Despite mounting headwinds, Home Improvement outlook is holding up better than most of retail.

Many of us are watching the retail industry with intrigue as it navigates a tricky combination of generally strong consumer spending and employment along with a strong housing market that has slowed recently, going up against historically high inflation and normalizing interest rates.

Leveraging HundredX’s proprietary listening methodology, we evaluated almost 900,000 pieces of feedback received over the last 12 months from real customer experiences at more than 300 retailers across the country for insight into consumers’ future net purchase intent (NPI), the drivers behind changes in intent, and customer satisfaction (CSAT).

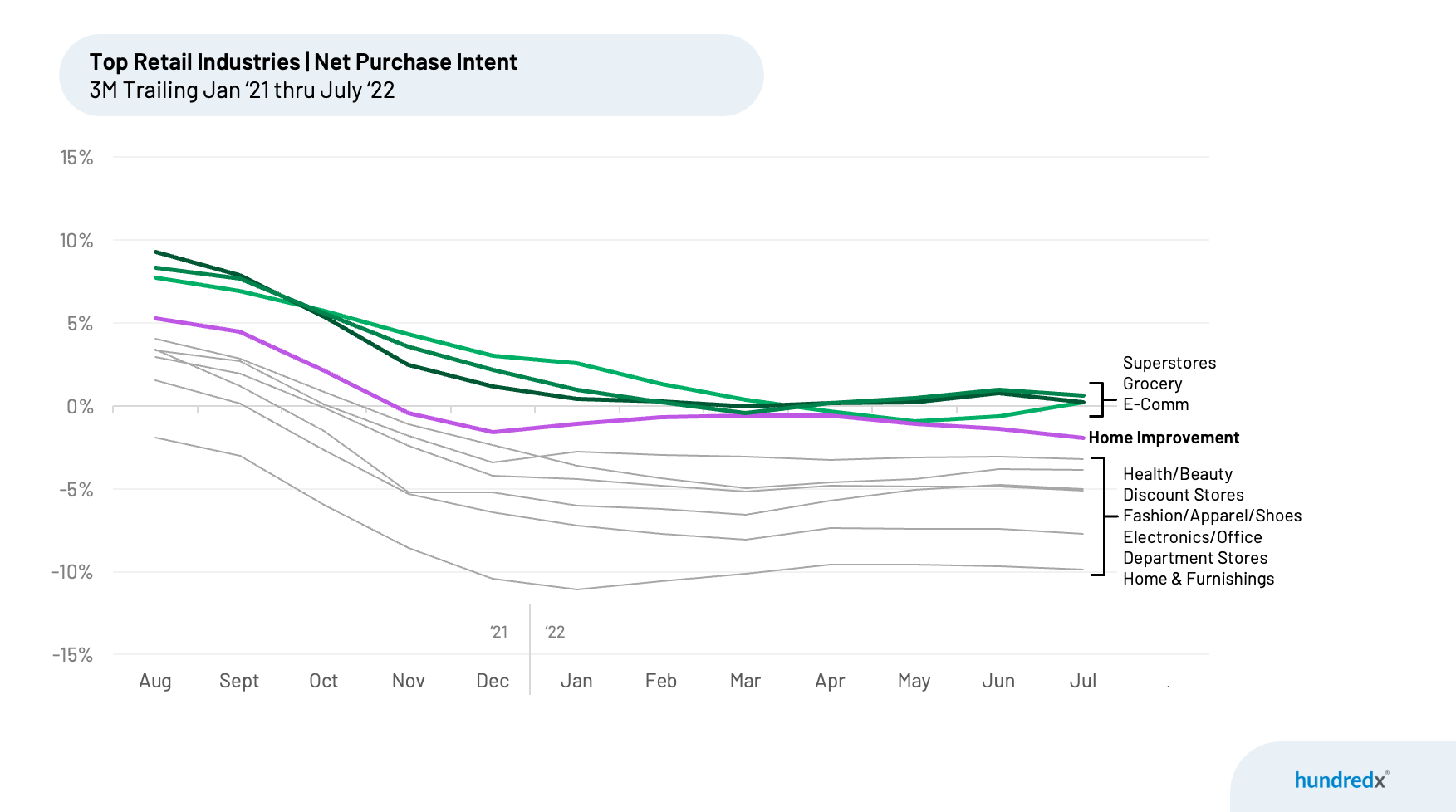

From August 2021 through early 2022, “the Crowd” indicated an impending slowdown on the horizon in sales growth across the various retail segments. NPI for all retail sectors covered by HundredX fell by 8% to 10% over that period. NPI reflects the percentage of customers who plan to spend more at a store or on a brand over the next 12 months minus the percentage that plan to buy less. During that same period, we saw growth in overall U.S. Retail and Food Service sales, measured by the U.S. Census Bureau, slow from a recent peak of 30%-50% in March through May 2021 to stabilize around 8%-10% since March 2022. Trends in the HundredX NPI data across the retail industries have correlated with the overall trends in retail sales growth, also remaining stable after dropping since 1Q 2022.

Recent Indicators from "The Crowd"

NPI for the less discretionary categories such as Superstores, Grocery, and E-Commerce has held up the best over the last year relative to more discretionary categories like Fashion and Apparel, Electronics and Department Stores. This is what we expected to see during a period of high inflation and rising economic uncertainty. Interestingly, NPI for the Home Improvement space remained relatively flat all year and held up to still be one of the strongest in retail despite facing a number of headwinds. Home sales are slowing, mortgage rates are rising, and home price appreciation is rolling over in many markets after multiple years of robust increases. Many expect these factors to dampen spending on home remodeling. We continue to closely watch NPI trends to see what "the Crowd" will say about its intent to spend on home improvement in the coming months. We also continue to watch the spread between Home Improvement and Home & Furnishing NPIs, which has widened since summer 2021, indicating people are more likely to continue fixing up their homes versus redecorate them as the US housing market cools.

