Capital One gaining on Amex, credit industry stable

With continued uncertainty about the outlook for the economy, inflation, and consumer spending, we look at trends for credit card companies ahead of earnings reports from American Express and Capital One to see which card companies are gaining traction vs. losing ground.

We looked at more than 20,000 pieces of customer feedback across over 10 credit card issuers over the last year, with a specific focus on American Express, Capital One, and Chase. We find the following insights:

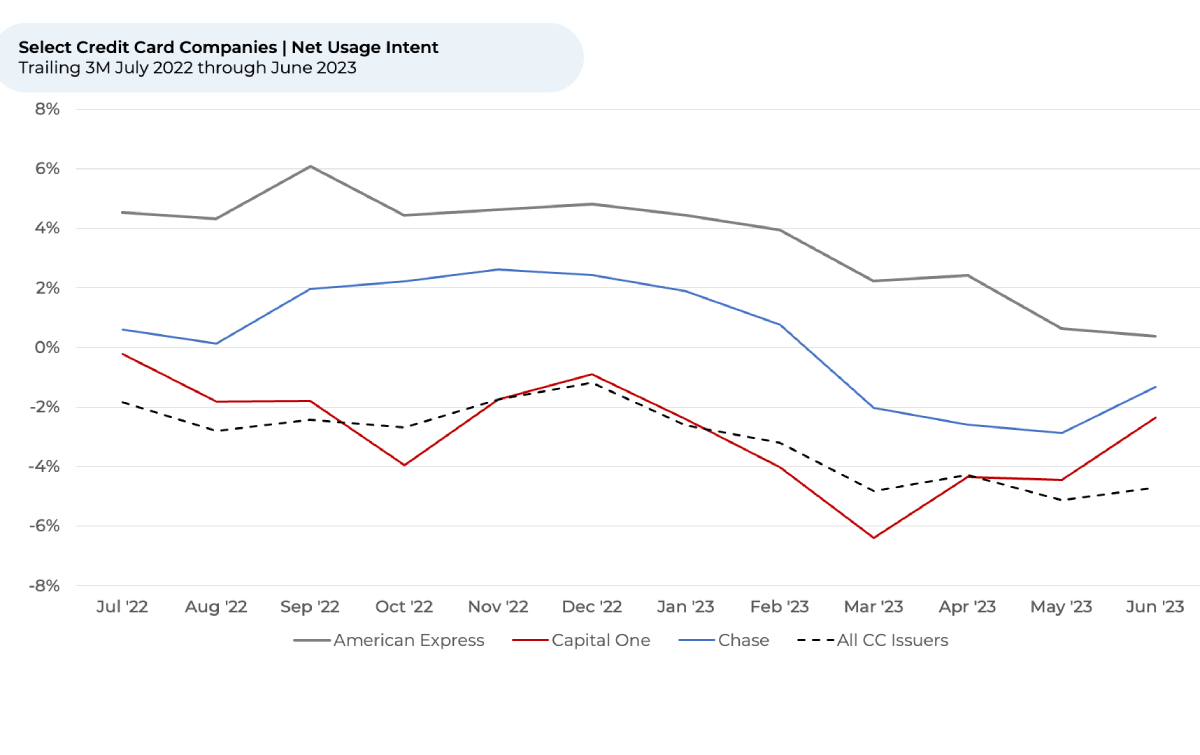

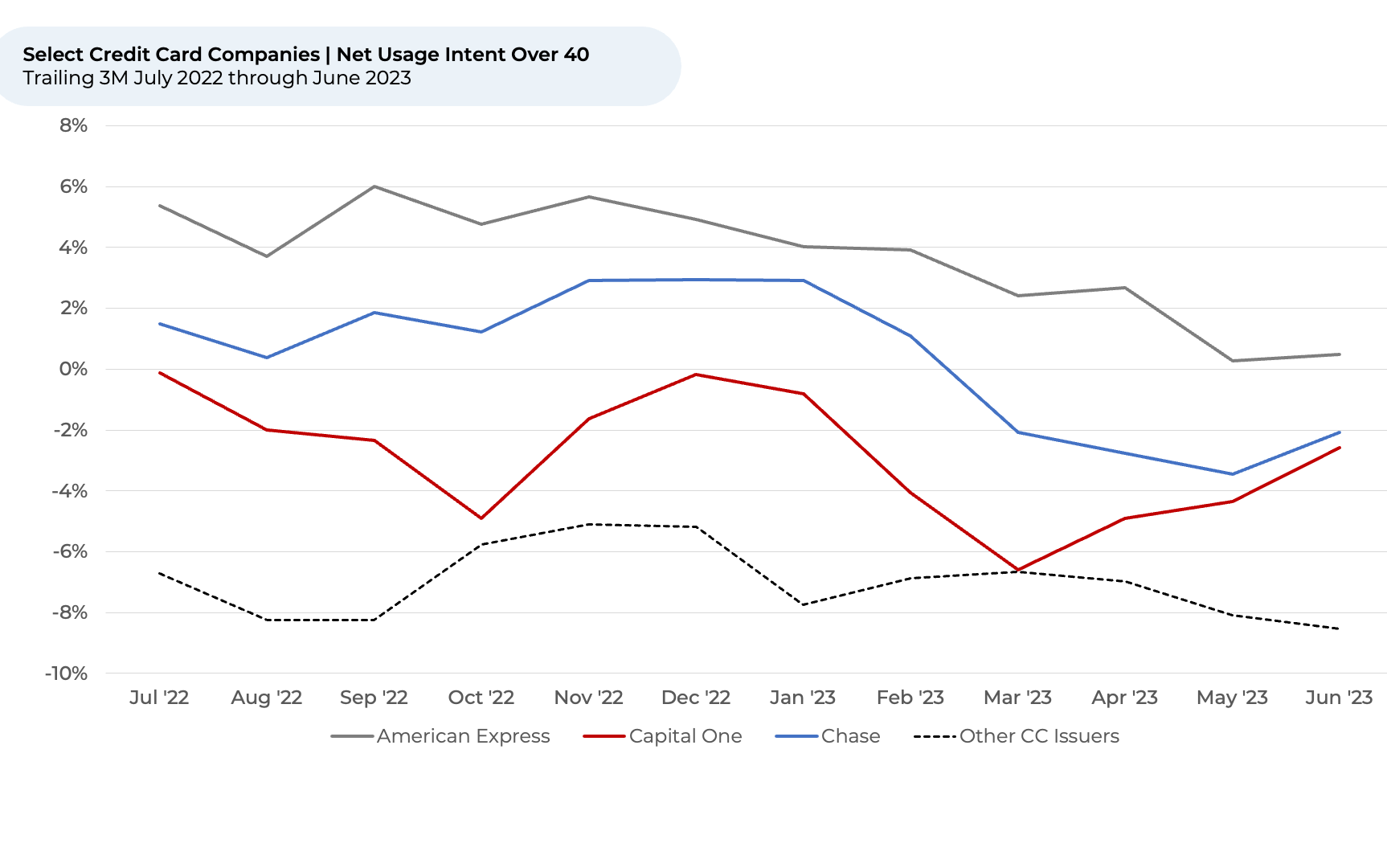

- Usage Intent¹,² for all credit card issuers was flat from March to June 2023, after dropping 4% from December 2022 to March 2023.

- American Express has seen its lead in Usage Intent over Chase and Capital One shrink since March, as Capital One has risen 4% while Amex has dropped 2%.

