HundredX recently analyzed trends in customer sentiment for Bud Light versus competitors through May 2023. The analysis draws on over 75,000 pieces of continuous, double-blind customer feedback across the Alcohol category during the past year, including over 5,000 on Bud Light and Budweiser.

Key Takeaways:

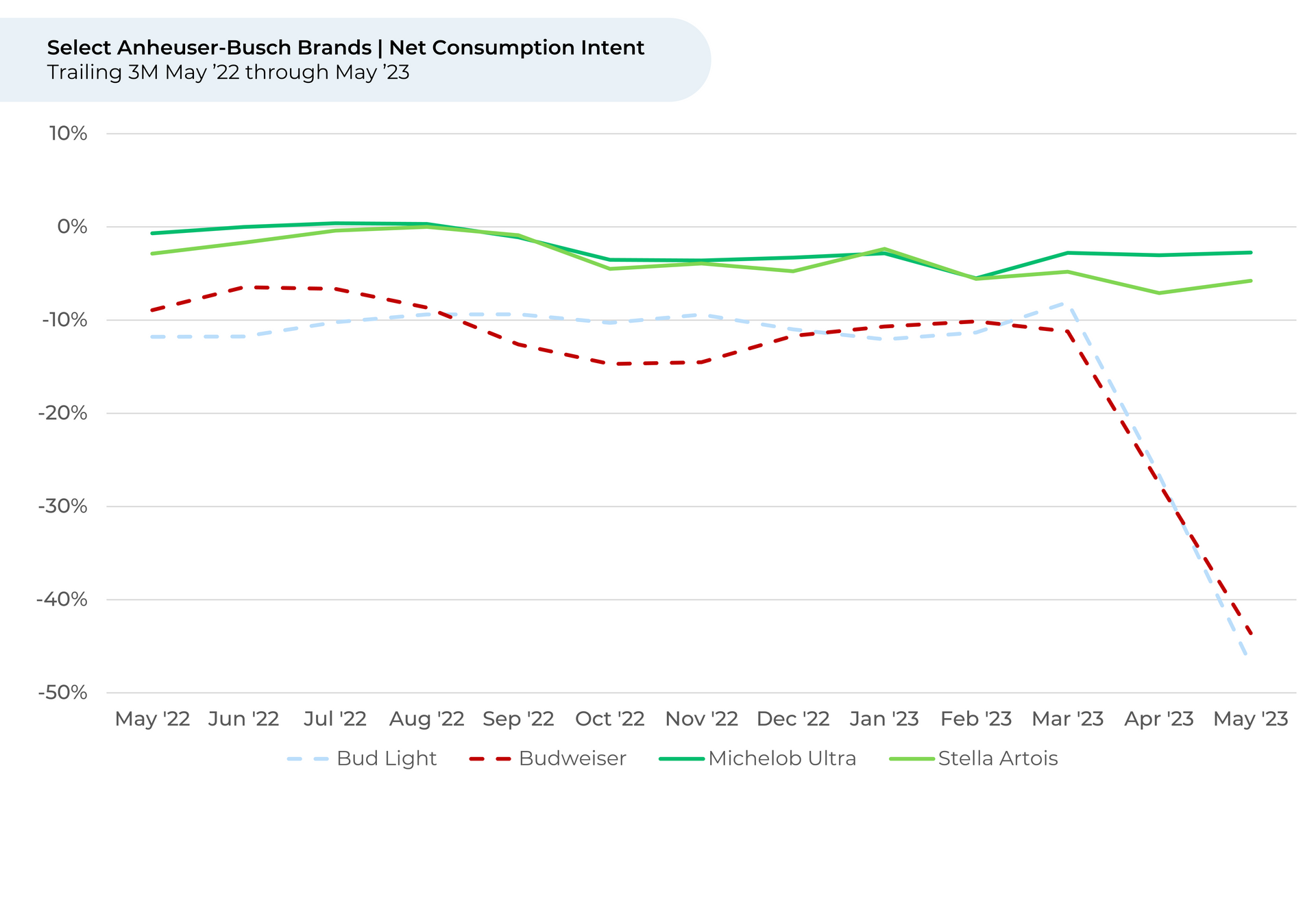

- Future Demand Outlook: Bud Light customer future Consumption Intent1,2 continued to fall throughout May, dropping 39% versus March.

- The Budweiser brand declined 32% during the same period, but other Anheuser-Busch brands such as Michelob and Stella remain largely unaffected.

