In a bid to make its drive-thru services faster and more accurate, Wendy’s is looking to staff its drive-thrus with Google Cloud-powered chatbots.

The fast-food chain will start piloting the generative AI chatbot solution, called Wendy’s FreshAI, in a Columbus, Ohio-area restaurant in June. According to a press release, the chatbot will be able to understand and place customer orders, even if they have modifications. The move could have big implications for Wendy’s, which has reported that 75% - 80% of its customers prefer to order through drive-thru. Ideally, this will free-up employees to focus on a number of other activities, improving speed and service levels, revenue and margins.

By examining close to 400,000 pieces of feedback from “The Crowd” of real customers of over 180 Quick, Fast, Casual restaurants, April 2022 through April 2023, we find that this appears to be a smart partnership for Wendy’s.

- Both speed and order accuracy are within the top four factors fast food customers say they care most about, along with taste (first) and price.

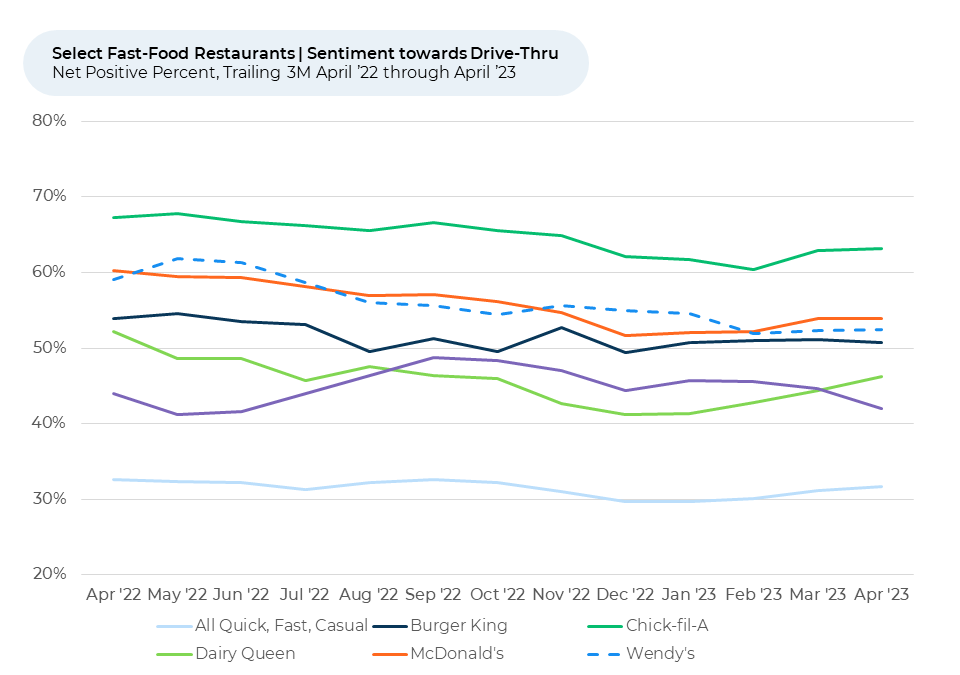

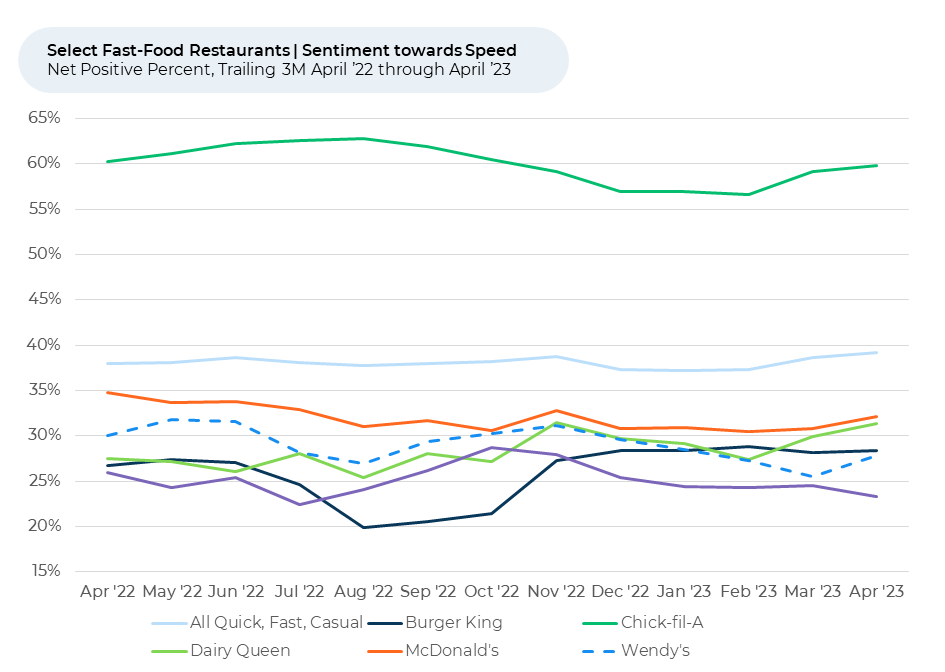

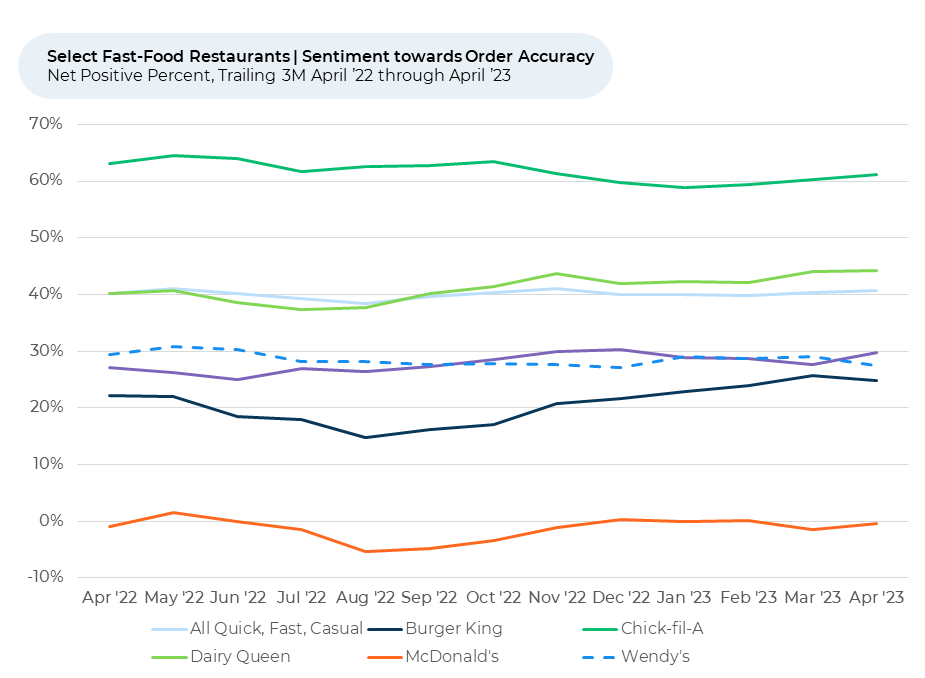

- While customer sentiment¹,² towards Wendy's drive-thrus is relatively high (well above the average fast-food company), there’s room for improvement in terms of speed and order accuracy.

