Amid continued inflation and holiday sales, we look to the Consumer Products brands posting the biggest gains in Purchase Intent1 and sentiment towards prices. We look through more than 450,000 pieces of feedback, November 2021 through November 2022, from The Crowd – real people who purchase consumer goods products – to understand the buying habits of real customers around the holiday season. We find:

- Purchase Intent is down across Consumer Products, with Apparel the most resilient and Meat Alternatives, Healthcare Apparel, and Luxury Goods performing the worst.

- Warm apparel companies Patagonia and Ugg saw the biggest increase in customers wanting to buy more from them.

- While people don’t love the prices for Flowers, price sentiment did increase noticeably over the past three months.

- Makeup & Skincare brands Sephora Collection, Clinique, NYX, and wet n wild saw some of the biggest recent gains in sentiment towards Price.

The clear underperformers in Purchase Intent are Luxury Goods and Flowers.

Over the past three months, Purchase Intent1 has been relatively stable across Consumer Products, with the overall sector down less than a percentage point. Plant-based Meat Alternatives (down 3%), and Healthcare Apparel (down 2%) stood out as the biggest decliners. Purchase Intent for consumer products reflects the percentage of customers who expect to purchase or consume more of the product over the next 12 months minus the percentage who plan to purchase or consume less. We find brands that see their spread in Purchase Intent improve vs. peers tend to see stronger growth rates and market share gain.

The downward movement in Plant-based Meat Alternatives doesn’t come as a surprise. The sector has had a tough year. Once media darling Beyond Meat posted a 1% revenue increase year-over-year for Q1 2022 ending April 2, but then a decrease of 2% in Q2 and a whopping 22% decrease in Q3. Meanwhile, Planterra, the U.S. plant-based protein subsidiary of meat processer JBS, announced plans to shutter the business by the end of 2022. The largest brands have seen customer satisfaction with their Taste go up, but Price, Healthiness and Ingredients all fall over the last three months.

“Tasty plant-based product. Much too expensive,” one person said to HundredX of a Plant-based Meat Alternative company.

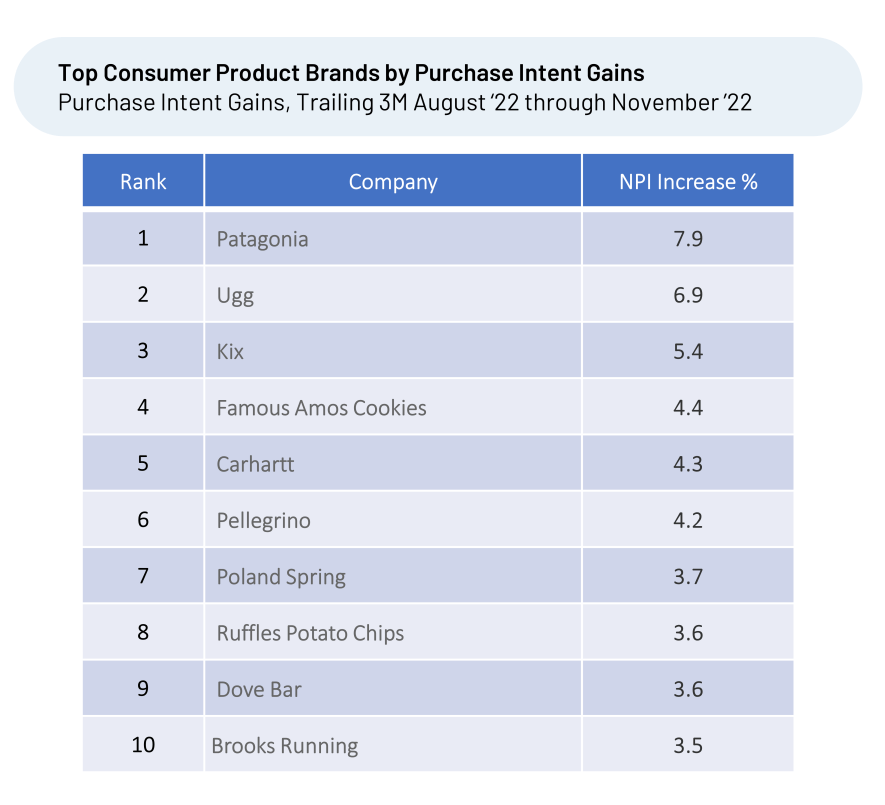

Consumer Product Brand Gainers

While Purchase Intent for many Consumer Products brands remained relatively flat over the past three months, the following products posted the biggest gains -->

Patagonia and Ugg, apparel brands known for their cold-weather products, are at the top of the list. Likely as the weather cools, more people turn to Ugg for warm boots and Patagonia for warm jackets. Over the past couple of months, Patagonia was featured in many articles praising the performance of their new down jackets. The company also enjoyed press covering its founder’s decision to give the company to a charitable trust in September. Patagonia saw significant improvements in customer sentiment towards its Quality, Durability, Comfort and Brand Image over the last three months. One person shared with HundredX, “Amazing values. Way to go giving up the business. I’ll give you more business because of the causes you support.”

Ugg saw the largest increases in customer satisfaction with its Styles, Comfort and Quality over the last three months. Many recent articles have discussed their new releases and the impact celebrities wearing them have had on their popularity. “Uggs are so comfortable and trendy. They go with so many outfits and they fit perfectly.” one person told HundredX. Another said, “I live in Uggs in winter, and they make leaving the house possible when temperatures are subzero. Love the basics and the fancy versions that are great for work.”

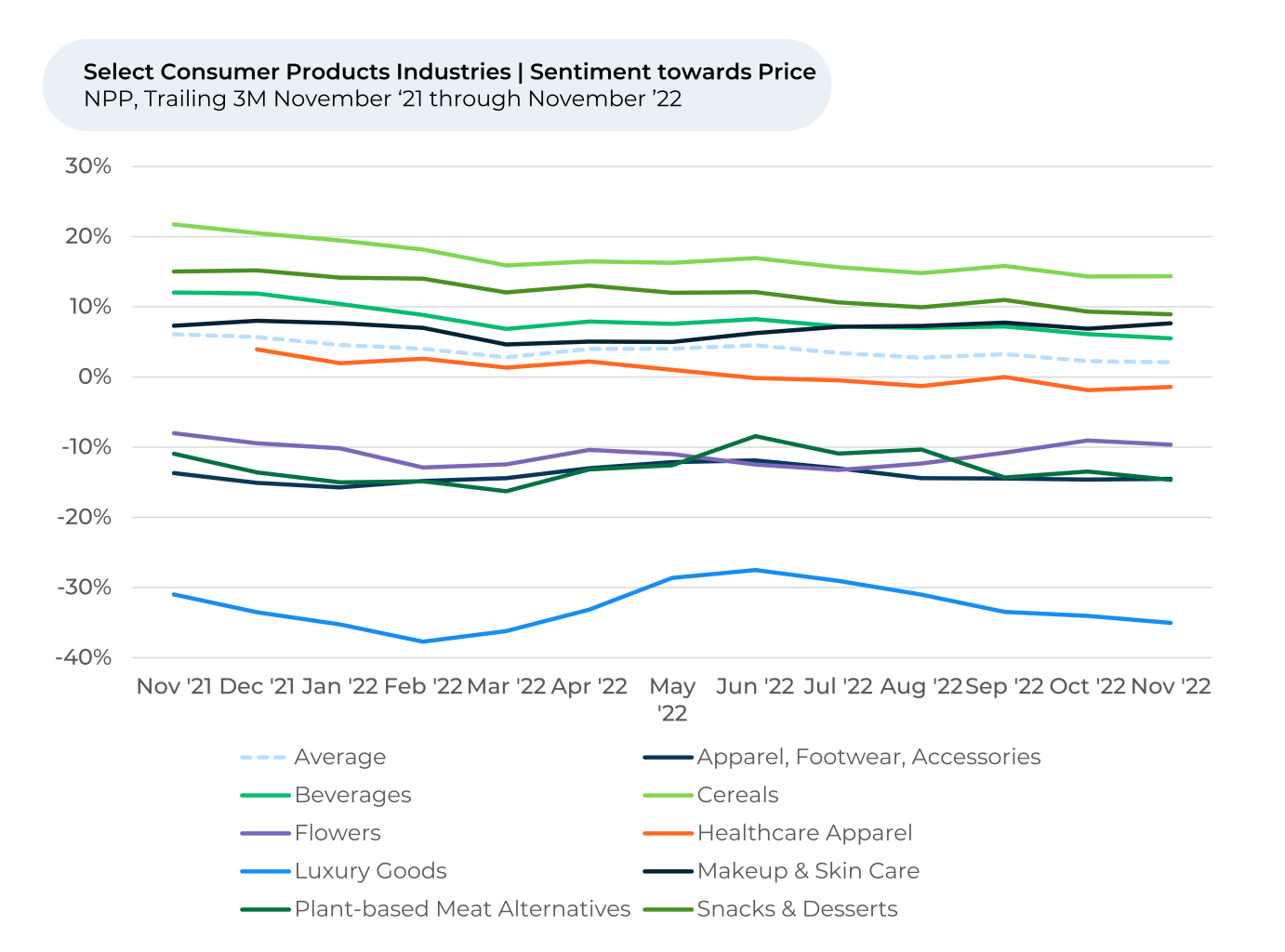

The Power of Pricing

When customers consider satisfaction and whether to buy a product again, price is one of the most important factors. Customers’ sentiment on price for our overall Consumer Products coverage is on a slow, downward trend that started last year. HundredX measures sentiment1 as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like the brand.

Flowers are generally expensive; thus, it is not surprising customers feel more negative about the price of flowers than they do most other consumer products. However, the Flowers sector has seen some improvement in recent months. Sentiment increased 3% from August to November, up the most of any Consumer Products sector.

The following Consumer Goods brands posted the biggest gains in customer sentiment towards Price over the past three months -->

Makeup & Skincare had several big movers – wet n wild, Sephora Collection, Clinique, and NYX. Each of the makeup and skincare brands posted significant Black Friday savings, potentially contributing to their increase on Price sentiment.

1 All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.