U.S. auto sales poised for bounce back?

While the auto industry has not yet fully recovered from the acute supply chain issues that hurt production, increased prices due to lower volumes, and higher loan interest rates, some positive signs have emerged recently. It seems autos are poised to finally emerge from a very challenging year (U.S. vehicle sales down 8% YoY for 2022), primarily driven by a significant increase in available cars and the popularity of electric vehicles. Many questions remain, including the health of the U.S. economy, interest rates, tax incentives, and buyer choice regarding traditional gas vs. electric vehicles. All these factors play important roles in which brands maintain customer loyalty and new sales.

We look to “The Crowd”, drivers sharing feedback with HundredX, to get a read on recent auto loyalty trends and which brands customers favor most.

- Improving loyalty trends continue for Auto Brands, despite higher vehicle prices.

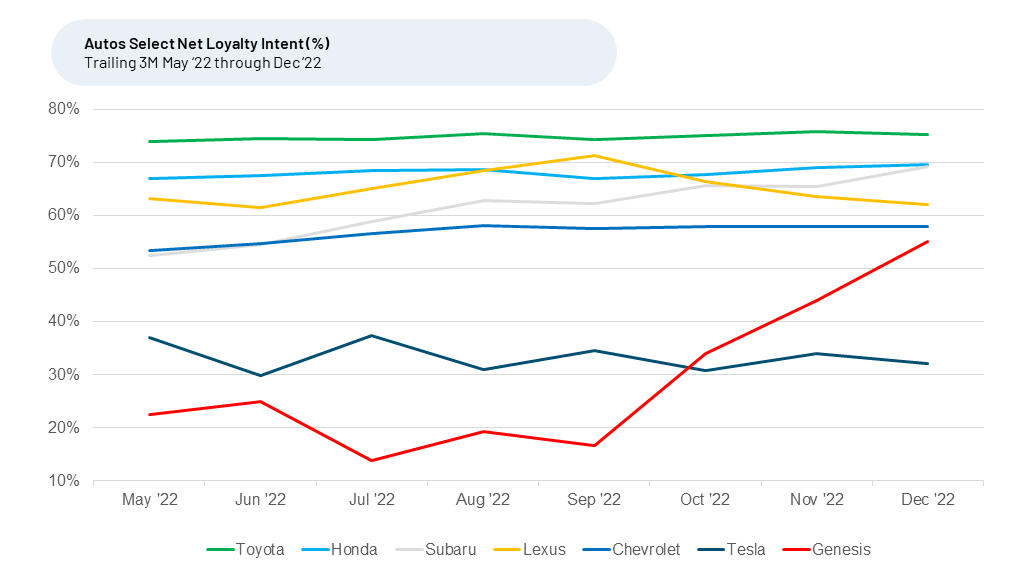

- Overall auto winners in Loyalty Intent include Toyota, Honda, and Subaru. Smaller maker Genesis saw the biggest loyalty increase during the last three months, as new EV models became available.

- Tesla’s overall Loyalty Intent fell throughout the second half of 2022, with the steepest declines for 40–49-year-olds and households making more than $200K annually. Sentiment towards Tesla’s Brand Values and Trust has dropped significantly in the past few months.

- The most favored Auto Brands do a great job of satisfying customers with their Comfort, Style, Performance, Value, and Reliability.