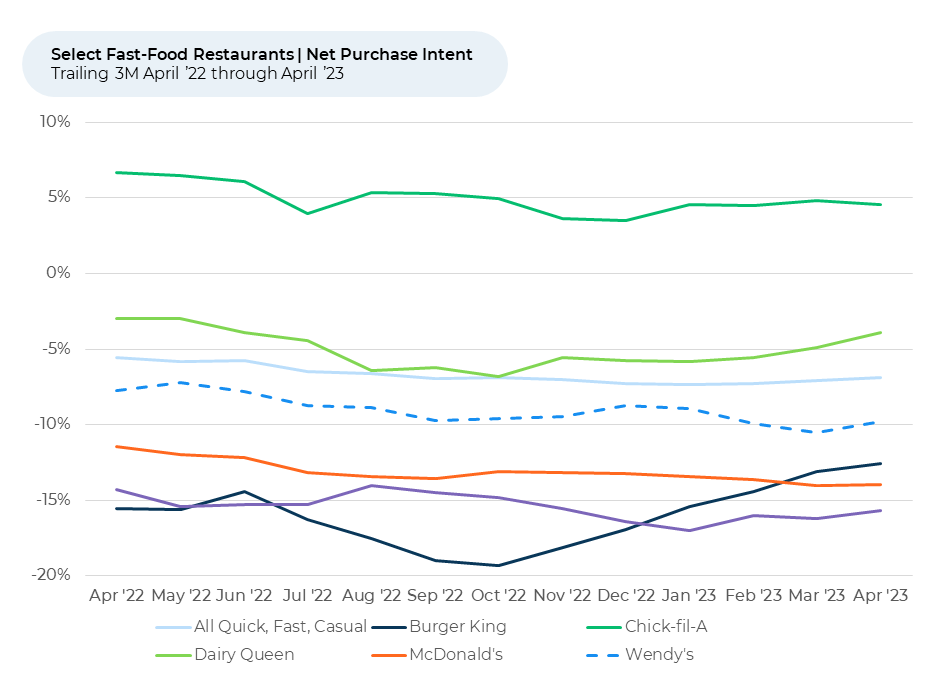

- Insights from our AI-driven Resource Allocation decision model indicates if the chatbot pilot proves successful, Wendy’s could potentially reallocate investments to steal market share from some of its biggest competitors, including McDonald’s and Burger King.

In April 2023, customer sentiment towards Wendy's drive-thrus reached 52%, which is much higher than the 32% average for all Quick, Fast, Casual restaurants we cover. This suggests that Wendy's customers generally have a more positive experience at its drive-thrus compared to the average fast-food chain. Wendy’s lags slightly behind McDonald’s (54%), one of its biggest competitors.

However, when it comes to speed and order accuracy, Wendy's has some catching up to do. In April 2023, customer sentiment towards Wendy's speed hit 28%, below the average for all Quick, Fast, Casual restaurants, which stands at 39%. McDonald's is ahead of Wendy’s scoring 32%, while Burger King matched Wendy's at 28%. This indicates that Wendy's, along with its biggest competitors, needs to improve how quickly customers get their meals in order to meet even the average QFC restaurant’s performance.

Similarly, Wendy's scored a 28% in order accuracy sentiment for April 2023, once again falling short of the industry average of 41%. Here, Wendy’s outperformed McDonald’s and Burger King, but has room for improvement to catch up with customer sentiment for the overall industry.

Ultimately, the introduction of Google Cloud-powered chatbots in Wendy's drive-thrus could be a game-changer for the fast-food giant. By automating the order-taking process, the AI-driven chatbots have the potential to significantly improve both speed and order accuracy, addressing two of the top factors fast-food customers care about.

Our AI-driven Resource Allocation decision-model indicates a successful roll out the chatbot solution across its other locations could allow investments that could help boost Wendy’s Purchase Intent³, which is currently higher than McDonald’s and Burger King but slightly behind the industry average. The chatbot could directly improve sentiment towards not only the drive-thru experience, but order accuracy and speed as well, which have an even higher correlation with observed purchase intent. It would also free up people and resources to focus more on the atmosphere and cleanliness of the stores and associate attitudes, which have an even higher impact on the observed future spending intentions of customers. As a result, Wendy's could drive more customer activity and improve its market share in the fast-food industry.

Thus, we will be watching how the AI-driven solutions perform for Wendy’s like many others in the fast-food industry. If successful, we would expect other chains may follow suit, implying better experiences may be on the way for fans of the large QFC restaurant chains.

- All metrics presented, including Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Purchase Intent is measured by the percentage of customers who plan to visit the brand more during the next 12 months minus the percentage that intends to visit less. We find businesses that see Purchase Intent trends gain versus the industry have often seen growth rates for domestic users and engagement also improve versus peers.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.