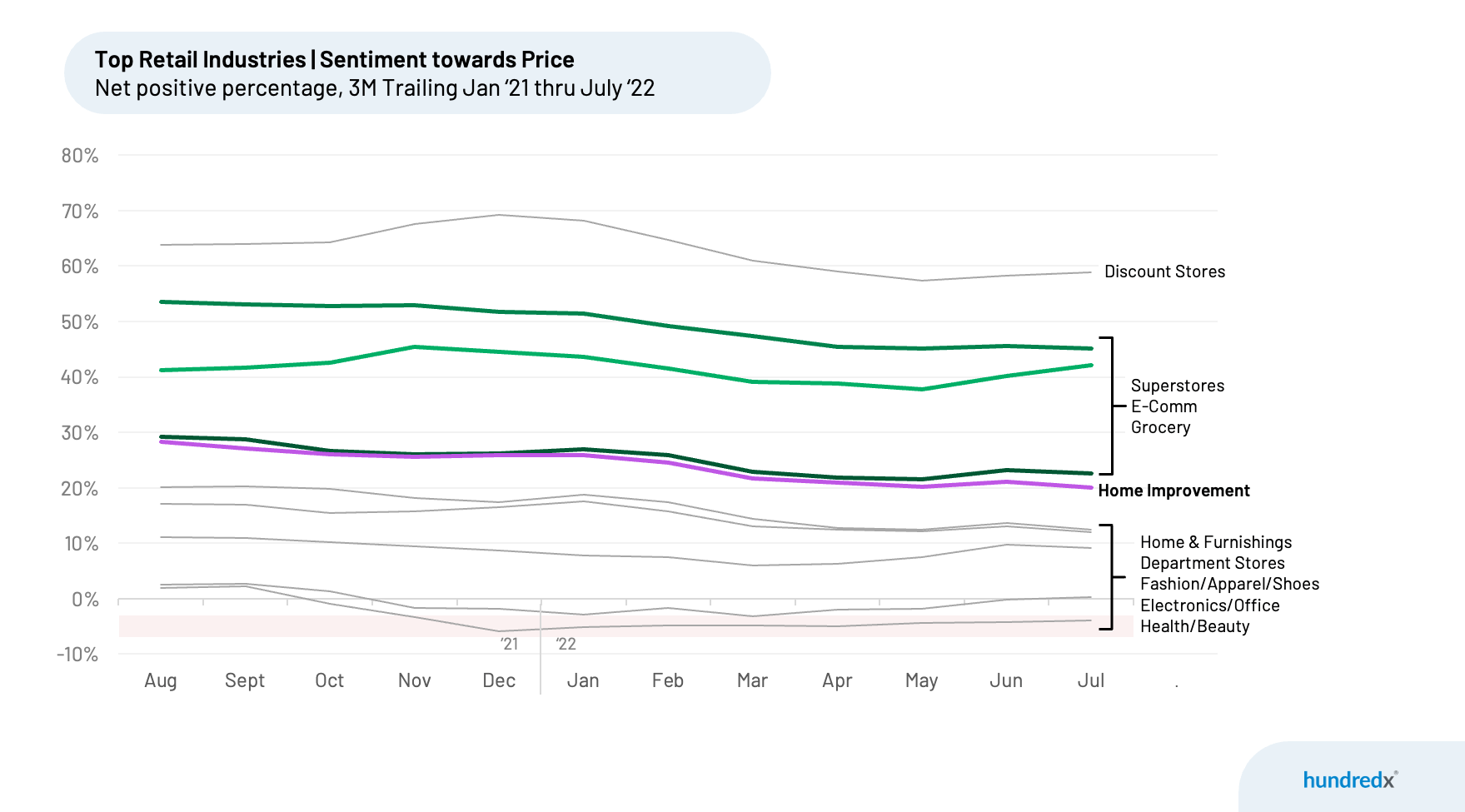

Like most of the 75 consumer-facing industries under HundredX coverage, consumer sentiment towards price in all retail industries has softened over the last twelve months. Interestingly, sentiment for Superstores, Home Improvement, Home Furnishings, and Grocery fell the most over the last twelve months, while E-Commerce, Electronics, and Fashion & Apparel have not fallen much at all. Sentiment is measured using Net Positive Percentages (NPP) which represents the percentage of customers who view a factor as a positive (reason they liked the products, people, or experience) minus the percentage who see the same factor as a negative.

A Winning Formula for Home Improvement Sales

Given the complexity of the US housing market today, the widening gap between NPI for the Home Improvement and Home & Furnishing sectors, and recent earnings reports from Home Depot and Lowes, we took a deeper look at the data to understand what it takes for retailers to win with customers in the dynamic Home Improvement sector today based on what customers shared with HundredX.

We evaluated almost 60,000 pieces of feedback in the last 12 months from real customer experiences at 14 home improvement stores across the United States. Our analysis indicates the Home Improvement retailers having the best Customer Satisfaction (CSAT) tend to do a better job than the broader industry at delighting their customers with respect to specific purchase drivers -- namely, Selection, Price, Availability, and Staff Knowledge.

