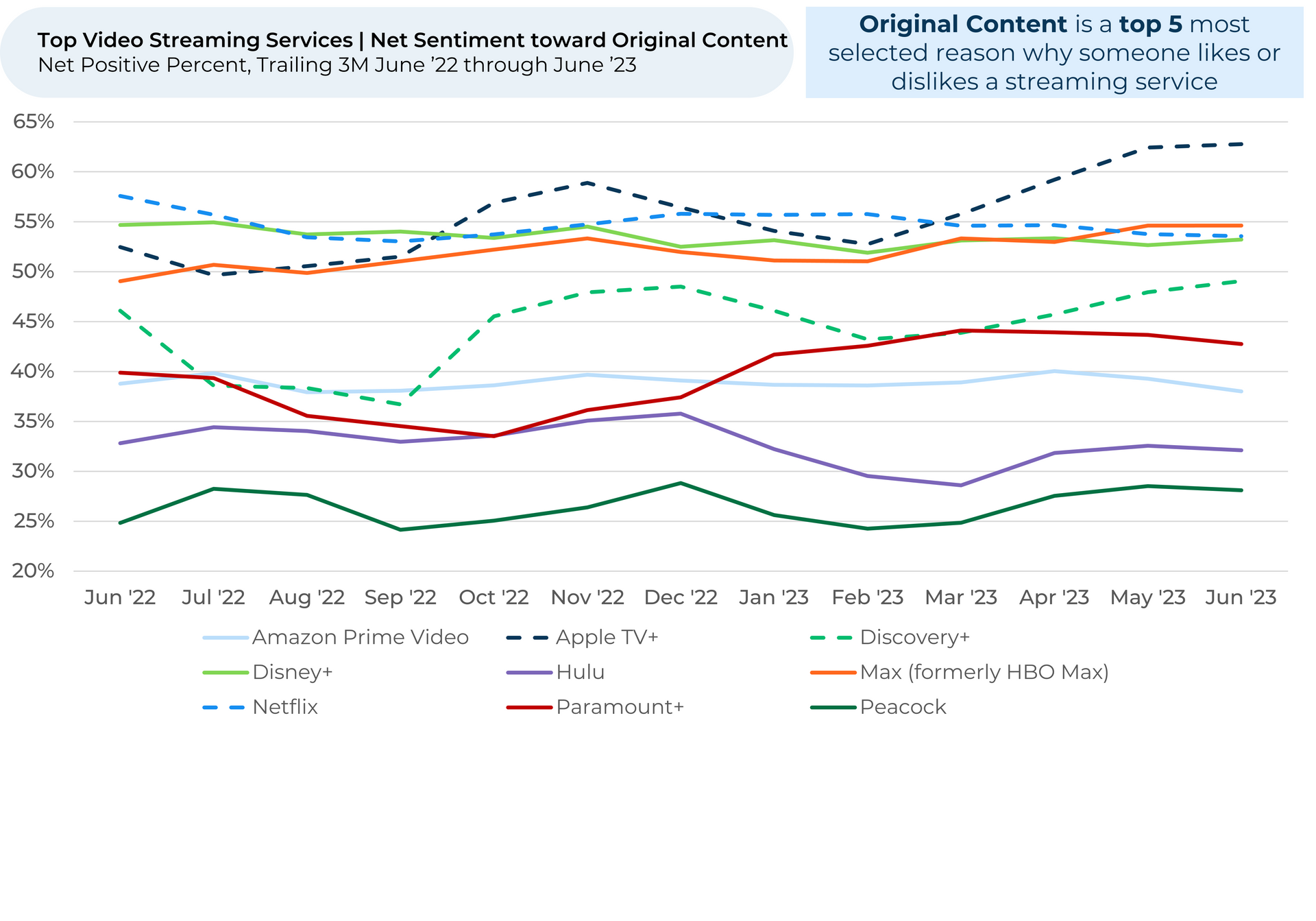

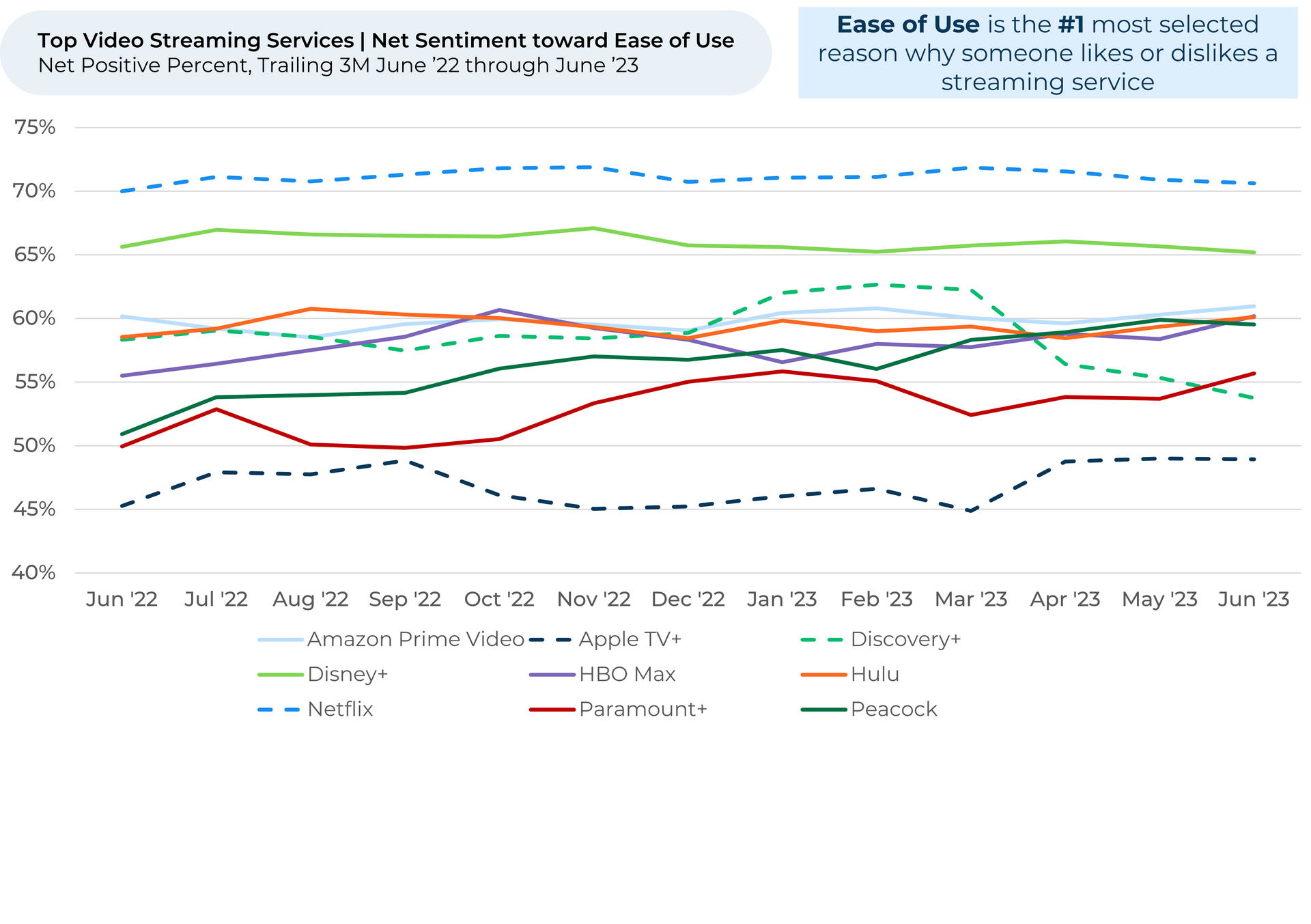

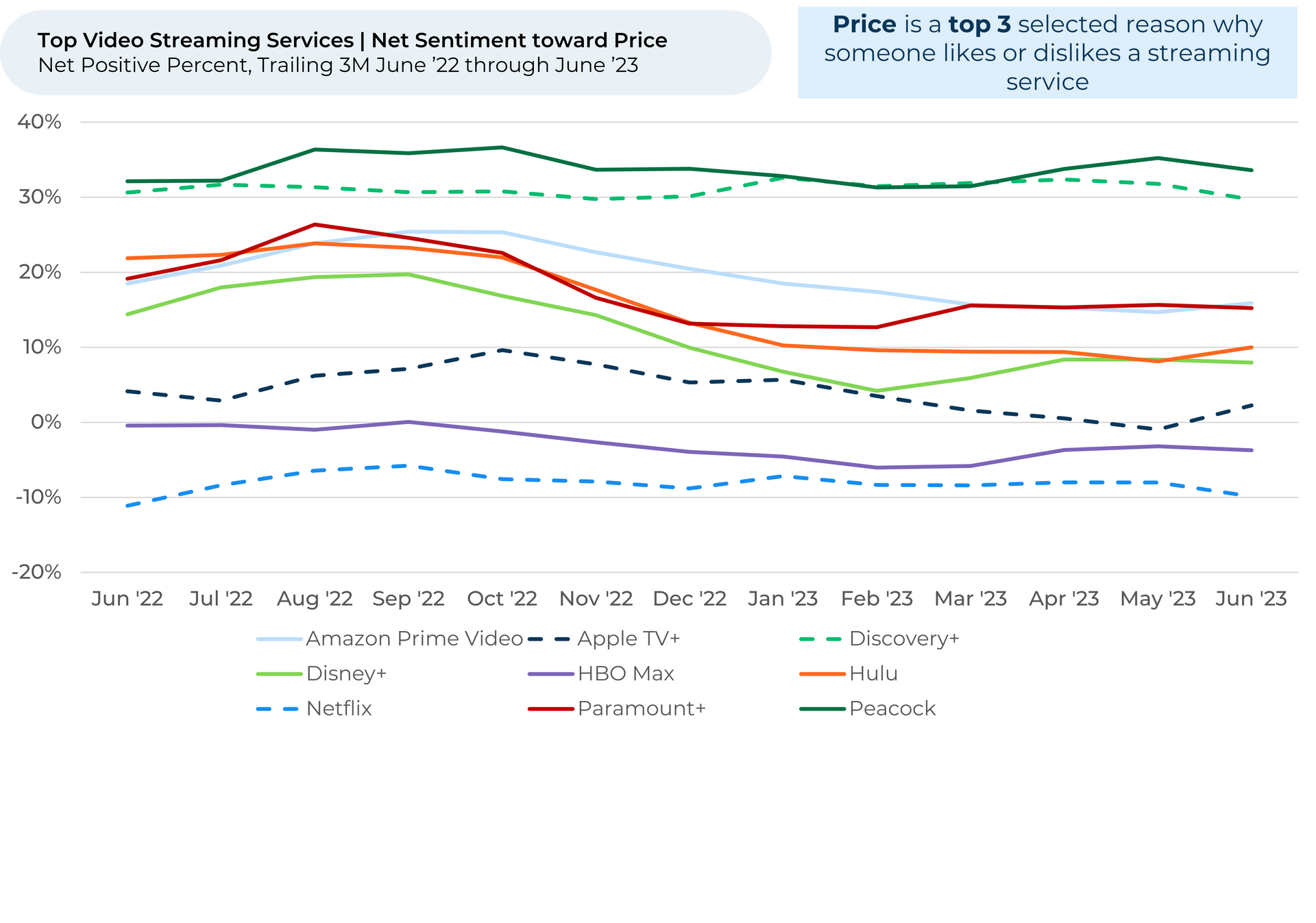

The video streaming industry has had a busy few months. HBO Max and Discovery+ came together to form Max, Paramount+ folded Showtime into its service, and Netflix finally introduced additional fees to share accounts outside of your household in the U.S.

Looking to “The Crowd” of streaming viewers, HundredX details how real customers view some of these changes and how their opinions could continue to shape the industry.