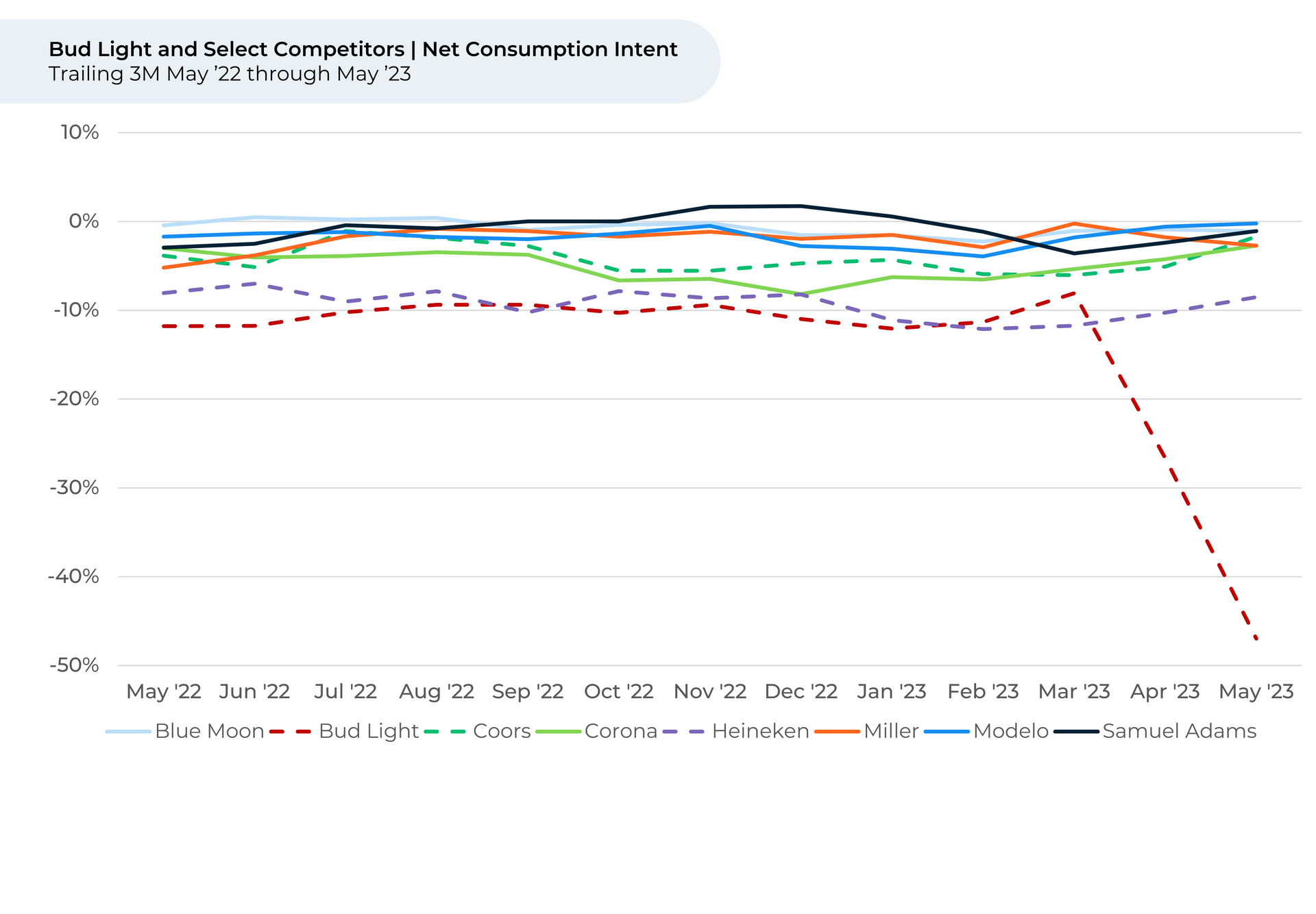

- Coors and Heineken appear to be best positioned to gain market share from Bud Lights’ decline.

