Home Fitness Experiences a Massive Bump During COVID

The ‘Home Fitness’ industry experienced a massive bump in popularity during the COVID-19 pandemic as many gyms & fitness centers were forced to shut their doors. Peloton was a big winner last year when the company saw its stock price increase by over 400% in 2020.1 Another winner during the Covid lockdown was Mirror, which was purchased in June of 2020 by Lululemon for over $500 million.2

Although 2020 proved to be a successful year for companies in the ‘Home Fitness’ space, 2021 has been a bit rockier. The rollout of the COVID vaccines, which allowed gyms & fitness centers to reopen, combined with a general public eagerness to socialize slowed the momentum for ‘Home Fitness’ related spending. The results of the shift in consumer fitness trends has had a significant impact on companies in the ‘Home Fitness’ industry. For example, Lululemon recently lowered revenue estimates for their Mirror product to the range of $125 - $130 million, down from earlier estimates that ranged from $250 - $275 million. Their CEO, Calvin McDonald, even admitted to investors that “2021 has been a challenging year for digital fitness.”3

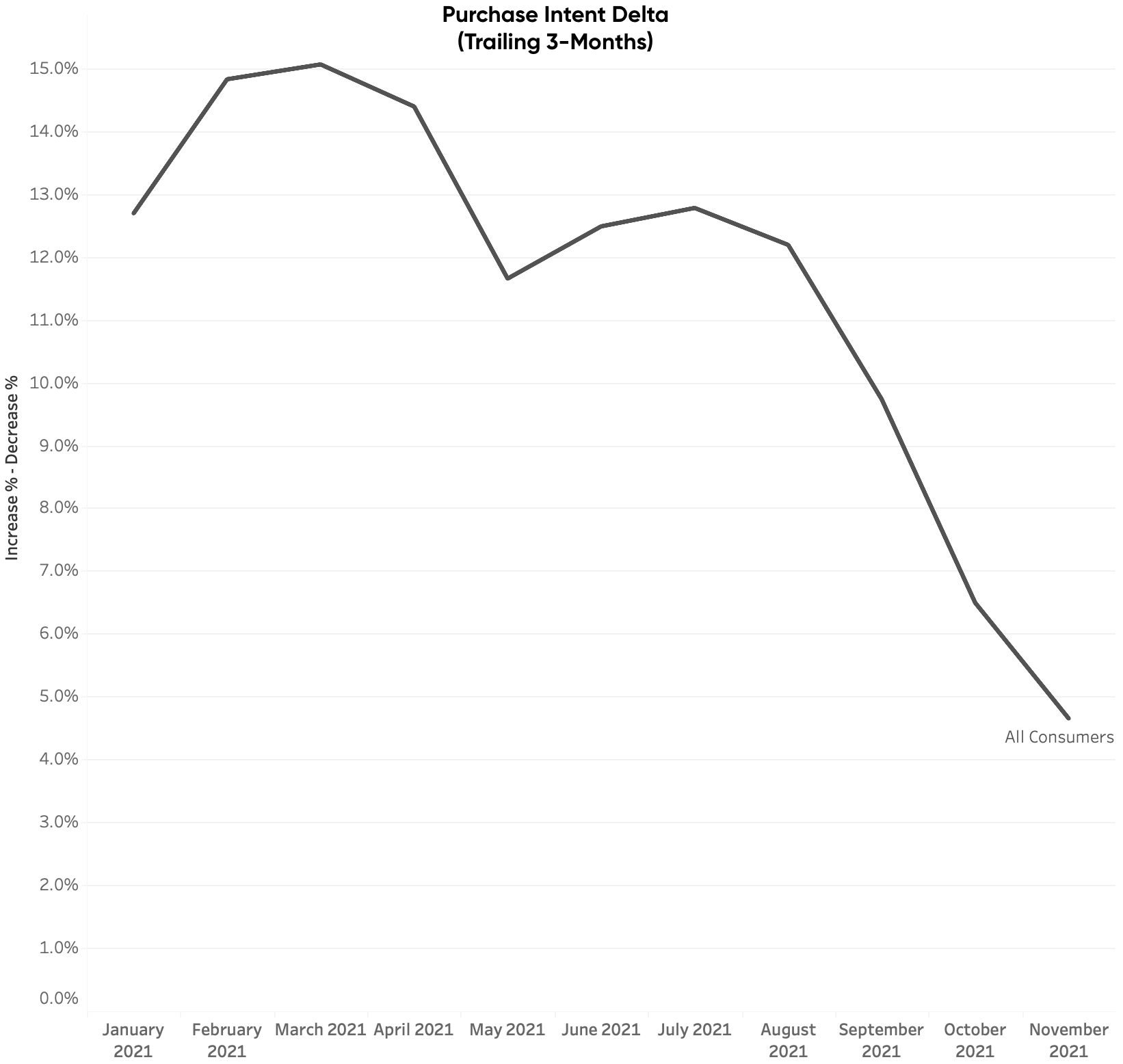

HundredX Home Fitness Industry Future Purchase/Usage Intent (Trailing 3 Months)

The rollercoaster type year for the industry was captured within data collected at HundredX. Below is a graph showing the purchase/usage intent delta for the ‘Home Fitness’ industry since the start of the year. The industry began to witness a slight decline after vaccines rolled out beginning in March, then a slight uptick in the months leading up to summer. However, the industry has seen a steep decline since July, indicating momentum from 2020 might have finally run out of steam.