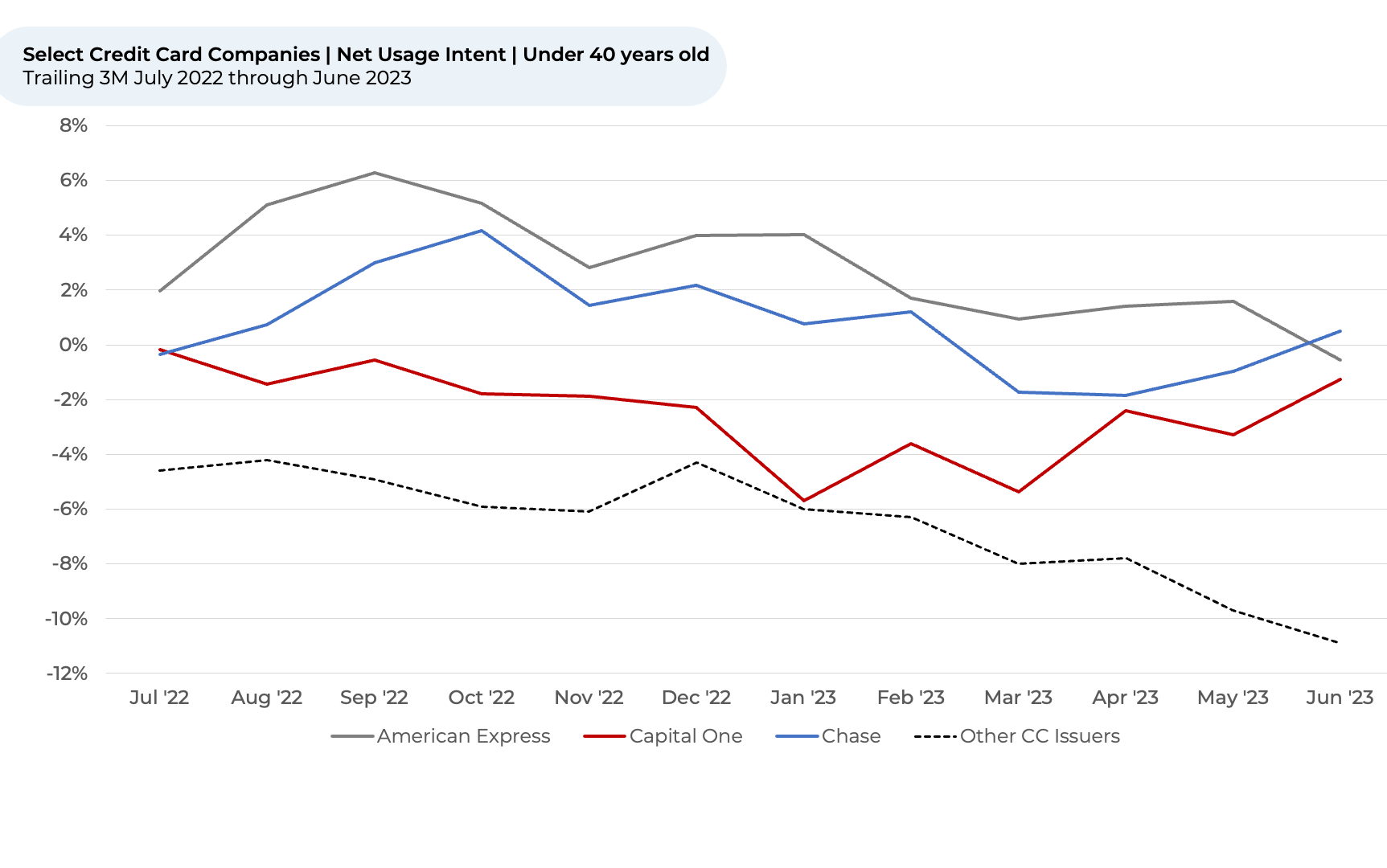

- Despite Amex investing to attract Millennial and Gen Z customers, Chase recently passed American Express in Usage Intent among customers under the age of 40.