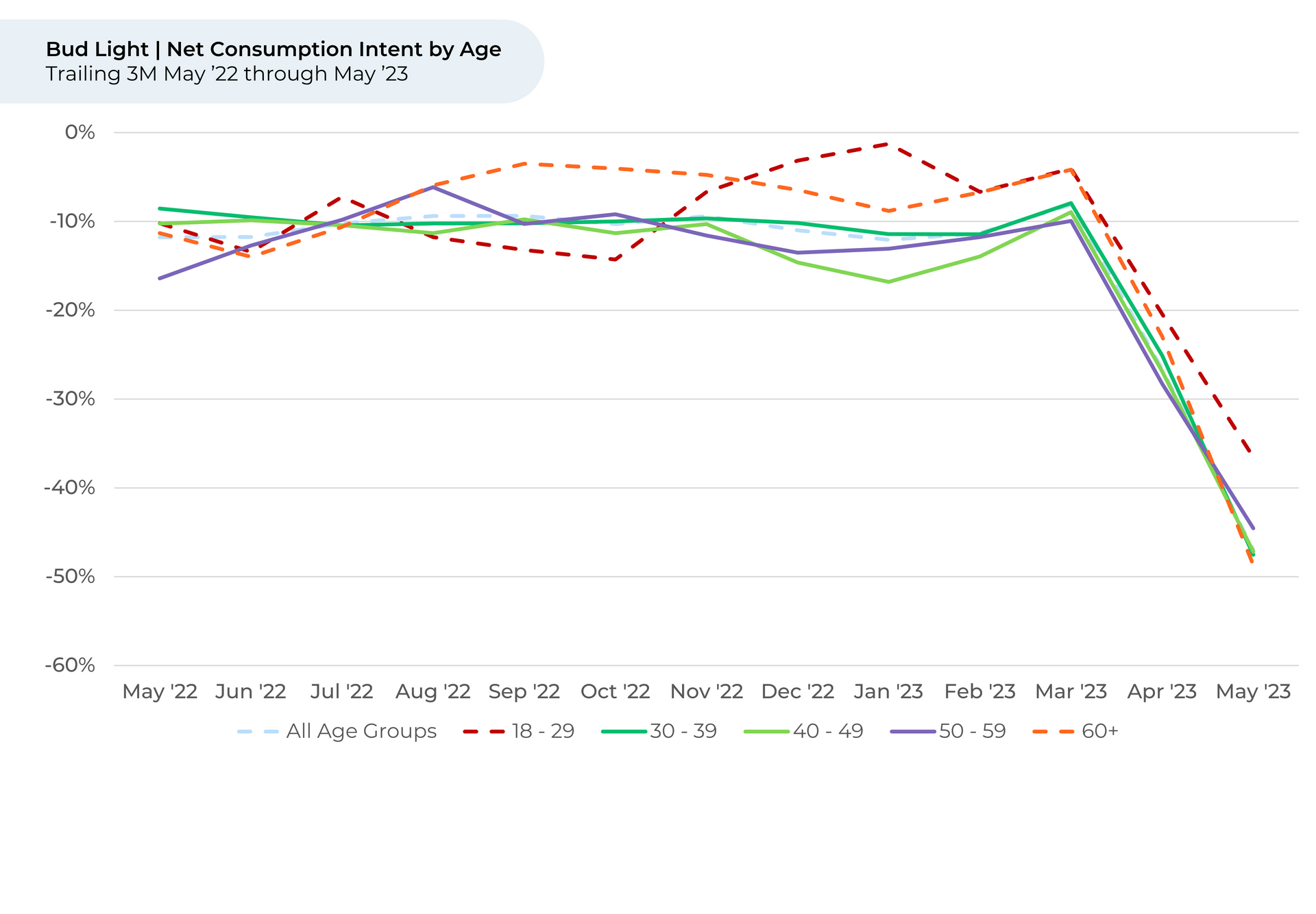

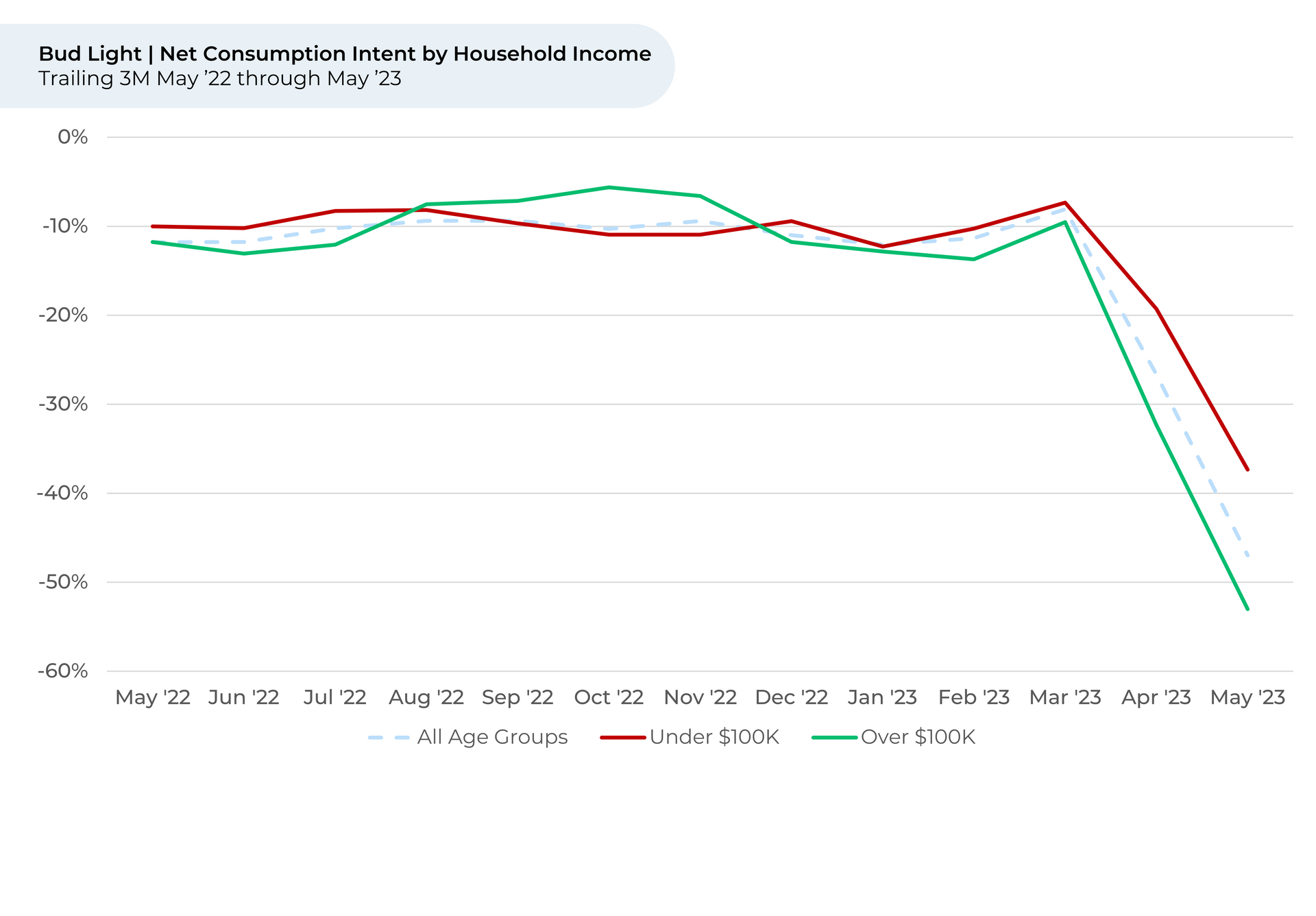

- Demographics: Bud Light Consumption Intent declined across almost all demographics. It fell the most for older (-45%) and higher income customers (-44%) and least for younger (-32%) and less affluent customers (-30%). While significant, differences across gender ID, race and geography were somewhat less dramatic.