Results for Key Home Fitness Leader - Peloton

Peloton has seen a significant drop in its stock price over the past few months, falling by as much as 76% since the start of 2021. The company recently lowered their revenue and earnings guidance for FY2022 in a letter to shareholders. 4

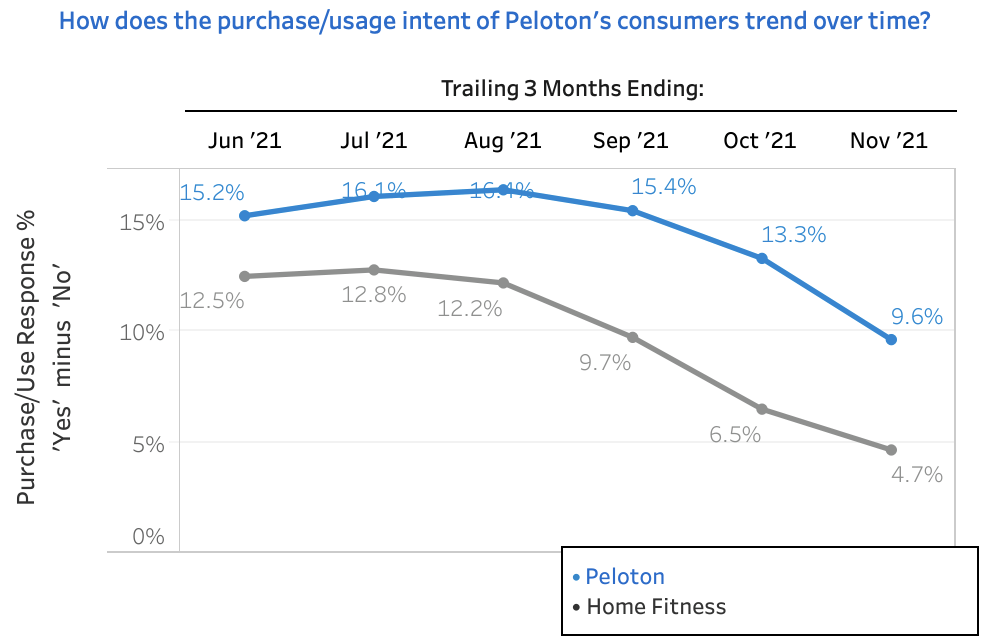

Purchase/Usage Intent

According to HundredX data, consumers rank Peloton as the top ‘Home Fitness’ company in both NPS & Consumer Satisfaction. While the company continues to be best in class, it is not immune to the industry-wide shift from at-home to in-person fitness. In fact, the company has seen its purchase/usage intent decline at a faster rate compared to the rest of the industry in recent months.

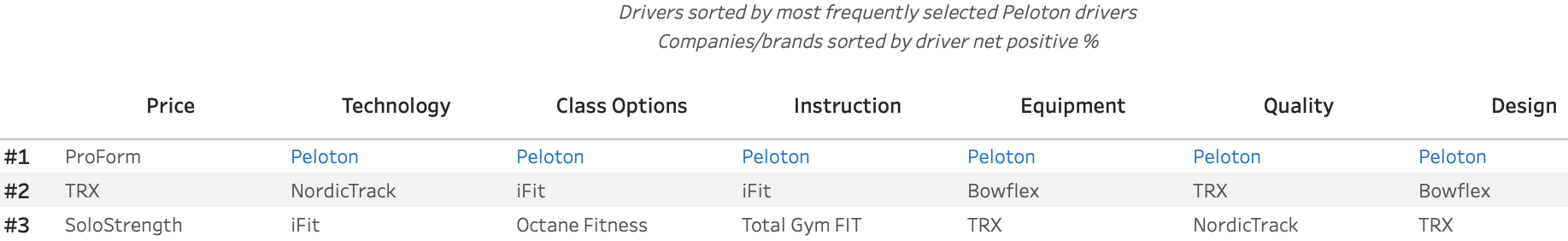

Drivers

Peloton is seen as the best in the industry across 6 of its 7 most popular ‘consumer drivers’. Consumers view the company’s price as the largest drawback. Peloton stated in their most recent quarterly report that “price remains a barrier to purchase for many consumers and this is our latest step to improve the accessibility of our platform.”