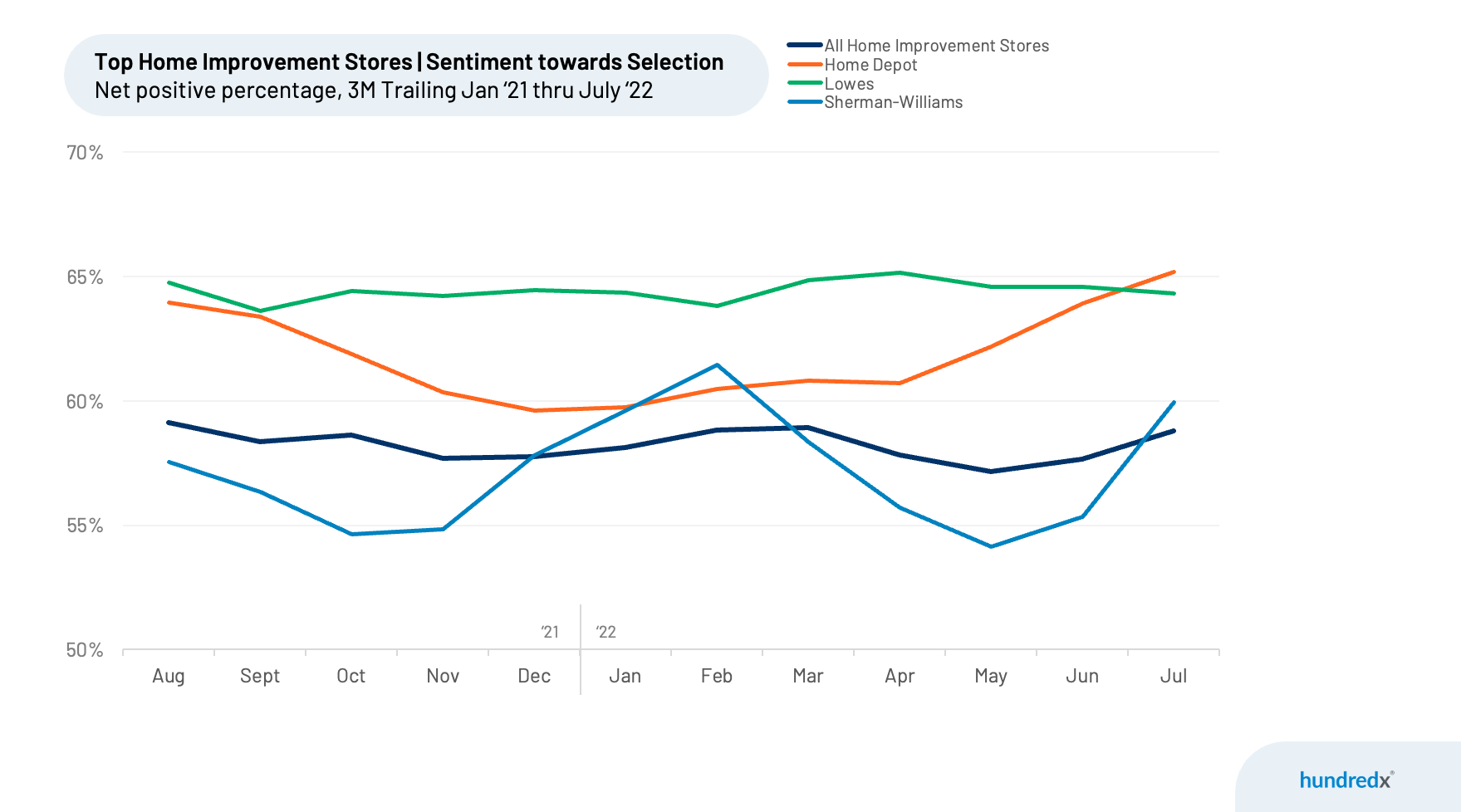

Selection

As the largest players in the space, it isn’t surprising that Home Depot and Lowe’s are winning with customers in terms of sentiment towards “Selection”. For the trailing three months ended (T3M) July 2022, Home Depot and Lowe’s had NPPs of 65% and 64% respectively, with their leads over the broader group expanding in the last three months.

Interestingly, Sherwin Williams, the leading paint manufacturer, made the biggest jump over the last three months, from significantly lagging the group to passing it with a T3M July 2022 NPP of 60%. On its July earnings call the company discussed its investments to win market share with professionals painters via selection, loyalty programs, and more. Looking at the data, the crowd definitely took notice as the volume of customer feedback to HundredX focused on 'selection' observably increased in the last six months. One customer recently shared, “I use this paint store sometimes. I always try to use my regular paint store if our customers are ok with it but a lot of them request Sherwin Williams because the product and selection and availability is excellent.” Another said, “I always find that Sherwin Williams paints are of high quality. Also, they have a great selection. When I go to a store I can get colors matched easily.”