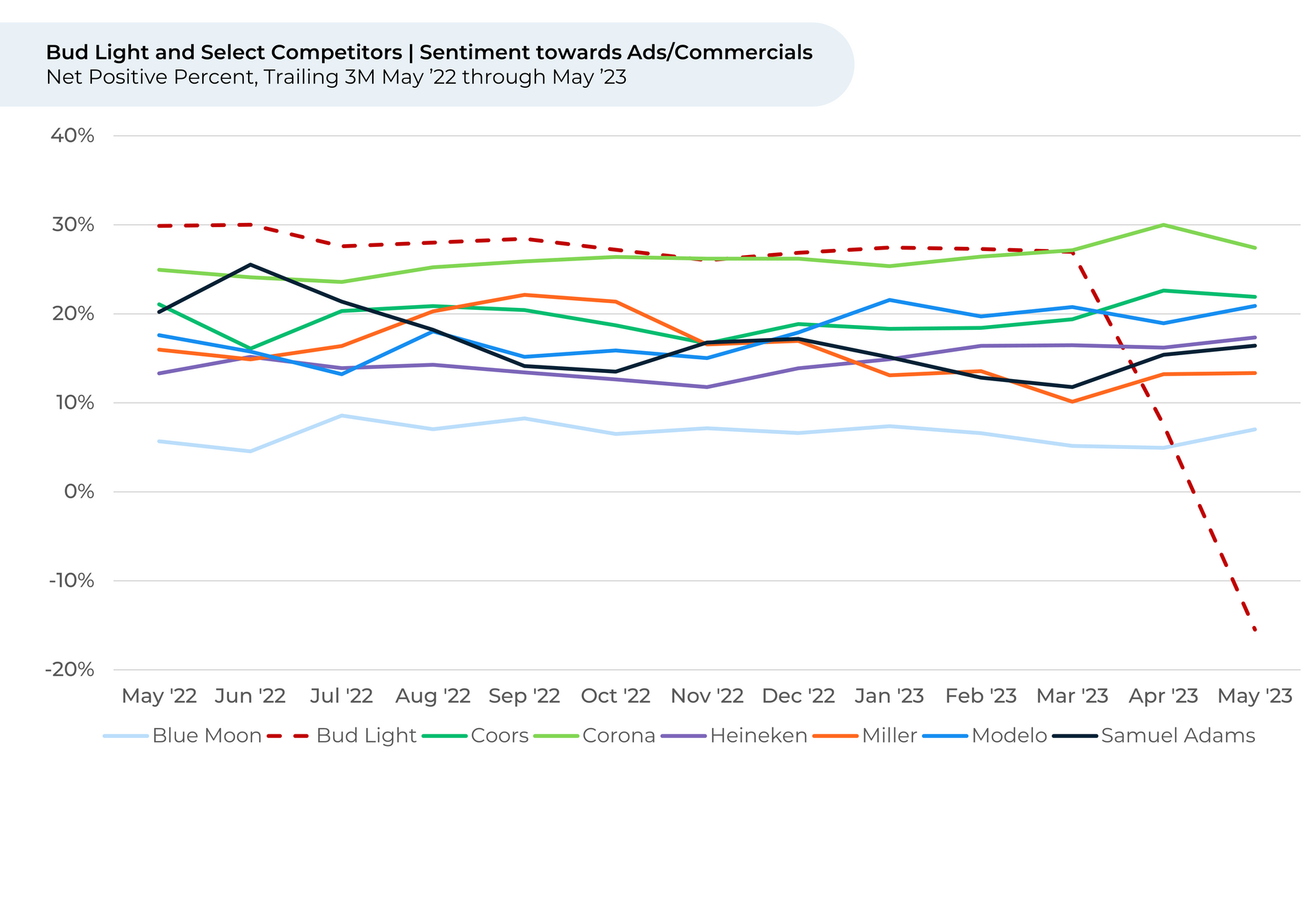

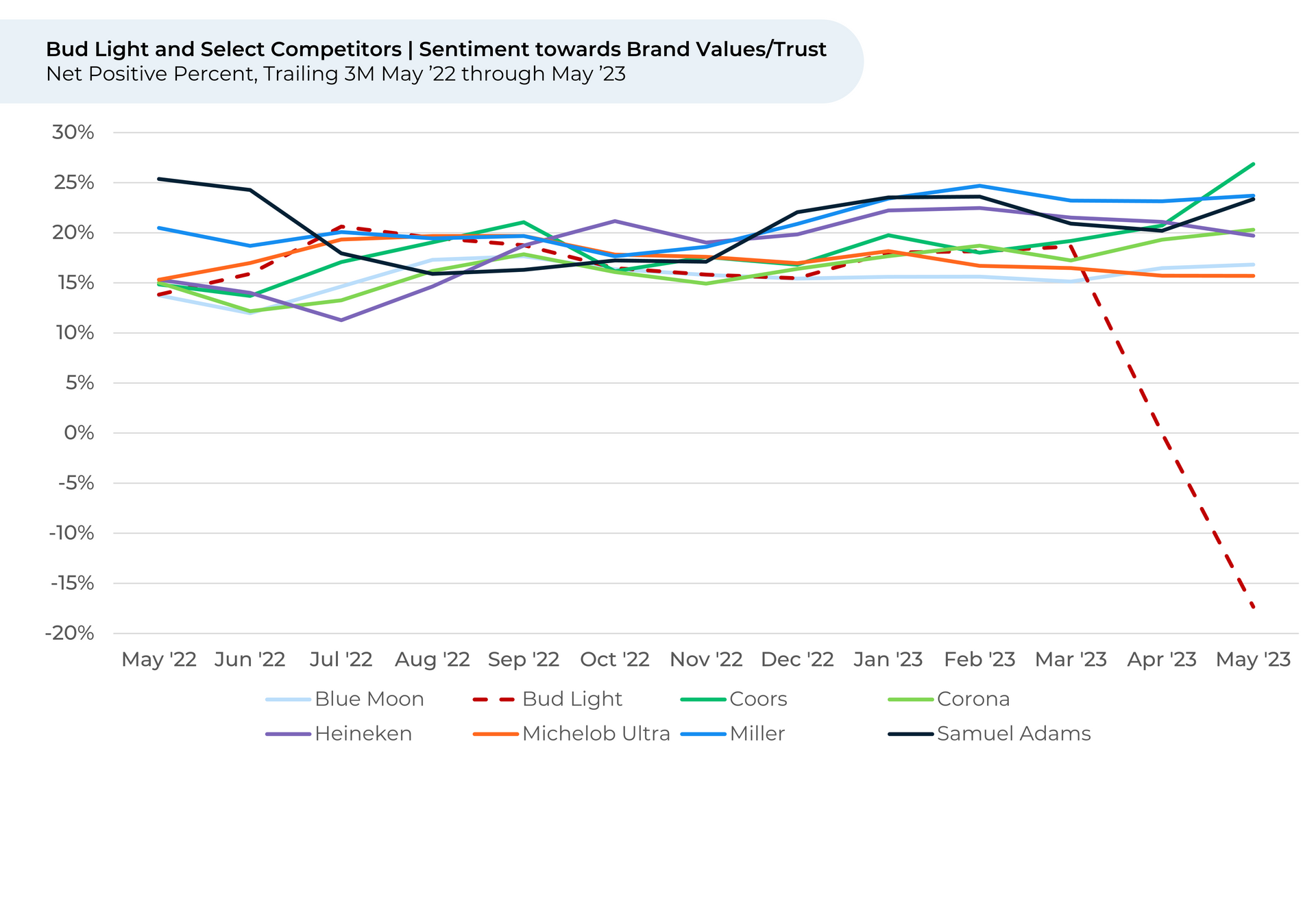

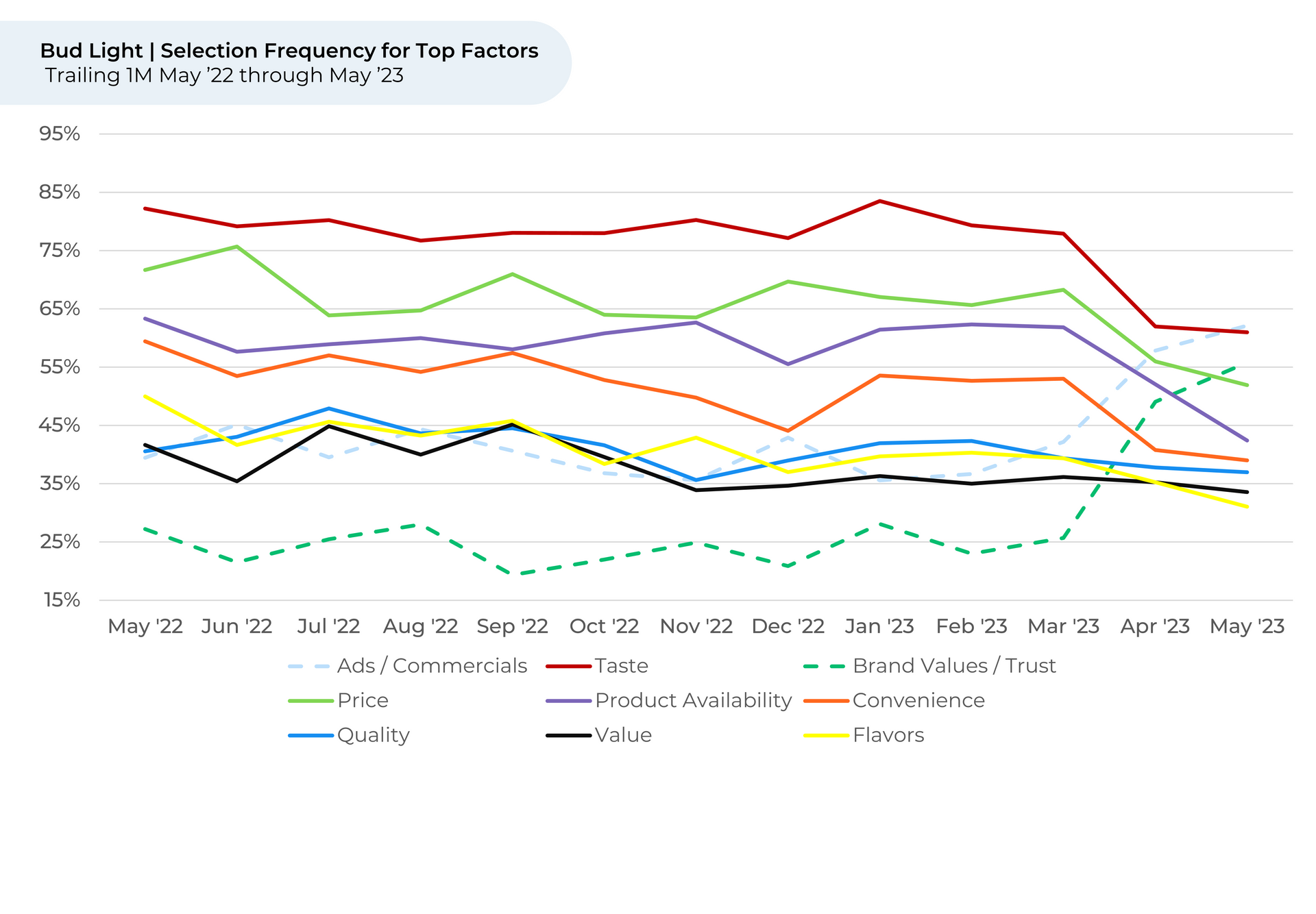

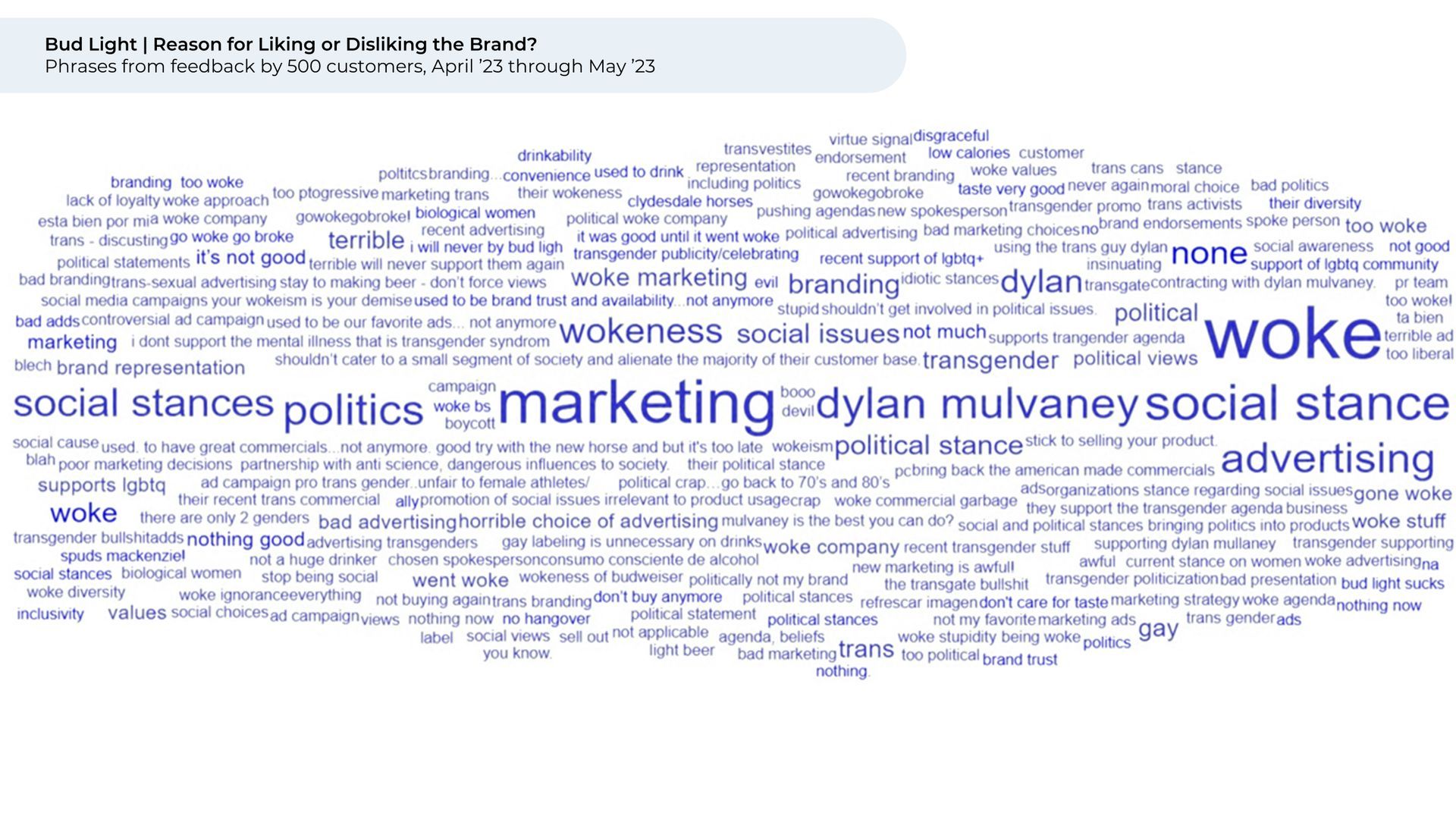

- Key Drivers: Customer net favorability3 towards Bud Light "Ads/Commercials" and "Brand Values/Trust" crashed after April 1, falling 42% and 36%, respectively. Ads/Commercials and Brand Values/Trust are now the first and third most selected factors in customer feedback versus ranking 7th and 13th historically.