Customer Migration

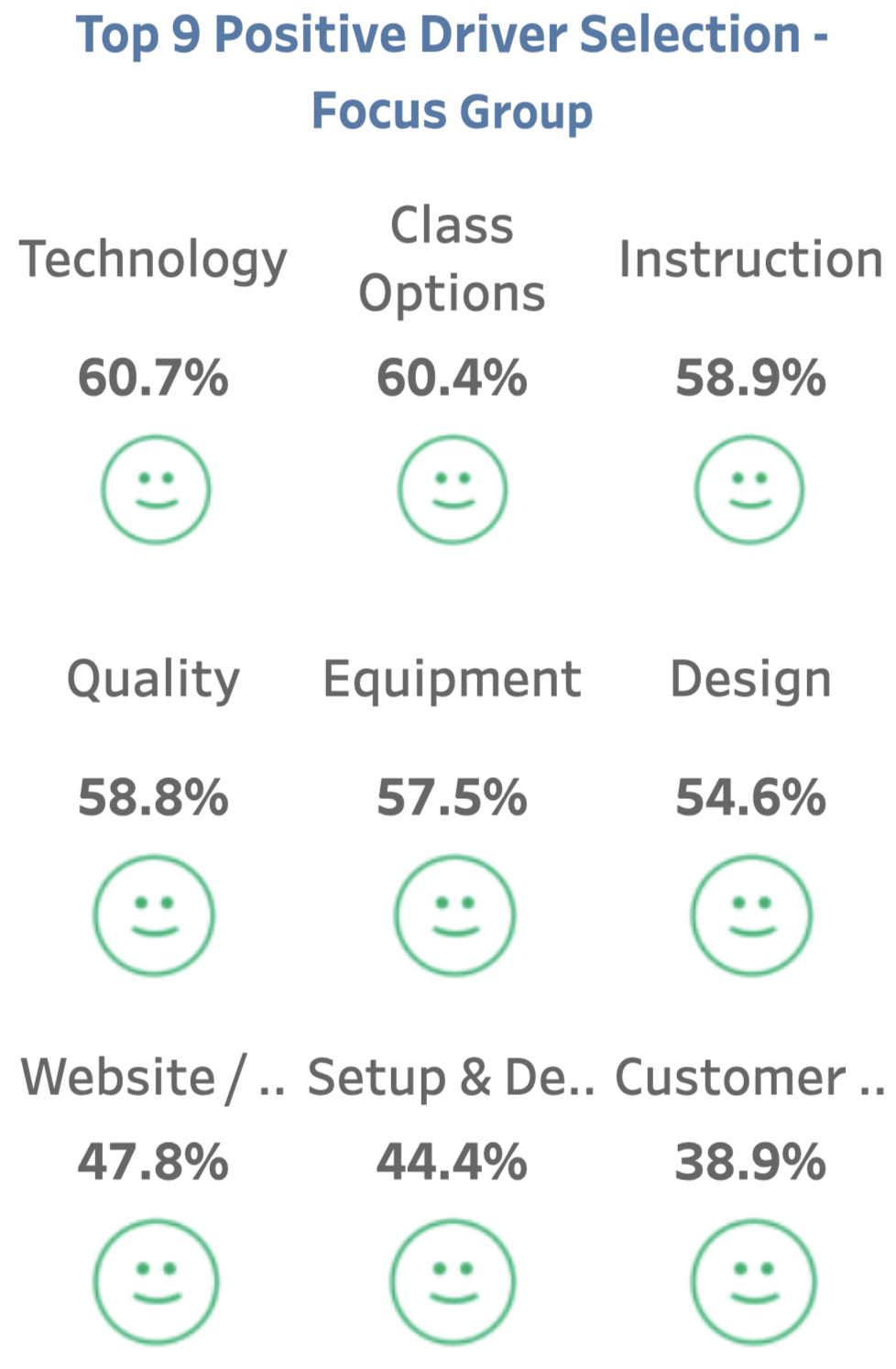

Consumers that plan to spend/use more or about the same.

Consumers that plan to spend/use less.

HundredX looked at consumers from the last year (12/1/20 - 11/30/21) that indicated they would use Peloton more, less, or about the same over the next twelve months. Customers who plan to use Peloton more or about the same indicate that the company’s superiority in Technology, Class Options, Instructors, Quality, Equipment, and Design (indicated above left) drives their interest. However, for customers who plan to use Peloton less, price remains the biggest deterrent.

- Washington Post: The pandemic's home-workout revolution may be here to stay

- WSJ: Lululemon Buys Mirror, an At-Home Fitness Startup, for $500 Million

- Business Insider: Lululemon spent $500 million on high-tech fitness startup Mirror but the deal is losing its shine, analysts say

- Peloton Investor Relations: Q1 2022 Shareholder Letter

This analysis is based on HundredX's proprietary data, developed from consumer feedback collected through the HundredX Causes Program.

Nothing in the HundredX data constitutes professional or investment advice on the part of HundredX.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.