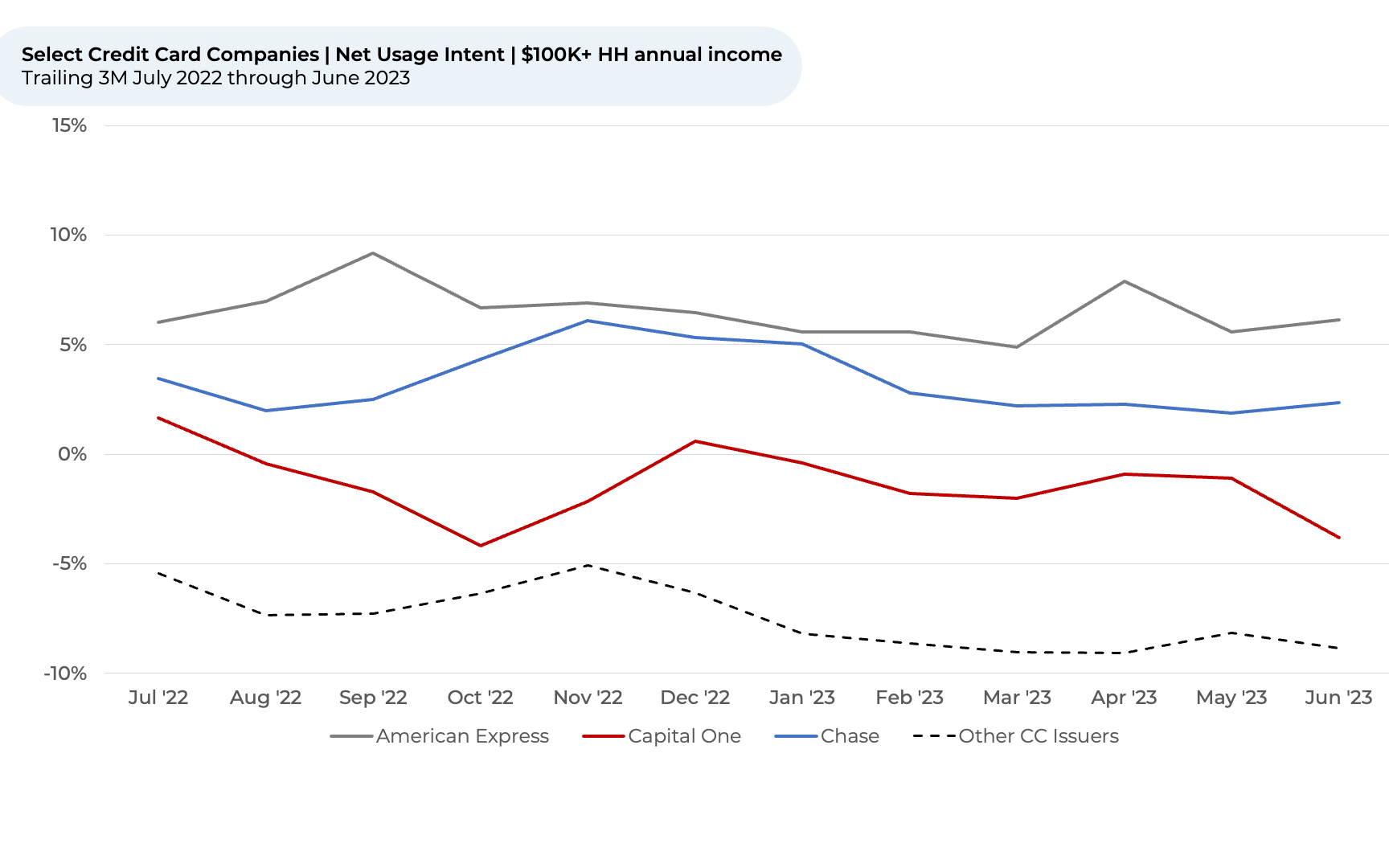

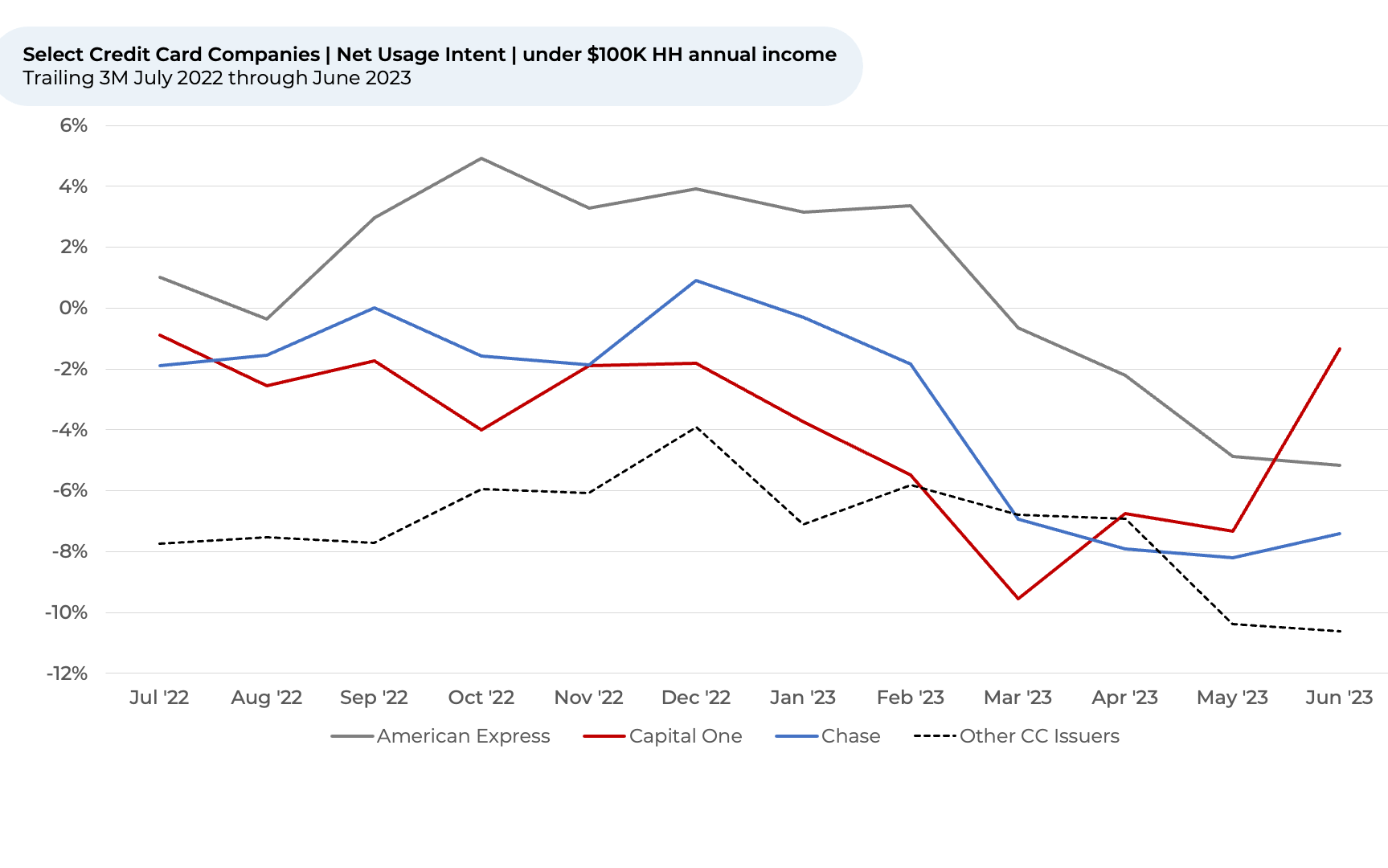

- American Express has maintained its leadership position in Usage Intent among affluent customers ($100K+/year in income), but Capital One has passed American Express and Chase with less affluent customers following an 8% increase since March while American Express has seen a 5% decline.