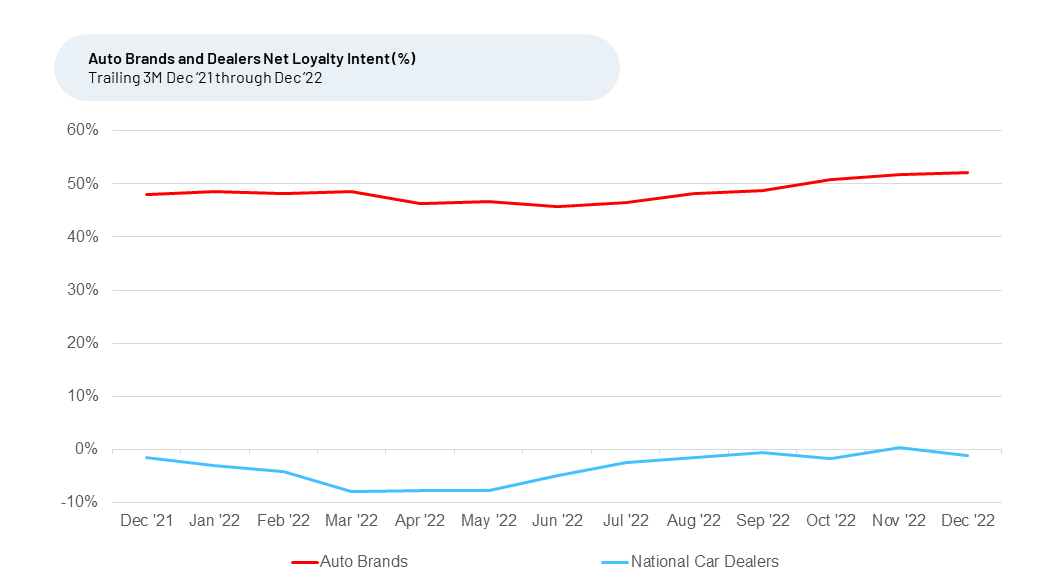

- Auto Dealer Loyalty Intent, while improving since mid-year, remained flat over the last three months.

Leveraging HundredX’s proprietary listening methodology, we evaluate more than 170,000 pieces of feedback from real auto sector customers across the country. We analyze insights for customers’ future Loyalty Intent¹ for Auto Brands, focusing on which companies look to benefit most.

Despite high prices, Net Loyalty Intent for Auto Brands increased to 52% in December 2022, rising from a low of 46% in June 2022.

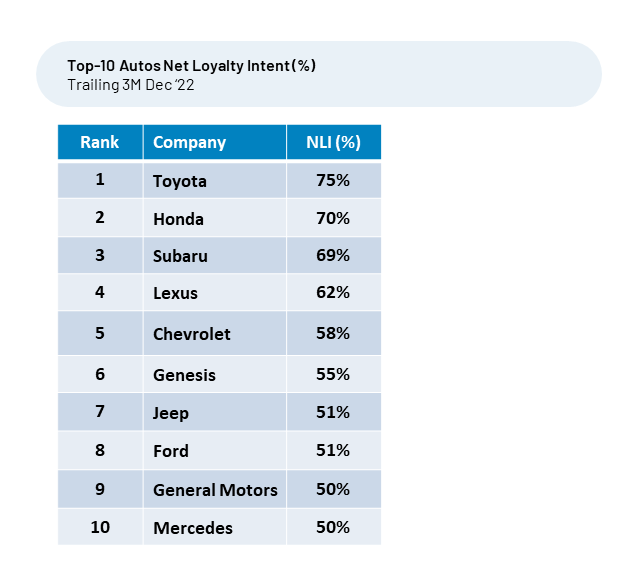

Top overall Autos Net Loyalty Intent leaders

Loyalty Intent reflects the percentage of customers who plan to purchase a specific brand in the future minus the percentage that plan to purchase less. Shifts in loyalty intent versus the industry have been indicative of shifts in market share.

The Crowd tells us they are most positive on purchasing Toyota, Honda, and Subaru again.

Toyota, the current Loyalty leader, continued its stable run on top, rising slightly from 74% in September 2022 to 76% December 2022. Out of over 40 auto brands covered by HundredX, Toyota customer satisfaction ranks #1 for Quality, #2 for Brand Values and Trust, and #3 for Value. The brand improved the most recently with Style. One recent satisfied customer commented, “Toyotas are very reliable and stylish.”

Tesla’s overall customer loyalty intent declined to 32% for December 2022, down from a high of 38% in July 2022. The giant in the EV space leads on customer satisfaction with technology and its website across companies we cover. The decline in loyalty intent is particularly sharp for 40-49 year-olds, dropping from 55% to 28% from May to December 2022. Owners who make more than $200,000 annually saw loyalty intent fall from 77% to 47% from February to December 2022. We have also observed a sharp decrease in customer’s sentiment toward Brand Values and Trust overall. This change has seemingly affected demand. Perhaps in response, Tesla just dropped prices by 20% in the U.S. and Europe in an effort to boost sales as competition intensifies. This price cut also helps more of its models qualify for federal tax credits.

