Consumer Appetites Bearish in Response to Price Increases on Food and Beverage

As inflation soars, concerns around the rising prices of food and groceries for everyday Americans is dominating headlines. Understandably so as an April report from the USDA sees food prices continuing to rise for 2022. At HundredX, we wanted to understand how consumers are reacting to these price increases and whether they plan to curb their spending on food and beverage as costs rise.

Leveraging our proprietary listening methodology, we evaluated more than 250,000+ pieces of customer experience feedback over the past six months on leading businesses across eight subcategories of food and beverage. For each company, consumers were asked whether they plan to spend more, less, or the same over the following 12 months.

Consumers

tighten their wallets

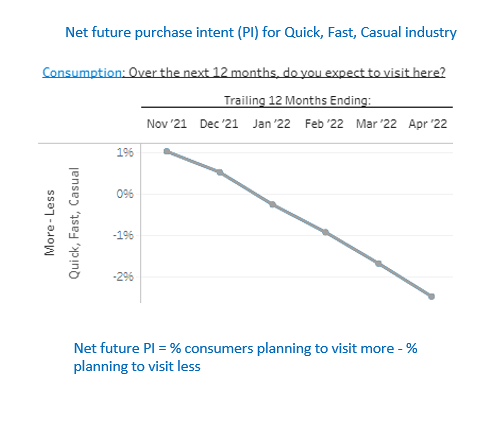

Our data shows consumers’ stated future spending declined over the last six months through April, with the bulk of the decrease occurring in the last few months of 2021, then stabilizing at these lower levels in 2022. Notably, the outlook for leading grocers went from positive future spending growth at the start of the period to flat in March and April 2022. Moreover, an examination of the sub-categories within food and beverage where growth outlook declined the most included Sit-Down Dining; Quick, Fast, Casual; and Grocery. Specific to Quick, Fast, Casual, future purchase intent continued to decline into 2022.

Increases universally degrade consumer sentiment

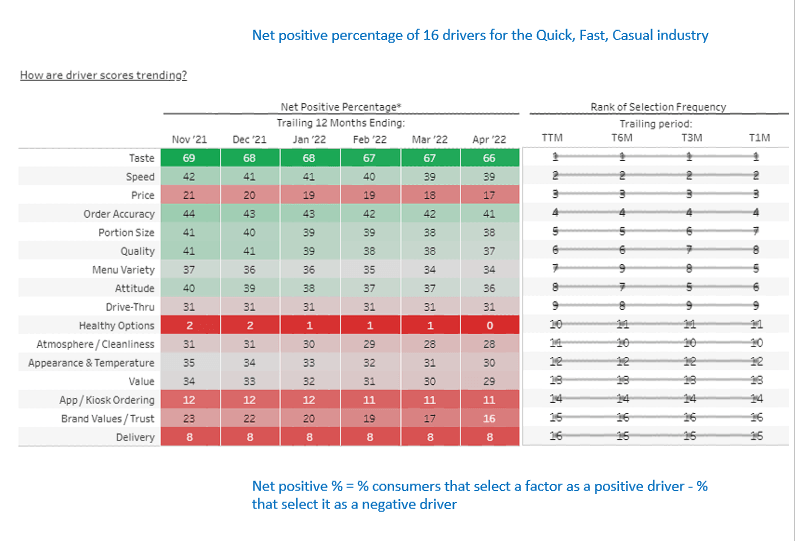

While many factors impact future consumer purchase behavior, the data is clear – price is the biggest driver during the past 6 months. Across the board consumer feedback data showed “price” exhibiting the largest negative change in sentiment among 16 different driver options. As we noted in the Food Institute's recent article, Food Delivery and Quick, Fast Casual saw the largest negative shifts in price-related sentiment among the eight subcategories analyzed. And, despite consumer sentiment towards price also falling for both Food Delivery and for Snacks and Desserts, the future purchase outlook for both remained stable. The lone outlier is Alcohol, which saw future purchase intent rise modestly, while price sentiment was stable. Interestingly, sentiment towards Alcohol availability is decreasing, most likely a response to supply chain disruptions.

Relative winners in a weakening environment

As consumers’ future spend outlook grew more cautious across these subcategories during the 4th quarter of 2021, the data show it stabilizing thereafter. Despite this bearish tread, bright spots do exist in several subcategories. Specifically, a few of the companies that saw future purchase intent hold up better against these pressures over the last six months were:

- Sit-Down Dining: Bonefish Grill, Cheddar’s Scratch Kitchen, and Chuy’s

- Quick Fast Casual: Baskin Robbin’s, Chick-Fil-A, Chipotle, Dairy Queen, Qdoba Mexican Eats and Starbucks.

- Grocery: Albertsons, Kroger, Meijer Grocery and Shop Rite

Cautious, yet optimistic look ahead

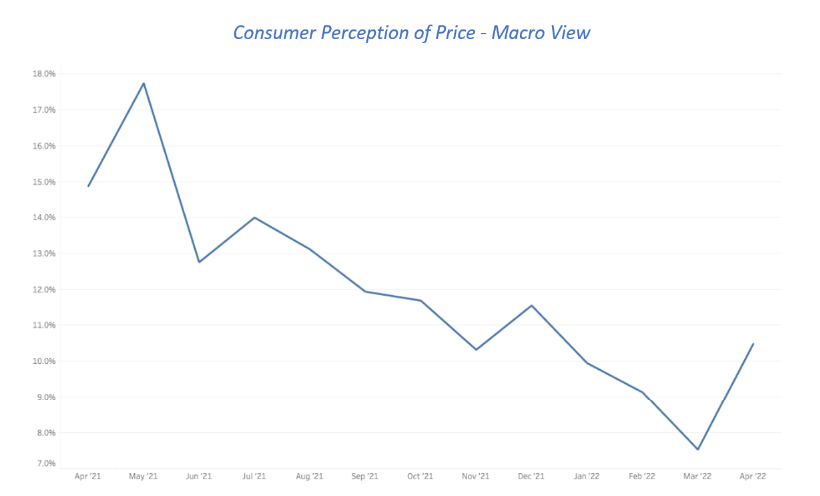

While consumers continue to tread cautiously, there are signs of optimism with regards to inflation. Early indicators within our data from the first two weeks of April show pricing pressure trends may be starting to reverse – a potential signal the market is at or near peak inflation – welcomed news for both consumers and companies alike. HundredX continues to monitor this trend.

For a closer look at those companies within the food and beverage industry both battling and/or taming inflation headwinds, or to understand more about our data solutions, please reach out to us at: https://hundredx.com/contact

About HundredX Data

Leveraging advanced technologies and data science to combine more than 5M+ feedback interactions across 2,200+ brands and 75+ industries with decades of strategy and investment expertise from Wall Street, HundredX delivers proprietary, cross-market views to equip business leaders with an actionable understanding for where consumer demand is shifting, what factors are driving purchase intent, and where competitive opportunities are emerging.

Learn more about HundredX and our solutions by requesting a demo.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.