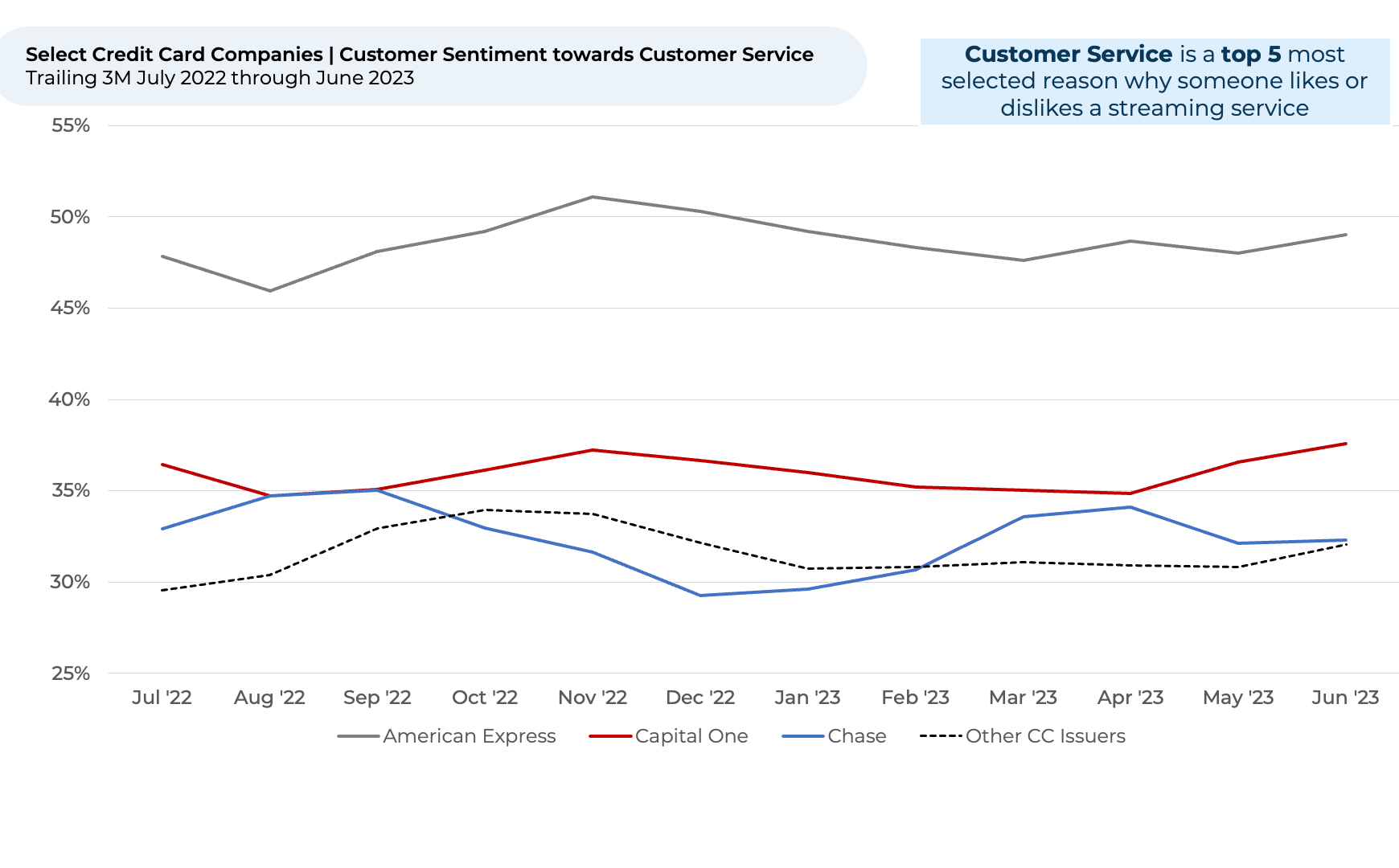

- Capital One has cut into American Express’ lead in customer net sentiment³ towards Rewards Programs and Customer Service

over the last three months. HundredX’s AI-based Resource Allocation model indicates these two areas have the biggest impact on customer Usage Intent.

Discover HundredX insights into Credit Card industry trends:

Please contact our team for a deeper look at HundredX's credit card data, which includes more than 80,000 pieces of customer feedback across 13 credit card businesses including Visa and Mastercard (which we do not include in our analysis of issuers discussed above).

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Sentiment / Net Positive Percent are presented on a trailing three-month basis unless otherwise noted.

- Usage Intent reflects the percentage of customers who plan to use a specific brand during the next 12 months, minus the percentage who plan to use less. We find businesses that see customer Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers.

- HundredX measures net sentiment toward a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.