Honda and Subaru loyalty intent stayed on track throughout the year, a sign of their ability to continue satisfying customers with Quality/Reliability, Value, and Cost of Ownership.

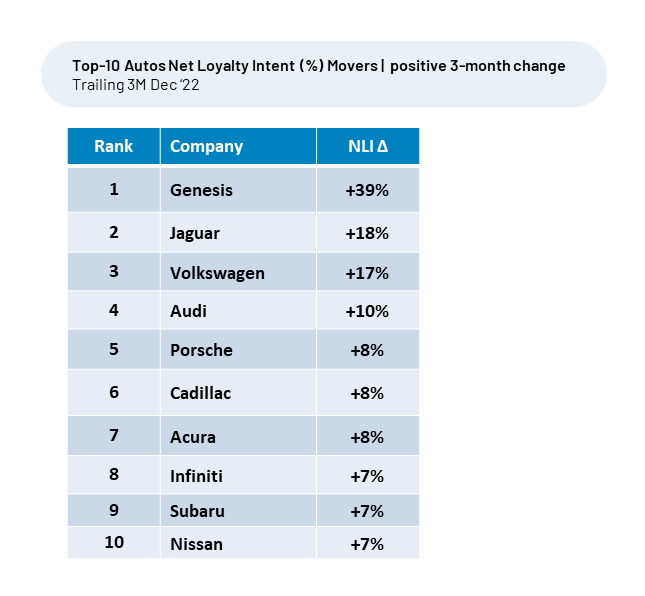

Largest Autos Net Loyalty Intent movers

The auto brands launching new EV models are among the biggest gainers in loyalty intent the last three months, December 2022 versus September 2022. When we compare a brand’s loyalty intent over time to the Industry’s average, we find brands with loyalty intent rising faster than the sector average are poised to gain market share.

Top Autos Net Loyalty Intent movers highlights

As more car manufacturers increase supply, especially of new electric models, brands such as Genesis, Volkswagen, Audi, and other innovators appear poised to gain share. EV sales almost doubled from 2021 to 2022, accounting for almost 5% of U.S. car sales, according to Edmunds.

Genesis, still a relatively small brand developed by Hyundai Motor America, makes higher-end, traditional and electric vehicles. It had a very successful 2022 sales year, boosted primarily by EV sales. Loyalty intent improved from 14% in July 2022 to 55% to December 2022. While many brands are adding EV to their lineups and introducing various hybrid, plug-in hybrid, and EV models, Genesis has focused on very well designed, all-electric SUVs. The Genesis GV 60 EV, GV70 EV, and G80 EV models have been favored by customers. The Crowd’s sentiment became much more positive during the past few months on Genesis’ Performance, Style, and Tech/Features.

Volkswagen, which has seen high demand for its ID.4 electric vehicle, hit a high mark for its loyalty intent reaching 42% for December 2022, up from 24% in August 2022. Customer sentiment is highest towards Volkswagen’s Style, Comfort, and Performance. The brand has seen improvement in customer satisfaction with Attitude/Knowledge, Tech/Features, and Brand Values and Trust as well. Volkswagen ID.4 sales are up 28% year over year, primarily due to availability and overall demand for EVs, as they begin to displace traditional gas vehicles. A recent customer commented, “I love VW and am excited about EV from them.”

Customer Satisfaction

We also find Customer Satisfaction (CSAT) for Autos (4.4) has remained steady over the course of the last year. HundredX measures CSAT on a 5-point scale.

Sentiment towards a driver of satisfaction is measured by Net Positive Percent (NPP), which is the percentage of customers who say a driver (such as Quality or Price) is a reason they like a brand/product minus the percentage who say it is a reason they do not like it.

While The Crowd tells us that the overall loyalty outlook will most likely continue its trend, select Auto brands making strides in the areas customers care about the most are poised to gain market share relative to the broader sector. We continue to monitor trends to see what changes emerge in 2023.

- All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.