In today's fast-paced and inflation-impacted world, staying on top of fashion trends without breaking the bank can be a challenge. Shein, a rapidly growing e-commerce and fashion brand, has managed to stay ahead of the curve by offering trendy styles at unbeatable prices. After analyzing over 310,000 pieces of feedback across 240 e-commerce and fashion brands, we have some fascinating insights into consumer shopping trends and the success of Shein. We find:

- The segments of retail that are strong in delivering their customers low-cost items and value continue to have the best demand growth outlooks.

- E-commerce Purchase Intent is still the highest in retail at 1%, followed by grocery and superstores at 0%. All other sectors are negative, with home & furnishings and jewelry the weakest at -15%.

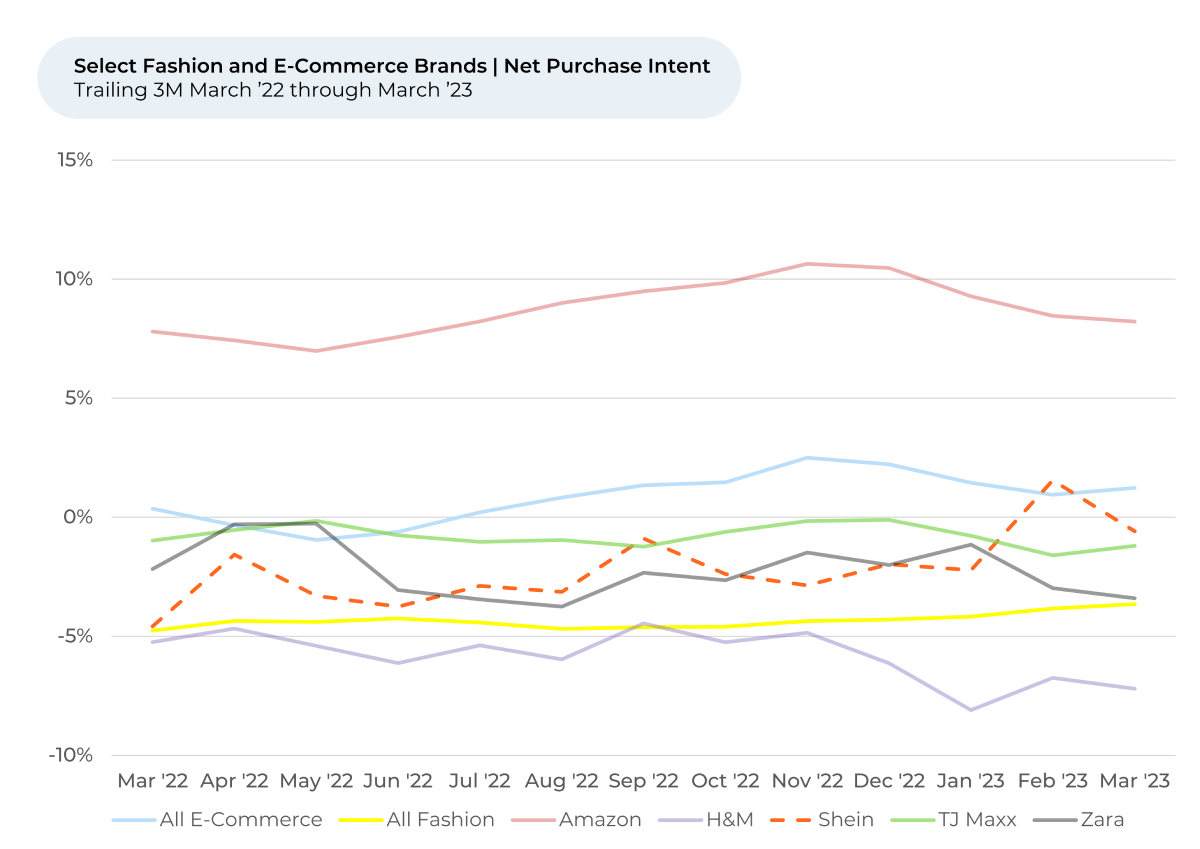

- Purchase Intent for e-commerce is down modestly since the beginning of the year, while it is up slightly for fashion to -4%. Fashion still significantly lags e-commerce.