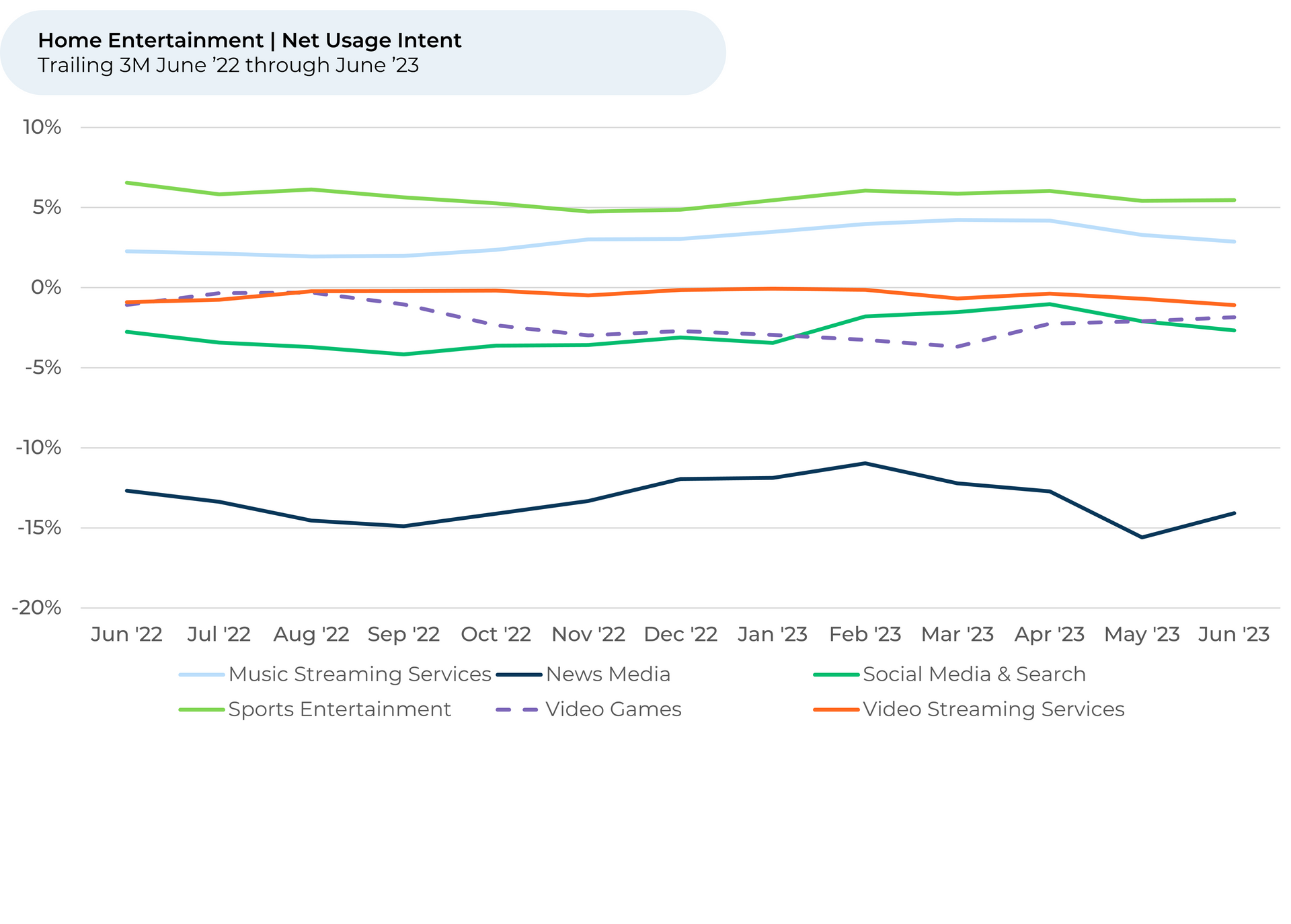

After analyzing more than half a million pieces of feedback in the entertainment sector, including 100,000 across 22 video streaming services, we find: