New attractions mean higher

customer satisfaction at Hersheypark.

As we approach this holiday season, a popular time of year for vacations and travel, we look at interesting shifts and trends within the Theme Parks industry.

Looking at more than 26,000 pieces feedback on Theme Parks from “The Crowd,” real theme park customers who leave feedback on the HundredX platform, from May through October 2022, we see Hersheypark:

- Posts some of the biggest gains in Customer Satisfaction (CSAT) over the past few months; and

- Was

one of only 3 of the 11 parks (along with Disney World and Epcot) to see Net Purchase Intent (NPI) increase during October 2022, after declining the last 3-4 months.

Break me off a piece of that market share

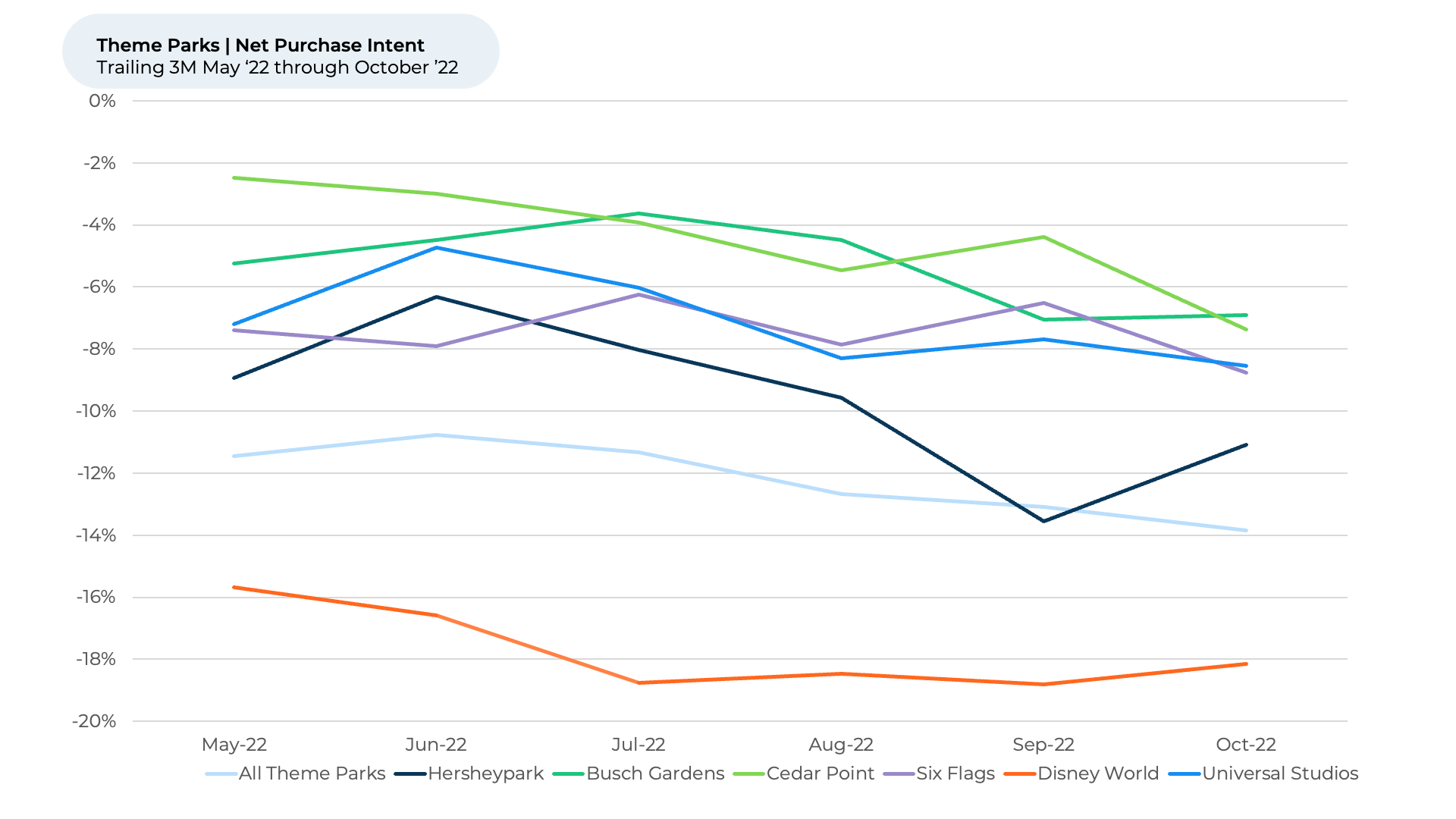

Hersheypark is the greatest gainer in NPI from T3M September to T3M October 2022, rising by 3% to -11%. Its rebound stands out against the overall downward trend we’ve seen across the Theme Park industry since T3M June.

Net Purchase Intent measures the percentage of customers who plan to visit the park more over the next 12 months minus the percentage who plan to visit less. We find businesses that see their spread in NPI vs. their peer group improve (as Hersheypark did in October 2022) post market share gains.

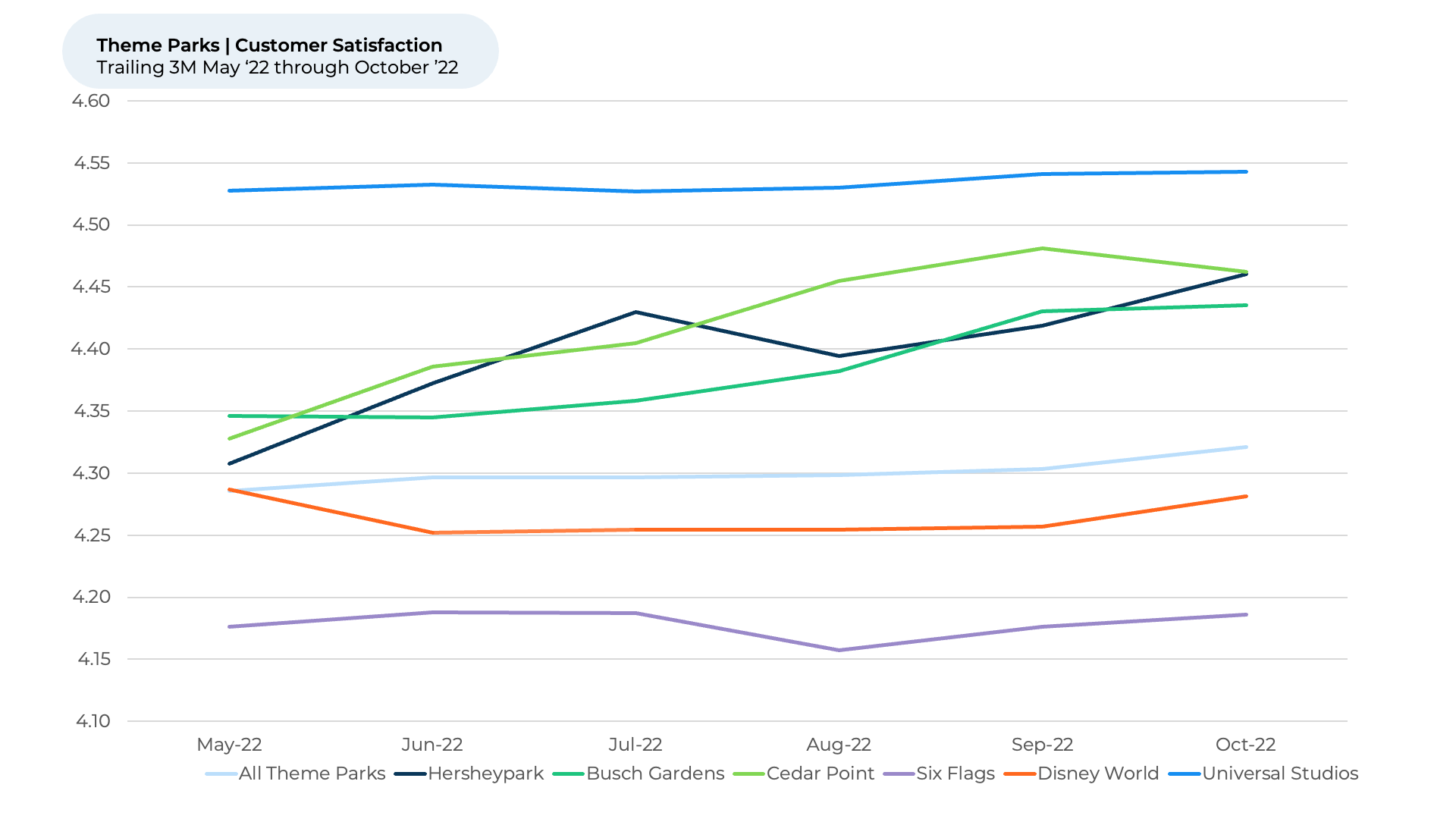

Hersheypark is one of the largest positive movers in CSAT from T3M May to T3M October 2022, rising from 4.3 to 4.5, while the peer average has remained flat. Note, we track CSAT on a 5-point scale.

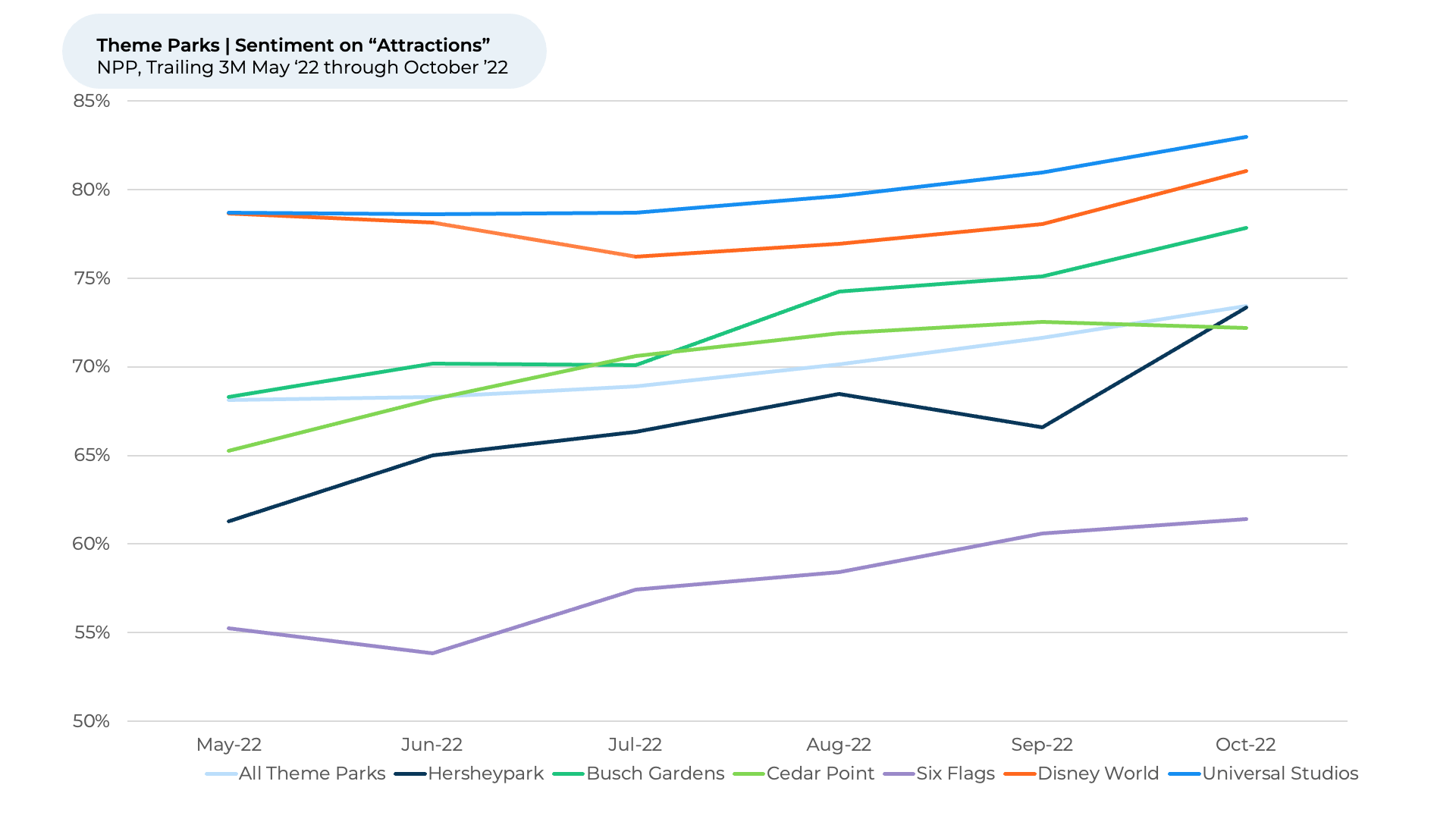

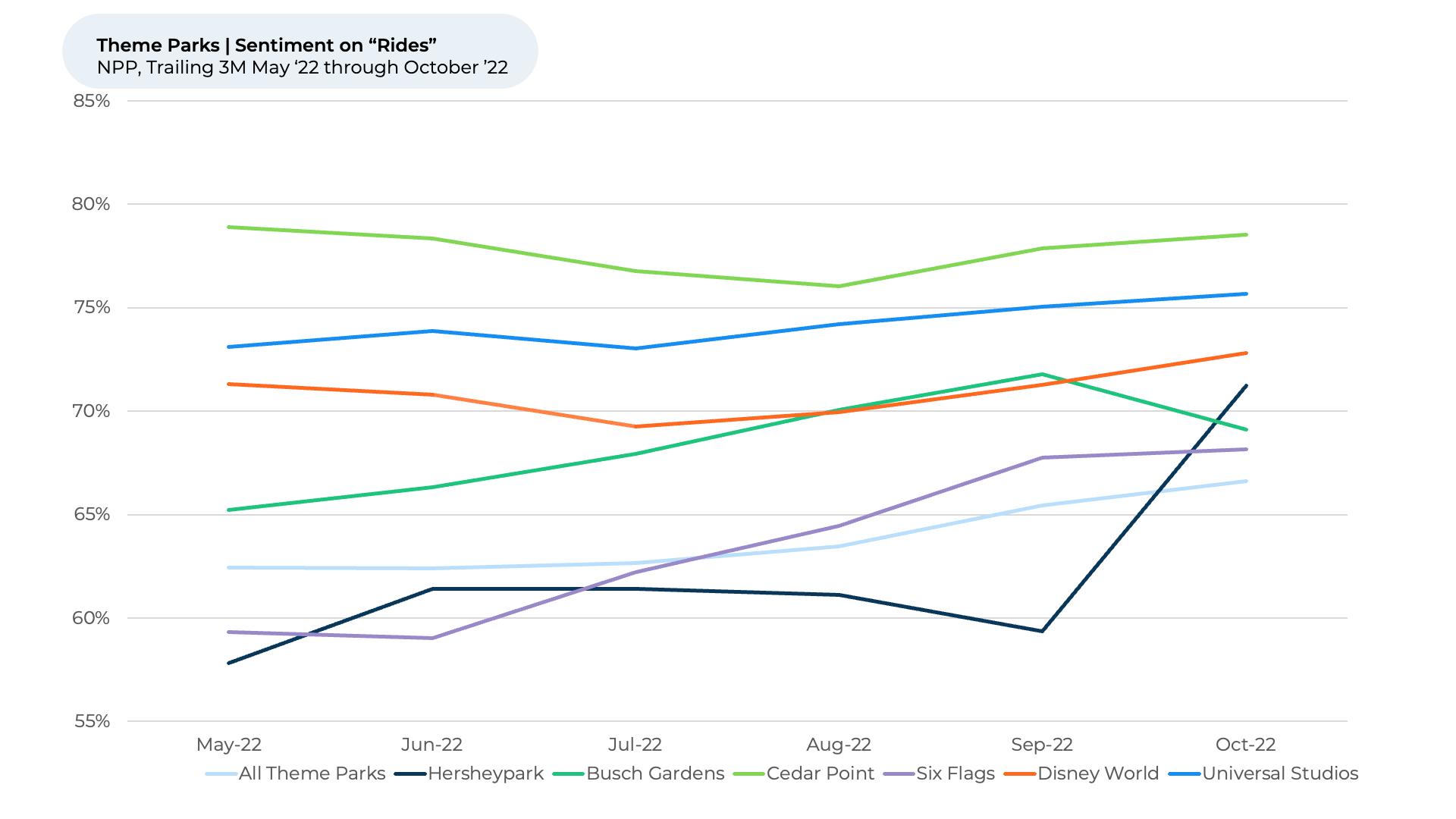

These positive trends appear driven by recent jumps in customer satisfaction with Hersheypark’s Attractions and Rides — two of the most selected drivers of CSAT and purchase intent across the Theme Park industry. Customer sentiment towards these factors moved upward significantly over the past month for Hersheypark.

Treat, not trick

Meanwhile, sentiment towards “Rides” for Hersheypark jumped from a 59% NPP in T3M September to 71% in T3M October. Hersheypark rose from being 6% below the peer average of 65% for T3M September to 5% ahead of the peer average of 66% for T3M October.

In mid-September, Hersheypark launched Hersheypark Halloween, its annual Halloween event. Running from mid-September to the end of October, the event features lights-out versions of its rides, dressed-up employees, and trick-or-treating. Most major theme parks hold yearly Halloween events; however, unlike most other theme parks this year, Hershey Park introduced a new experience called Dark Nights. The experience, included in the base ticket option, brought haunted houses, “scare zones,” and new food and drink offerings.

New rides are a plus

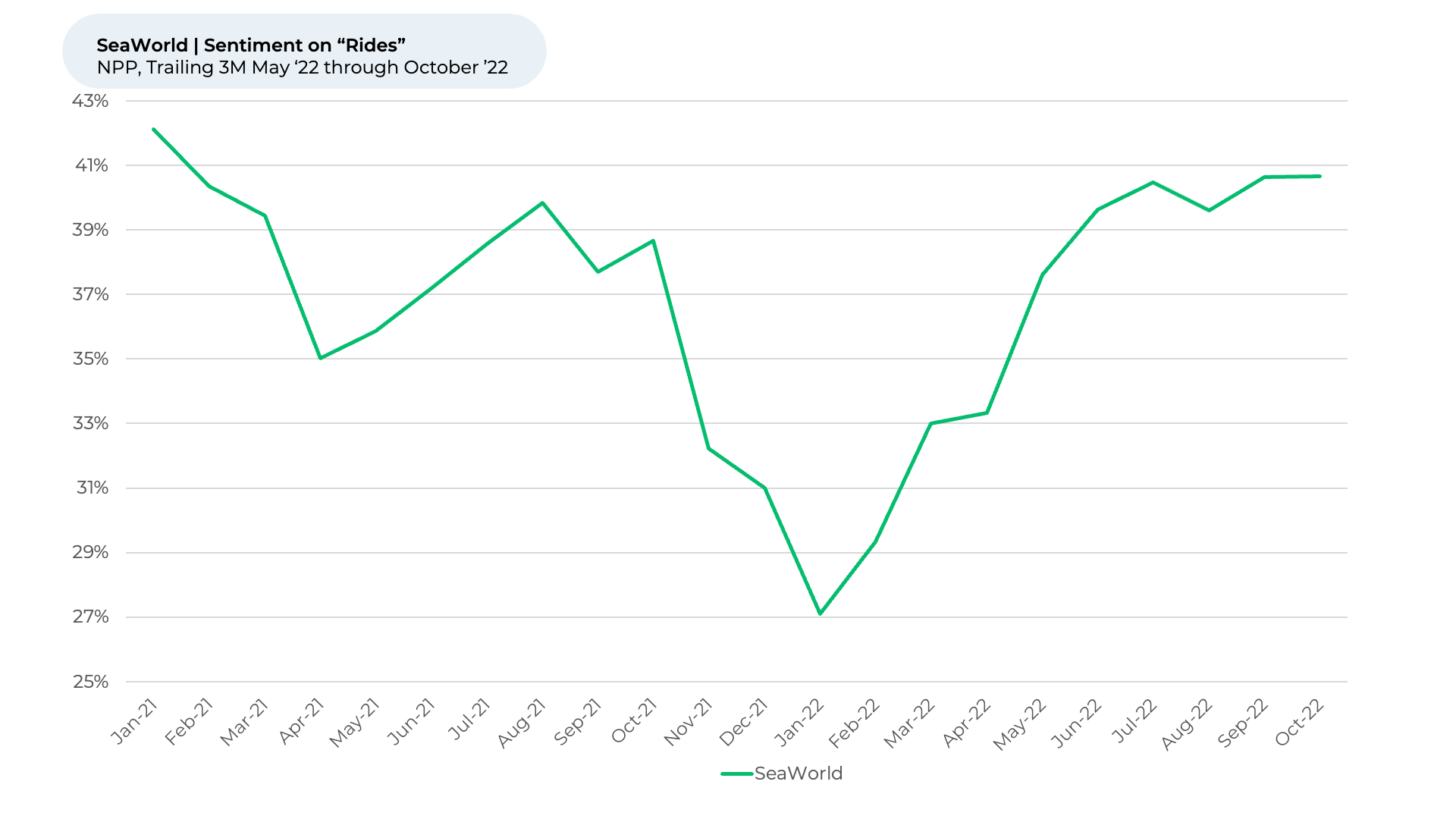

We see the sentiment towards “Rides” for SeaWorld jumped from 27% NPP in T3M January to 33% NPP in T3M April.

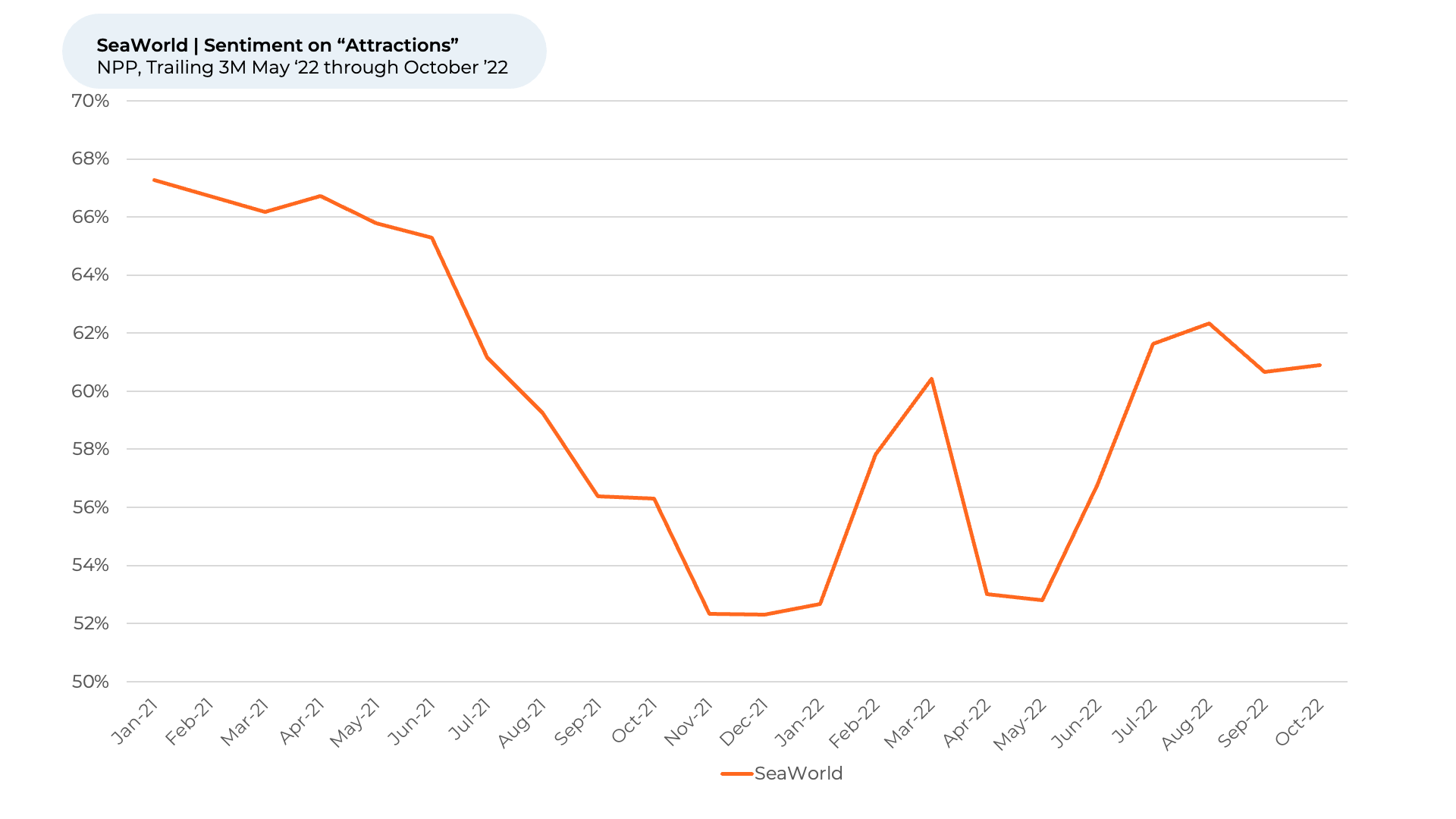

Likewise, looking at sentiment towards “Attractions,” SeaWorld moved from 53% NPP in T3M January to 60% NPP in T3M March, before moving back down to 53% the following month.

The bottom line — theme park customers like new attractions. We will continue to monitor Hersheypark and the other theme parks to see whether its NPI will continue to gain versus peers, if it results in market share gains and the impact of other competitive activity in the industry.

To learn more about HundredX competitive trends and customer satisfaction drivers for theme parks, or for any of the other 75+ industries we cover, please contact us.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on specific motivators of customer satisfaction, other companies within 75+ other industries we cover, or to learn more about using Data for Good, please contact us.