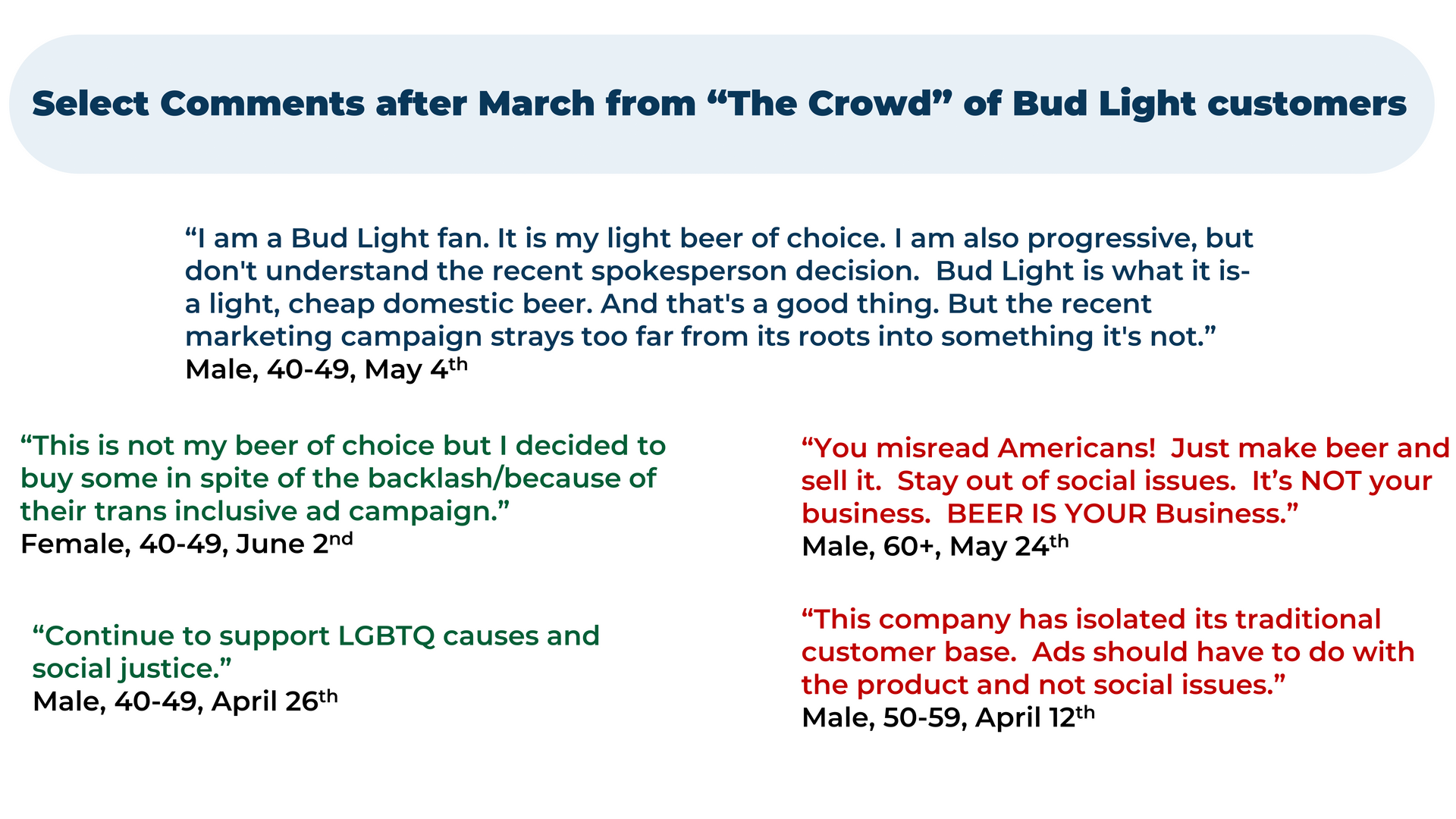

- Customer verbatim comments commonly include themes related to “marketing,” and “social stances” as reasons they like or dislike Bud Light.

Discover HundredX insights into Bud Light and Budweiser:

Please contact our team for a deeper look at HundredX's data on Alcohol and Spirits, which includes more than 100,000 pieces of customer feedback across 66 alcohol brands.

- All metrics presented, including Net Consumption (Consumption Intent) and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Consumption Intent for alcohol represents the percentage of customers who expect to consume more of that brand over the next 12 months, minus those that intend to consume less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.