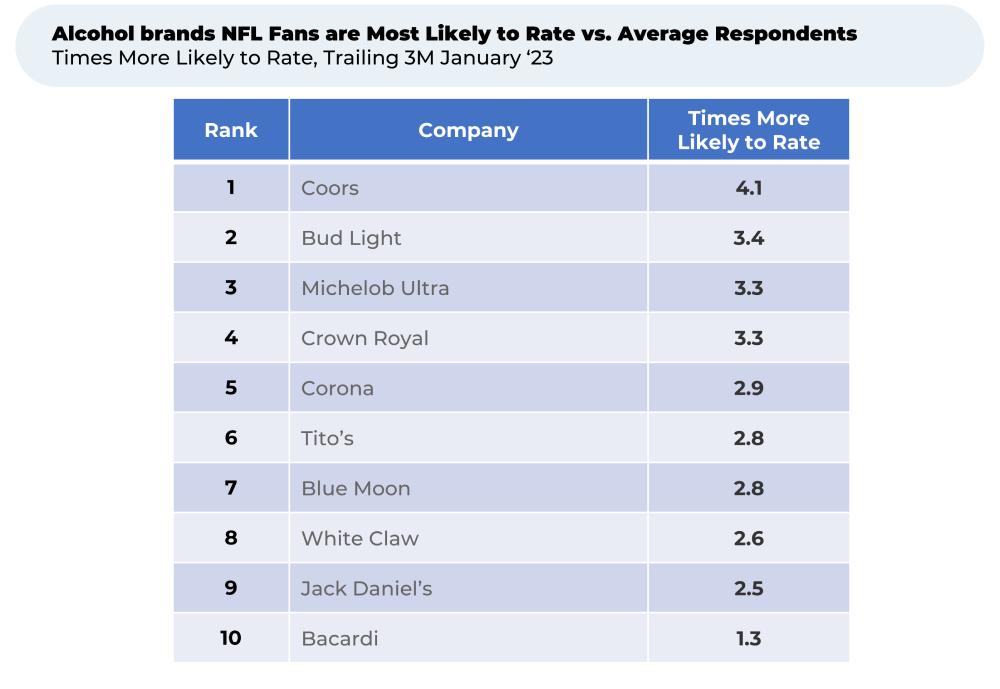

NFL fans tend to leave the most feedback compared to average respondents on the following alcohol brands:

Beer is the obvious winner here, with NFL fans far more likely to leave reviews for Coors (4.1x), Bud Light (3.4x), and Michelob Ultra (3.3x) compared to the average respondent.

Football fans have long seen Michelob Ultra ads during games. Anheuser-Bush, the parent company of Ultra, Bud, and Busch, had a thirty-year-long exclusivity deal with the NFL to advertise its beers during the Big Game. The alcohol giant ended that deal this year, meaning football viewers will see ads for various drinks, including Coors and Crown Royal. Still, Coors is a regular advertiser for standard football games. In 2022, Coors launched an ad campaign with Kansas City Chiefs quarterback Patrick Mahomes.

How about some snacks to pair with that beer?

NFL fans are more than 1.1x more likely to rate some of the top snacks HundredX covers than the average person. In total, HundredX covers 98 snack and dessert brands.