- Shein has a higher Purchase Intent¹,² than the overall fashion industry.

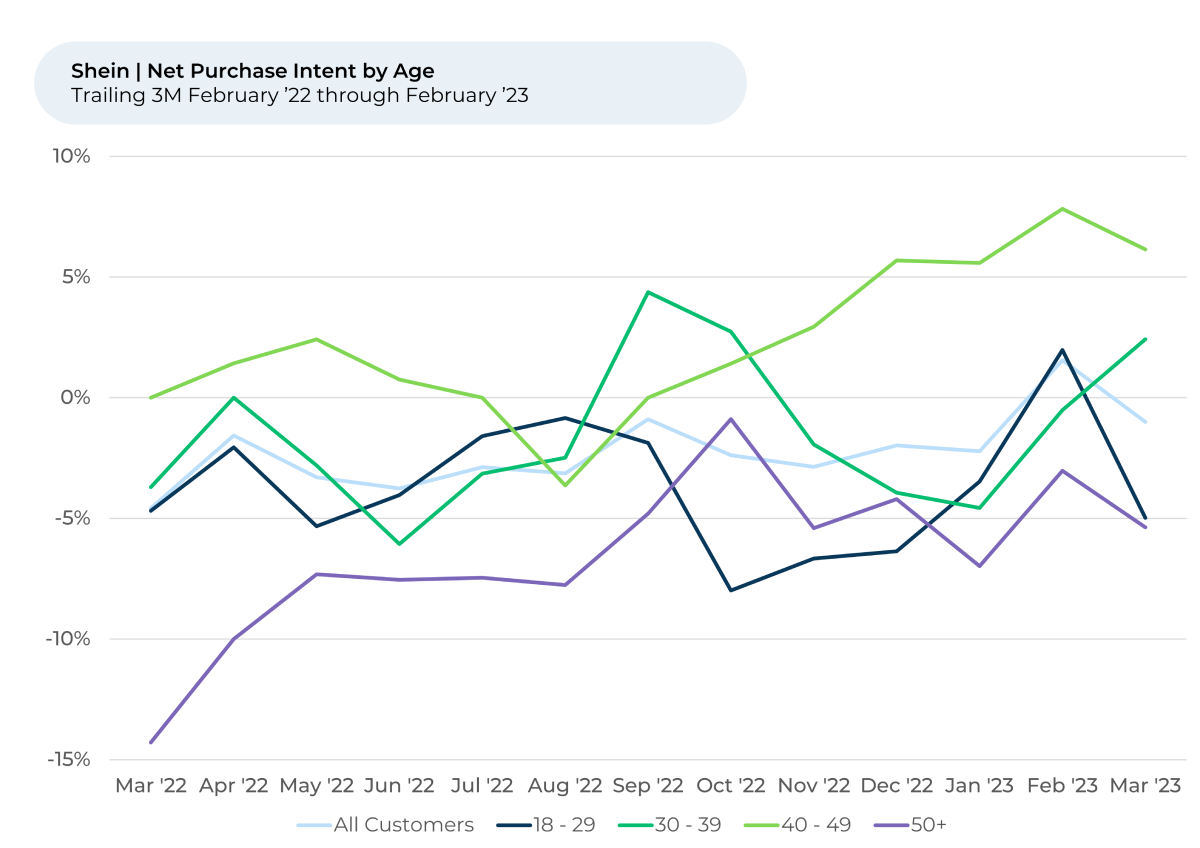

- Shein’s Purchase Intent is highest among customers in their forties. However, it recently spiked for customers in their thirties.