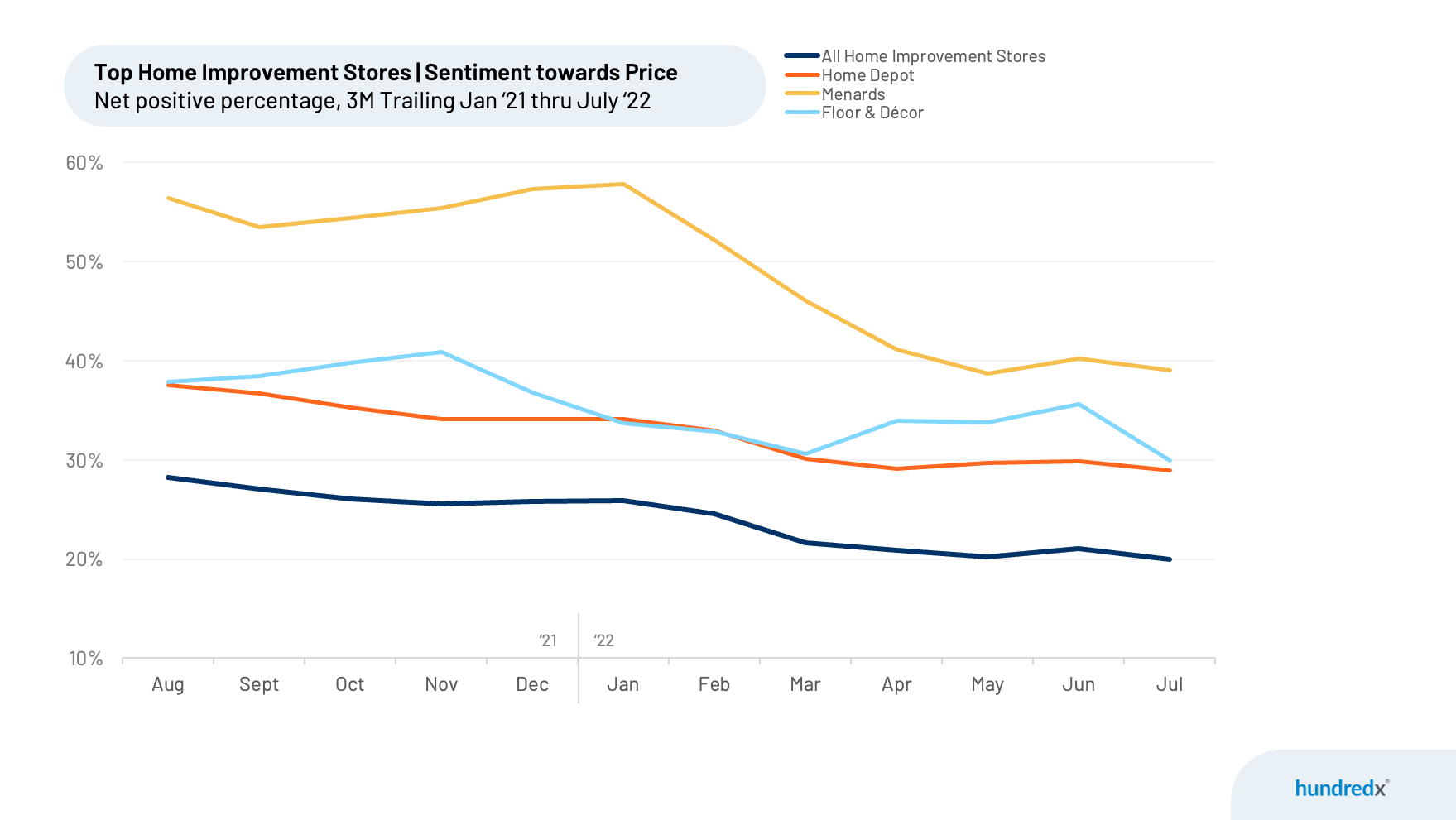

Price

Sentiment towards “Price” has slipped significantly over the last six months for Menard's, the Wisconsin-based chain with over 300 locations. NPP for T3M July 2022 has fallen from 58% in January 2022 to 39% as of July 2022. That said, it remains the leader in “Price” customer satisfaction, followed by Floor & Décor and Home Depot. Menard’s long running slogan has been “Save big money at Menard’s”, and it appears "the Crowd" continues to recognize Menard's for its commitment to competitive pricing, service, and its rebate program. One Menard's customer recently shared with HundredX, “Employees are very helpful and go out of the way. Prices are the best in the area as compared to Home Depot and Lowes.”