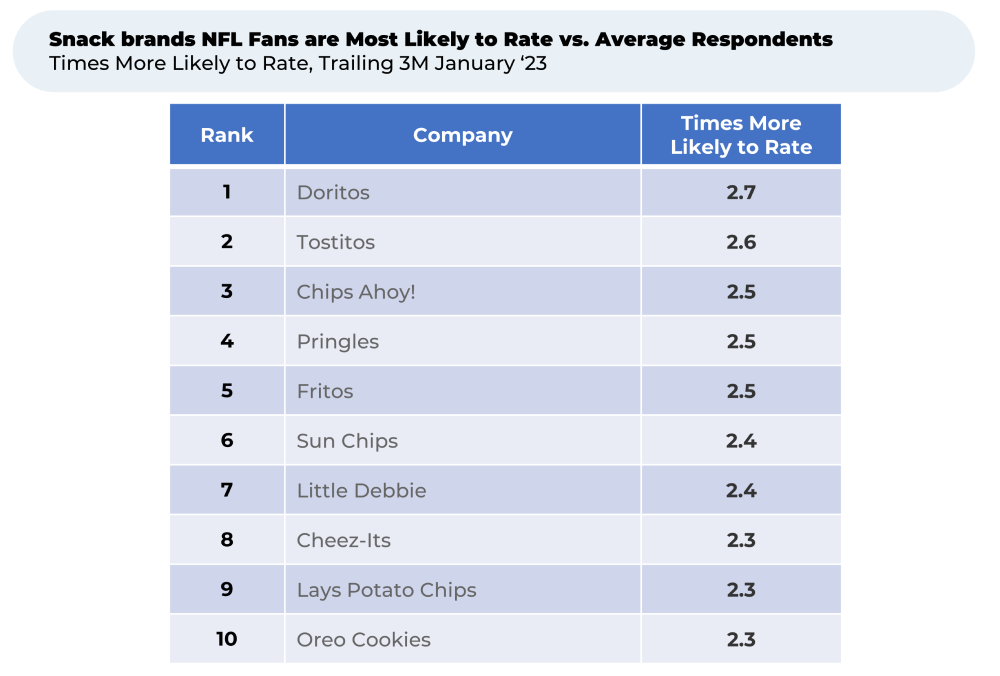

NFL fans tend to leave the most feedback compared to average respondents on the following snack brands:

Doritos is the clear winner here, with NFL fans 2.7x more likely to leave feedback for them compared to the average respondent. Doritos, owned by Frito-Lay, has been advertised during major football games for almost the past twenty years. It’s known for its comical, popular ads, regularly spending millions of dollars a year to show off its chips during the Big Game.

Tostitos, second up on the list and owned by Frito-Lay, is another game day favorite. Grocery stores frequently discount and advertise the tortilla chips, alongside salsa, ahead of Sunday football games. Ahead of this year’s Big Game, Tostitos ran Tost by Tostitos, a pop-up restaurant in Arizona. February 9 – 11, 2023.

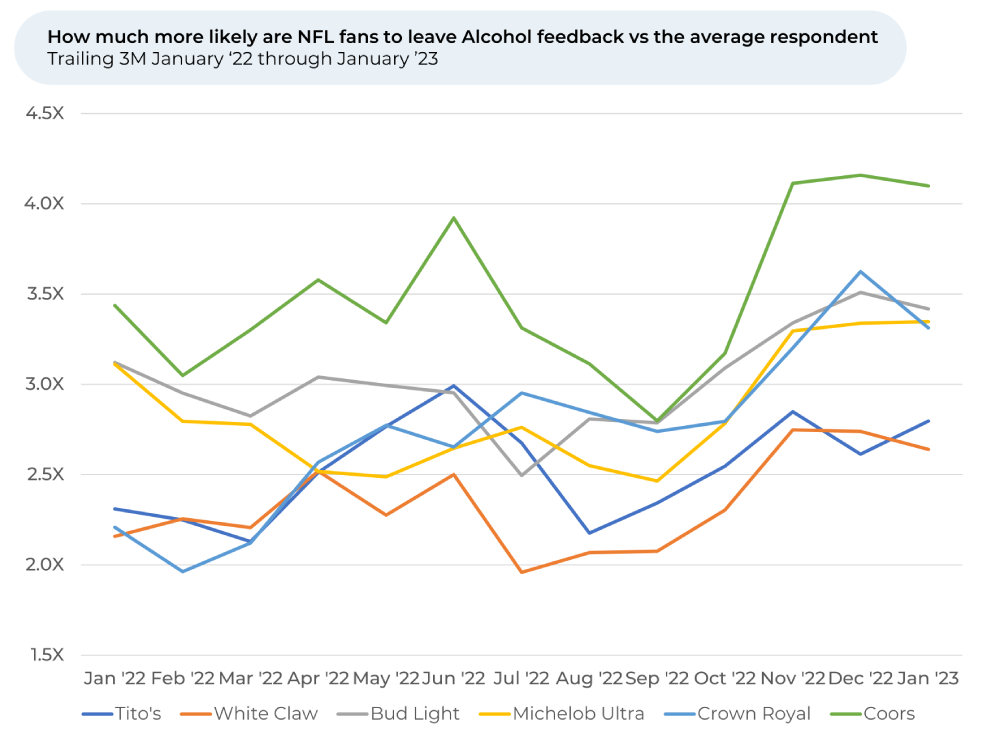

Advertising Power

Interestingly, we find football fans are slightly more likely to rate alcohol and food in the colder months (October through January) compared to the three months prior (June through September). This seems to correspond to the NFL season, which runs from September to February each year. Whether it’s increased advertising or just wanting to watch football and eat at the same time, the cold months seem like the time football fans snack the most.

While the Big Game is just one day a year, HundredX will continue monitoring that fundamental relationship between food, drinks, and sports throughout 2023. Last year, HundredX found a likely correlation between soccer fans and the sports bar chain Buffalo Wild Wings. Soccer fans seem to eat there more during MLS and the Premier League seasons.

By better understanding the relationship between restaurants, alcohol, or snacks and sports, HundredX can better understand what sport fans are most likely to eat and why.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.