- People like Shein’s price and styles³ far more than the average e-commerce or fashion brand – highlighting why Shein “hauls” are so popular on social media.

Shein's Purchase Intent has risen slightly since December 2022, up about 1%, but did dip by 2% from February to March. Purchase Intent for the overall fashion and e-commerce sectors rose slightly in the last month. Within fashion, Purchase Intent was seasonally up

for activewear, which we covered in a recent post.

Purchase Intent being higher for Shein than the average fashion brand underscores its ability to captivate today’s customers and stay relevant in a rapidly changing fashion landscape. By consistently delivering on-trend styles at affordable prices, Shein has positioned itself as a go-to destination for fashion-conscious shoppers seeking value. The company, a hit on TikTok, appeals to both young and middle-aged adults.

Interestingly, Shein’s Purchase Intent is highest among customers in their forties, having grown significantly (+6%) over the past six months. As of March 2023, Purchase Intent is around 6%. The rise corresponds with a pickup in sentiment of this age group towards Shein’s search, website and checkout. Numerous blogs and features in 2022 highlighted Shein gaining popularity with middle-aged customers looking for more stylish, affordable outfits.

“I have recently started buying from Shein. Love the clothes and other products. Very happy,” one woman in her 40s recently told HundredX.

Other feedback shared with HundredX by people in their forties notes many enjoy buying Shein clothing for their children.

“Two teenage daughters. Trendy and cheap!” one person said.

Shein’s Purchase Intent trends with the TikTok generations are more mixed recently. Shein has shined with the 30-39-year-olds age group. Purchase Intent for the group climbed 6% over the past three months to 2%, recovering from a pullback in the fall. Sentiment of this group towards Shein’s value, ease of use and search are up this year.

Shein’s TikTok following has grown over the past year. Videos tagged with #Sheinhaul, a tag users put on videos that feature them trying on multiple Shein outfits, rose from 5.1 billion views in May 2022 to 7.3 billion views in November 2022. Similarly, Shein’s official TikTok account increased its follower count from 3.7 million followers in March 2022 to 5.4 million followers in October 2022.

By contrast to shoppers in their thirties, Purchase Intent for 18–29-year-olds pulled back sharply this year after rallying last fall. The dip corresponds to 18-29-year-olds viewing the prices and selection of Shein less positively. It also corresponds to the recent surge in popularity for Temu, a similar, Chinese-owned e-commerce store that sells clothing, jewelry, accessories, and more for low prices.