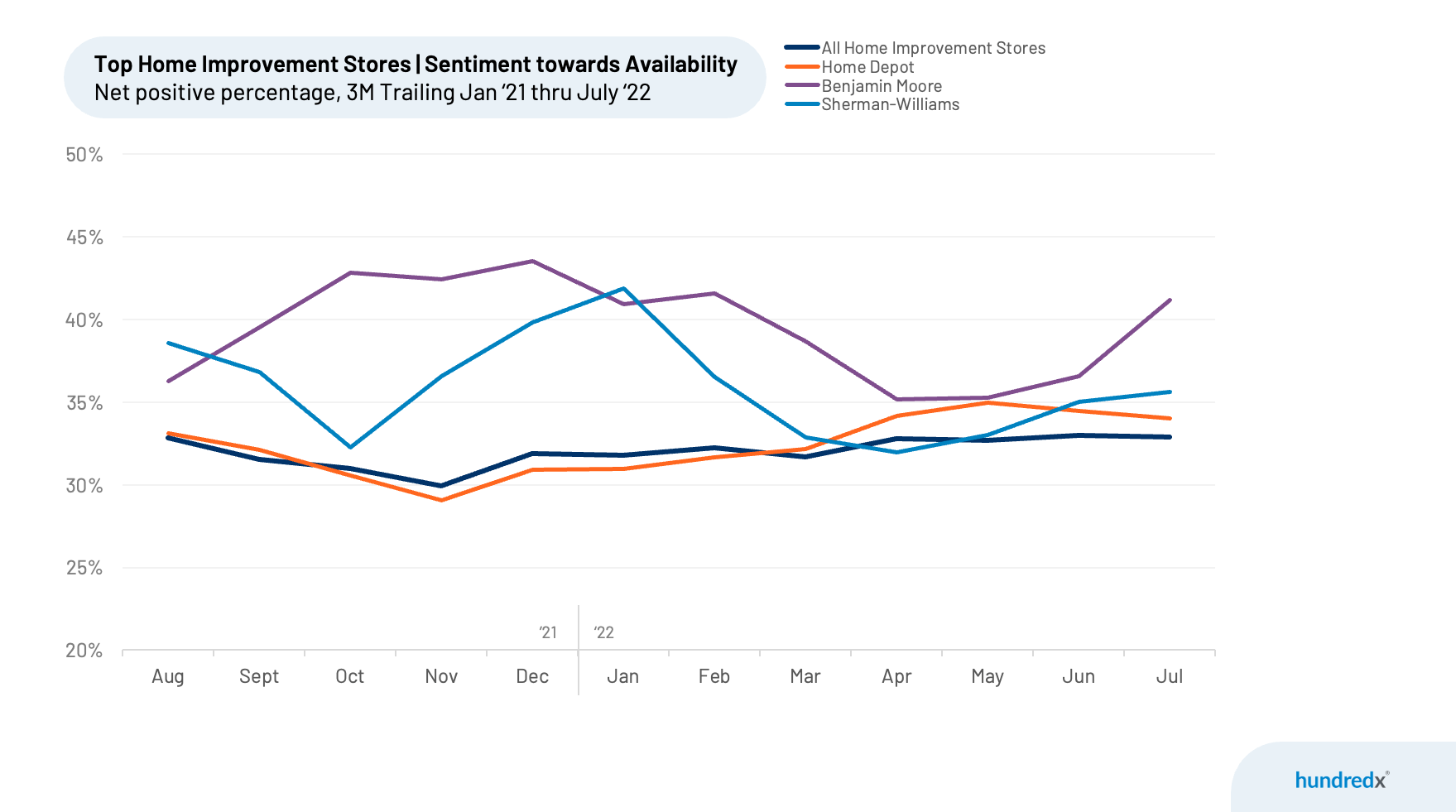

Availability

With supply chain and stocking issues front and center all year, it is fitting that “Availability” is one of the top drivers of CSAT for home improvement stores. Customers' feedback to HundredX show they are increasingly relying on websites to check availability before coming to the store to avoid any issues. Benjamin Moore leads the home improvement space on “Availability” customer satisfaction, with its NPP for T3M July 2022 breaking out versus the group to 41%. One customer recently told HundredX, “I appreciate Benjamin Moore products being available when [a competitors’] store shelves are nearly empty.”