Priced for a Big Haul

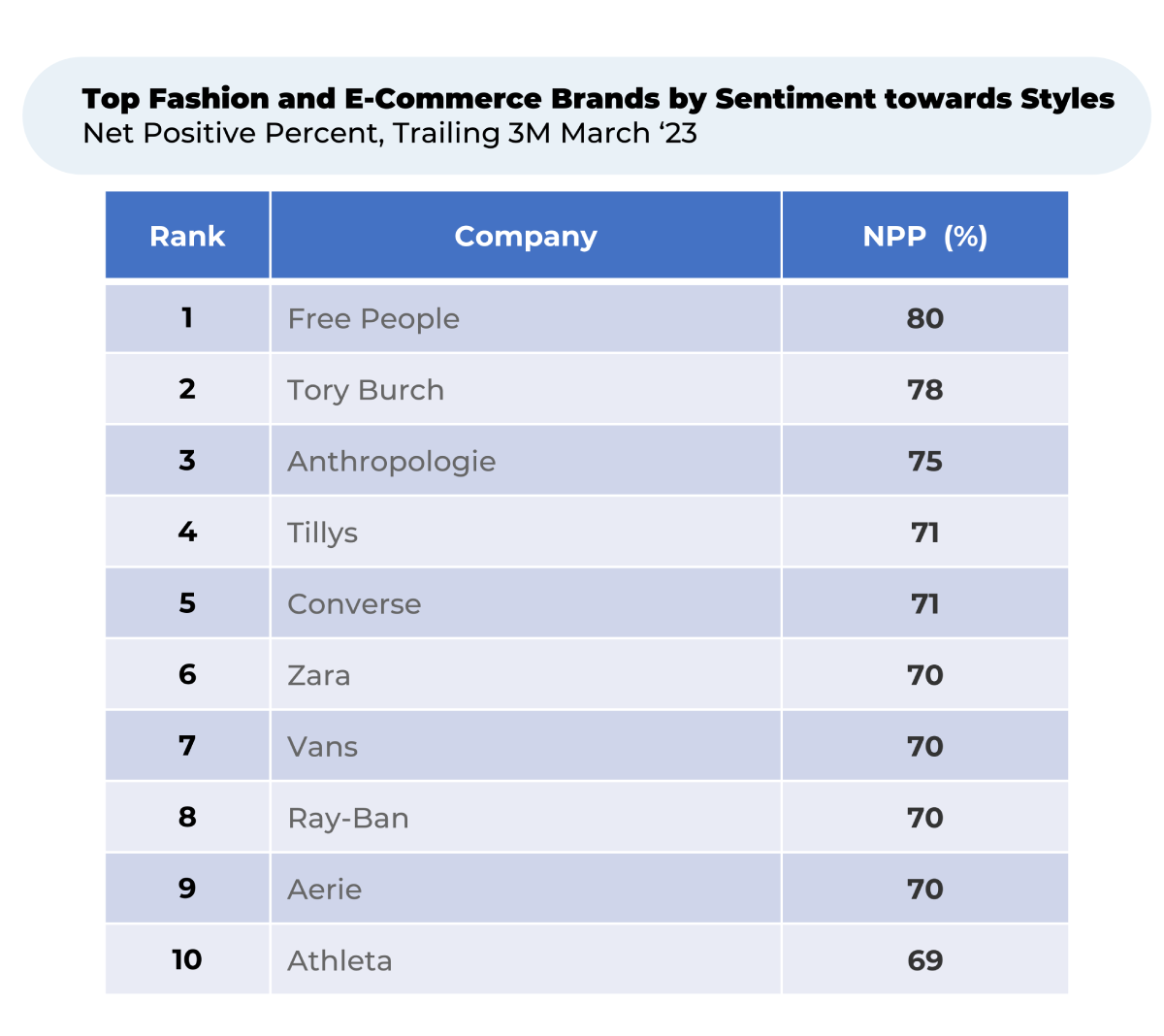

Those Shein hauls, where people buy dozens of outfits and try them all on all at once, are popular enough to bring in billions of views. They also speak to Shein’s attractive prices. Its customers’ sentiment towards prices is in the top 3 of all the e-commerce and fashion companies we cover.

Shein’s customers tell HundredX they love the prices, with their sentiment towards Price around 80%, about 40% higher than the average E-commerce company and 70% higher than the average Fashion brand.

Shein is one of a few Chinese shopping apps that have exploded in popularity in the West because of their large selections of products and cheap prices. Customers can buy full outfits – a top, bottom, undergarments – on Shein for less than $20. That’s a tough price to beat for most American retailers.

“Awesome clothing, very good prices and products and fast shipping and arrival,” one Shein shopper recently told HundredX.

There’s also a lot of style packed into Shein’s low prices. At 62%, “the Crowd” of Shein customers’ sentiment towards Styles is 27% higher than the average e-commerce brand and 12% higher than the average fashion brand.

“Shein is affordable and has a variety of clothes/styles that are very trendy and unique,” someone recently told HundredX.

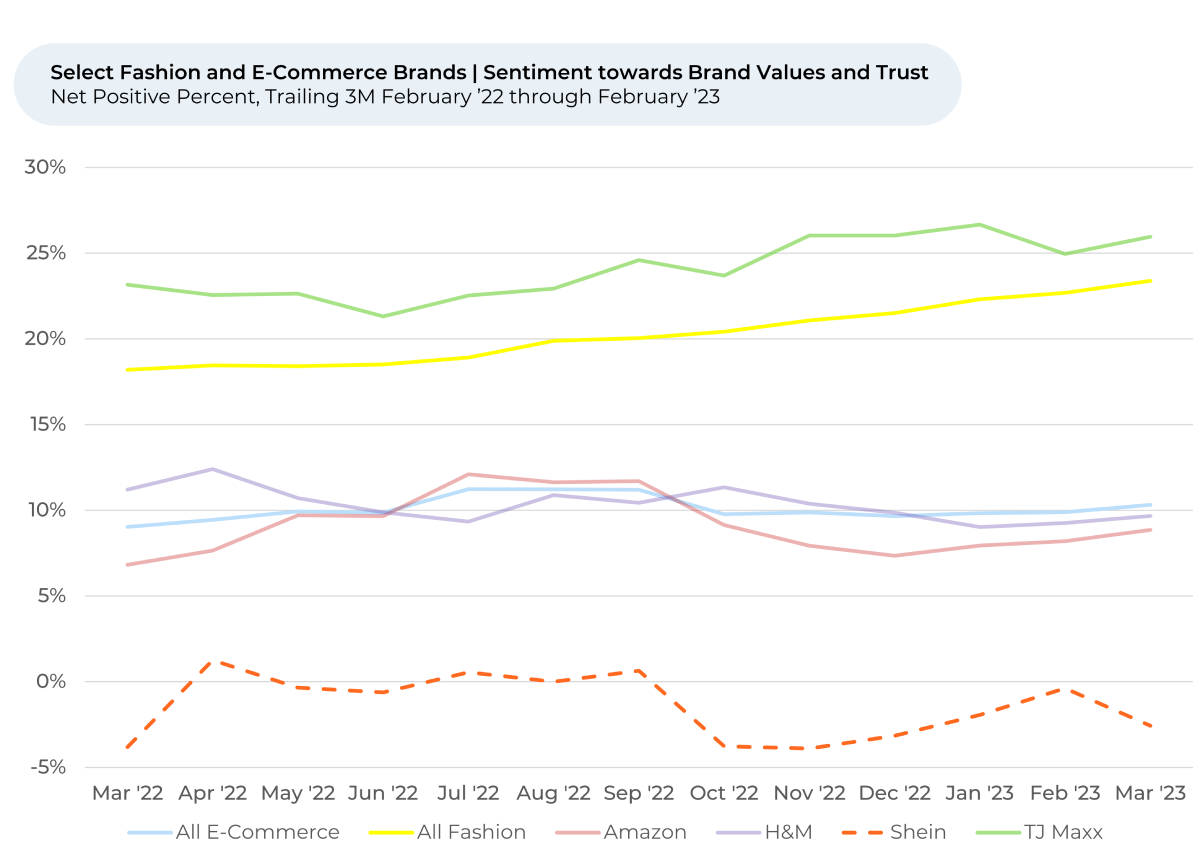

However, there are some critics that feel Shein’s low-priced clothing may have a social cost. The Crowd sentiment towards Shein’s Brand Values & Trust is less favorable than the average E-commerce and Fashion company. Several respondents have noted allegations that Shein has poor working conditions and underpays workers when leaving negative feedback on the company.

Even so, according to HundredX data, Shein appears poised for more growth. The app, at the time of writing, is in the top ten free apps on Apple’s App Store. TikTok #sheinhaul videos keep getting views, and its social media accounts keep gaining followers. HundredX will continue monitoring Shein and other E-commerce and Fashion companies to see which ones best navigate the tricky economic environment and consumers’ focus on both price and style.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent for retail subsectors represents the percentage of customers who expect to spend more with that brand over the next 12 months, minus those that intend to spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.