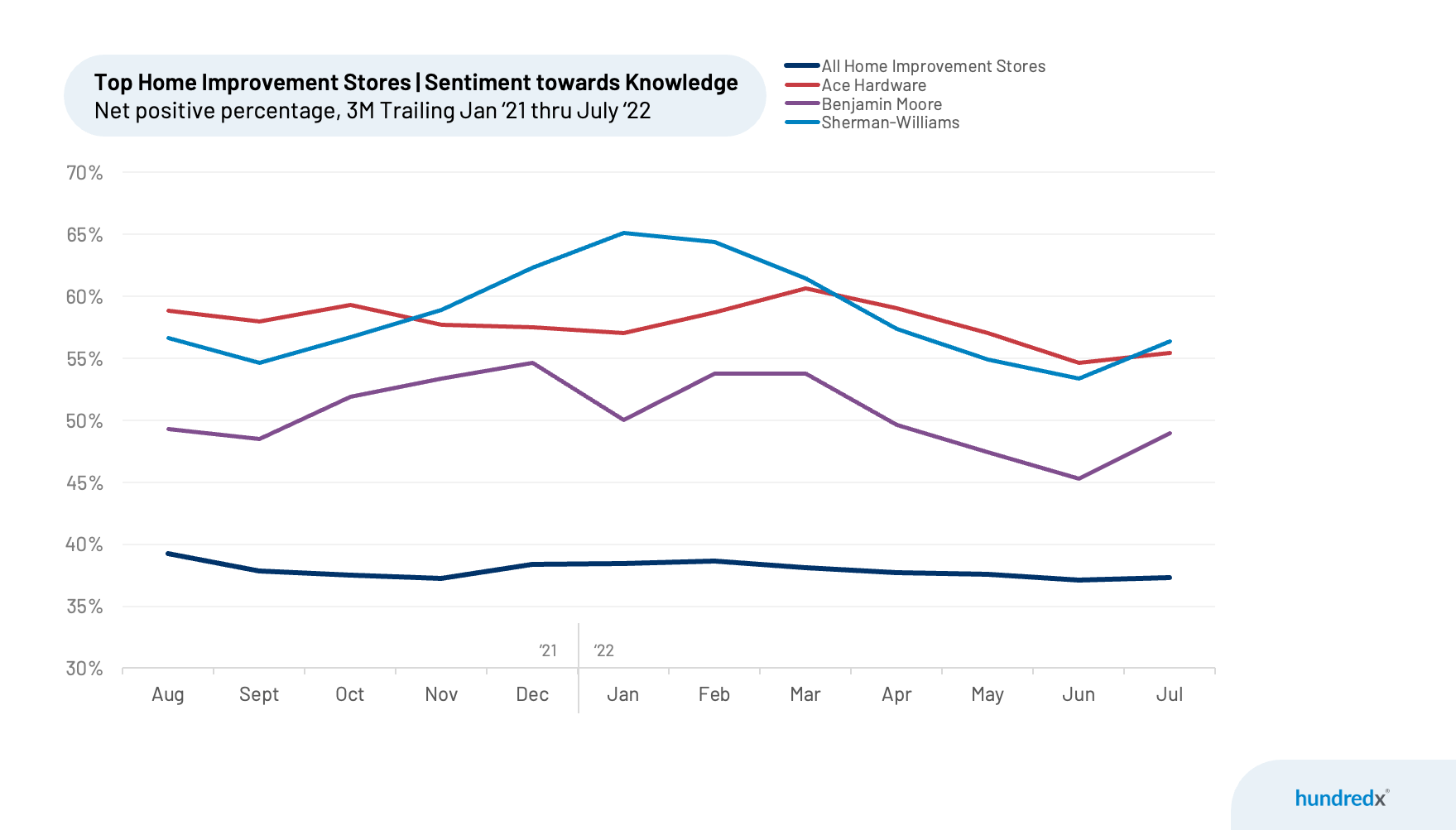

Knowledge

Review of customer comments shows their perception of a staff member’s knowledgeability not only has a direct impact on the customer’s ability to identify and understand the products they are looking for, but also has an indirect impact on their overall customer experience. For example, consumers have noted when staff are unable to tell them where certain products are, their perception of Selection and Availability are also impacted.

Sherwin Williams and Ace Hardware are virtually tied in “Knowledge” customer satisfaction, with NPP for T3M July 2022 of 56% and 55% respectively. Both are well ahead of the group average of 37%. The crowd is indicating Ace Hardware is living up to its dedication to being the “place with the helpful hardware folks.” Its customers’ comments are dominated by appreciation for the quality of its staff, with one sharing, “What I appreciate from this company is the knowledge the employees have about products and the helpfulness in getting the products I need. I have needed unusual products based on size that other retailers could not get. Ace has come through every time in store and online.”

While the backdrop for home improvement stores remains challenging with rising rates and inflation, retailers elevating the customer experience by tapping into what their customers really desire, as evidenced here, remains a winning formula. Those home improvement retailers investing in the in-store experience by offering the right balance of price, knowledge, availability, and selection not only keeps customers loyal but keeps them coming back to spend more at their favorite home improvement store.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on metrics for the Retail Industry, Home Improvement sector, and any of our 75+ other industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact